Commodity Plastics Market Share, Size, Trends, Industry Analysis Report, By Product (PE, PP, PVC, PET, PS); By Application (Automotive, Electronics, Packaging, Pharmaceuticals, Textiles, Consumer Goods); By Region; Segment Forecast, 2021 - 2028

- Published Date:Jun-2021

- Pages: 105

- Format: PDF

- Report ID: PM1168

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

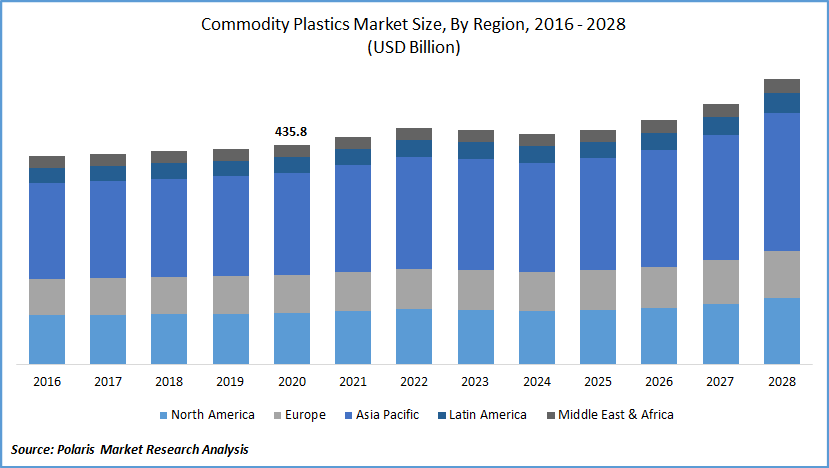

The global commodity plastics market was valued at USD 435.8 billion in 2020 and is expected to grow at a CAGR of 3.3% during the forecast period. Commodity plastics offer numerous scopes for applications across various industries. They can be used for various purposes such as packaging, photography, garbage containers, magnetic tapes, and clothing, among others.

Moreover, commodity plastics are widely used in several applications across various industries including consumer goods, manufacturing, automotive, packaging, construction, electronics, pharmaceutical, and textiles, among other industries.

Accelerating growth in the demand for flexible packaging, automobile parts for reducing weight, etc. among other consumable products is directly propelling demand for these products. In addition, bio-based polymers offer better options in terms of the stringent regulatory framework for plastic usage in comparison to the traditional ones. They exhibit properties such as moisture resistance, and high durability. All the factors together are positively impacting the demand for commodity plastics.

Know more about this report: request for sample pages

The increasing shift in the utilization of bio-based polyethylene terephthalate (PET), polystyrene (PS), polyethylene (PE) to petroleum-based plastic products is expected to alter the market dynamics. This shift is largely due to the fluctuating crude oil prices and increasing awareness about the environmental pollution created by the use of fossil fuels.

The continuous increase in metal pricing is also responsible for the growing demand for plastics. However, some of the countries are banning the usage of non-biodegradable plastics, as a result of which the industry players are increasingly focusing on innovation. Besides, the commodity plastics market is experiencing heavy demand, due to the increasing need for lightweight electric vehicles.

Know more about this report: request for sample pages

Commodity Plastics Market Report Scope

The market is primarily segmented on the basis of type, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The global commodity plastics market is segmented based on product into PE, Polypropylene (PP), polyvinyl chloride (PVC), PET, and PS. PET was the largest product segment in 2020. Increasing demand from the packaging industry and the growing popularity of flexible packaging are some of the factors driving the commodity plastics industry.

Insight by Application

The commodity plastics market is further bifurcated into application sectors including consumer goods, automobile, packaging, construction, textile, pharmaceuticals & medical and electronics. The packaging segment was the largest application market segment in 2020.

Development in packaging materials development technology, demand for flexible packaging products, and increasing use of renewable packaging materials is anticipated to be the primary factors driving the market growth for commodity plastics. Increasing demand for bio-based polymers is yet another potential factor for the rising demand for commodity plastics.

Geographic Overview

Asia Pacific market dominated the global commodity plastics industry in 2020. The region is anticipated to experience significant growth over the forecast period, owing to the heavy investments made by the governments of emerging nations to strengthen their base of skilled workforce. This is one of the reasons that plastic manufacturing and processing companies for the west have started setting their base in the region for skilled but low-wage laborers.

The recent government initiatives taken by Indian, Thailand, and Chinese government to promote the manufacturing sector are acting in favor of the market. For instance, in 2015, the Government of India (GOI) introduced ‘Make in India’ project. Similar steps were taken by Thailand government, by the announcement of favorable buyer’s incentive.

The commodity plastics consists of large number of global, regional, and local market players. There is high competing on differentiated product lines. Furthermore, they face stiff competition in terms of quality, pricing, and technology.

The presence of numerous vendors results in lowering down of cost price and sales volumes. Such a scenario usually creates a negative impact on the financial health of a company. Moreover, the market products are subject to several state, local, and federal laws and regulations, duties, and trade agreements.

Competitive Analysis

Some of the key market players operating in the commodity plastics industry include Covestro, BASF SE, Mitsui Chemicals Inc., Eastman Chemical Corporation, INEOS, Mitsubishi Chemical Corporation, DIC Corp & RTP Company Huntsman Corporation, LyondellBasell, The Dow Chemical Co., Nippon Polyurethane Industry Corp Ltd., Woodbridge Foam Corp., Lubrizol Corporation, and The Rampf Holding GmbH & Co. KG. These players are observed proactively engaging in activities aimed at the development of new products and advanced technology.