Rare Disease Genetic Testing Market Share, Size, Trends, Industry Analysis Report, By Disease Type; By Technology; By Speciality; By End-Use (Research Laboratories & Cros, Hospitals & Clinics, Diagnostic Laboratories); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1772

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

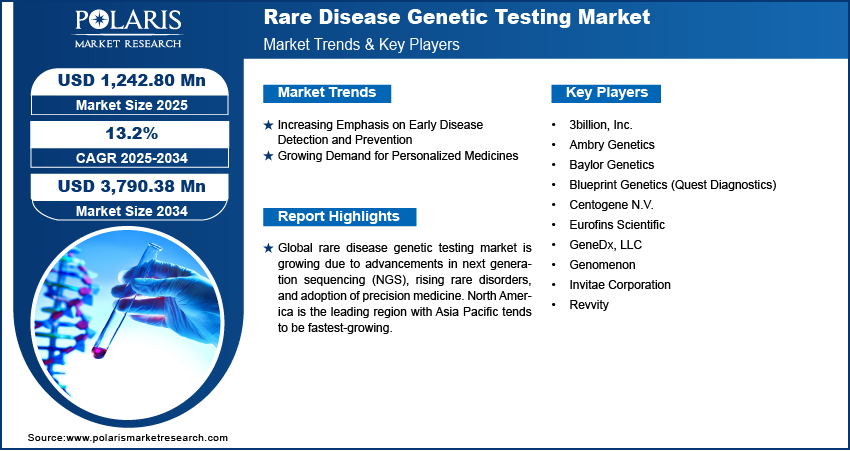

The global rare disease genetic testing market was valued at USD 334.7 million in 2023 and is expected to grow at a CAGR of 12.70% during the forecast period.

The rare disease genetic testing market has witnessed significant growth in recent years due to advancements in genetic testing technologies and increased awareness about rare genetic disorders. Rare diseases, also known as orphan diseases, are a group of conditions that affect a small percentage of the population. Genetic mutations often cause these diseases and can be challenging to diagnose and treat.

To Understand More About this Research: Request a Free Sample Report

Genetic testing plays a crucial role in identifying and diagnosing rare diseases. It involves analyzing an individual's DNA to detect any genetic variations or mutations responsible for their symptoms. The testing process typically includes DNA sequencing, molecular analysis, and other techniques to identify specific congenital abnormalities associated with rare diseases.

Several factors driving the market include advancements in DNA sequencing technologies, such as next-generation sequencing (NGS), which have made genetic testing more accessible and cost-effective. This has enabled healthcare providers to offer comprehensive genetic testing panels that can analyze multiple genes simultaneously, improving diagnostic accuracy for rare diseases.

The increasing prevalence of rare diseases and the rising demand for early and accurate diagnosis fuel the market growth. Many rare diseases have a genetic basis, and early detection can significantly impact patient outcomes by facilitating timely interventions and appropriate disease management strategies.

The COVID-19 pandemic has had mixed effects on the market. On the positive side, there has been an increased focus on personalized medicine and targeted therapies, with genetic testing playing a crucial role in identifying rare genetic disorders and guiding customized treatments. The pandemic has also accelerated the adoption of telemedicine, enabling at-home testing and virtual genetic counseling for individuals with rare diseases.

However, there have also been negative impacts, including disruptions in healthcare services leading to delayed diagnosis and testing, supply chain disruptions causing delays and increased costs, financial constraints affecting affordability and accessibility of testing, and research disruptions slowing down the development of new technologies and interventions.

Industry Dynamics

Growth Drivers

Technological advancements and next-generation sequencing (NGS)

The rare disease genetic testing market is experiencing growth driven by technological advancements in genetic testing, particularly next-generation sequencing (NGS), which has greatly enhanced the accuracy, speed, and cost-effectiveness of genetic testing. These advancements enable laboratories to analyze multiple genes simultaneously, improving the detection of rare genetic variants.

