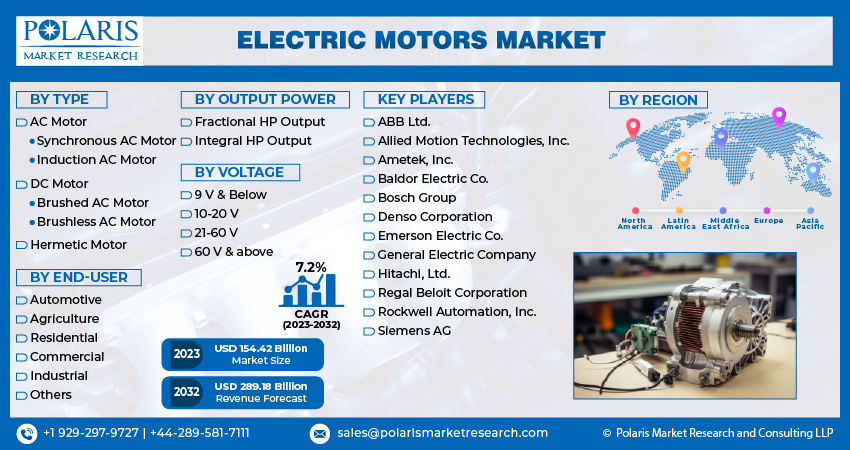

Electric Motors Market Share, Size, Trends, Industry Analysis Report, By Type (AC Motor, DC Motor, Hermetic Motor); By Output Power; By Voltage; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1068

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

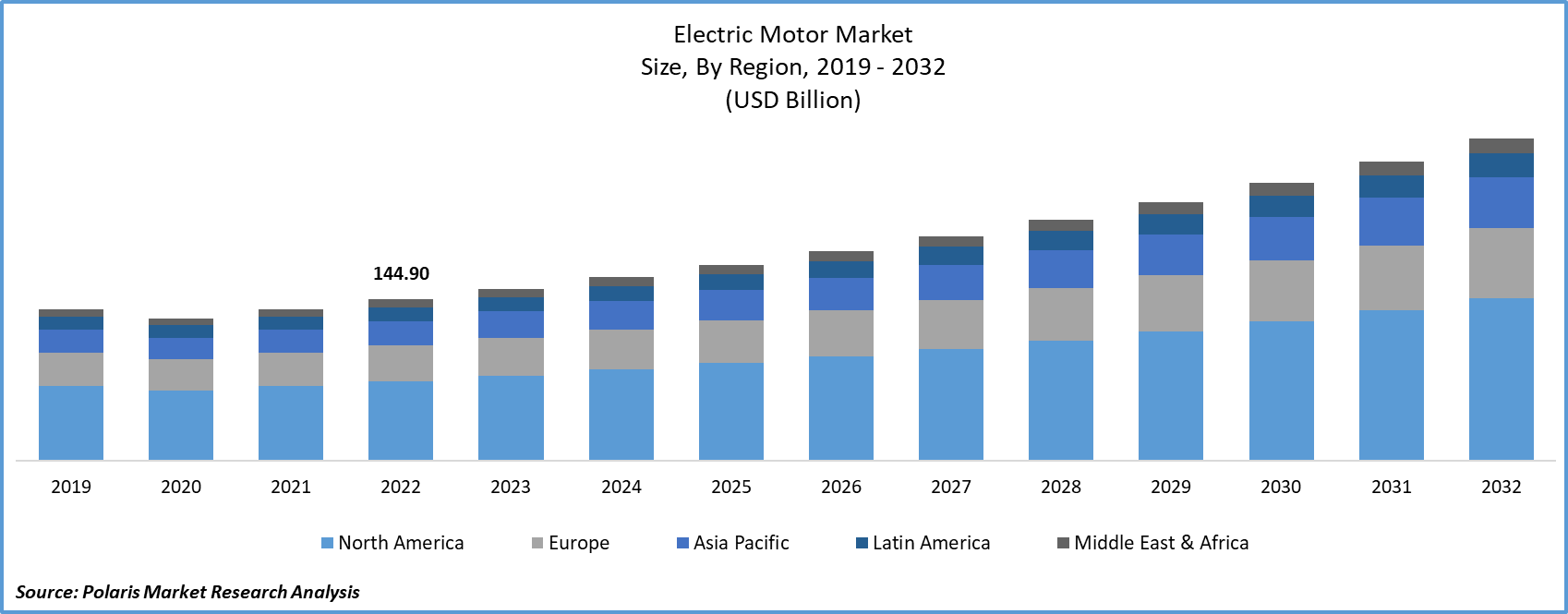

The global electric motors market size and share was valued at USD 154.42 billion in 2023 and is expected to grow at a CAGR of 7.30% during the forecast period.

