Anti-Drone Market Share, Size, Trends, Industry Analysis Report, By Mitigation Type; By Application (Detection Systems and Detection & Disruption Systems); By End-Use; By Technology; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM1026

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global Anti-Drone market was valued at USD 1397.95 million in 2023 and is expected to grow at a CAGR of 26.6% during the forecast period.Development in uncrewed aerial vehicles technology capabilities, adoption of counter UAV across various industries for security, and an increasing number of attacks have led to market demand for protection, boosting the anti-drone market growth during the forecast period. The developments in the capabilities of UAVs fuel the anti-drone business.

To Understand More About this Research: Request a Free Sample Report

Companies that provide anti-drone systems to armies are heavily investing in it by inventing newer methods to fight the threat posed by anti-drone market to protect safety and security from terrorists. In terms of technology, the counter UAV sector is expanding. Drone technology advancements and developing small- and medium anti-drones capable of identifying micro-UAVs ranging from 1.5 to 2 kilometers offer manufacturers opportunities. The growing demand for radar, RF scanners, and electro-optical infrared devices for payload detection will drive the anti-drone market.

Civil uncrewed aerial vehicles are increasingly used for agricultural and farming, weather and catastrophe monitoring, oil and gas inspection, aerial photography and filmmaking, scientific research and power, and utility industry surveys worldwide. As the use of such systems across numerous industries creates the dangers of hacking by terrorists and anti-social groups, the market demand for counter-UAV systems would grow significantly. The rising harmful activities of uncrewed aerial vehicles flying close to commercial aircraft and airports create a significant market demand for such systems for safety reasons. Developing such devices that do not interfere with routine airport operations will fuel the expansion of the anti-drone market.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Anti-Drone Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Moreover, increasing security violations by such unlicensed unmanned aerial vehicles, along with increased terrorism and illicit activities, has significantly fueled the anti-drone industry in recent years. Unmanned aerial vehicles are increasingly used for illegal and covert operations such as drug smuggling and spying. Even though numerous prototypes have been produced to oppose one unmanned aerial vehicle at a time, market leaders are working on building superior technological, engineered base solutions to combat simultaneous threats from numerous aircraft systems. However, due to the sheer utilization of laser technology, the cost of R&D activities is relatively expensive. The market's expansion has been stifled as a consequence of this.

Industry Dynamics

Growth Drivers

The rapid increase in the use of drones for both professional and recreational purposes has raised concerns about potential airborne attacks, leading to a growing demand for anti-drone technologies. Governments worldwide are increasingly supporting deploying anti-drone systems to address these security concerns. The design of anti-drone defenses has been significantly influenced by the need to mitigate airborne risks.

Developing and marketing advanced drone detection and mapping technologies have received substantial government support. These technologies offer improved tracking, detection, anti-jamming, and direction-finding capabilities, driving the demand for anti-drone systems. For example, the Airports Authority of India (AAI) is set to acquire two anti-drone systems in 2022-23, providing comprehensive drone detection, monitoring, identification, and neutralization capabilities.

Additionally, the Defence Research and Development Organisation (DRDO) has developed drone technology that can provide armed services with an advantage in intercepting and eliminating enemy drones. These advancements in anti-drone systems showcase the commitment of governments to enhance their security measures against potential drone threats.

Overall, the rising concerns about airborne attacks, government support, and the development of advanced anti-drone technologies are driving the industry's growth. The demand for comprehensive drone detection, tracking, and neutralization systems will continue increasing as the need for enhanced security measures becomes more critical.

Report Segmentation

The market is primarily segmented based on mitigation type, application, end-use, technology, and region.

|

By Mitigation Type |

By Application |

By End-Use |

By Technology |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The detection and disruption systems segment accounted for the highest market share

The detection and disruption systems segment is expected to be the most significant revenue contributor in the global market in 2022 and retain its dominance in the foreseen period. The rising number of terrorist organizations displaying the capacity to control a wide range of drones, including armed systems, is credited to the growth.

According to the Association of the United States Army, terrorist groups have utilized or attempted to employ airborne drones for various purposes, including intelligence gathering, explosive delivery, and chemical weapon delivery. The FAA (Federal Aviation Administration) permitted the commercial use of drones beyond the pilot's line of sight in 2020. Additionally, detection and disruption systems have significant applications in the military, defense, and homeland security verticals. The entry of any unlawful drone into a country's banned territory is recognized, and the drone is subsequently disabled on the spot.