The increasing prevalence of rare diseases worldwide has spurred the demand for genetic testing. As rare diseases often have a genetic basis and can be challenging to diagnose through traditional methods, genetic testing plays a vital role in accurately identifying and diagnosing these disorders. The growing awareness of rare diseases and their genetic components has led healthcare providers to incorporate genetic testing into their diagnostic and treatment decision-making processes.

Another significant driver is the rise of personalized medicine and targeted therapies. Genetic testing allows healthcare professionals to identify specific genetic mutations or variations responsible for rare diseases, facilitating personalized treatment strategies tailored to individual patients. This approach improves treatment outcomes, reduces adverse effects, and optimizes patient care. Additionally, the demand for early diagnosis of rare diseases has fueled the adoption of genetic testing. Early identification enables timely interventions, appropriate treatment planning, and genetic counseling for patients and their families. By facilitating early diagnosis, genetic testing contributes to more effective disease management and improved patient outcomes.

Supportive regulatory environments have also played a role in the market's growth. Governments and regulatory bodies have recognized the importance of genetic testing in rare diseases, implementing policies and regulations to streamline approval processes, ensure quality standards, and promote research and development. These initiatives have fostered innovation and expanded access to genetic testing services.

Also, increasing awareness and patient advocacy efforts have heightened the recognition of genetic testing's value in rare diseases. Patient organizations, healthcare professionals, and advancements in media and communication have raised awareness about rare diseases and the role of genetic testing. This has increased the demand for genetic testing services among patients, healthcare providers, and the general public.

Report Segmentation

The market is primarily segmented based on disease type, technology, specialty, end-use, and region.

|

By Disease Type |

By Technology |

By Speciality |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Disease Type Analysis

Endocrine and metabolism diseases segment accounted for the significant market share in 2022

The endocrine and metabolism diseases segment held the significant market share in 2022. The segment's growth was driven by the increasing demand for understanding the molecular and genetic causes of endocrine diseases like Cushing's syndrome. Additionally, identifying inherited mutations in primary pigmented nodular adrenocortical disease and bilateral macronodular adrenal hyperplasia is expected to boost this segment's progress further.

The immunological disorders segment is projected to have the highest revenue share. Multiple Sclerosis (MS), one of the most prevalent rare diseases, contributes significantly to this segment. Researchers in this field are particularly focused on studying the genetic profile of MS and gaining valuable insights into the underlying causes and physiology of the disease, which in turn drives market growth.

By Technology Analysis

Next-generation sequencing segment is anticipated to hold significant market share over forecast period

The next-generation sequencing segment is expected to hold a significant market share. Adopting next-generation sequencing-based gene panels for various applications such as neurologic disease, cancer, pediatric conditions, cardiovascular disease, psychiatric disorders, and other disease testing has been a key driver for the segment's growth.

Next-generation sequencing is classified into two categories whole exome and genome sequencing. The increasing acceptance of whole exome sequencing-based gene tests in the medical field has played a crucial role in advancing next-generation sequencing technology, thereby driving the growth of the rare disease genetic testing market.

