Systemic Scleroderma Treatment Market Share, Size, Trends, Industry Analysis Report, By Drug Class (Immunosuppressors, Phosphodiesterase 5 inhibitors-PHA, Endothelin Receptor Antagonists, Prostacyclin Analogues, Calcium Channel Blockers, Others); By Regions; Segment Forecast, 2021 - 2028

- Published Date:Jan-2021

- Pages: 78

- Format: PDF

- Report ID: PM1791

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

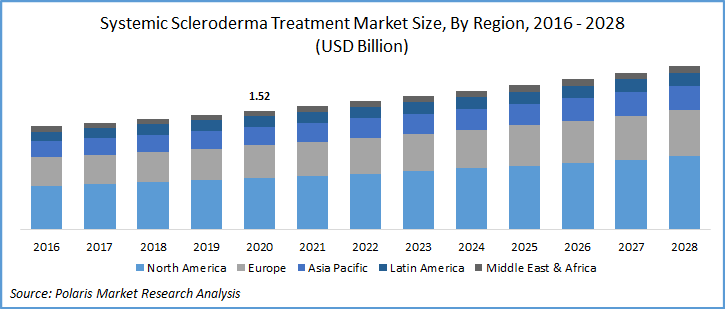

The global systemic scleroderma treatment market was valued at USD 1.52 billion in 2020 and is expected to grow at a CAGR of 4.1% during the forecast period. Key factors responsible for systemic scleroderma treatment include rapidly transforming scientific literature in systemic scleroderma, off-label drugs for symptomatic conditions, and innovations in the first-line therapies. The development towards targeted biologics and combination therapies also supplementing the systemic scleroderma treatment industry growth.

However, lack of efficient results, unique drug development challenges, and recent failures in clinical trials to prove real-world evidence support curtailing the systemic scleroderma treatment industry growth. For instance, in September 2020, Corbus Pharmaceuticals, pipeline product, Lenabasum, failed to show positive results in phase III trials, despite promising phase II trials.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Systemic scleroderma treatment industry players are focusing on a novel drug candidate at a rapid pace, varying in the mode of action and molecular entities. In the recent past, for instance, in September 2020, the U.S. based Kadmon Holdings, Inc. approved of orphan drug designation by the U.S. FDA for the potential drug candidate belumosudil (KD025). The drug was intended to treat systemic sclerosis. KD025 is a Rho-associated coiled kinase 2, addressing both immune and fibrotic mechanisms, currently being into phase II trials.

Know more about this report: request for sample pages

New approvals and a robust drug pipeline are projected to fuel systemic scleroderma treatment industry growth. For instance, in September 2019, USFDA approved Ofev (nintedanib) drug from Boehringer Ingelheim International, to treat patients with Systemic Sclerosis with Interstitial Lung Disease (SSc-ILD), followed by approval from European Medical Agency, in April 2020. Furthermore, novel therapies based on nilotinib and ziritaxestat are expected to be launched soon, to make market competition fiercer.

Systemic Scleroderma Treatment Market Report Scope

The systemic scleroderma treatment industry is primarily segmented on the basis of drug class, and region:

|

By Drug Class |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Drug Class

Based upon the drug class, the global market for systemic scleroderma treatment is categorized into immunosuppressors, phosphodiesterase-5-inhibitors-PHA, endothelin receptor antagonists, prostacyclin analogs, calcium channel blockers, and others. In 2020, the immunosuppressors market segment of the systemic scleroderma treatment industry accounted for the largest share in the global market for systemic scleroderma treatment and is projected to remain dominant. This high market share is due to the availability of immune suppressants as a gold standard among all the treatments. Most of the drug candidates are based on such drug class, as it offers better patient outcomes.

PDE-5 inhibitors market segment of systemic scleroderma treatment market is projected to account for a significant market share over the study period. Players in the market are focusing on off-label product expansion to expand their customer base. For instance, in June 2020, Pfizer announced the completion of phase III trials for its drug candidate Revatio, to treat pulmonary hypertension in infants. Owing to such development, ERAs are expected to stay as branded therapies to treat conditions with a high incidence of PAH.

Geographic Overview

Geographically, the global systemic scleroderma treatment market is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). North America region is the largest revenue contributor followed by Europe and the Asia Pacific region. In 2020, the North American market for systemic scleroderma treatment accounted for over 40% of the global market.

The regional factors responsible for the market growth include high penetration of biologics, favorable reimbursement scenario, and recent innovations in the immune suppressants-based drug pipeline. In the U.S. alone there are around 20 to 21 annual cases of the diseases per million adults and approximately 276 cases of the concerned cases per millions of the total population in the market. The condition also has direct economic costs of around USD 17,365 to USD 18,396 per individual. The steady increase in the burden of disease is expected to spur the market of systemic scleroderma treatment.

Europe market for systemic scleroderma treatment is estimated to follow North America, majorly due to extensive use of generics and off label drugs for the condition. In the UK, the market is expected to witness extensive growth over the market study period owing to the introduction of biologics and research on small molecules.

For instance, Actelion Pharmaceuticals Ltd., announced the approval for its drug, Uptravi, for the treatment of PAH. In developing nations of Asia Pacific, the use of generics and OTC drugs is going to be a mainstay in the treatment method. The increasing access to biosimilar and immune suppressants is likely to spur regions' systemic scleroderma treatment industry growth.

Competitive Insight

The prominent market players operating in the systemic scleroderma treatment industry are Roche Ltd.; United Therapeutics; Boehringer Ingelheim International GmbH; Johnson & Johnson Services, Inc.; GlaxoSmithKline plc; Pfizer, Inc.; Eli Lilly and Company; Bayer AG; Mylan N.V.; Teva Pharmaceutical Industries Ltd.