Rapid Medical Diagnostic Kits Market Share, Size, Trends, Industry Analysis Report, By Product [Professional and Over-The-Counter (OTC)]; By Technology (Agglutination, Solid Phase, Lateral Flow, and Other Technologies); By Application; By End Use; By Regi

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM1741

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

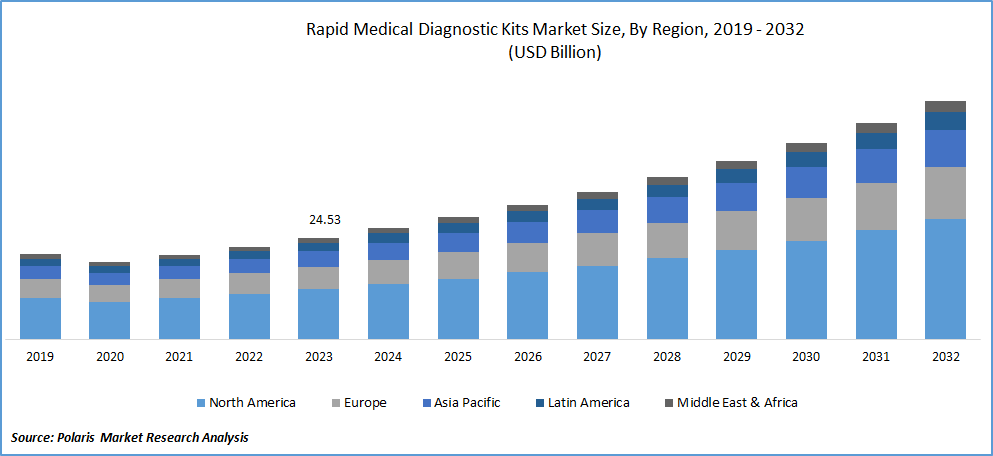

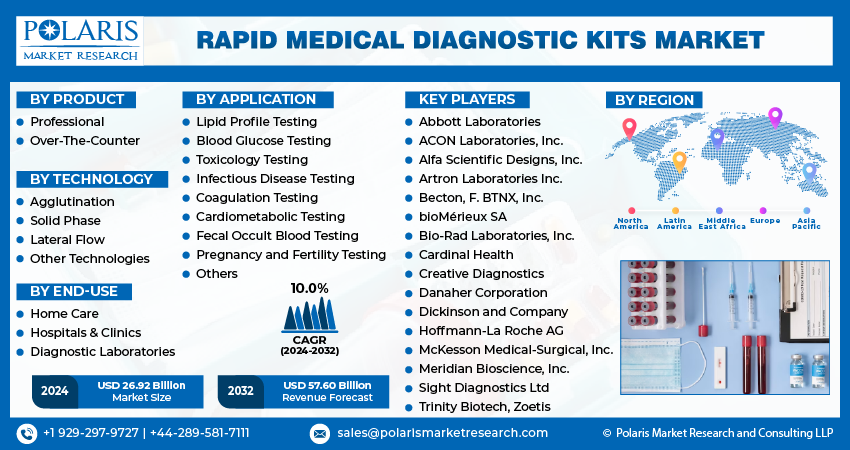

The global rapid medical diagnostic kits market was valued at USD 24.53 billion in 2023 and is expected to grow at a CAGR of 10.0% during the forecast period.

Rapid diagnostic test (RDT) kits are easy and quick-to-form medical diagnostic tests. They provide results within a few minutes, making them suitable for preliminary or emergency medical screening. RDTs are particularly useful in limited-resource medical facilities, where access to laboratory facilities and specialized equipment may be restricted.

Rapid medical diagnostic kits, also known as rapid diagnostic tests (RDTs) or point-of-care tests, are portable, easy-to-use diagnostic tools designed to provide quick and reliable results for detecting various diseases or conditions. These kits are designed to deliver rapid and accurate results, often within minutes, without complex laboratory equipment or specialized training.

To Understand More About this Research: Request a Free Sample Report

It typically consists of a test device, reagents, and instructions for use. The test device may utilize different detection methods, such as lateral flow immunoassays, nucleic acid amplification, or antigen-antibody reactions, to detect specific biomarkers or pathogens associated with the targeted disease. The reagents included in the kit are designed to facilitate the detection process and ensure accurate results.

These diagnostic kits are widely used in various healthcare settings, including hospitals, clinics, community health centers, and at home. They are particularly useful in resource-limited stages or remote areas where access to laboratory facilities and skilled personnel may be limited. Rapid medical diagnostic kits have been developed for various conditions, including infectious diseases (such as HIV, malaria, and influenza), sexually transmitted infections, cardiovascular diseases, pregnancy testing, and, more recently, for detecting COVID-19.

The demand for rapid medical evaluation is expected to increase due to the rising prevalence of multidrug-resistant bacterial infections. Additionally, the outbreak of COVID-19 has invented a substantial opportunity for manufacturers to create rapid diagnostic test supplies to prevent the spread of the virus. Factors such as expanding population, genetic variation in hosts and pathogens, and environmental changes increase demand for rapid medical supplies, driving industry expansion.

The rising incidence of chronic and infectious diseases and increasing health awareness drive the demand for point-of-care diagnostics and contribute to rapid medical diagnostic kits market growth.

