5G System Integration Market Size, Share & Trends Analysis Report By Services (Consulting, Infrastructure Integration, Application Integration); By Vertical; By Application; By Region - Segment Forecasts, 2024-2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1708

- Base Year: 2023

- Historical Data: 2019-2021

Report Outlook

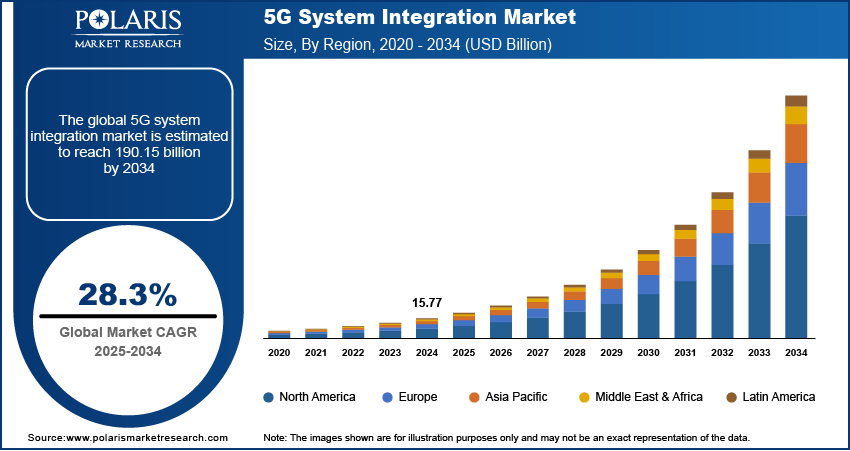

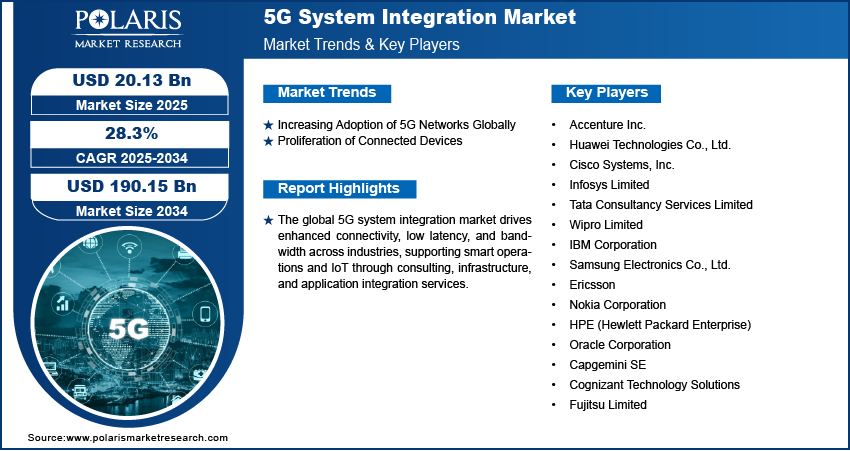

The global 5g system integration market was valued at USD 12.32 billion in 2023 and is expected to grow at a CAGR of 28.30% during the forecast period. The new 5G network requires an organization's virtual and physical parts to work with improved applications or systems. For applications in various sectors, such as information technology, retail, telecommunications, manufacturing, and others, the 5G system integration offers seamless connectivity and extremely fast internet speeds. Rising demand for high-speed bandwidth capacity has enabled businesses to modernize their network infrastructure, improving operational effectiveness while cutting expenses across the board. The need for 5G system integration services is thus anticipated to increase due to the widespread deployment of updated network infrastructure across organizations to provide better services to their consumers.

Know more about this report: Request for sample pages

Additionally, several firms have created and used the technologies to compete in a market that is quite competitive. To give these 5G technologies unified communication, manufacturers are integrating them with next-generation networks. Supplying constant connectivity and remote monitoring also helps lower operational expenses and downtime. Thus, it is predicted that the demand for 5G system integration services will increase during the forecast period due to the robust industrial internet of things (IIoT) implementation and the rising demand for 5G services to provide unified connectivity.

The market players' increasing desire for flexible manufacturing suppliers widens the good chances for the 5G system integration market to flourish over the next several years. Internet of Things usage is increasing.

