Agriculture and Farm Equipment Market Share, Size, Trends, Industry Analysis Report, By Type (Tractors, Harvesters, Soil Preparation & Cultivation, Irrigation & Crop Processing, Agriculture Spraying Equipment, Hay & Forage Machines, Others), By Automation, By End-Users, By Region, Segments & Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1080

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

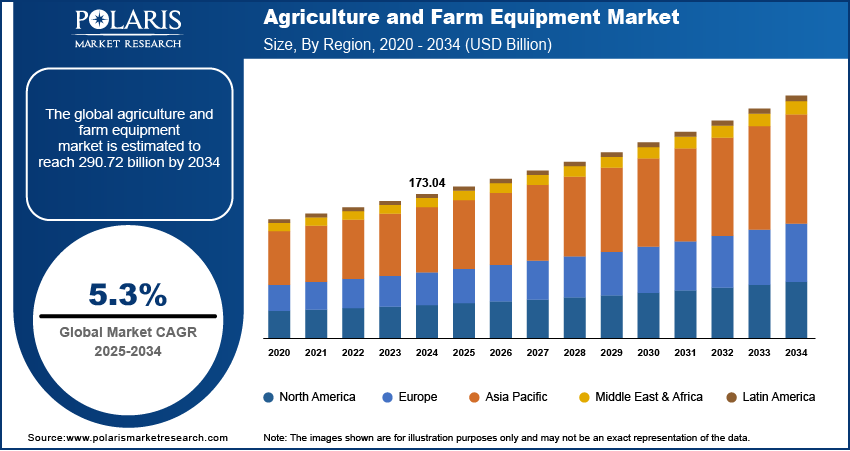

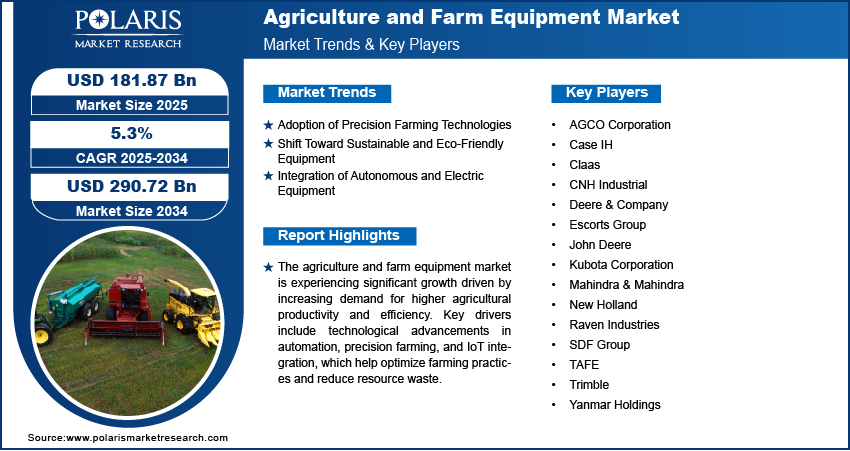

The global agriculture and farm equipment market was valued at USD 73.72 Billion in 2023 and is expected to grow at a CAGR of 4.70% in the forecast period. The increasing demand for farm mechanization in developing countries, increase in farm loan waiver schemes and favorable government regulations are the key factors expected to drive the market in the forecast period.

Know more about this report: Request for sample pages

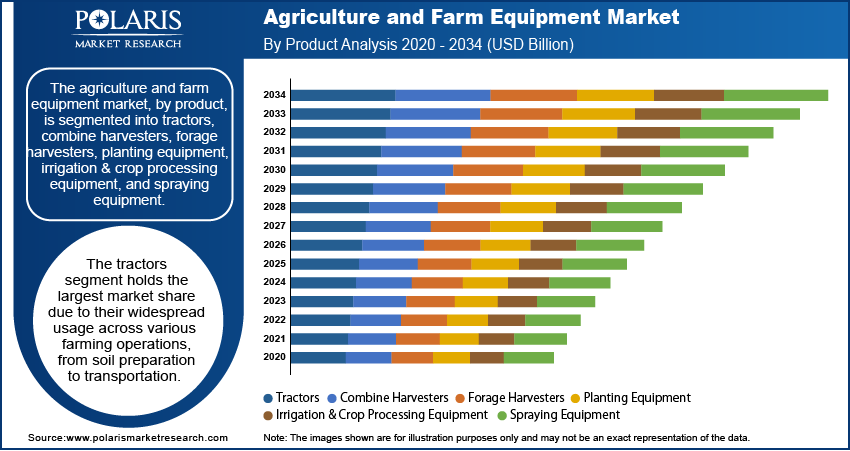

Agriculture and Farm Equipment encompass various tools and machinery used in different agricultural practices. Some common types of equipment used in agriculture and farming market include tractors, harvesters, irrigation systems, plows, cultivators, seeders, and sprayers. In addition to these types of equipment, a variety of other tools and machinery are used in agriculture and farming, including plows, cultivators, balers, and combine harvesters.