The electric motor is an electrical device that converts electrical energy into mechanical energy. The electric motor is an inseparable constituent of ventilation, heating, and cooling equipment. Electric motors are also used in numerous industrial applications, such as motor vehicles, industrial machinery, and home appliances, among others.

To Understand More About this Research: Request a Free Sample Report

The increasing applications of electric motors in industries such as automotive and agriculture and global industrial growth are driving the growth of the market. Electric motors are utilized in several industries, such as automotive, construction, healthcare, consumer goods, and agriculture, among others, and growth in these industries globally is anticipated to bolster the growth of the electrical motors market.

Electric motors consist of essential components, including a rotor, commutator, brushes, axle, field magnet, and power supply. AC motors come with several key features, such as controlled acceleration, low power demand during startup, modifiable operational speed, customizable torque limits, and a decline in power line disturbances. On the other hand, DC motors deliver advantages like easy installation, a linear speed-torque curve, swift starting, stopping, reversing, and accelerating capabilities, as well as speed control across a broad range. These motors find diverse applications in industrial fans, home appliances, watches, blowers, pumps, disk drives, machine tools, and various other domains, showcasing their versatility and importance across distinct sectors.

The COVID-19 pandemic had a significant impact on the electric motors market. The widespread disruptions caused by the virus, including lockdowns, supply chain interruptions, and economic slump, have impacted the production and demand of electric motors across numerous industries. Primarily, the market experienced a decline as manufacturing activities were delayed, and many projects were put on hold. However, as the world adapted to the new normal and industries began to recover, there has been an increasing focus on the adoption of electric motors in various applications.

The pandemic has highlighted the importance of resilient and sustainable technologies, leading to a surging interest in electric vehicles and renewable energy solutions, both of which heavily rely on electric motors. The push for cleaner and more energy-efficient technologies is anticipated to drive the electric motors market in the forecast period. Furthermore, the focus on automation and smart manufacturing, accelerated by the need for contactless operations, has also augmented the demand for electric motors in industrial applications. Despite the initial challenges posed by the pandemic, the electric motors market is composed for growth as industries prioritize sustainability and resilience in the post-COVID time.

For Specific Research Requirements: Request for Customized Report

Rapid urbanization leads to a surge in demand for diverse services, giving opportunities for the widespread deployment of electrical motors. Within the residential domain, the need for motors accelerates across various household applications. This elevated demand for power later stimulates an expansion in energy generation capacities. Further, the cultivation of crops plays a key role in driving the adoption of electric machines within the agricultural sector. These factors are anticipated to contribute to the growth of the electric motor market in the forecast period.

Industry Dynamics

Growth Drivers

- Increasing automobile manufacturing and rising demand for electrical vehicles will drive the growth of the market

The surging trend in automobile manufacturing, associated with a growing global demand for electric vehicles (EVs), is composed to drive the growth of the electrical motors market. As automotive manufacturers increasingly shift their focus towards producing environmentally sustainable vehicles, the demand for electric motors, an essential component in EVs, is noticing significant growth. Electric motors operate as the primary power source in electric vehicles, transforming electrical energy into mechanical energy to drive. The ongoing advancements in electric vehicle technology are linked with government initiatives facilitating the adoption of clean energy solutions.

This surge in demand is ascribed to the various industries as well as the automotive sector, including industrial machinery and appliances. As the global automotive landscape experiences a transformative switch towards greener and cleaner mobility solutions, the electrical motors market is anticipated to experience vital growth in the forecast period, driven by the increasing production and adoption of electric vehicles globally. The demand for electric motors is at its peak in the automotive industry, driven by improvements in motor safety, enhanced operational efficiency, and advanced insulation technologies. This surge in demand is fueled by the rapid progress in technology, which is gaining significant traction in the market.

Report Segmentation

The market is primarily segmented based on type, output power, voltage, end-user, and region.

|

By Type |

By Output Power |

By Voltage |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The AC Motor segment accounted for the largest revenue share in 2022

The AC Motor segment accounted for the largest revenue share. A significant proportion can be ascribed to the extensive applications of AC motors, ranging from irrigation pumps to advanced robotics. Moreover, their smaller size, cost-effectiveness, and lighter weight contribute to the widespread utilization of HVAC equipment. The automotive sector has witnessed substantial growth in the adoption of electric AC motors due to advancements in highly efficient and affordable electronics and improvements in permanent magnetic materials.

Anticipated increases in demand across various industries, including chemicals, paper and pulp, cement, and wastewater treatment, are expected to drive the market growth. Due to highly cost-effective and efficient electronics, linked with substantial progress in permanent magnetic materials, the adoption of electric AC motors in the automotive industry has experienced a robust and rapid expansion. The enriching sales of electric vehicles and the ensuing broadening of the machine type's measurement are anticipated as key drivers for AC Motor's continued expansion throughout the forecast period.