The COVID-19 pandemic epidemic has significantly impacted the worldwide 5G sector. Only some nations, including the US, Spain, France, and the U.K., initially delayed spectrum auctions to provide 5G services. Additionally, several telecom network providers have temporarily delayed the rollout of 5G networks for telecom operators globally in the first and second quarters of 2020, including Huawei Technologies Co. Ltd, Ericsson, and Nokia Corporation. The holdup impacts the demand for 5G system integration services in 5G network implementation. Additionally, some federal governments in important nations like the U.S., U.K., Germany, and others announced various economic stimulus programs, made lockdown facilities more accessible, and let businesses resume operations with a reduced employee capacity.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global market growth is driven by the significant deployment of advanced network infrastructure in organizations, which will deliver better and ultra-fast 5G services. For instance, several technological companies, including Qualcomm, Apple Inc., T-Mobile US, Verizon Communications, Nokia Corporation, Broadcom, Analog Devices, and Analog Devices, are working very hard to upgrade their current telecommunications infrastructure to the ultra-rapid 5G network. The major technological companies' activity in this area will likely accelerate market expansion.

The widespread need for ultra-high-speed internet access for various applications, including healthcare, smart cities, consumers, and others, is also anticipated to fuel market expansion. According to the SmartCitiesWorld October 2019 publication, villages are rapidly becoming semi-urban regions, and semi-urban areas are quickly becoming urban areas. Nearly 55% of the world's population, or 68% by 2050, is predicted to live in cities, according to May 2018 United Nations research. Therefore, it is anticipated that increased urbanization will encourage people to use the internet to communicate with the rest of the globe, putting more strain on the world's existing telecommunications infrastructure. More bandwidth would therefore be highly desired and available in ultra-fast.

Report Segmentation

The market is primarily segmented based on Services, Vertical, Application and region.

|

By Services |

By Vertical |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

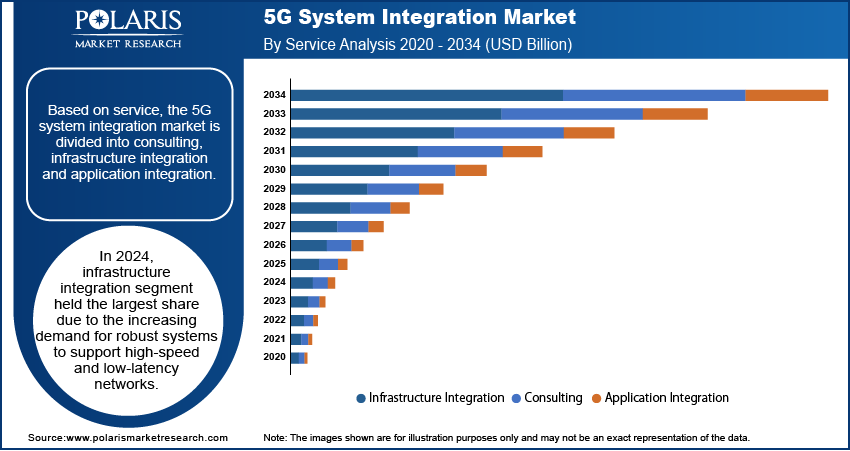

The infrastructure integration segment is expected to dominate market during the forecast period

The global market is divided into Consulting, Infrastructure Integration, and Application Integration services based on services. The market category for infrastructure integration prevailed with the largest share. The increased need for integrating legacy or traditional network infrastructure with cutting-edge 5G network architecture is the cause of this high growth. This reduces the additional expense associated with the hardware by allowing consumers to use the outdated gear while still having access to improved functionality. Building management, network integration, and data center infrastructure management (DCIM) are included in the infrastructure system integration services.

The consulting industry is expected to expand dramatically due to the rapidly increasing need for 5G technologies, which involve extremely effective network hardware. Businesses that interact with the system

The home and office broadband segment dominated the global market in 2022

Based upon application, the global market is categorized into Smart City, P2P Transfers /mCommerce, Collaborate Robot /Cloud Robot, Logistics & Inventory Monitoring, Industrial Sensors, Wireless Industry Camera, Logistics & Inventory Monitoring, Drone, Home and Office Broadband, Gaming and Mobile Media, Remote Patient and Diagnosis Management, Vehicle-to-everything (V2X), Intelligent Power Distribution Systems, and others.

Because of the growing demand for innovative 5G system integration services to provide seamless enhanced mobile broadband (eMBB) internet connectivity to businesses and consumers, home and office broadband is predicted to dominate the market. Also, substantial rise in deployment of IoT devices throughout the smart cities globally is further anticipated to boost the demand for ultra-fast 5G system integration services in order to match the compatibility of the devices with advanced network services. This key factor is expected to propel the smart city application segment growth.

The vertical segment it and telecom dominated the market for forecast period

Based upon vertical, the global market is categorized into IT & Telecom, Transportation & Logistics, Energy & Utility, Media & Entertainment, BFSI, Healthcare, Manufacturing, Retail and Others. Because of the increasing demand for advanced 5G integration services from various telecom and IT firms to support the rollout of new 5 G radio waves, IT & Telecom is predicted to dominate the market. The need for complex system integration services throughout the IT and telecom sector is anticipated to increase due to the significant demand for integrating data center network hardware with enterprise network architecture.

