Aircraft De-icing Market Share, Size, Trends, Industry Analysis Report, By Fluid Type (Type I, Type II), By Method (Spray, Chemical), By Application (Commercial, Military), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1584

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

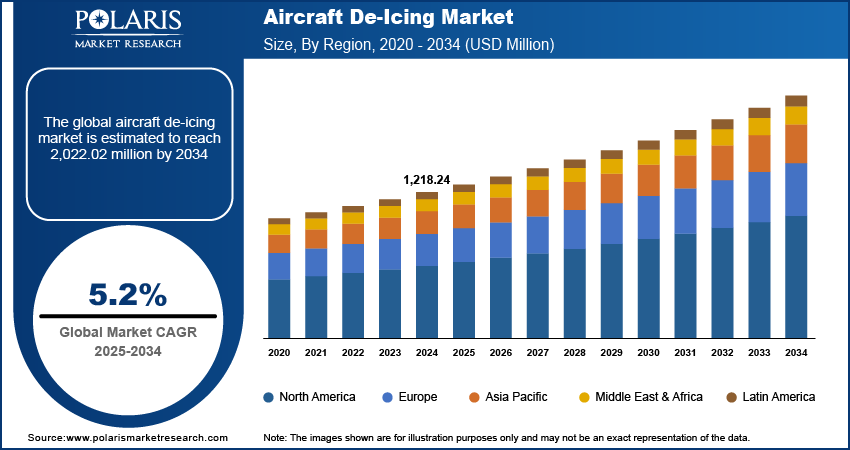

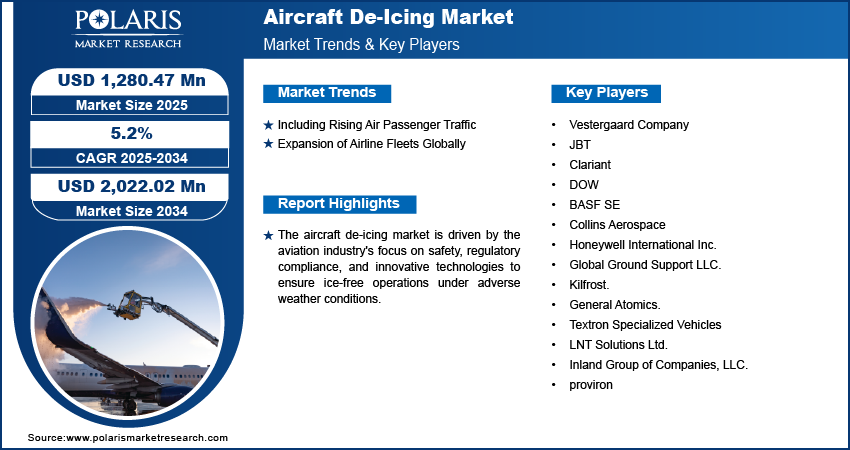

The global aircraft de-icing market was valued at USD 1.94 billion in 2023 and is expected to grow at a CAGR of 5.3% during the forecast period.

The expansion of the market is linked to heightened safety concerns, as the accumulation of snow and ice on an aircraft's surface can markedly impair its performance. Additionally, compliance with de-icing guidelines mandated by aviation authorities like the Federal Aviation Administration (FAA) further fuels the demand for this product. Consequently, these factors are expected to boost the product's market demand in the foreseeable future.

To Understand More About this Research: Request a Free Sample Report

Additionally, the demand for de-icing services is influenced by the varied weather patterns experienced in different regions where airlines operate. Adverse winter conditions such as snow, freezing rain, and ice can significantly impact aircraft safety and performance. With the global expansion of commercial aviation, airlines operate in regions prone to unpredictable or persistent winter weather, emphasizing the essential need for dependable de-icing services.

Areas prone to cold weather and frequent snowfall necessitate de-icing procedures to guarantee the safe operation of flights. The escalating volume of flights and the continuous expansion of the aviation sector are additional factors contributing to the increasing demand for products in this market. For instance, data from the International Trade Administration reveals a significant surge in air passenger activity, marking a 70% growth in 2022. International aviation experienced an even more remarkable growth of 150% compared to the pandemic period.

For Specific Research Requirements: Request for Customized Report

Additionally, the market has been substantially affected by the COVID-19 pandemic. The upheaval caused by the pandemic, encompassing travel constraints, diminished air travel, and the general economic downturn, has influenced the need for aircraft de-icing services. Data from the International Civil Aviation Organization (ICAO) reveals significant revenue losses in the global aviation industry, amounting to USD 372 billion in 2020 and USD 324 billion in 2021, attributable to government-imposed travel restrictions worldwide.

Growth Drivers

The increasing global air traffic contributes to the demand for aircraft de-icing market.

With a growing number of individuals opting for air travel, particularly in winter, the imperative to guarantee safe operations through the removal of ice and snow from aircraft surfaces has intensified. Statistics from Airlines for America indicate that commercial aviation contributed significantly to the U.S. economy, constituting 5% of the country's GDP, totaling USD 1.25 trillion in 2022. Consequently, the expanding aviation sector is expected to boost the demand for the product in the U.S. throughout the forecast period.

Furthermore, the United States encounters a wide range of climates, encompassing areas with frigid temperatures and substantial snowfall. This diversity mandates the implementation of de-icing methods to uphold the performance and safety standards of aircraft. Additionally, stringent regulations established by U.S. aviation authorities necessitate adherence to de-icing protocols, amplifying the product's demand within the nation.

