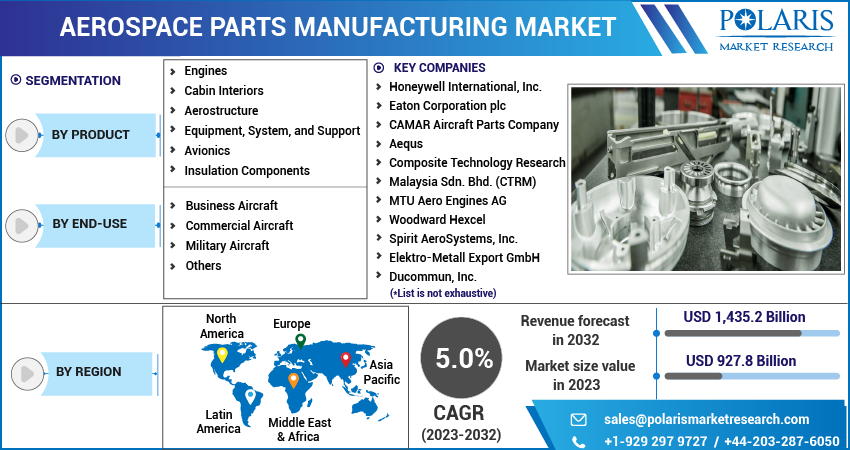

Aerospace Parts Manufacturing Market Share, Size, Trends, Industry Analysis Report, By Product (Engines, Cabin Interiors, Aerostructure, Equipment, System, and Support, Avionics, Insulation Components); By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM2353

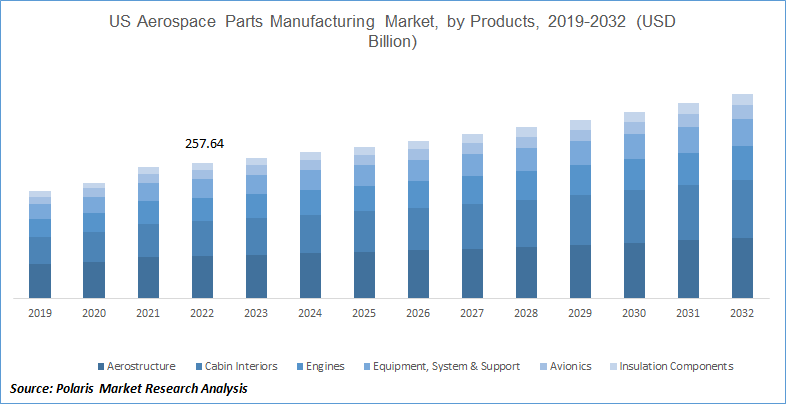

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global aerospace parts manufacturing market was valued at USD 888.6 billion in 2022 and is expected to grow at a CAGR of 5.0% during the forecast period.

The aerospace parts manufacturing market encompasses producing and supplying various components and parts used in the aerospace industry. This market is critical in creating and maintaining aircraft, spacecraft, and other aerospace systems.

To Understand More About this Research: Request a Free Sample Report

Aerospace parts manufacturing involves the fabrication, assembly, and testing of components such as engines, avionics systems, landing gears, airframes, control systems, and other vital parts required for the functioning of aerospace vehicles. These parts need to meet stringent quality and safety standards to ensure the reliability and performance of the overall aerospace system.

The aerospace industry is characterized by its demand for high precision, lightweight materials, and advanced technologies to enhance efficiency, safety, and sustainability. The aerospace parts manufacturing market continuously strives to meet these requirements by leveraging cutting-edge manufacturing techniques, including additive manufacturing, composite materials, and advanced machining processes.

The aerospace parts manufacturing market is driven by the growing demand for commercial air travel, increasing defense expenditures, and the rising adoption of uncrewed aerial vehicles (UAVs) and space exploration missions. Additionally, ongoing advancements in aerospace technologies, such as electric propulsion systems and autonomous flight capabilities, are creating new opportunities for aerospace parts manufacturers.

The aerospace parts manufacturing is anticipated to experience growth due to the increasing demand for lighter, more innovative, and fuel-efficient airplanes, driven by the need to reduce carbon emissions. Additionally, the industry is expected to benefit from the rise in fleet renewal levels and increased aircraft manufacturing. Technological advancements and the demand for specialized aircraft for specific tasks also contribute to expanding the global aerospace parts manufacturing industry.

The growth of commercial air travel worldwide is a significant driver of the aerospace parts manufacturing industry. The increasing passenger demand for air transportation necessitates the production of more aircraft, due to a higher demand for aerospace parts and components.

The defense and military sector is a major consumer of aerospace parts. Governments worldwide invest in defense expenditures to enhance national security and maintain military capabilities. It drives the demand for aerospace parts for military aircraft, helicopters, missiles, and other defense systems.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Increased Collaboration Among Competitors

The manufacturing industry in aviation goods has experienced significant benefits due to increased collaboration among competitors. For example, the partnership between Kencoa Aerospace Corporation and SyncFab, the pioneering Manufacturing Blockchain and Supply Chain Blockchain platform connecting component manufacturers and purchasers. This collaboration aims to enhance digitalization convenience and efficiency for customers in the aviation, aircraft, and military sectors.