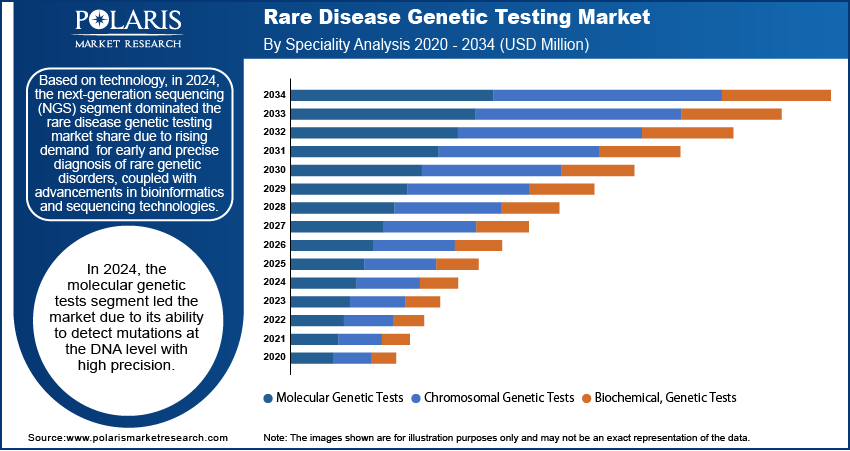

By Speciality Analysis

Molecular genetic test segment is expected to grow fastest in the market during forecast period

The molecular genetic tests segment is anticipated to grow fastest in the market. This growth is attributed to technological advancements and expertise in managing high-throughput technologies in clinical settings. Molecular genetic testing techniques are employed to identify mutations or other abnormalities that cause genetic illnesses. These techniques focus on analyzing single genes and short lengths of DNA, making them suitable for rare and ultra-rare diseases. This factor is expected to drive the market for rare disease genetic testing and contribute to expanding the molecular genetic tests segment.

Genome sequencing emerged as the most widely used advanced testing technique. It is readily available in research and clinical settings, thanks to low-cost sequencing tests. This accessibility promotes the development of new tests based on next-generation sequencing technology.

Furthermore, the biochemical and genetic tests segment is projected to experience rapid growth during the forecast period. This segment can identify alterations in DNA that could lead to metabolic diseases and assess the quantity, activity, and associated abnormalities of proteins.

By End-Use Analysis

Research Laboratories & CROs segment hold the largest revenue share in 2022

Research labs and Contract Research Organizations (CROs) hold the largest revenue share in the market. These entities serve as significant contributors to the market. Laboratories, in particular, are key end users and offer a wide range of testing specialties, including molecular, chromosomal, and biochemical genetic tests.

The demand for molecular genetic testing-based laboratory testing is rapidly expanding globally. Many laboratories, including those approved by the Clinical Laboratory Improvement Amendments (CLIA), provide genetic testing services across various areas such as clinical cytogenetics, pathology, and chemistry.

Moreover, the diagnostic laboratories segment is expected to grow fastest during the forecast period. This growth can be attributed to the increasing collaborations and partnerships between diagnostic laboratories and genetic testing companies, which further drive advancements and accessibility in rare disease genetic testing.

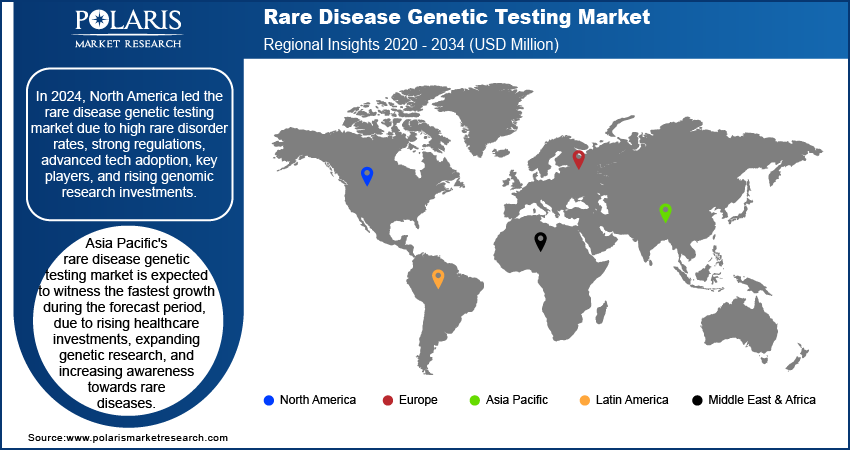

Regional Insights

North America is anticipated to hold the largest market share over forecast period