By Output Power Analysis

- The fractional HP segment accounted for the highest market share during the forecast period

The fractional HP segment accounted for the highest market share during the forecast period. The extensive occurrence of electric motors can be attributed to their adaptable applications across various household devices, ranging from vacuum cleaners and refrigerators to coffee machines. Moreover, they find utility in industrial equipment, exhibiting suitability for robust operations in challenging industrial settings. Electric motors offer several benefits, such as advanced starting torque and stability amongst fluctuations in electric current.

These compact and energy-efficient motors find overall applications in diverse industries, including automotive, appliances, HVAC (Heating, Ventilation, and Air Conditioning), and other small machinery. The demand for fractional HP electric motors has been steadily growing due to the increasing emphasis on energy efficiency and the rising adoption of automation in different sectors. These motors play a critical role in powering a range of devices, from household appliances like blenders and fans to industrial equipment with lower power requirements. The market for fractional HP electric motors is expected to continue expanding as industries seek more efficient and compact solutions for their diverse applications.

Regional Insights

- Asia Pacific accounted for the largest market share in 2022

Asia Pacific accounted for the largest market contributor in the electric motors market. The region is experiencing ongoing expansion across various sectors, such as automotive, fertilizer, chemical, and petrochemical industries. This growth is anticipated to create influential opportunities for global electric motor companies. China has played a key role in driving the international industrial landscape, standing at the forefront of chemical, cement, electricity, and steel manufacturing. Additionally, it is a key player in the production of petroleum and petroleum products. The country is actively exploring the integration of new industrial applications into its manufacturing portfolio.

The industrialization of the Asia Pacific region is driving rapidly, leading all sectors to transition towards internet-centric operations. Developed nations in the region, such as South Korea and Japan, are reportedly awakening to the potential of advanced services and interconnected devices. Concurrently, the automobile industry in the region is experiencing vital growth.

Europe region is accounted for the fastest growth in the electric motors market. Driven by a high emphasis on renewable power and ambitious green energy targets. The region's commitment to sustainability is further underscored by the increasing adoption of electric motors in the industrial and agriculture sectors, contributing to an increased demand for these technologies. This dual focus on eco-friendly energy solutions and the integration of electric motors in numerous sectors positions Europe as a key player in advancing environmentally conscious practices and driving market expansion.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ABB Ltd.

- Allied Motion Technologies, Inc.

- Ametek, Inc.

- Baldor Electric Co.

- Bosch Group

- Denso Corporation

- Emerson Electric Co.

- General Electric Company

- Hitachi, Ltd.

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG

Recent Developments

- In July 2023, General Electric Vernova's Solar & Storage Solutions united with Fortune Electric to co-create Battery Energy Storage Solutions (BESS) in Taiwan. The goal is to employ electric motors within the storage system to regulate energy flow, oversee the charging and discharging of batteries, and guarantee a seamless integration of stored energy.

- In May 2023, ABB Limited announced the purchase of Siemens' low-voltage NEMA motor business. This strategic acquisition is poised to enhance ABB's standing as a NEMA motor manufacturer, bolstering its presence in the NEMA motor sector and expanding its product offerings.

- In August 2022, Johnson Electric Holdings Limited introduced a motorized steering wheel adjuster. This electric motor allows drivers to easily achieve a comfortable driving position.

- In May 2022, Allied Motion Technologies Inc. has widened its motion capabilities and strengthened its integrated motion solutions by acquiring ThinGap. This strategic move has given rise to the incorporation of ThinGap's motor into Allied Motion's portfolio, resulting in an enriched array of product offerings in the electric motor market.

Electric Motors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 164.77 billion |

|

Revenue Forecast in 2032 |

USD 289.18 billion |

|

CAGR |

7.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Output Power, By Voltage, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

Custom Market Research Services

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Look Through Our Best-Selling Reports

Blue Ammonia Market Size, Share 2024 Research Report

High Pressure Laminate Market Size, Share 2024 Research Report

Limestone Market Size, Share 2024 Research Report

FAQ's

key companies in electric motors market are ABB Ltd., Allied Motion Technologies, Inc., Ametek, Inc., Baldor Electric Co., Bosch Group, Denso Corporation, Emerson Electric Co

The global electric motors market is expected to grow at a CAGR of 7.2% during the forecast period.

The electric motors market report covering key segments are type, output power, voltage, end-user, and region.

key driving factors in electric motors market are Increasing automobile manufacturing and rising demand for electrical vehicles will drive the growth of the market

The global electric motors market size is expected to reach USD 289.18 billion by 2032