Leukemia Therapeutics Market Share, Size, Trends, Industry Analysis Report, By Type of Leukemia (Chronic Myeloid, Chronic Lymphocytic, Acute Lymphocytic, Acute Myeloid); By Treatment Type; By Route of Administration; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM1341

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

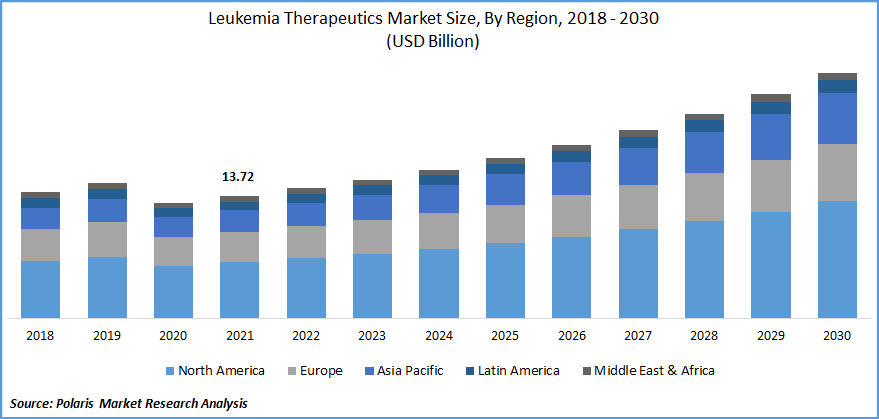

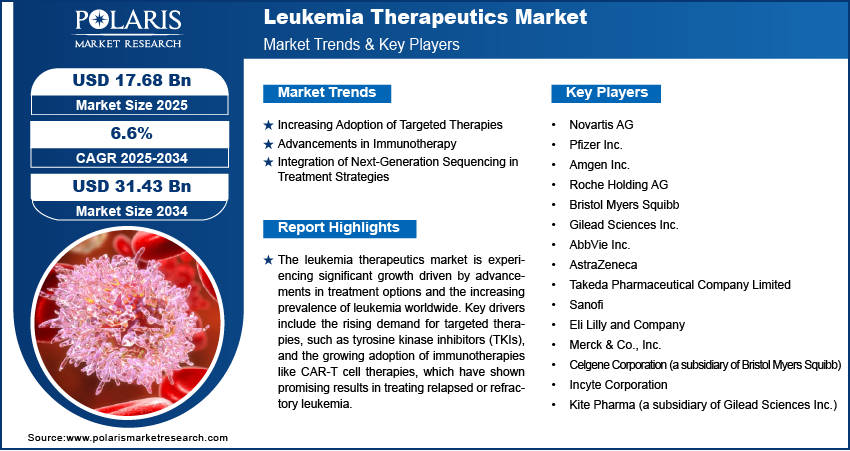

The global leukemia therapeutics market was valued at USD 13.72 billion in 2021 and is expected to grow at a CAGR of 8.3% during the forecast period. The market for leukemia treatments is primarily driven by an increase in leukemia cases, a high unmet medical demand for cancer treatment, and increased investment in the healthcare industry.

Know more about this report: Request for sample pages

Around the world, leukemia affects a sizable portion of the population. Acute and chronic illnesses that are frequently brought on by radiation exposure, poor lifestyle decisions, and environmental factors are how leukemia is identified. The main market drivers are an aging population base and substantial unmet needs for the early detection and treatment of leukemia.

The Leukemia & Lymphoma Society 2021 study estimates that men are affected by leukemia by a ratio of about 36.5 percent. More males than women are diagnosed with leukemia and passed away from it. Additionally, people of all sexes and ages were affected by leukemia, which had 474,519 cases worldwide in 2020, according to GLOBOCAN 2020 statistics.

According to the same source, leukemia was a significant cause of death worldwide in 2020. As a result, the overall data show that a sizable population is susceptible to leukemia, which could directly affect the market's growth during the forecast period.

The development of this industry is also predicted to be aided by improvements in drug discovery, growth in the number of biotechnology firms, and increased R&D spending. For example, the Leukemia & Lymphoma Society Therapy Acceleration Program announced five additional investments in April 2021 to accelerate the development of novel and improved immunotherapies to treat blood malignancies.

Through grants and TAP investments, LLS has committed more than USD 100 million over the past several decades to advancing cutting-edge strategies that use cellular immunotherapies to combat blood malignancies. There are both positive and harmful effects of the COVID-19 pandemic on the healthcare sector.

There is an imbalance between the supply and demand for pharmaceutical products in the healthcare sector due to the stringent lockdowns that numerous governments worldwide have enacted to stop the coronavirus from spreading. The majority of corporations have manufacturing bases in important nations like the USA, UK, and Germany, where the pandemic has had a significant influence, affecting the company's revenue for numerous healthcare items in the process.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising cancer incidences are expected to drive market growth over the forecast period. According to the Centers for Disease Control and Prevention, cancer will cause roughly 10 million deaths worldwide in 2020. An additional 19.3 million cancer cases are anticipated to be identified by 2025. Furthermore, According to National Institutes of Health data from 2022, there were 4.1 new instances of acute myeloid leukemia for every 100,000 men and women. The annual mortality rate was 2.7 per 100,000 men and women.