The market is influenced by government policies and regulations related to agriculture and farming and changes in weather patterns and environmental conditions. Technological advancements are also playing a significant role in the growth of the agriculture and farm equipment market, with innovations helping to increase efficiency, reduce labor costs, and improve the accuracy of farming operations. The market is highly competitive, with many manufacturers and suppliers operating in the industry. Manufacturers continuously develop new and improved equipment and technologies to meet the evolving needs of farmers and the agriculture industry.

For instance, according to the Association of Equipment Manufacturers (AEM), U.S. tractor sales increased by 15.3% in 2021, with 244,637 tractors sold. Further, tractor sales in China increased by 12.8% in 2020, with 228,300 units sold, according to the China Association of Automobile Manufacturers (CAAM).

The Agriculture and Farm Equipment market faces several challenges, including increasing cost of agricultural equipment, lack of skilled labors, and environmental concerns. The cost of acquiring modern farm equipment and machinery is high, which makes it difficult for small farmers and operators to invest in such equipment. It limits the adoption of modern equipment in many regions, especially in developing countries.

The Agriculture and Farm Equipment Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The demand for Agriculture and Farm Equipment is often seasonal, leading to supply chain issues and high inventory costs for manufacturers and suppliers. The Agriculture and Farm Equipment market depends on external factors such as weather, commodity prices, and government policies, which can impact demand and sales.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing demand for farm mechanization in developing countries drives growth in the Agriculture and Farm Equipment market. As developing countries continue to experience population growth and urbanization, there is an increased need for efficient and sustainable agricultural practices to meet the growing demand for food.

In many developing countries, small-scale farmers dominate the agricultural sector and often lack access to modern farm equipment. However, with the advent of new technologies and government support, there is a growing trend toward mechanization in these countries. Governments are providing subsidies and incentives for farmers to purchase equipment, while manufacturers are developing low-cost and specialized machinery to cater to the needs of small-scale farmers.

The implementation of farm loan waiver schemes has a positive impact on the Agriculture and Farm Equipment market, as it can increase the purchasing power of farmers and stimulate demand for farm machinery and equipment. In addition, implementing farm loan waiver schemes can promote agricultural growth and improve the overall productivity of the sector. Farmers can invest in better quality seeds, fertilizers, and other inputs with reduced financial burden, leading to improved crop yields and higher incomes.

Report Segmentation

The market is primarily segmented based on type, automation, end users and region

|

By Type |

By Automation |

By End Users |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The harvester segment is anticipated to witness the fastest CAGR in the forecast period.

One of the main reasons for the market growth is the increasing demand for efficient harvesting machines that can reduce the labor and time required for harvesting. Additionally, the rising trend of precision farming and the need for higher productivity and efficiency in agriculture have also contributed to the growth of the harvester segment.

Moreover, the use of advanced technologies such as GPS, sensors, and automation in modern harvesters has made them more accurate, efficient, and user-friendly, further boosting their market demand. As a result, manufacturers are increasingly focusing on developing advanced and innovative harvesters to cater to the growing demand from farmers.

The semi-automatic equipment segment is anticipated to dominate the market in the forecast period.

In recent years, the semi-automatic equipment segment has dominated the Agriculture and Farm Equipment market, particularly in developing countries.

One of the main reasons for this dominance is the affordability and availability of semi-automatic equipment compared to fully automatic equipment. Semi-automatic equipment balances manual labor and fully automatic machines, making them a cost-effective option for small and medium-scale farmers in developing countries. Additionally, semi-automatic equipment is versatile and can be used for multiple farming activities such as plowing, tilling, sowing, and harvesting, further boosting their market demand.

Moreover, the increasing focus on farm mechanization and the need for higher productivity and efficiency in agriculture has also contributed to the growth of the semi-automatic equipment segment. As a result, manufacturers are increasingly focusing on developing advanced and innovative semi-automatic equipment to cater to the growing demand from farmers.

The original Equipment Manufacturers (OEMs) segment is projected to witness the fastest growth rate in the forecast period.

In the Agriculture and Farm Equipment market, OEMs are responsible for designing and producing a wide range of equipment, from tractors and harvesters to irrigation systems and seed drills. They are critical in providing farmers with the necessary tools to maximize productivity and efficiency.