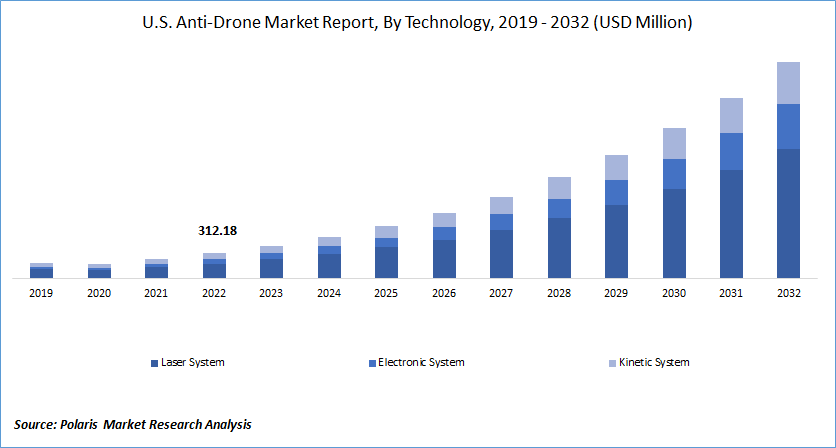

North America dominated the global market in 2022

North America had the largest revenue share in 2022. This is primarily due to the United States Department of Defense's acquisition of counter UAV systems. The US government has significantly invested in the counter-drone effort in recent years. The US Government said in June 2021 that, by FY2022, the Department of Defense plans to spend $636 million on counter-UAS research and development and at least USD $75 million on C-UAS procurement, an increase of USD 134 million over FY2021. Thus, the governmental focus on investment in the development of counter-drone systems is boosting the growth in the region.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global market. The region is expanding due to rising government spending on aerospace and defense infrastructure development in India and China. In December 2021, the Defence Research and Development Organization (DRDO) created a counter-drone system for detecting, deterring, and destroying approaching drones, providing another boost to India's defense system. This drone system will enable the positive effect of drones constituting a danger to national security. DRDO has created a new system to improve overall security.

Competitive Insight

Some of the major players operating in the global market include Aaronia AG, Airbus Defence, and Space, Battelle, Blighter Surveillance Boeing, CACI International Inc., Chess Dynamics Ltd., Dedrone, Enterprise Control Systems Ltd., Israel Aerospace Industries, L-3 Communications Ltd., Leonardo Spa, Lockheed Martin, Moog Inc., Northrop Grumman, Raytheon Technologies Corp., Saab AB, SRC Inc., Thales Group, among others.

Recent Developments

- In May 2022, DroneShield, a prominent provider of RF sensing, artificial intelligence, and machine learning systems, successfully deployed its DroneSentry solution to ensure comprehensive coverage for the 2022 IRONMAN Texas triathlon event held in April 2022. This deployment showcased the company's ability to provide city-wide protection against unauthorized drones during high-profile events.

- In October 2021, DroneShield Ltd announced that the US Department of Homeland Security had procured multiple units of its DroneSentry-X systems. These cutting-edge systems offer on-the-move capabilities for countering unmanned aerial systems (C-UAS), further strengthening the Department's ability to detect and mitigate potential threats from unauthorized drones.

Anti-Drone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1803.36 million |

|

Revenue forecast in 2032 |

USD 10,395.59 million |

|

CAGR |

26.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Mitigation Type, By Application, By End-Use, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aaronia AG, Airbus Defence and Space, Battelle, Blighter Surveillance Boeing, CACI International Inc., Chess Dynamics Ltd., Dedrone, Enterprise Control Systems Ltd., Israel Aerospace Industries, L-3 Communications Ltd., Leonardo Spa, Lockheed Martin, Moog Inc., Northrop Grumman, Raytheon Technologies Corp., Saab AB, SRC Inc., Thales Group |

We provide our clients the option to personalize the Explore the market dynamics of the 2024 Anti-Drone Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports.

Browse Our Top Selling Reports

Grinding Fluids Market Size, Share 2024 Research Report

Term Insurance Market Size, Share 2024 Research Report

Abrasive Blasting Nozzle Market Size, Share 2024 Research Report

Camping Coolers Market Size, Share 2024 Research Report

Clinical Communication and Collaboration Market Size, Share 2024 Research Report

FAQ's

The global Anti-Drone market size is expected to reach USD 10,395.59 million by 2032.

Top market players in the Anti-Drone Market are Aaronia AG, Airbus Defence, and Space, Battelle, Blighter Surveillance Boeing, CACI International Inc., Chess Dynamics Ltd.

North America contribute notably towards the global Anti-Drone Market.

The global Anti-Drone market expected to grow at a CAGR of 26.6% during the forecast period.

The Anti-Drone Market report covering key type, application, end-use, technology, and region.