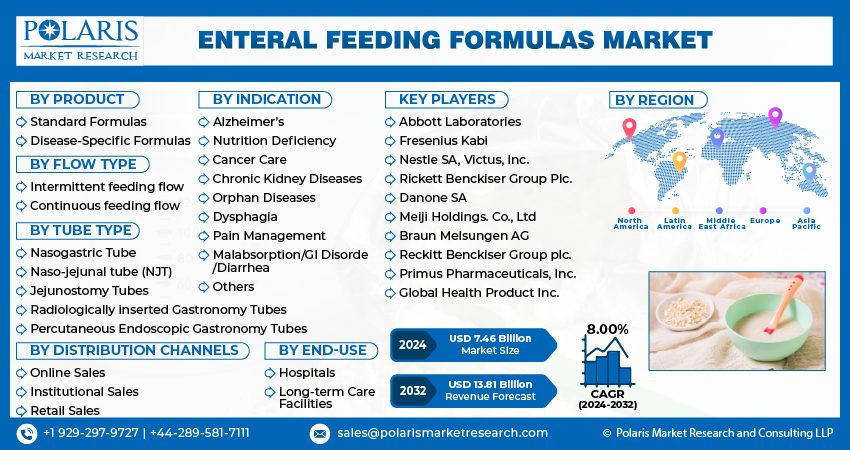

Enteral Feeding Formulas Market Share, Size, Trends, Industry Analysis Report, By Products (Standard formula, Disease-Specific Formulas); By Flow Type; By Tube Type; By Indication; By End-Use; By Distribution Channels; By Region, And Segment Forecasts, 2024-2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1786

- Base Year: 2023

- Historical Data: 2019-2021

Report Outlook

The global enteral feeding formulas market was valued at USD 6.94 billion in 2023 and is expected to grow at a CAGR of 8.00% during the forecast period. The rise in the aging population and the incidence of chronic diseases, which put individuals at a higher risk of life-threatening disorders like cardiovascular disease, cancer, diabetes, renal failure, and liver failure, are the key factors expected to drive the acceptance of enteral feeding formulas and boost market growth in upcoming years. For instance, according to the Centers for Disease Control and Prevention (CDC), approximately 85% of older adults live with at least one chronic disease, and 65% have two or more chronic conditions.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the adoption of enteral feeding formulas is also driven by the increasing prevalence of malnutrition associated with higher ICU mortality. Although a common and under-recognized condition globally, malnutrition is responsible for a high mortality rate in some regions. For instance, WHO reports that malnutrition is the cause of about 45% of deaths among children under the age of 5, with a higher death rate in low- and middle-income countries. Thus, the rising prevalence of malnutrition, especially in ICU patients, is expected to drive the adoption of enteral feeding formulas and accelerate market growth. Additionally, the increasing number of premature births is also contributing to the demand for enteral feeding formulas to fulfill the nutritional requirements of newborns, further boosting the market growth.

Also, enteral nutrition is considered the preferred method for feeding vulnerable infants at risk of disease and death due to undernutrition and vitamin and mineral deficiencies. Additionally, the growing awareness of the benefits of primary enteral feeding, which improves clinical products for critically injured and ill patients and reduces non-septic and septic complications, which is expected to drive market growth in the coming years.

Moreover, during the forecast period, technological advancements and product innovations are expected to drive the market. Key players are focusing on expanding their product portfolio by developing advanced medical devices that can deliver enteral nutrition and meet the demands of patients receiving treatment in homecare settings and intensive care units.

The COVID-19 pandemic has rapidly increased cases, resulting in a surge in ICU admissions due to severe chronic health conditions and coronavirus infections. It has led to increased adoption of enteral nutrition, driving market growth. During the pandemic, the adoption of enteral feeding formulas was increased due to guidelines published by healthcare authorities. For example, in April 2020, the Society of Critical Care Medicine and the American Society for Parenteral and Enteral Nutrition recommended early enteral nutrition for severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) patients within 24-36 hours of ICU admission. These guidelines have played a role in driving the adoption of enteral feeding formulas.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

One of the main factors driving the adoption of enteral feeding formulas is the rise in chronic diseases and the aging population, which puts them at a higher risk of life-threatening disorders. Additionally, the increased majority of malnutrition, with higher ICU mortality rates, has contributed to the growth in using enteral feeding formulas.

In addition, the adoption of enteral feeding formulas is fueled by the increasing number of premature births requiring adequate nutritional support. Moreover, there is growing awareness about the benefits of early enteral feeding, which can reduce complications and improve outcomes for critically ill and injured patients which is anticipated to boost the market growth.

Additionally, the COVID-19 pandemic has led to a surge in the adoption of enteral nutrition as more patients with coronavirus infections and severe chronic health conditions are admitted to ICUs. Healthcare authorities' guidelines recommending early enteral nutrition for severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) patients within 24–36 hours of admission to the ICU have further increased the adoption of enteral feeding formulas during the pandemic.

Report Segmentation

The market is primarily segmented based on product, flow type, tube type, indication, end-use, distribution channels, and region.

|

By Product |

By Flow Type |

By Tube Type |

By Indication |

By End-Use |

By Distribution Channels |

By Region |

|

|

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

The standard formulas segment is expected to account for the largest market share during the forecast period

Standard formulas are anticipated to account for the largest share of the market in the forecast period based on the product. This significant market proportion can be due to the widespread use of standard formulas among all patient groups and the related cost-effectiveness.

Additionally, manufacturers' increased efforts to create and market dietary supplements tailored to the needs of patients with particular diseases have spurred category growth. Over the forecast period, it is also anticipated that a rise in the use of immune-modulating and disease-specific formulae to treat several chronic diseases will accelerate segment growth.

