Inflammatory Bowel Disease Treatment Market Share, Size, Trends, Industry Analysis Report, By Disease indication; By Drug Class; By Route of Administration; By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 114

- Format: PDF

- Report ID: PM1340

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

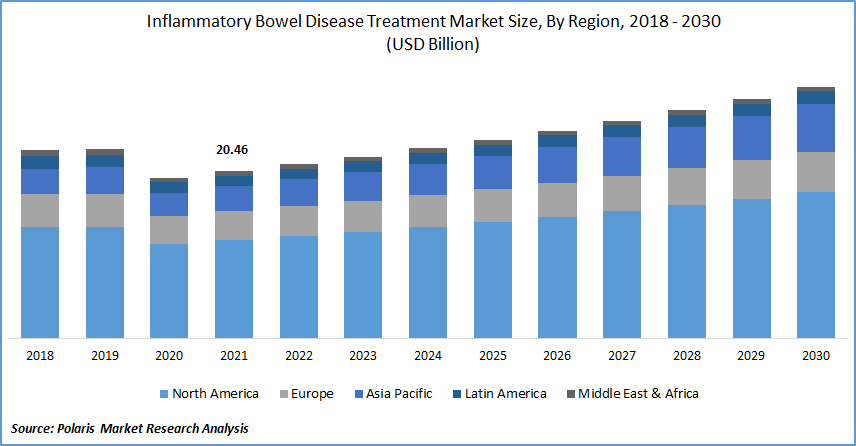

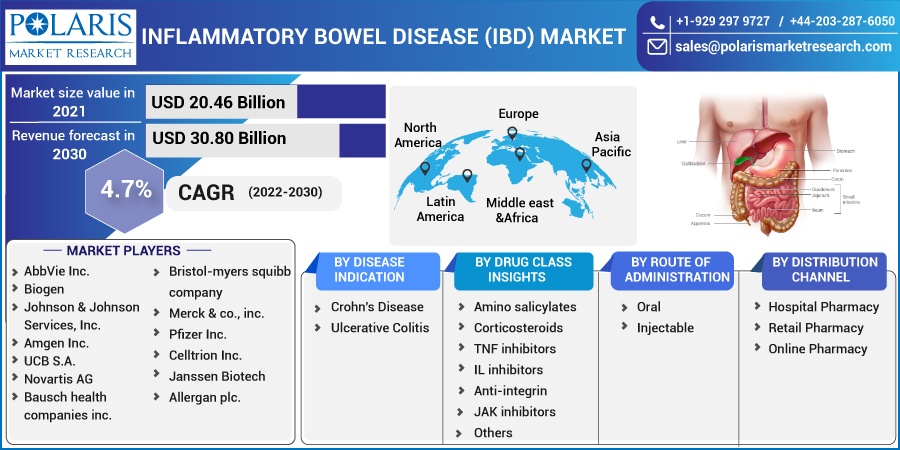

The global inflammatory bowel disease treatment market was valued at USD 20.46 billion in 2021 and is expected to grow at a CAGR of 4.7% during the forecast period. The rising prevalence of Crohn's disease and ulcerative illness globally is anticipated to be an important driver of market expansion over the course of the forecast period.

Know more about this report: Request for sample pages

Growth in the use of biologics in medicine and the availability of potent pipeline drugs, including Vedolizumab, Tofacitinib, Ustekinumab, Filgotinib, and Upadacitinib and are additional factors contributing to the market's anticipated growth in the next years.

The emergence of promising developmental drugs for the treatment of inflammatory bowel disease (IBD) will fuel industry expansion. According to ClinicalTrials.gov., there are currently 965 clinical trials being undertaken in the United States alone out of the 2,784 clinical trials (including medication development, observational studies, and others) connected to IBD.

The inflammatory bowel disease treatment market is being driven by advances in product research, prescription approval, and a growing propensity to use biologic and biosimilar medications. The growth in inflammatory bowel disease medicine sales through the internet, retail, and hospital pharmacies are assisting businesses in increasing their revenue.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One reason for the development of the inflammatory bowel disease treatment market is the rising incidence of Crohn's disease and ulcerative colitis, as well as the increased awareness of the condition worldwide. The incidence rate of IBD is consistently increased over the course of a few years, especially in newly industrialized countries, which implies that IBD is a disease that affects people all over the world.

Each year, 70,000 new cases of IBD are detected, and up to 80,000 children appear to have Crohn's disease (CD) or ulcerative colitis (UC). Approximately 2.5 to 3 million people in Europe, or roughly 0.3% of the total population, are thought to be affected by IBD, according to Hammer et al. As per British Medical journals, IBD may affect up to 240,000 people in the United Kingdom.

As a result, a number of major businesses in the sector are focusing on R&D and investigating new possible candidates for treating IBD. For instance, in March 2022, Arena Pharmaceuticals, a medical start-up developing novel potential treatments for the treatment of several immuno-inflammatory bowel diseases, was acquired by Pfizer Inc.

Report Segmentation

The market is primarily segmented based on disease indication, drug class insights, route of administration, distribution channel, and region.

|

By Disease indication |

By Drug Class Insights |

By Route of Administration |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Crohn's disease held a significant revenue share

In 2021, Crohn's disease held a significant revenue share, dominating the industry for treatments for inflammatory bowel disease. During the forecast period, it is expected that the segment will continue to rule. The inflammatory bowel disease treatment market is being driven by reasons such as a high prevalence rate, an increase in the prescription rate for biologics, and high costs related to treating Crohn's disease.

