5G Smartphone Market Share, Size, Trends, Industry Analysis Report, By Operating System (iOS, Android, Windows, and Others); By Sales Channel (Online, Offline); By SIM Type (Single SIM, Multi SIM); By End User (B2B, B2C); By Regions; Segment Forecast, 2020 - 2027

- Published Date:Aug-2020

- Pages: 117

- Format: PDF

- Report ID: PM1707

- Base Year: 2019

- Historical Data: -

Report Outlook

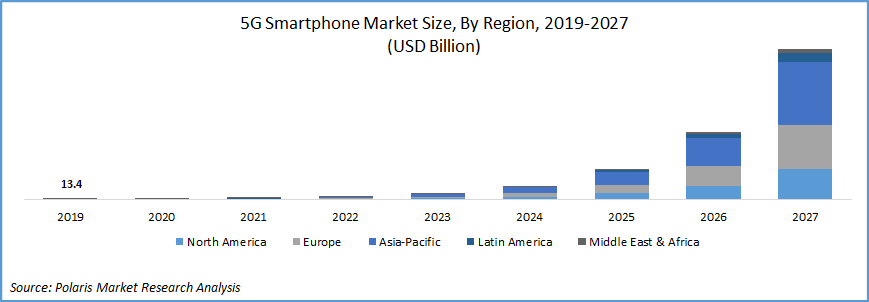

The global 5G Smartphone market was valued at USD 13.4 billion in 2019 and is expected to grow at a CAGR of 122.7% during the forecast period. The market demand in 2019 reached 12.42 million units, however there was a steep reduction in the first two quarters of 2020. The market is again expected to gain traction from Q3 and Q4 of 2020 and is expected to maintain its momentum during the forecast period.

The factors boosting the overall market growth are its ability to provide high speed internet connectivity, coverage, and reliability in comparison to its 4G based smartphones, new product launches by 5G enabled smartphones manufacturer, huge untapped market in the emerging economies, particularly China and India. The key functional drivers favoring market growth are increased mobile broadband, reliable low latency communication, high level of security, and power efficiency.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The prices remained fairly constant in 2019 Q4 to 2020 Q1. However, the rollout of Chinese manufactured 5G smartphones put pressure on major industry participants which led to rapid price decline across the globe. In addition, COVID-19 outbreak also further contributed to this rapid price decline. However, the nature of the technology has attracted users beyond first users and hence as the intensity of pandemic recedes, it is expected that it will lead to price stabilization.

The growth in adjacent market is hugely responsible for its success. The innovations in the 5G network technology, operator support, and substantial price reductions to make it affordable for all kinds of businesses created a positive atmosphere. The 5G technology offers lower latency rate, which benefitted online games, video conferencing, and the VOIP calls. It also acts as a robust platform to nurture new mobile based business models.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The need for increased internet speed among end users is driving the market across the globe with more reliable connections on smartphones than ever before. Smartphones offers high bandwidth to provide high video streaming capabilities, un-interrupted video calling, and augmented and virtual reality games, apart from its other applications.

The innovations in the Fog computing is the key enabler in the adoption of smartphones. Smartphones are becoming integral part of our life, and its extensive usage led to the surge in mobile data traffics. In such scenario, guaranteed efficient service for the users become a big issue among 5G network operators. Fog computing is a promising, efficient customized service to offer dedicated mobile traffics. It deploys efficient computing capabilities at the proximity of the users. It explores demand patterns for network providers and accordingly provides localized services and dedicated short distance local network connections.

Challenges

However, the distribution of 5G Smartphone are negatively impacted by the COVID-19 pandemic in 2020. Although, the smartphone manufacturers are working together with their supplier network and to address these tough challenges in terms of production and operations. This is a key factor that acts as a hurdle for the growth of the market.