The intermittent feeding flow segment is expected to account for the highest revenue share during the forecast period

During the forecast period, the intermittent feeding flow is expected to account for a high revenue share of the enteral feeding formulas market based on flow type. This is attributed to the increasing recommendation by physicians to administer intermittent enteral nutrition due to its better gastrointestinal tolerance among patients. Moreover, intermittent feeding has been shown to improve whole-body protein synthesis, increase mesenteric arterial blood flow, and reduce blood glucose concentration, all of which are contributing to the growth of this segment.

Furthermore, intermittent feeding is recommended multiple times throughout the day, which can increase muscle protein synthesis and thus drive its adoption. Additionally, this flow type provides flexibility during rehabilitation and other procedures and reduces the risk of diarrhea, which is expected to boost the segment's growth further.

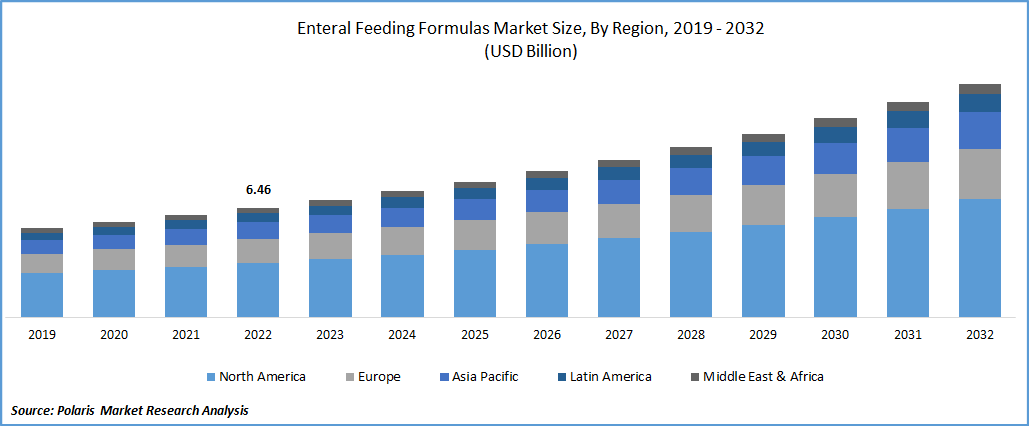

The demand in North America has dominated the market share in 2022

The enteral feeding formulas in North America have dominated the market share in 2022 due to various factors such as the rapidly aging population, surging prevalence of preterm births, and the increasing number of chronic disease patients. As per the Rural Health Information Hub report of 2022, there are more than 46 million people aged 65 or above in the United States, which is expected to reach nearly 90 million by 2050. The rise in the geriatric population is expected to drive the growth of the enteral feeding formula market in this region due to the increasing adoption of enteral feeding formulas in this age group.

The Asia Pacific region is expected to dominate the enteral feeding formulas market during the forecast period due to its large population, an increasing number of chronic disease patients, and rising incidence of malnutrition. The region's growing number of preterm births is also a significant factor driving regional growth.

During the forecast period, the enteral feeding formula market is expected to dominate the Asia Pacific region. It can be attributed to the large population, an increase in chronic disease patients, and a rise in malnutrition. According to the World Health Organization (WHO), Asia and sub-Saharan Africa account for 60% of reported preterm birth cases. India, China, Nigeria, Pakistan, and Indonesia are the top five countries with the largest preterm births. Additionally, an increase in awareness about better nutrition management and growing healthcare expenditure in many Asian countries are expected to drive the market in the upcoming years.

Competitive Insight

The major global market players include Abbott Laboratories, Fresenius Kabi, Nestle SA, Victus, Inc., Rickett Benckiser Group Plc., Danone SA, and Meiji Holdings. Co., Ltd, Braun Melsungen AG, Reckitt Benckiser Group plc., Primus Pharmaceuticals, Inc., Global Health Product Inc.

Recent Developments

- In July 2020, Baxter International, Inc. and VIPUN Medical collaborated to bring the Gastric Monitoring System to the market. This innovative system includes a smart enteral feeding tube that can measure stomach motility, which is valuable information for clinicians in the ICU and other clinical settings. By providing this data, the system helps clinicians make informed decisions about nutrition for their patients.

- In September 2021, Abbott, a company based in the United States, introduced a new enteral feeding formula line. These formulas are made with plant-based proteins and organic food ingredients, offering an alternative to traditional procedures.

Enteral Feeding Formulas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.46 billion |

|

Revenue Forecast in 2032 |

USD 13.81 billion |

|

CAGR |

8.00% from 2024 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Flow Type, By Tube Type, By Indication, By End-Use, By Distribution Channels, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Abbott Laboratories, Fresenius Kabi, Nestle SA, Victus, Inc., Rickett Benckiser Group Plc., Danone SA, and Meiji Holdings. Co., Ltd, Braun Melsungen AG, Reckitt Benckiser Group plc., Primus Pharmaceuticals, Inc., Global Health Product Inc. |

FAQ's

The global enteral feeding formulas market size is expected to reach USD 13.81 billion by 2032.

Key players in the enteral feeding formulas market are Abbott Laboratories, Fresenius Kabi, Nestle SA, Victus, Inc., Rickett Benckiser Group Plc., Danone SA, and Meiji Holdings. Co., Ltd, Braun Melsungen AG, Reckitt Benckiser Group plc.

North America contribute notably towards the global enteral feeding formulas market.

The global enteral feeding formulas market expected to grow at a CAGR of 7.9% during the forecast period.

The enteral feeding formulas market report covering key segments are product, flow type, tube type, indication, end-use, distribution channels, and region.