The global market development is anticipated to be fueled by the R&D and new product releases being carried out by a sizable number of companies. For instance, on September 22, 2022, the National Cancer Institute (NCI) and Mayo Clinic will begin working together on a phase I trial to assess the safety, effectiveness, and best dosage of onvansertib for the treatment of patients with relapsed or unresponsive chronic leukemia. Onvansertib interacts with and inhibits the PLK1 enzyme, which inhibits the growth of cancer cells and causes cell death. Such product development efforts and product launches are aiding the market's growth.

Report Segmentation

The market is primarily segmented based on type, treatment type, route of administration, and region.

|

By Type |

By Treatment Type |

By Route of Administration |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Chronic myeloid segment accounted for the largest revenue share

The market for leukemia therapeutics is predicted to be dominated by chronic myeloid leukemia in 2021. The prevalence of Chronic Myeloid Leukemia (CML) and the number of treatment options available for it are two factors driving this market's growth. In the United States, the American Cancer Society estimates that there will be 8,860 new instances of chronic myeloid leukemia in 2022, with 5,120 men and 3,740 women receiving the diagnosis. Additionally, 1,220 people will pass away from the disease (670 men and 550 women).

This is predicted to fuel market expansion. Additionally, the growth of this market sector is driven by an aging population, increased financing for cancer research, and the creation of novel treatments. It is anticipated that a rising number of drugs will receive regulatory body approval throughout the projected period. For instance, the biopharmaceutical company Ascentage Pharma Limited reported in November 2021 that the European Commission had approved the candidate olverembatinib, an orphan classification for treating chronic myeloid leukemia.

Chemotherapy segment will account for a higher share of the market.

The chemotherapy category is expected to dominate the market throughout the forecast period since chemotherapy is the first line of treatment for leukemia, resulting in effective treatment outcomes for the patient. Several businesses are concentrating on producing ground-breaking medicines for leukemia treatment to preserve their competitive edge and enter into new regional markets. Therefore, chemotherapy is the primary form of treatment for most leukemia patients.

For instance, BDR Pharma has announced the release of Midostaurin. It is approved to treat rare, challenging malignancies. The medication is licensed for use in adults with newly diagnosed acute myeloid leukemia who are FLT3 mutation-positive, along with conventional daunorubicin & cytarabine induction and intensive cytarabine-based chemotherapy as for patients in complete remission followed by Midostaurin single-agent maintenance therapy.

Injectable segment is expected to hold the significant revenue share

The injectable segment accounted for the largest share due to the presence of chemotherapy and targeted therapies, making it the most preferred route of administration. The older population needs a broader supply of generic medications and dosages.

Moreover, when people age, they develop a variety of ailments, which has caused the medication delivery sector to rise rapidly. In addition, the market for injectable medication delivery will be considerably impacted by the expanding global markets for biologics and biosimilars.

Furthermore, the sector for injectable pharmaceutical administration is being driven ahead by rising urbanization and disposable wealth. Additionally, the market for injectable medicine administration will expand more quickly due to changing lifestyles and increased healthcare infrastructure spending.

The demand in North America is expected to witness significant growth

In 2021, North America had a value of USD XX billion. Due to high healthcare spending, numerous major participants in developing new leukemia treatments, and the rising prevalence of leukemia patients across North America, the area now has a dominant position in the global market.

For instance, the American Cancer Society predicted in January 2022 that there would be around 60,650 new cases of leukemia, 24,000 leukemia-related fatalities, and approximately 11,450 deaths from acute myeloid leukemia in the U. S. that year. According to the data, a significant portion of adults are affected and need appropriate medical care if they want to live longer.

Much medical equipment has been installed in diagnostic centers, hospitals, and other medical facilities. Many original equipment manufacturers in the U.S. are leading the world in pharmaceutical and biotechnology enterprises. The American medical device market is well-established and diverse and offers patients various diagnostic and therapeutic tools. As a result, the regional market is expanding.

Competitive Insight

Some of the major players operating in the global market include AbbVie, Bristol-Myers Squibb, Novartis, F. Hoffmann-La Roche, Pfizer, Sanofi, Amgen, Gilead Sciences, Takeda Pharmaceutical, GlaxoSmithKline plc, Biogen, Celgene, Genzyme Corporation, Roche, Ambit Biosciences Corporation, and Ariad Pharmaceuticals.

Recent Developments

- In September 2022, the Oryzon Genomics conducted study trial to assess safety and efficacy of RP2D with iadademstat + gilteritinib in the FLT3-mutated recurrent AML condition.

Leukemia Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 14.60 billion |

|

Revenue forecast in 2030 |

USD 27.63 billion |

|

CAGR |

8.3 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Treatment Type, By Route of Administration, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AbbVie, Bristol-Myers Squibb, Novartis, F. Hoffmann-La Roche, Pfizer, Sanofi, Amgen, Gilead Sciences, Takeda Pharmaceutical, GlaxoSmithKline plc, Eisai C., Biogen, Celgene, Genzyme Corporation, Roche, Ambit Biosciences Corporation, and Ariad Pharmaceuticals. |