Emission Monitoring System (EMS) Market Share, Size, Trends, Industry Analysis Report, By System Type (Continuous Emission Monitoring System, Predictive Emission Monitoring System); By Offering; By Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 114

- Format: PDF

- Report ID: PM2447

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

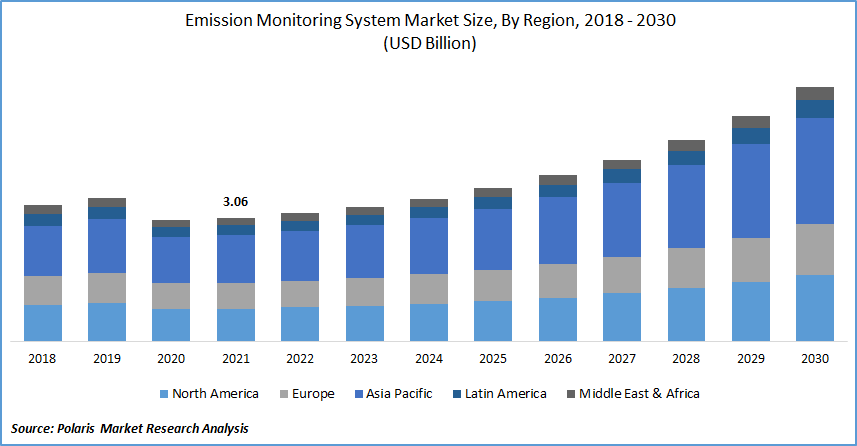

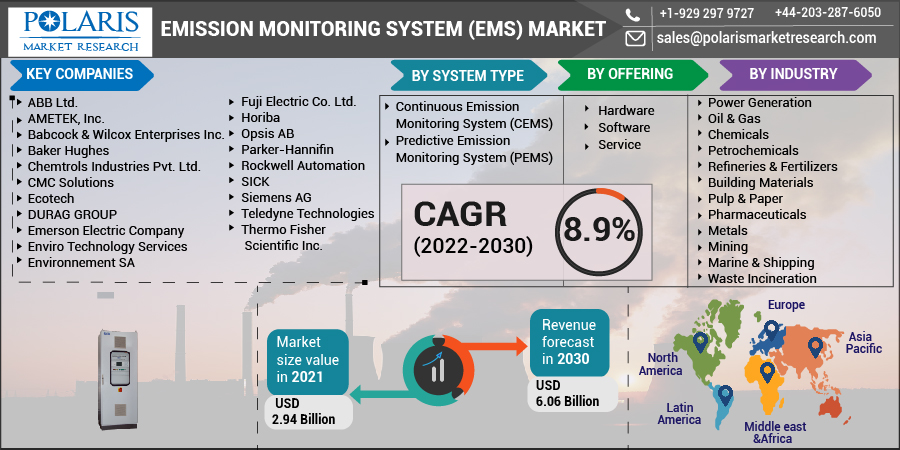

The global emission monitoring system (EMS) market was valued at USD 2.94 billion in 2021 and is expected to grow at a CAGR of 8.9% during the forecast period. Global market demand is being driven by stringent government regulations requiring the EMS deployment in the upstream and downstream oil & gas verticals to analyze air quality.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Environmental regulatory agencies require industries to use emission monitoring structure to track pollutant emissions. It enables businesses to determine the gas concentration or the emission level for various air pollutants. EMS measures and monitors emissions, but it also assists companies in effectively reporting and reducing air-polluting gases. Some structure manufacturers are experimenting with artificial intelligence (AI) to reduce the release of hazardous materials. For instance, ABB Ltd. has created an empirical model based on process data to predict emissions.

However, energy consumption is increasing in tandem with population growth; however, in light of the hazardous pollutants released into the environment, countries are increasingly turning to renewable energy resources for energy generation. Advanced technologies such as solar panels, windmills, and bioenergy have been adopted.