The growth rate of the OEM segment can be attributed to several factors. Firstly, as agriculture becomes increasingly mechanized, farmers rely more on specialized equipment to perform various tasks. It has led to a growing demand for equipment designed and built specifically for agricultural use, where OEMs excel. Additionally, OEMs have the expertise and resources to develop innovative solutions that meet the unique needs of farmers and improve crop yields.

Another reason for the growth is the high customization required in agricultural equipment. Every farm is different, and farmers require equipment tailored to their specific needs and growing conditions. OEMs can provide this level of customization, ensuring that farmers have the right tools for the job.

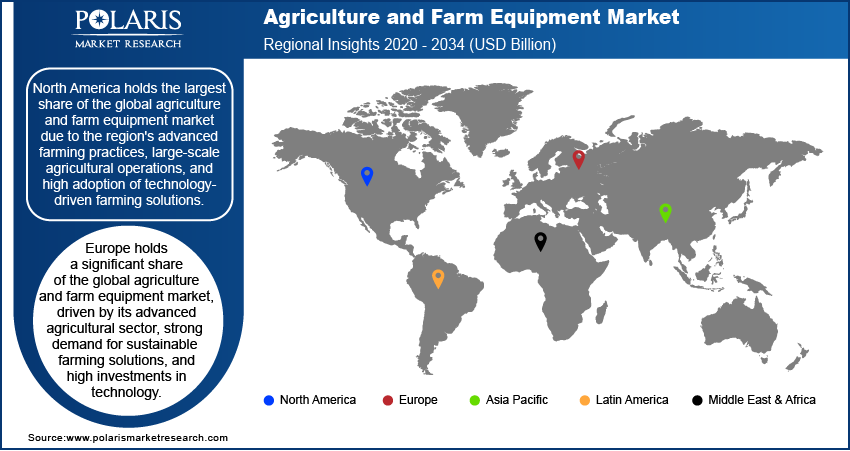

Europe is projected to account for a considerable growth rate in the forecast period.

In Europe, the Agriculture and Farm Equipment market has been witnessing steady growth due to various factors, such as the growing demand for food, higher productivity, and the increasing adoption of advanced farming technologies. Moreover, many small and medium-sized farms in the region drive the need for smaller, more efficient farming equipment.

The European Union's Common Agricultural Policy (CAP) has also supported the modernization of farming equipment and the adoption of new technologies. Additionally, the trend toward sustainable agriculture and organic farming has led to the demand for specialized equipment for these practices. Overall, Europe's Agriculture and Farm Equipment market is expected to continue growing in the coming years.

Competitive Insight

Some of the prominent key players operating in the marketspace includes Deere & Company, CNH Industrial NV, AGCO Corporation, Kuhn Group, Krushi Chang Harvesters, Morris Equipment Ltd., Tractors & Farm Equipment Limited, Valmont Industries, Inc., Mahindra & Mahindra Ltd., Tractor and Farm Equipment Limited (TAFE), Excel Industries, Krone UK Group, Kubota Corporation, SDF S.p.A

Recent Developments

- September 2022: KUBOTA Corporation has released a new electric tractor model, LXe-261, in European market as an initiative to reduce the C02 product emissions.

- March 2022: New Holland Agriculture, a brand of CNH Industrial has expanded its dealership network by appointing 12 new dealers across multiple locations to supply advanced mechanization for farmers in India.

Agriculture and Farm Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 77.05 Billion |

|

Revenue forecast in 2032 |

USD 111.17 Billion |

|

CAGR |

4.70% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Automation, By End Users, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Deere & Company, CNH Industrial NV, AGCO Corporation, Kuhn Group, Krushi Chang Harvesters, Morris Equipment Ltd., Tractors & Farm Equipment Limited, Valmont Industries, Inc., Mahindra & Mahindra Ltd., Tractor and Farm Equipment Limited (TAFE), Excel Industries, Krone UK Group, Kubota Corporation, SDF S.p.A |

The analysis of Agriculture and Farm Equipment Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis. report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Browse Our Top Selling Reports

Solvent Recovery and Recycling Market Size, Share 2024 Research Report

Cephalosporin Drugs Market Size, Share 2024 Research Report

Ear Infection Treatment Market Size, Share 2024 Research Report

FAQ's

The agriculture and farm equipment market report covering key segments are type, automation, end users and region.

Agriculture and Farm Equipment Market Size Worth $111.17 Billion By 2032.

The global agriculture and farm equipment market expected to grow at a CAGR of 4.67% in the forecast period.

Europe is leading the global market.

key driving factors in agriculture and farm equipment market are increasing demand for farm mechanization in developing countries.