Ethylene Market Share, Size, Trends, Industry Analysis Report, By Feedstock (Naphtha, Ethane, Propane, Butane, Other Feedstock); By Application; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM1516

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

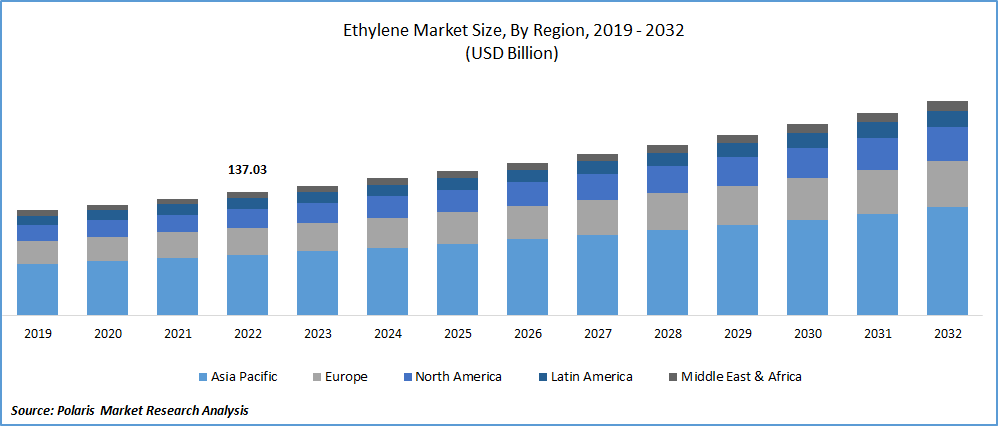

The global Ethylene market was valued at USD 137.03 billion in 2022 and is expected to grow at a CAGR of 5.7% during the forecast period.

The ethylene market is a vital sector within the chemical industry, driven by the increasing demand for ethylene-based products across various end-use industries. Ethylene, a colorless and flammable gas, is produced by cracking hydrocarbon feedstocks such as ethane, propane, and naphtha. It is widely used as a raw material in polyethylene (PE) production, which is extensively utilized in the packaging industry.

To Understand More About this Research: Request a Free Sample Report

The rising demand for PE in the packaging sector, the packaging industry has experienced significant expansion due to the growing e-commerce market, increasing consumer preference for convenient and sustainable packaging, and the rise in demand for packaged food and beverages. Being lightweight, durable, and recyclable, PE is widely adopted for packaging applications, driving the demand for ethylene.

Moreover, the global shift towards bio-based products is expected to impact the development of the ethylene industry. As consumers become more conscious of environmental sustainability, a growing preference for bio-based materials over traditional petrochemical-based products is growing. This trend has prompted the exploration of renewable feedstocks and the development of bio-based ethylene production technologies, potentially influencing future ethylene demand.

Additionally, the growth of the ethylene market is influenced by factors such as infrastructural advancements, urbanization, and population growth. Rapid industrialization, urban development, and construction activities worldwide have increased the demand for various applications of ethylene derivatives, including pipes, wires, films, and coatings..

The COVID-19 pandemic significantly impacted the market, causing demand, supply chains, and price disruptions. Lockdowns and reduced consumer spending decreased demand for ethylene-based products in the automotive, construction, and packaging industries. Supply chain disruptions, including transportation restrictions and manufacturing facility shutdowns, caused delays in production and delivery. This resulted in volatile prices, influenced by fluctuating feedstock costs and changing supply-demand dynamics.

However, as economies recover and vaccination efforts progress, the ethylene market is expected to rebound, driven by the resumption of construction projects, the reopening of industries, and increased demand for ethylene-based products in healthcare and sustainable packaging. The pandemic has also accelerated sustainability initiatives, potentially impacting the long-term development and adoption of bio-based ethylene production technologies and recycled plastics.

Industry Dynamics

Growth Drivers

Growth in the hospitality construction

The expansion of the hospitality industry, including hotels, resorts, and other accommodations, is driving the demand for ethylene and its derivatives. As the global tourism sector continues to grow, there is a need to construct new hospitality establishments to meet the increasing demand for accommodation. Ethylene-based materials such as polyethylene are widely used in various applications within the construction sector, including piping systems, insulation, flooring, and roofing. The growth in hospitality construction directly translates to increased demand for ethylene, contributing to the market's overall expansion.