Industry Dynamics

Growth Drivers

Advanced EMS launches by the major market players and their focus on assisting the countries in monitoring air quality. For instance, in October 2021, Nornickel's manufacturing facilities participated in a pilot project in Russia to implement an automatic air quality monitoring structure. The action plan will be part of the national Environment project and spread across the country. This unveils an automated monitoring structure for air pollutants from the Company's facilities and atmospheric air monitoring in Norilsk's residential neighborhoods.

Furthermore, in February 2021, ABB launched CEMcaptain, a new emissions monitoring and controlling structure developed to help delivery companies manage compliance with the IMO emissions regulations, which will go into effect in 2020. CEMcaptain is a multi-component analyzer program that provides real-time emissions measurement data by integrating analyzer modules and sample handling components into a standalone enclosure. Thus, these above factors assist the emanation monitoring structure market in growth during the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on system type, offering, industry, and region.

|

By System Type |

By Offering |

By Industry |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by offering

Hardware segment has garnered the largest market share in the global emission monitoring system (EMS) market. The expansion of the hardware EMS market can be driven by the fact that they are used to collect emissions data in both CEMS and PEMS. The CEMS is a hardware-powered structure that predicts gas emissions using hardware components such as sensors. The PEMS is a software-powered system that predicts gas emissions using hardware components such as sensors.

Insight by System Type

Based on the system type, the CEMS segment registered the highest market growth rate over the study period. CEMS are used to gather data on gas emission levels from various industries, including power generation, oil & gas, chemical products, and waste incineration. Furthermore, a rise in the number of strict pollution monitoring laws and regulations across industries is expected to propel the market for CEMS. For instance, as per the United States Environment Protection Agency (EPA), the "Pollution Prevention Act" states that "the Environmental Protection Agency should establish a source reduction program that collects and distributes information, provides monetary funds to other countries.

Geographic Overview

In terms of geography, North America had the largest market revenue share in the global emission monitoring system (EMS) market The region is expanding due to its well-established and well-defined emission-control regulations. For instance, as per the EPA, "The Clean Air Act" states the shift of the U.S. government towards controlling air pollution. This bill authorized the creation of federal and state regulations to limit emission levels from both stationary (industrial) and vehicles.

Moreover, Asia Pacific is expected to witness a high CAGR in the global emission monitoring system (EMS) market. The region's growing electricity plants and chemical industries are the primary users of emission monitoring systems. Furthermore, the rise in coal-powered power plants is driving up the market demand for emission systems. COVID-19 imposed lockdowns throughout the region. Due to the closure of many manufacturing units during the lockdown, Asian countries lost a significant amount of market and revenue.

Competitive Insight

Some of the major market players operating in the global emission monitoring system (EMS) market include ABB Ltd., AMETEK, Inc., Babcock & Wilcox Enterprises Inc., Baker Hughes, Chemtrols Industries Pvt. Ltd., CMC Solutions, Ecotech, DURAG GROUP, Emerson Electric Company, Enviro Technology Services, Environnement SA, Fuji Electric Co. Ltd., Horiba, Opsis AB, Parker-Hannifin, Rockwell Automation, SICK, Siemens AG, Teledyne Technologies, and Thermo Fisher Scientific Inc.

Emission Monitoring System (EMS) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.94 Billion |

|

Revenue forecast in 2030 |

USD 6.06 Billion |

|

CAGR |

8.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By System Type, By Offering, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB Ltd., AMETEK, Inc., Babcock & Wilcox Enterprises Inc., Baker Hughes, Chemtrols Industries Pvt. Ltd., CMC Solutions, Ecotech, DURAG GROUP, Emerson Electric Company, Enviro Technology Services, Environnement SA, Fuji Electric Co. Ltd., Horiba, Opsis AB, Parker-Hannifin, Rockwell Automation, SICK, Siemens AG, Teledyne Technologies, and Thermo Fisher Scientific Inc. |