According to the Canadian Digestive Health Foundation Public Impact Series, Canada has one of the highest rates of CD in the world, second only to New Zealand (16.5 cases per 100,000 population) and slightly higher than Scotland (11.7 cases per 100,000 population) and England/Wales (11.7 cases per 100,000 population) (5.9 to 11.1 cases per 100,000 population).

The development of the ulcerative colitis industry is attributed to both the growing number of medications that have been given regulatory agency approval for the treatment of ulcerative colitis and the rising incidence of the ailment globally. In the United States and Europe in 2020, ulcerative colitis accounted for 54% of all inflammatory bowel disease cases. Furthermore, it is anticipated that the use of biologics to treat ulcerative colitis will increase dramatically in the coming years.

TNF inhibitors accounted for the largest revenue share

This is primarily due to the high cost of these medications, increased use of biologics and biosimilars in Western nations like Germany, France, the United Kingdom and the United States, and the segment's huge revenue share can all be attributed to the improved efficacy and safety of pharmaceuticals in this class in the treatment of IBD.

In the treatment of IBD corticosteroids, amino salicylates, anti-integrin's and IL inhibitors all have a significant share of the industry. Amino salicylates are used as the first line of treatment for IBD. However, it is projected that JAK inhibitors will expand at the fastest rate during the forecast period.

Injectable category led the market for the treatment of inflammatory bowel disease

In 2021, the injectable category led the market for the treatment of inflammatory bowel disease. The high efficacy of injectable medications is the reason for the segment's dominance. IL inhibitors like Stelara and TNF inhibitors like infliximab, adalimumab, certolizumab pegol, and golimumab are both injectable medications. The dominance of the injectable industry is mostly due to the high number of prescriptions and the high price of these medications.

Over the forecast period, the oral mode of medication delivery is anticipated to experience the fastest growth. The approval of JAK inhibitors for the treatment of IBD and the existence of potent oral pipeline drugs for the treatment of IBD are two factors that have contributed to the expansion of this industry. JAK inhibitors and S1P modulators, which will soon be available, are anticipated to accelerate the inflammatory bowel disease treatment industry expansion.

Hospital pharmacy sector dominated the market

Hospital pharmacies and retail pharmacies, and others make up the distribution channel segments of the market. Because reimbursement rules in poor countries cover the high cost of these pharmaceuticals, the hospital pharmacy segment has a substantial market share.

By accounting for the biggest revenue share in 2021, the hospital pharmacy sector dominated the market for the treatment of inflammatory bowel disease. Over the projection period, the sector is expected to rule the industry. Inflammatory bowel disease patient hospitalization rates are rising, which is fuelling the industry's expansion.

North America had the largest revenue share in the market

North America had the largest revenue share in the market. Region's growth was primarily due to the high prevalence and rising incidence of ulcerative colitis and Crohn's disease in the United States and Canada. The region's domination of the worldwide market can be attributed to these variables as well as to the region's developed healthcare system and high risk of lifestyle-related factors.

Additionally, the worldwide IBD therapy market in the region is anticipated to be driven by the strong product pipelines of leading competitors.

APAC is projected to register the highest growth rate over the study period. In the following period, the market is anticipated to be driven by the rising incidence of ulcerative colitis and Crohn's disease in the area, as well as by the increased prescription of biosimilars and approval of innovative drugs.

According to a study published in NCBI in 2022, East Asia, which includes Japan, Korea, China, and other countries, has the highest incidence of inflammatory bowel disease. The economies of countries like China and India are also predicted to keep growing.

Competitive Insight

Some of the major players operating in the global market include AbbVie, Biogen, Johnson & Johnson, Amgen, UCB S.A., Novartis AG, Takeda Pharmaceutical Company Limited, Bausch Health, Bristol-Myers Squibb Company, Gilead sciences, Merck, Pfizer, Lilly, and Celltrion.

The leading players are now focusing on implementing strategies into practice, such as using new technology, product innovations, acquisitions and mergers, joint ventures, and collaborations, to improve their market position in the worldwide inflammatory bowel disease treatment market.

Recent Developments

- In March 2022, FDA has approved RINVOQ for the treatment of severe to moderate ulcerative colitis developed by the AbbVie Inc.

- In May 2021, the U.S. Food and Drug Administration (FDA) authorized Bristol Myers Squibb's- Zeposia drug for the treatment of people with moderately to very active UC.

- In September 2019, the European Union approved STELARA, a drug manufactured by Janssen Biotech, Inc., for the treatment of moderate to severe active ulcerative Colitis.

Inflammatory Bowel Disease Market Report Scope

|

Report Attributes |

Details |

|

|

Market size value in 2021 |

USD 20.46 billion |

|

|

Revenue forecast in 2030 |

USD 30.80 billion |

|

|

CAGR |

CAGR of 4.7% from 2021 to 2030 |

|

|

Base year |

2021 |

|

|

Historical data |

|

|

|

Forecast period |

2022 - 2030 |

|

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

|

Segments covered |

Type; drug class; route of administration; distribution channel; region |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

|

Key companies |

AbbVie Inc., Biogen, Johnson & Johnson Services, Inc., Amgen Inc., UCB S.A., Novartis AG, Takeda Pharmaceutical Company Limited, Bausch health companies inc., Bristol-myers squibb company, Merck & co., inc., Pfizer Inc., Celltrion Inc., Janssen Biotech, Allergan plc. |