Feed Pigment Market Share, Size, Trends, Industry Analysis Report, By Type; By Carotenoids Source (Natural, Synthetic), By Livestock (Swine, Poultry, Ruminants, Aquatic animals, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 118

- Format: PDF

- Report ID: PM2274

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

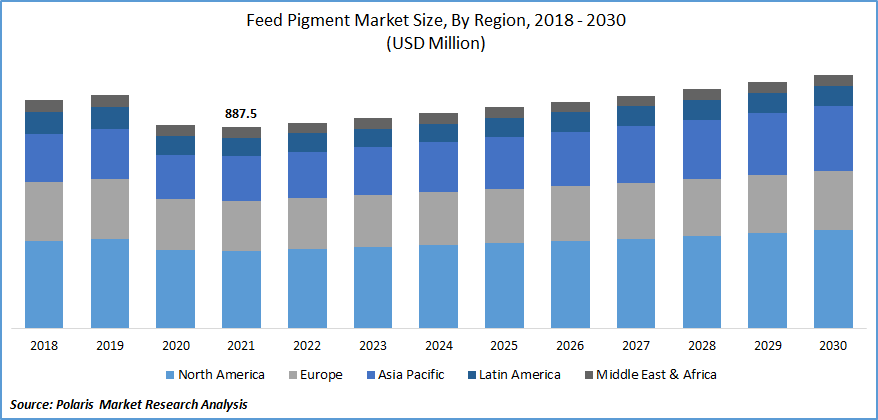

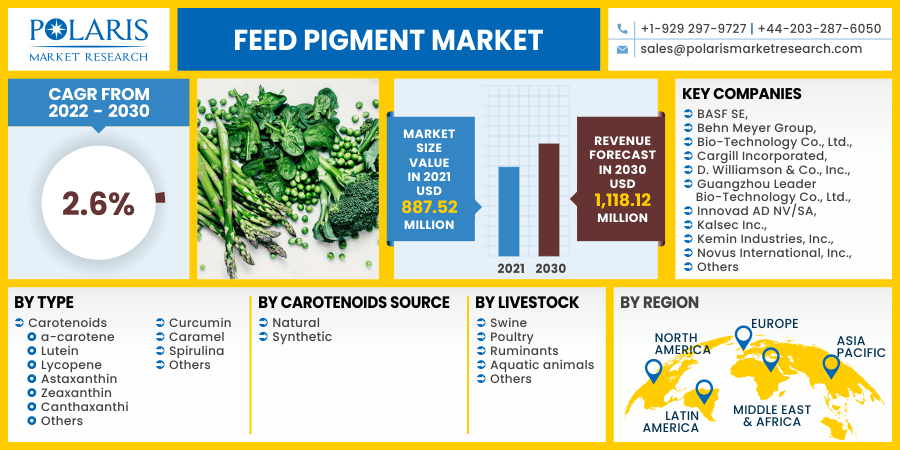

The global feed pigment market was valued at USD 887.52 million in 2021 and is expected to grow at a CAGR of 2.6% during the forecast period. Feed pigments are primarily used to enhance the nutritive value and the appearance of the animal feed. Feed pigments have high nutrition value, helping in curing allergies and strengthening the immune system of the animals.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The rising meat consumption globally, along with the recent animal diseases outbreak, plays a crucial role in driving the market's growth. Furthermore, the increasing development by major market players globally is anticipated to offer lucrative industry growth opportunities. The outbreak of the COVID-19 exhibits a considerable impact on the demand for food pigment. The pandemic had shown a significant effect on the purchasing power of the buyers and the global economy. The onset of the COVID-19 reflects the downfall of the industry growth owing to the unprecedented restrictions on movement along with the disruptions in personal and business activities.

The disruption in the supply chain, lockdown measures, and limited consumer spending is anticipated to hamper the industry development. However, the demand for food pigment is projected to bounce back in the forecast years as the governments across nations are uplifting lockdown restrictions, and the economy is booming up again. Additionally, the growing focus of the population towards healthier food amid the virus outbreak is anticipated to drive the feed pigment market's growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The primary factors driving the feed pigment market's growth include the increasing demand for meat globally and rising health awareness among the population regarding healthy food consumption, among others. According to the Organization of Economic Co-ordination & Development, global meat consumption has increased from 114 million metric tons in 2017 to over 117 million metric tons in 2018. Moreover, the most consumed meat is poultry meat with per capita consumption of around 30.6 kg/year, followed by pork meat with per capita consumption of over 23.5kg/year and beef with per capita consumption of over 14.8 kg/year. This increasing meat consumption worldwide is anticipated to boost the feed pigment market's growth during the forecast period.

