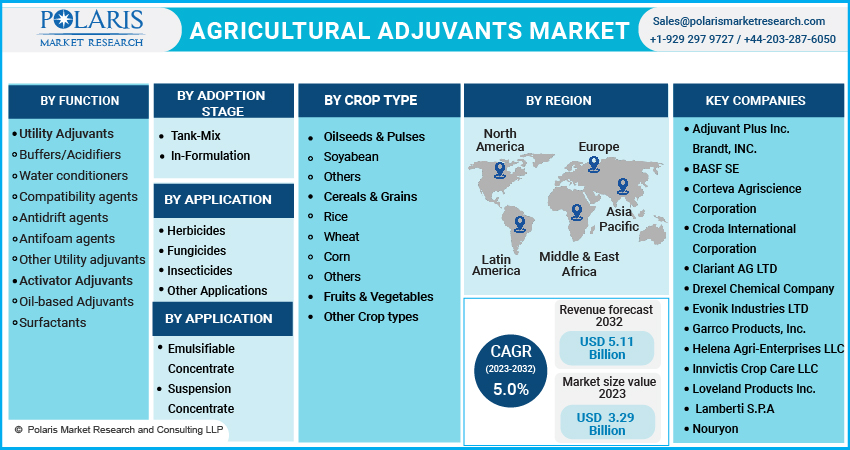

Global Agricultural Adjuvants Market Share, Size, Trends, Analysis, Industry Report By Function, By Application (Herbicides, Fungicides, Insecticides, Other Applications), By Crop Type, By Formulation, By Adoption Stage, By Region and Forecast, 2023 – 2032

- Published Date:Apr-2023

- Pages: 118

- Format: PDF

- Report ID: PM1184

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

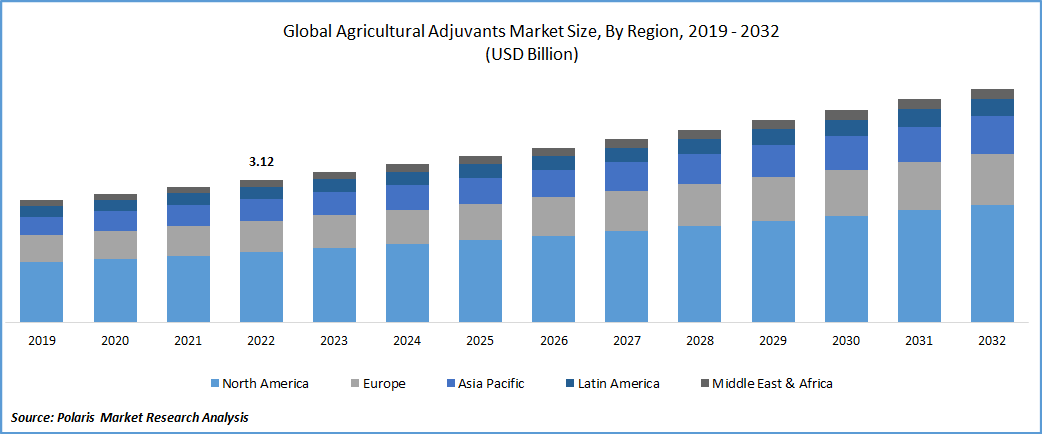

The Global agricultural adjuvants market was valued at USD 3.12 Billion in 2022 and is expected to grow at a CAGR of 5.0% during the forecast period. Global Agricultural adjuvants are substances added to pesticides, herbicides, and fungicides to improve their effectiveness and efficiency. These substances can enhance the ability of these products to penetrate plant tissues and increase their effectiveness against pests and diseases. Agricultural adjuvants are used in various farming practices, including field crops, fruit and vegetable production, and turf management. There are many different agricultural adjuvants, each with unique properties and benefits.

Know more about this report: Request for sample pages

One of the most common types of adjuvants is surfactants, which are used to reduce the surface tension of water and improve the wetting and spreading of pesticides on plant surfaces. Surfactants are particularly useful when dealing with waxy or hairy plant surfaces that can be difficult for pesticides to penetrate. Another important type of adjuvant is crop oil concentrates (COCs). COCs are made of various kinds of vegetable or petroleum-based oils, and they help improve pesticide penetration into plant tissues.

Compatibility agents are used to ensure that different pesticides and adjuvants can be mixed without reacting or degrading the effectiveness of each other. This is particularly important when multiple products are used in the same application, as incompatible mixtures can cause damage to crops or reduce the effectiveness of the treatment. In conclusion, agricultural adjuvants play an essential role in modern agriculture. They help improve the effectiveness and efficiency of pesticides, herbicides, and fungicides, leading to better crop yields and more efficient use of resources. With the wide variety of adjuvants available, farmers and applicators can choose the right products to meet their specific needs and achieve their crop production and pest management goals.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The agricultural adjuvants market is experiencing a surge in demand as growers look to improve the effectiveness of their crop protection products. The growth drivers for the global agricultural adjuvant market include the increasing demand for food due to population growth, the need to optimize crop yields, and sustainable agriculture practices.

Population growth drives the demand for more food production, leading to increased demand for agricultural adjuvants. Adjuvants help growers to maximize their crop yields by improving the efficiency and effectiveness of crop protection products. This can be especially important in regions with limited land, and farmers need to maximize the production from each acre.

In addition, there is a growing need for sustainable agriculture practices. The use of adjuvants can help growers reduce their overall use of pesticides, herbicides, and fungicides by improving the effectiveness of these products. This, in turn, can help reduce agriculture's environmental impact.