5G Smartphone Market Report Scope

The market is primarily segmented on the basis of Operating System, By Sales Channel, By Sim Type, By End User, and geographic region.

|

By Operating System |

By Sales Channel |

By Sim Type |

By End User |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Operating System

Based upon operating system, the market is categorized into iOS, Android, Windows, and others. Among all, the Android OS segment held the largest share in the global market in 2019, owing to the fact most of the smartphone manufacturers across the globe prefers Android as an operating system, strong back up from parent Google, and long term strategic partnerships with major technology giants. For instance, in July 2020, Reliance Jio and Google entered into a strategic partnership to manufacture an affordable 5G Android based smartphone in India, as a part of the governments Make in India initiative.

Moreover, iOS segment is expected to witness significant growth over the forecast period owing to the popularity and brand benefit of Apple products. The security from malwares for this costly smartphones is further boosting the growth of iOS devices.

Insight by Sales Channel

Based on sales channel, the 5G Smartphone market is categorized into online and offline. The offline segment accounted for the majority of the share, due to the large range of outlets are there, including retail shops, hypermarkets, mobile stores, and brand stores. Many consumers prefer to buy electronics from local shops as these stores enable consumers to have touch and feel experience of a phone before purchase, on-site guidance from a salesperson, instead of waiting for the delivery.

The online segment projected to register highest growth rate over the study time period. This high growth is due to respective brand offers, discounts, attractive sale deals by e-commerce firms. Moreover, the traction in online based sale is increasing due to the door step delivery, and effective return policies by the major e-commerce giants such as Apple, Amazon, and Flipkart.

Insight by Sim Type

Based on SIM type, the 5G Smartphone market is categorized into single SIM and multi SIM. In 2019, multi-sim segment accounted for the largest share, owing to the fact it enables users to shift from one network to other instantly. This is very beneficial when it comes for travelers who travels from abroad be it for business or leisure as it provides them to insert local sim to stay connected and reduce their international roaming charges. Also, offers the added bonus of cheap international calls along with the sim offerings.

For instance, the 5G multi-SIM solution by Qualcomm Technologies provides best cellular performance, coverage and power-efficiency, supporting all key regions and frequency bandwidth. Whereas the single sim anticipates the growing market due to dual-SIM smartphones run out of battery faster than the single sim smartphones. Moreover, if one of the sim card is getting weak signal, the phone tries hard retain the connectivity at the expense of battery.

Insight by End User

Based upon end user, the market is categorized into B2B and B2C. Of all, B2C segment held the largest share in the global market in 2019, due to the consumption of 5G technologies and increasing adoption leading to larger customer base in Asia Pacific and Europe. India and China would be the huge market, as it has huge proportion population with high disposable income, and surge in online games due to COVID-19 situation.

Geographic Overview

Geographically, the global 5G Smartphone market is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). Asia Pacific region is the largest revenue contributor followed by Europe. In 2019, the Asia Pacific region accounted for major share of the global market. Demand side factors include huge customer base with seeking smartphones, particularly in China, and India. Manufacturers in the region are focusing on introducing low cost series of smartphones to target middle income population strata. Users from India and China are most active on social media apps and content creation apps such as TikTok, Instagram which further boosting smartphone penetration.

The favorable policy and technological framework in India, China and South Korea would create an apt ecosystem for 5G Smartphone, along with concerned infrastructure for all the connected devices. These countries could contribute build research and development expertise, design led manufacturing, intellectual property to invigorate domestic demand with in-house manufacturing capabilities. Emerging economies in the Asia-Pacific region should focus on network densification, reforms in telco sector with levies in taxation, investments in information security, internet of things, standardization and implementation of new network based technologies, to boost local manufacturing to provide low cost and high quality 5G handsets.

Europe is expected to grow at the highest growth rate over the forecast period, owing to the need for high speed network, tach savvy, high net worth individuals seeking high speed internet connectivity and compatible electronic gadgets. The consumers in the region generally go after premium handsets.

Competitive Insight

Some of the major players operating the market include Apple Inc., Ericsson, China Mobile, Huawei Technologies Co. Ltd., Motorola, Inc., Lenovo Group Limited, BBK Electronics Corporation, Nokia, LG Electronics Inc., TCL Communication Limited, Xiaomi Corporation, Samsung Electronics Co., Ltd