Furthermore, the increasing mass production of meat and the recent livestock diseases outbreak are expected to increase the demand for food pigment globally due to the health benefits of food pigments such as carotenoids for the animals. Feed pigments strengthen the animal's immune &reproduction systems and further enhance their metabolism levels.

Report Segmentation

The market is primarily segmented on the basis of type, carotenoids source, livestock, and region.

|

By Type |

By Carotenoids Source |

By Livestock |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The Carotenoids segment holds the larger shares in 2021 and is expected to lead the industry in the forecasting years. The considerable share of the segment can be attributed to the benefits offered by carotenoids. Carotenoids are added to the animal's feed as they provide nutrients that support animal health and further enhance product quality.

Nowadays, a new type of concentrated carotenoids is being developed in order to help the feedstuff formulators to deliver required carotenoids to the animals at any given time. This recent development is further anticipated to boost the growth of the segment. Moreover, the acceptance of Astaxanthin feed pigment among the feed manufacturers is estimated to drive the segment's growth. This feed pigment functions as hormone precursors and further prevents various diseases, improving overall animal health.

The spirulina segment is projected to show the fastest growth rate in the forecasting years. The rapid growth of the segment can be attributed to the rising awareness in the animal feed pigment industry regarding the health benefits offered by these feed pigments. These have high nutritional benefits and help stimulate the production of white blood cells, allowing the overall immunity of the animal. These further help cure allergies, skin diseases, eye disorders, and others.

Geographic Overview

Geographically, North America dominated the market in 2021 and is anticipated to maintain its dominance over the forecast period. This huge industry share of the region can be attributed to the increasing production of feed pigment in the region on account of the rising demand among the consumers across the food industry. The expanding focus of the younger population towards healthier food owing to the increasing health concerns is anticipated to boost the industry's growth. Furthermore, key industry players in North America are strategically focusing on firming their R&D activities by capitalizing on innovative technologies in order to offer a wide range of products.

For instance, in June 2019, Kemin Animal Nutrition and Health, based in the U.S., added KEM GLOTM to its extensive line of carotenoids. This organic KEM GLO is a USDA-certified organic additive that assists in brightening the color of egg yolks. These developments made by key industry players in North America are anticipated to offer lucrative industry growth opportunities. Moreover, the Asia Pacific feed pigment market is anticipated to exhibit a progressive CAGR over the forecast years. Developing nations such as India, China, and Japan offer lucrative growth opportunities for the players operating in the industry. Further, the presence of a large customer base across the region is anticipated to drive market growth.

The rise of the dietary supplements market in the Asia Pacific is anticipated to boost the market's growth. Moreover, the changing lifestyle of the population on account of the increasing per capita income is shifting the consumer's preference towards more healthy & nutritive food options, thus driving the growth of the market. The huge poultry business in the region, along with the increasing popularity of aquaculture, is anticipated to create market growth opportunities. The increasing population is boosting the consumption of meat products across the region, thus boosting the market's growth.

Competitive Insight

Some of the major players operating in the global market include BASF SE, Behn Meyer Group, Bio-Technology Co., Ltd., Cargill Incorporated, D. Williamson & Co., Inc., Guangzhou Leader Bio-Technology Co., Ltd., Innovad AD NV/SA, Kalsec Inc., Kemin Industries, Inc., Novus International, Inc., Nutreco Holdings, Nutrex NV, PHW Group, Royal DSM NV, and Vitafor NV.

Feed Pigment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 887.52 million |

|

Revenue forecast in 2030 |

USD 1,118.12 million |

|

CAGR |

2.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Type, By Carotenoids Source, By Livestock, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BASF SE, Behn Meyer Group, Bio-Technology Co., Ltd., Cargill Incorporated, D. Williamson & Co., Inc., Guangzhou Leader Bio-Technology Co., Ltd., Innovad AD NV/SA, Kalsec Inc., Kemin Industries, Inc., Novus International, Inc., Nutreco Holdings, Nutrex NV, PHW Group, Royal DSM NV, and Vitafor NV |