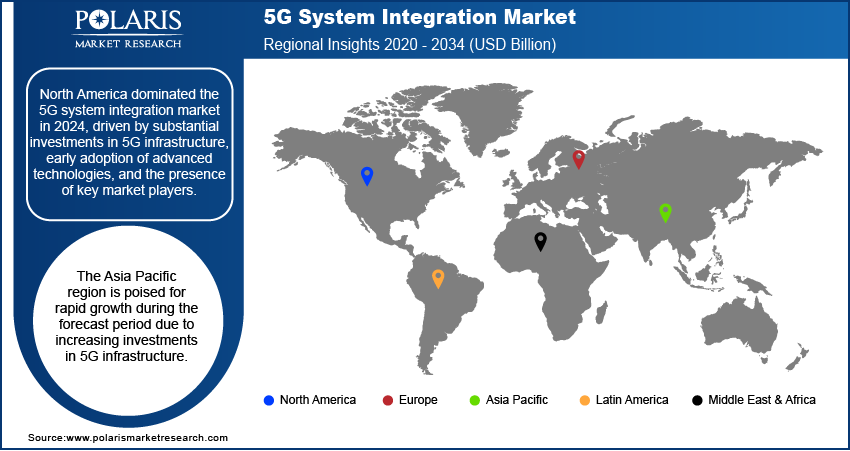

The demand in North America is expected to witness significant growth in 2022

Geographically speaking, North America dominates the 5G system integration market and contributes the most income to it. Several important telecoms and IT companies that are significant industry players are based in North America, which is a vital factor in the region's growth. Among a select few of these businesses are Cisco Systems, Inc., Microsoft Corporation, and IBM Corporation. The need to integrate applications and infrastructure to support the cutting-edge New Radio frequency bands is also anticipated to drive the regional market growth. This is due to market players such as Verizon Communications Inc. and AT&T Inc. increasing their investments in 5G infrastructure.

Over the projection period, Asia-Pacific is anticipated to grow the fastest, largely due to the rapid expansion of the total number of IT enterprises throughout the developing nations of India and China that are committed to deploying 5G IT solutions. Leading telecom firms like China Telecom, KT Corporation, China and SK Telecom Mobile are also making major investments in rolling out their 5G networks in nations like South Korea, Japan, and China, which is also anticipated to add to the market growth in the area.

Competitive Insight

Global 5G system integration market Key players operating primarily focusing on product innovation, development and strategic acquisitions in order to strengthen their capabilities for research and development of new products. These key strategies enable the companies to strengthen their market position while also boosting their geographical presence.

Some of the key players operating in the global market comprises of Huawei Technologies Co., Ltd., Atos Syntel, ALTRAN, IBM Corporation, AMDOCS, Capgemini, CA Technologies, Cisco Systems, Inc., Tech Mahindra, Cognizant, ECI TELECOM, Ericsson, Keysight Technologies, Radisys Corporation, HCL Technologies Limited, HPE, Samsung Electronics Co., Ltd., Oracle Corporation, Infosys Limited, Tata Consultancy Services Limited, Wipro Limited, ZTE, and Sigma Systems.

Recent Developments

- In March of 2020, Fujitsu launched the first private 5G network for commercial use in Japan, thereby strengthening its market position.

- In May 2020, HCL Technologies purchased Cisco's self-optimizing network (SON) technology to strengthen its 5G capabilities and competitiveness.

5G System Integration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.74 billion |

|

Revenue forecast in 2032 |

USD 115.60 billion |

|

CAGR |

28.30% from 2024 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Services, By Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Huawei Technologies Co., Ltd., Atos Syntel, ALTRAN, IBM Corporation, AMDOCS, Capgemini, CA Technologies, Cisco Systems, Inc., Tech Mahindra, Cognizant, ECI TELECOM, Ericsson, Keysight Technologies, Radisys Corporation, HCL Technologies Limited, HPE, Samsung Electronics Co., Ltd., Oracle Corporation, Infosys Limited, Tata Consultancy Services Limited, Wipro Limited, ZTE, and Sigma Systems. |

FAQ's

The 5g system integration market report covering key segments are services, vertical, application and region.

5G System Integration Market Size Worth $115.60 Billion By 2032.

The global 5g system integration market is expected to grow at a CAGR of 28.2% during the forecast period.

North America is leading the global market.

Key driving factors in 5g system integration market are increased industrial automation and growing need for network infrastructure.