Moreover, prominent manufacturers are relocating their production operations to emerging nations in response to growing demand from MRO (Maintenance, Repair, and Overhaul) solution providers. This shift is having an impact on the aviation components factory industry. Additionally, the extended lifespan of airplanes provides industry participants with lucrative opportunities throughout the expected period.

However, certain challenges could hinder the market in the future. These include the need for substantial capital expenditure and the volatility of raw material costs. These factors are expected to exert limitations on the market during the forecast period.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Aerostructure segment held the highest market share in 2022

The aerostructure segment held the highest market share due to the growing utilization of composite materials in fuselage manufacturing, effectively reducing the need for frequent maintenance in high-stress environments.

Furthermore, the global manufacturing market is experiencing notable development driven by the introduction of innovative aircraft constructions that are lighter in weight, resulting in improved efficiency. Incorporating lightweight components increases airplanes' speed and contributes to reduced carbon emissions and enhanced fuel economy.

Over the forecast period, the insulation component segment will exhibit significant growth due to the increasing number of airplanes in the fleet and the regular maintenance and replacement requirements of aerospace parts, including insulation components.

Similarly, the avionics segment is anticipated to experience substantial growth during the forecast period. This growth is driven by aircraft upgrades featuring new technologies, planned maintenance activities, and the rising demand for fuel-saving technologies in the aviation industry.

Commercial aircraft segment held the largest market share during the forecast period

During the forecast period, the commercial aircraft segment held the largest market share due to the escalating air traffic in emerging countries such as India and China. Additionally, urbanization, business travel, and tourism are expected to drive the demand for commercial aircraft in the market.

On the other hand, the military aircraft segment is projected to experience significant growth in the forecast period. This growth is primarily driven by the increasing demand for fighter aircraft, fueled by global security concerns. Furthermore, various government initiatives aimed at strengthening military capabilities are contributing to the growth of this segment.

North America dominated the market in 2022

In 2022, North America dominated the market primarily due to the presence of key manufacturers such as GE Aviation, Intex Aerospace, and other significant players. Moreover, the region's aerospace parts industry is expected to expand over the estimated period, driven by the growing demand for innovative and fixed-wing aircraft.

Meanwhile, the Asia Pacific region is anticipated to experience substantial growth during the forecast period. This growth can be attributed to the increasing prominence of maintenance, repair, and overhaul (MRO) operations in the region's emerging economies. Additionally, the region's growing population and rising disposable income levels among consumers are expected to drive the demand for airplanes, consequently boosting the need for the aerospace parts market in the Asia Pacific region.

Competitive Insight

Some of the key players operating in the global market include Honeywell International, Inc., Eaton Corporation plc, CAMAR Aircraft Parts Company, Aequs, Composite Technology Research Malaysia Sdn. Bhd. (CTRM), MTU Aero Engines AG, Woodward Hexcel, Spirit AeroSystems, Inc., Elektro-Metall Export GmbH, Ducommun, Inc., Rolls Royce plc, Engineered Propulsion System, Subaru Corp., GE Aviation, IHI Corp., Textron, Inc., Kawasaki Heavy Industries Ltd., Safran Group. JAMCO Corp., Liebherr International AG, Superior Aviation Beijing, Mitsubishi Heavy Industries, Ltd., Lufthansa Technik AG, and Raytheon Technologies Corp.

Recent Developments

- In July 2019, a US-based distributor of various aerospace parts, Kellstrom Defence Aerospace, Inc., completed the acquisition of Williams Aerospace & Manufacturing, Inc. Williams Aerospace & Manufacturing specializes in security aircraft spare parts and other gear. This acquisition allowed Kellstrom Defence Aerospace to expand its product offerings and strengthen its position in the aerospace industry.

- In June 2019, a major player in the aerospace manufacturing company Boeing acquired Encore Aerospace LLC company. Encore Aerospace is known for producing cabin interiors and other composites designed for the aerospace industry. This acquisition enabled Boeing to enhance its capabilities further in providing high-quality cabin interiors and advanced composites for the aerospace sector.

Aerospace Parts Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 927.8 billion |

|

Revenue forecast in 2032 |

USD 1,435.2 billion |

|

CAGR |

5.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Products, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Honeywell International, Inc., Eaton Corporation plc, CAMAR Aircraft Parts Company, Aequs, Composite Technology Research Malaysia Sdn. Bhd. (CTRM), MTU Aero Engines AG, Woodward Hexcel, Spirit AeroSystems, Inc., Elektro-Metall Export GmbH, Ducommun, Inc., Rolls Royce plc, Engineered Propulsion System, Subaru Corp., GE Aviation, IHI Corp., Textron, Inc., Kawasaki Heavy Industries Ltd., Safran Group. JAMCO Corp., Liebherr International AG, Superior Aviation Beijing, Mitsubishi Heavy Industries, Ltd., Lufthansa Technik AG, and Raytheon Technologies Corp. |

FAQ's

key companies in aerospace parts manufacturing market are Eaton Corporation plc, CAMAR Aircraft Parts Company, Aequs, Composite Technology Research Malaysia Sdn. Bhd. (CTRM), MTU Aero Engines AG.

The global aerospace parts manufacturing market is expected to grow at a CAGR of 5.0% during the forecast period.

The aerospace parts manufacturing market report covering key segments are product, end-use, and region.

key driving factors in aerospace parts manufacturing market are Increased Collaboration Among Competitors.

The global aerospace parts manufacturing market size is expected to reach USD 1,435.2 billion by 2032.