Report Segmentation

The market is primarily segmented based on fluid type, method, application, and region.

|

By Fluid Type |

By Method |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Fluid Type Analysis

- Type II segment held the largest share in 2022

Type II segment dominated the market. This dominance is due to its rapid de-icing properties, enabling swift de-icing processes and turnaround times. This quick action is vital in bustling airports where aircraft must be promptly de-iced to uphold flight schedules. Type II fluid is glycol-based, heated, and sprayed onto the aircraft, efficiently melting ice and ensuring a safe and efficient takeoff. Its effectiveness across a broad temperature range makes it suitable for diverse climates and weather conditions.

Furthermore, Type II fluid is recognized as more environmentally friendly than older de-icing fluids. It is less toxic and biodegradable, minimizing its impact on ecosystems and water sources. With growing emphasis on environmental sustainability, there has been a heightened demand for Type II fluid as airlines and aviation authorities prioritize eco-friendly practices.

Type I segment will grow at significant pace. These fluids, usually a heated blend of propylene glycol & water, excel in eliminating ice and frost from the surfaces, ensuring the safe take-off. Additionally, these fluids exhibit a swift dilution rate during precipitation, preserving their effectiveness. With the aviation industry's ongoing focus on safety and operational efficiency, the demand for these fluids is on the rise.

By Method Analysis

- Spray de-icing segment accounted for the largest market share in 2022

Spray de-icing segment accounted for the largest market share. This method's superiority stems from its adaptability to diverse weather conditions. In aircraft de-icing, a fluid is sprayed onto the surface, effectively removing ice & frost. The application is pressurized, ensuring comprehensive coverage of the aircraft's wings, tail, & control surfaces. This method's efficiency, thoroughness, and ability to function effectively in various temperatures and climates have fueled its demand, making it a preferred choice in the market.

Infra-red heating segment will exhibit robust growth rate. This technique employs infrared radiation to melt ice from aircraft surfaces. Infrared heaters emit heat energy, causing the ice to melt and slide off the aircraft. Unlike methods involving de-icing fluids, infrared heating is chemical-free. It eliminates the need for applying and later removing de-icing fluids, addressing environmental concerns and streamlining the ice removal process.

By Application Analysis

- Commercial aviation segment accounted for the largest market share in 2022

Commercial aviation segment accounted for the largest market share. This dominance can be attributed to stringent de-icing protocols mandated by aviation regulatory authorities like the Federal Aviation Administration (FAA). These regulations are in place to guarantee passenger and crew safety. Airlines are obligated to comply with these standards to retain their operational licenses and uphold rigorous safety measures, thereby fueling the demand for de-icing products.

Regional Insights

- North America region accounted for the largest share of global market in 2022

North America garnered the largest share. This dominance can be linked to the region's varied and frequently severe winter climate, marked by snowstorms, freezing rain, and ice buildup. These challenging weather conditions present a substantial obstacle to the safe functioning of aircraft, underscoring the critical importance of efficient de-icing protocols.

North America boasts major airports, serving as a central hub for both domestic & international travel. With the continuous increase in flights & passengers, the efficiency and timeliness of de-icing operations have become increasingly vital. For instance, in 2022, U.S. airlines operated around 25,000 flights, catering to over 2.5 Mn passengers from 80 countries and handling over 59,000 tons of cargo from nearly, 220 countries daily. Airlines are keen on minimizing delays & disruptions caused by the harsh winter weather conditions.

Adherence to regulatory standards is a significant driver behind the growing demand for aircraft de-icing services. Aviation regulatory authorities, like the Federal Aviation Administration (FAA) in the United States, have set precise guidelines for aircraft de-icing. Airlines are obligated to follow these rules to preserve their operational permits and uphold rigorous safety criteria. Non-compliance can lead to penalties and even the grounding of aircraft, emphasizing the importance of regulatory compliance in the industry.

Key Market Players & Competitive Insights

Companies in the aircraft de-icing industry vie for supremacy by focusing on product excellence, efficiency, dependability, and customer support. They dedicate resources to research and development, ensuring they remain at the forefront of innovation to cater to the dynamic requirements of the aviation sector. Furthermore, expansions, partnerships, and collaborations among manufacturers, service providers, and airport authorities are prevalent strategies. These initiatives offer a holistic and unified approach, bolstering their market standing.

Some of the major players operating in the global market include:

- BASF SE

- CLARIANT

- Contego Aviation Solutions

- CRYOTECH

- Dow

- JBT Corporation

- Kilfrost

- LyondellBasell

- Textron Ground Support Equipment Inc.

- Vestergaard Company

Recent Developments

- In June 2023, Vestergaard Company revealed plans for organizational growth to meet the escalating product demand in North America. This expansion aims to enhance the company's ability to efficiently meet customer needs, thereby solidifying its customer base.

Aircraft De-icing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.03 billion |

|

Revenue forecast in 2032 |

USD 3.09 billion |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 – 2032 |

|

Segments covered |

By Fluid Type, By Method, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The aircraft de-icing market report covering key segments are fluid type, method, application, and region.

Aircraft De-icing Market Size Worth $3.09 Billion By 2032

The global aircraft de-icing market is expected to grow at a CAGR of 5.3% during the forecast period.

North America is leading the global market

key driving factors in aircraft de-icing market are Advancements in De-icing Technologies.