Another growth driver for the agricultural adjuvant market is the need to optimize crop yields. Adjuvants can help growers to achieve optimal results by improving the absorption and retention of crop protection products. This can be particularly important in challenging environmental conditions, such as drought, where crops may be under stress and less able to absorb nutrients.

Report Segmentation

The market is primarily segmented based on function, application, crop type, formulation, adoption stage, and region.

|

By Function |

By Application |

By Crop Type |

By Formulation |

By Adoption Stage |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

The Herbicides segment is expected to witness the fastest growth over thee coming years

The herbicides segment of the agricultural adjuvant market is expected to grow the fastest over the coming years. This is due to a number of factors, including the increasing demand for food production, the need for more efficient weed management practices, and the development of new and innovative herbicide formulations.

The use of herbicides is a critical component of modern weed management practices. With the increasing demand for food production, growers need to maximize their crop yields by minimizing the impact of weeds on their crops. Herbicides can help to achieve this goal by selectively targeting and controlling the growth of unwanted weeds.

Agricultural adjuvants can enhance the effectiveness of herbicides by improving their absorption and penetration into the target weeds. Adjuvants can also help to reduce the amount of herbicide needed to achieve the desired level of weed control, thereby reducing the overall cost and environmental impact of weed management practices.

Developing new and innovative herbicide formulations is driving growth in the herbicides segment of the agricultural adjuvant market. New formulations are being developed that offer improved performance and safety and increased compatibility with other agricultural products.

The Emulsifiable Concentrate segment accounted for the largest market share in 2022

The emulsifiable concentrate (EC) segment accounted for the largest market share in the agricultural adjuvant market in recent years. Emulsifiable concentrates are a type of adjuvant used to improve crop protection products' effectiveness, such as herbicides, insecticides, and fungicides.

ECs are highly versatile and can be used with various crop protection products. They are easily mixed with water and can be applied using different methods, such as ground or aerial spraying. ECs can also improve crop protection products' spreading and wetting properties, which can help improve their effectiveness and reduce the amount of product needed to achieve the desired level of pest control.

One of the main advantages of ECs is their ability to reduce the amount of crop protection products needed to achieve the desired level of pest control. By improving the spreading and wetting properties of crop protection products, ECs can help to ensure that the products are evenly distributed across the target area, reducing the risk of under or over-application. This can help improve crop protection products' efficacy while lowering pest management practices' cost and environmental impact.

ECs can help improve crop protection products' penetration and absorption into plant tissues. This can be particularly important when treating difficult-to-control pests, such as mites or aphids, which wax layers or other barriers can protect. ECs can help to break down these barriers, allowing the active ingredients of crop protection products to reach the target pests more effectively.

The demand in Asia Pacific (APAC) is expected to witness significant growth over forecasted period

The demand for agricultural adjuvants is expected to grow significantly in the Asia Pacific (APAC) region in the coming years. This can be attributed to several factors, including the increasing demand for food production, the adoption of advanced farming practices, and the development of new and innovative adjuvant formulations.

The APAC region is home to several densely populated countries, including China, India, and Indonesia, witnessing rapid urbanization and industrialization. This has led to a significant increase in demand for food products, driving the growth of the agricultural adjuvant market in the region. Farmers are increasingly adopting advanced farming practices to maximize crop yields and ensure food security, leading to a higher demand for adjuvants that can enhance the performance of crop protection products and improve the efficiency of farming operations.

The increasing investment in research and development activities by key market players in the APAC region is driving the growth of the agricultural adjuvant market. These companies are developing new and innovative adjuvant formulations designed to improve crop protection products' performance and enhance farming operations' efficiency.

Competitive Insight

Some of the major players operating in the global market include Adjuvant Plus Inc., Brandt, INC., BASF SE, Corteva Agriscience Corporation, Croda International Corporation, Clariant AG LTD, Drexel Chemical Company, Evonik Industries LTD, Garrco Products, Inc.

Recent Developments

- In May 2021, BASF announced the launch of a new adjuvant, Heat LQ, designed for use in cotton crops. The product is formulated to improve the efficacy of herbicide applications and provide a higher level of weed control.

- In September 2021, BASF announced the acquisition of the biotechnology company ZedX Inc. The acquisition is expected to enhance BASF's digital farming capabilities and accelerate the development of new and innovative agricultural solutions.

Global Agricultural Adjuvants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.29 billion |

|

Revenue forecast in 2032 |

USD 5.11 billion |

|

CAGR |

5.0% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Function, By Application, By Crop Type, By Formulation, By Adoption Stage, By Regional |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Adjuvant Plus Inc., Brandt, INC., BASF SE, Corteva Agriscience Corporation, Croda International Corporation, Clariant AG LTD, Drexel Chemical Company, Evonik Industries LTD, Garrco Products, Inc., Helena Agri-Enterprises LLC., Innvictis Crop Care LLC, Loveland Products Inc. Lamberti S.P.A, Nouryon, Nufarm, and Plant Health Technologies |

FAQ's

The agricultural adjuvants market report covering key segments are function, application, crop type, formulation, adoption stage, and region.

Global Agricultural Adjuvants Market Size Worth $5.11 Billion By 2032.

The Global agricultural adjuvants market expected to grow at a CAGR of 5.0% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in agricultural adjuvants market increasing demand for green adjuvants and growing focus on health and consumption of organically produced food.