Breathalyzer Market Share, Size, Trends, Industry Analysis Report, By Product Type (Active, Passive); By Technology (Fuel Cell, Semiconductor Oxide Sensor, Others); By Application; By End-Use; By Regions; Segment Forecast, 2020 - 2027

- Published Date:Dec-2020

- Pages: 103

- Format: PDF

- Report ID: PM1747

- Base Year: 2019

- Historical Data: 2016 - 2018

Report Outlook

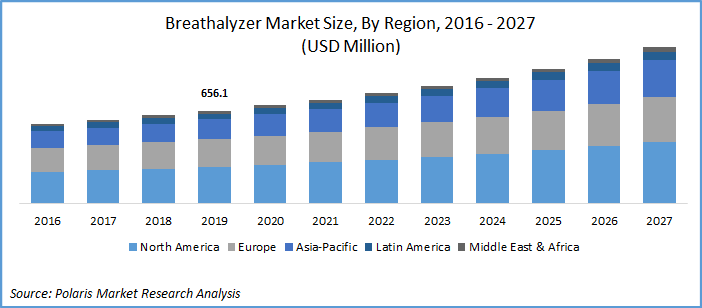

The global breathalyzer market was valued at USD 656.1 million in 2019 and is expected to grow at a CAGR of 6.7% during 2020-2027. The market growth is attributed towards the notable advancements in the devices and substantial funding by companies for innovation and development of advanced breathalyzer.

Notable government funding for development and deployment of breath analyzers to proactively control alcohol and drugs abuse is expected to drive demand. In addition to this, extensive adoption of breath analyzers by law enforcement authorities such as the police across the countries worldwide is also likely to complement demand.

Know more about this report: request for sample pages

Breathalyzer do not measure the blood alcohol concentration or content directly, which requires analyzing the blood sample. However, they determine the alcohol content in blood indirectly through the measurement of alcohol content through breath. As a result, the breath analyzers are actively being used to control or minimize the risk of alcohol and drug abuse among people and particularly, youngsters.

Industry Dynamics

Growth Drivers

The sudden outbreak of coronavirus enabled COVID-19 pandemic is the key factor driving the growth in the global market. The increasing cases of infected patients worldwide has accelerated the demand for advanced breathalyzer that are used for COVID-19 detection. Furthermore, the healthcare institutions globally are also extensively using the novel breathalyzers to precisely detect occurrence of COVID-19 disease among people which has led to increasing demand for the product post the outbreak of the pandemic.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

According to the ETHealthworld July 2020 publication, a French hospital has started the second trial among people regarding the effectiveness of breathalyzer to detect coronavirus infection among people. The hospital has successfully completed first phase of trial among few people of which, nearly 20 people were detected with COVID-19 infection and the remaining were identified to be not infected.

Breathalyzer Market Report Scope

The market is primarily segmented on the basis of product type, technology, application, end-use, and region.

|

By Product Type |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product Type

Based upon product type, the breathalyzer market is categorized into active and passive breathalyzers. Active segment accounted for the largest revenue share in 2019 owing to the increasing deployment of breathalyzer to proactively minimize the alcohol abuse and drug abuse by the concerned law enforcing authorities in the countries globally.

There’s extensive deployment of active breathalyzers across the globe is the primary factor for the segment dominance. According to the Hindustan Times October 2016 publication, the traffic police in Maharashtra state in India have extensively used advanced active breathalyzers to prevent drink and driving. These active breathalyzers are referred to as alcovisor breathalyzer that can click photograph of the motorist being analyzed for alcohol intoxication while uploading it to the server. These analyzers are equipped with 3G connectivity, Wi-Fi, and Global Positioning System (GPS). This is expected to further drive the demand for active segment over the coming years.

Insight by Technology

On the basis of technology, the breathalyzer market is further segmented into fuel cell, semiconductor oxide sensor, and others. Fuel cell technology is expected to hold a dominant share owing to highly accurate results provided by the analyzers even in re-tests as compared to the other technologies.

Insight by Application

Based upon application, the market is bifurcated into alcohol detection, drug abuse detection, disease detection, and others. Alcohol detection segment is anticipated to account for the largest revenue share in 2019 owing to the increasing use of breath analyzers by law enforcement authorities to prevent drink and drive incidents.

According to World Health Organization (WHO), drinking and driving is one of the main causes for road accidents across the globe. In high-income countries around 20% of the injured drivers have excess alcohol content in their blood. As a result, the demand for breath analyzers is increasing for alcohol detection, driving the application segment growth.

Insight by End-Use

On the basis of end-use, the breathalyzer market is categorized into government agencies, enterprises, home setting, hospital settings, and diagnostic centers. The government agencies segment is expected to account for the largest revenue share over the forecast period. This can be attributed to the strict government regulation regarding following the traffic rules. Breathalyzers are being issued by the government agencies to curb alcohol abuse while driving. The law enforcers are focused on strictly implementing do not mix drink with driving motto that has boosted the demand for breathalyzers by the government agencies.

Geographic Overview

North America is the largest contributor to the global revenue due to the expanding usage of breathalyzers by the law enforcers in the U.S. and Canada. According to the 660 City News January 2020 publication, the police professionals in Calgary, Canada have taken over 15,600 breath samples since the state’s police mandated the check since December 2018. Moreover, the presence of major companies with a dominant market share is another factor for high awareness pertaining to benefits of breath analyzers driving demand in the region.

In addition, the rising strict regulations considering the testing for alcohol consumption while driving across the countries such as Spain, Italy, Germany, France and United Kingdom (UK) fuels the European market growth. Moreover, as per Euro Tunnel March 2020 publication, the drivers across France are advised to carry with them a self-test breathalyzer whenever driving in France.

Competitive Insight

Some of the major players operating in the market include BACtrack Breathalyzers (KHN Solutions LLC), Dragerwerk AG, Quest Diagnostics, Intoximeters, Alcolizer, Lifeloc Technologies, Thermo Fisher Scientific, TruTouch, uVera Diagnostics, and Alere Inc. In June 2018, BACtrack launched the BACtrack C8 advanced breathalyzer that features a ZeroLine technology that can precisely estimate how much time it takes to detect the alcohol content in blood prior to the quantity of alcohol present in the blood becomes 0%.