Urbanization is a global phenomenon, with an increasing number of people migrating from rural areas to urban centers. This rapid urbanization trend fuels the demand for infrastructure development, including residential and commercial buildings, transportation systems, and public amenities. Ethylene-based products are extensively utilized in the construction and manufacturing sectors to meet urban development requirements. Polyethylene, for example, is used in pipes, wires, cables, and other construction materials. The growing urban population and infrastructure projects worldwide create a substantial demand for ethylene, thereby driving the market's growth.

Report Segmentation

The market is primarily segmented based on feedstock, application, end-use, and region.

|

By Feedstock |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Polyethylene segment holds significant revenue shares of the market in 2022

Polyethylene (PE) emerged dominant segment, capturing a significant revenue share in the market. It is projected to continue its dominance throughout the forecast period. The growing demand for High-Density Polyethylene (HDPE) in packaging and transportation applications is anticipated to fuel the overall demand for this product, thereby driving market growth.

Moreover, the expanding utilization of polyethylene in plastic containers within the food service and consumer product sectors is further contributing to the growth of this segment.

By End-Use Analysis

Packaging segment held the highest market revenue share in 2022

The packaging industry emerged as the dominant end-use segment in 2022, accounting for the highest market share, and is poised to witness substantial growth throughout the forecast period. The product's lightweight nature and strong compression capabilities have fueled its demand in the packaging sector for the production of ethylbenzene and polyethylene. This, in turn, facilitates the protection of packaged goods from potential damage caused by crushing or impact.

The construction market has experienced significant growth in regions like the Asia Pacific and Latin America, driven by extensive activities in India and China. Factors such as rapid urbanization, large population bases, and increased government expenditure on construction projects have contributed to the remarkable expansion of this segment. These trends are expected to stimulate the demand for ethylene-based products in the construction industry.

Regional Insights

Asia Pacific dominated the global market in 2022

Asia Pacific emerged as the market dominant in 2022 and is projected to grow at the highest compound annual growth rate (CAGR) throughout the forecast period. This growth can be attributed to the increasing demand for polyethylene in the plastics industry and compounds in the chemical sector, particularly from growing nations such as India, China, and Japan. The rapid industrial progress in these countries has elevated consumer lifestyles, leading to a substantial demand for high-performance plastics for essential everyday items.

Additionally, the expanding middle-class population is driving the demand for buildings and vehicles, further bolstering the market growth in the region.

Market Key Players & Competitive Insight

The ethylene market is characterized by intense competition, with key players continually striving to maintain and expand their market share. Established companies such as Dow Chemicals, ExxonMobil, and SABIC maintain a strong presence due to their extensive production capacities and global distribution networks. Additionally, technological advancements and innovation in ethylene production and processing methods, as well as a focus on sustainability and eco-friendly practices, have become crucial competitive factors. Furthermore, regional players and emerging markets are also making significant inroads, capitalizing on local demand and cost-effective production capabilities.

Some of the major players operating in the global market include:

- Borealis

- Chevron Phillips Chemical

- Dow Chemical

- Equistar Chemicals

- ExxonMobil

- Huntsman

- INEOS

- LyondellBasell Industries

- Mitsubishi Chemical

- Mitsui Chemicals

- National Iranian Petrochemical

- Nova Chemicals

- Royal Dutch Shell

- SABIC

- Sasol

- Showa Denko

- Sinopec Shanghai Petrochemical

- Total

- Tosoh

- LG Chem

Recent Developments

- In March 2022, Honeywell launched new advancements in technology to boost the production of ethylene from naphtha crackers.

- In April 2022, Lummus Technology and Braskem partnered to license green ethylene technology globally, enabling the production of bioethanol-based chemicals and plastics. This collaboration supports the industry's commitment to a carbon-neutral circular economy.

Ethylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 144.53 billion |

|

Revenue forecast in 2032 |

USD 238.39 billion |

|

CAGR |

5.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Feedstock, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The ethylene market report covering key segments are feedstock, application, end-use, and region.

Ethylene Market Size Worth $238.39 Billion By 2032 | CAGR: 5.7%.

The global Ethylene market is expected to grow at a CAGR of 5.7% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in ethylene market are 1. growth in the hospitality construction.