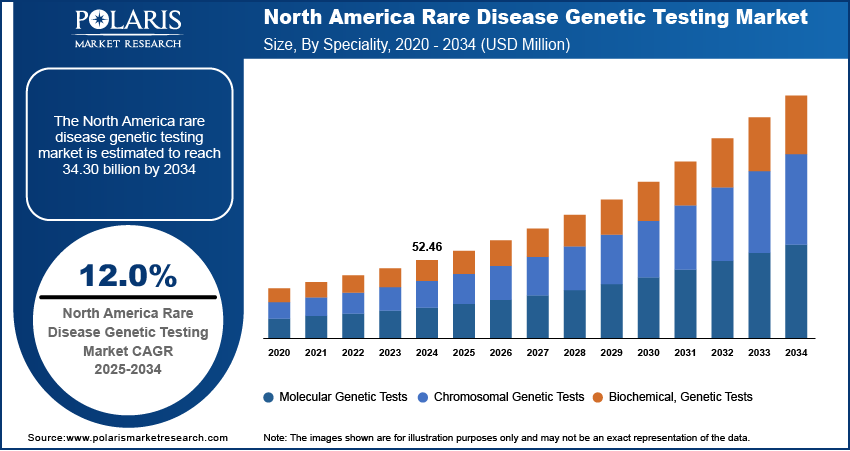

North America is projected to hold the largest market share during the forecast period due to the increasing prevalence of rare diseases, numerous disease registries, a significant number of research and development centers focused on ultra-rare diseases, and substantial investments in disease detection.

According to the National Institutes of Health, there are over 7,000 rare diseases, and nearly 30 million Americans have been diagnosed with one or more of these conditions. The rise in the number of patients undergoing disease testing has significantly contributed to the market growth in this region.

Key Market Players & Competitive Insight

The increasing recognition of the clinical utility of genetic testing for diagnosing and managing rare diseases. Key players are expanding their genetic testing portfolios and geographic reach through strategic acquisitions and partnerships. Advancements in next-generation sequencing (NGS) technologies have lowered the cost and improved the accuracy of genetic testing. As the demand for early and accurate rare disease diagnosis continues to rise, competition remains fierce in delivering innovative genetic testing solutions, customizing therapies, and optimizing patient outcomes.

Some of the major players operating in the global market include:

- 3billion, Inc.

- Ambry Genetics

- Arup Laboratories

- Artemis DNA

- Centogene N.V.

- Color Genomics, Inc.

- Coopersurgical, Inc.

- Eurofins Scientific

- Fulgent Genetics Inc.

- Genomenon

- Health Network Laboratories

- Invitae Corp.

- Laboratory Corporation of America Holdings

- Macrogen, Inc.

- Myriad Genetics, Inc.

- OPKO Health, Inc.

- PerkinElmer, Inc.

- PreventionGenetics

- Progenity, Inc.

- Quest Diagnostics Inc.

- Realm IDX, Inc.

- Strand Life Sciences

Recent Developments

- In February 2022, Bionano Genomics has recently introduced the Rare Undiagnosed Genetic Disease (RUGD) initiative, aiming to enhance the commitment and emphasis on clinical and translational research.

- In November 2021, Genomenon collaborated with Alexion to empower the genetic testing laboratories with the data they need to diagnose rare diseases.

Rare Disease Genetic Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 374.7 million |

|

Revenue forecast in 2032 |

USD 3,102.4 million |

|

CAGR |

13.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Disease Type, By Technology, By Speciality, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in rare disease genetic testing market are Opko Health, Inc., Arup Laboratories, Color Genomics, Inc., PreventionGenetics, Centogene N.V.

The global rare disease genetic testing market is expected to grow at a CAGR of 13.4% during the forecast period.

The rare disease genetic testing market report covering key segments are disease type, technology, specialty, end-use, and region.

key driving factors in industrial rare disease genetic testing market are technological advancements and next-generation sequencing (NGS).

The global Rare Disease Genetic Testing market size is expected to reach USD 3,102.4 million by 2032.