Rapid diagnostic test kits consist of essential medical equipment, tools, and devices that are easy to use and provide quick results in emergencies. These kits are disposable, membrane-based, and cost-effective, offering immediate treatment for individuals in critical medical conditions. They enable necessary and emergency medical care anywhere, ensuring prompt treatment in urgent situations.

Industry Dynamics

- Growth Drivers

- Increasing Incidences of Infectious Diseases

Rapid medical diagnostic kits play a crucial role in managing emergency medical situations. The increasing incidences of infectious diseases, diabetes, and cancer, along with the outbreak of COVID-19, have driven the global demand for these kits. The growing awareness of the importance of rapid disease treatment and its impact on patient outcomes has contributed to the market's growth. Quick medical diagnostic kits' ease of use and portability have also significantly driven market expansion.

The COVID-19 pandemic has further accelerated the demand for modern techniques and applications, particularly in point-of-care settings. It has led to the development of rapid diagnostic kits for COVID-19 testing. For instance, in March 2020, Mesa Biotech, Inc. received a contract of USD 561,000 from the U.S. Department of Health and Human Services to develop rapid diagnostic kits for COVID-19 diagnosis.

Report Segmentation

The market is primarily segmented based on product, technology, application, end-use, and region.

|

By Product |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Professional segment accounted for the largest market share in 2023

In 2023, the professional segment accounted for the largest share in the global market for medical diagnostic kits, focusing on laboratory tests that provide high specificity and sensitivity, ensuring an effective disease diagnosis. Professional test kits are widely recognized as the gold standard in research applications due to their efficacy and safety.

The over-the-counter (OTC) segment has shown significant potential in terms of revenue share. OTC kits are commonly used in various settings, such as offices, schools, and home care, offering a cost-effective and convenient alternative to laboratory testing. These kits are rapid medical diagnostic tools readily available, providing instant and quick disease diagnosis.

By End-Use Analysis

- The hospitals & clinics segment expected to witness fastest CAGR during the forecast period.

The hospitals & clinics segment expected to witness fastest CAGR during the forecast period, primarily due to the increasing prevalence of primary care settings within hospitals, where these kits are extensively used to diagnose and treat various diseases. Hospitals and clinics are major hubs for healthcare services, making them a major segment for adopting these kits.

Furthermore, the home care settings segment is also expected to grow significantly globally. This growth can be attributed to the rising trend of point-of-care testing services in home-based healthcare settings. Point-of-care testing allows for immediate diagnosis and monitoring of patients' home health conditions. This convenience and accessibility have increased demand for such kits in home care settings.

Regional Analysis

The North America accounted for the largest market share in 2023

In 2023, North America accounted for the largest market share of rapid medical diagnostic kits due to the high prevalence of diseases, particularly diabetes, in the area. The increasing awareness in the healthcare industry and the growing patient demand have contributed to the market's growth. For example, Abbott introduced the "Afinion HbA1c Dx" point-of-care HbA1c test in June 2019 to aid in diagnosing diabetic patients.

The Asia Pacific market is projected to grow at the fastest CAGR during forecast period. Key players in the region are introducing recent medical testing kits to provide comprehensive rapid diagnosis services. In March 2020, Biolidics, a Singapore-based company, introduced the "2019-nCoV IgG/IgM" quick kit for COVID-19. The company received approval from Singapore's Health Science Authority (HSA) for its rapid test kit, contributing to the growth of the immediate medical diagnostic kits market in the Asia Pacific.

Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the key players working in the global rapid medical diagnostic kits market include;

- Abbott Laboratories

- ACON Laboratories, Inc.

- Alfa Scientific Designs, Inc.

- Artron Laboratories Inc.

- Becton

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Cardinal Health

- Creative Diagnostics

- Danaher Corporation

- Dickinson and Company

- F. BTNX, Inc.

- Hoffmann-La Roche AG

- McKesson Medical-Surgical, Inc.

- Meridian Bioscience, Inc.

- Sight Diagnostics Ltd

- Trinity Biotech

- Zoetis

Recent Developments

- In March 2022, Brain Chemistry Labs and Arlington Scientific collaborated to develop a user-friendly rapid test kit. This kit aims to detect the presence of β-methylamino-L-Alanine (BMAA), a toxin in cyanobacterial blooms. BMAA is associated with the development of Amyotrophic Lateral Sclerosis (ALS), a severe paralytic disease.

- In March 2022, GenBody America, an affiliate of GenBody Inc., announced the opening of its production facility in California. The facility will manufacture visually readable anterior nasal swab kits for COVID-19 antigen tests. With a production capacity of 1.5 million kits per week, it aims to meet the growing demand for testing.

- In July 2021, IIT Hyderabad in India developed COVIHOME, an AI-powered rapid test kit for COVID-19. This kit enables the detection of symptomatic and asymptomatic patients within 30 minutes without needing medical expert supervision. It offers a convenient and efficient testing solution.

Rapid Medical Diagnostic Kits Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.92 billion |

|

Revenue forecast in 2032 |

USD 57.60 billion |

|

CAGR |

10.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Technology, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Rapid Medical Diagnostic Kits Market report covering key segments are product, technology, application, end-use, and region.

Rapid Medical Diagnostic Kits Market Size Worth $ 57.60 Billion.

The global rapid medical diagnostic kits market is expected to grow at a CAGR of 10.0% during the forecast period

The North America is leading the global market.

the key driving factors in Rapid Medical Diagnostic Kits Market is Increasing Incidences of Infectious Diseases