Flue Gas Desulfurization System Market Share, Size, Trends, Industry Analysis Report, By Type (Wet FGD Systems, Spray Dry FGD System, Dry & Semi-dry FGD Systems); By End-Use; By Installation (Greenfield, Brownfield); By Regions; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 118

- Format: PDF

- Report ID: PM2302

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

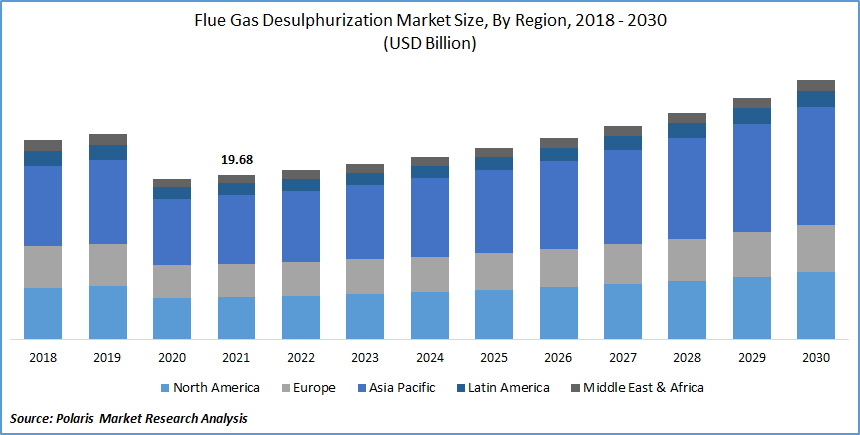

The global flue gas desulfurization system market was valued at USD 19.68 billion in 2021 and is expected to grow at a CAGR of 5.5% during the forecast period. The key factors such as the adoption of the flue gas desulfurization for removing SO2 from gases, government regulations for air pollutions, and the increase in demand for FGD from the power generation, chemical, iron, and steel, cement, and manufacturing industries are likely to drive the global industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The increased popularity of FGD in the cement and chemical manufacturing industries is likely to drive the worldwide flue desulfurization system market. Governments worldwide have become conscious of global warming and ecological balance, thereby increasing the demand for flue gas desulfurization. Players in the industry are attempting to broaden their product portfolio to eliminate gases from industrial facilities efficiently.

For instance, Mitsubishi Hitachi Power Systems, Ltd. sells flue desulfurization equipment such as wet limestone-gypsum flue desulfurization and saline FGD structures to remove SO2 from gases produced by furnaces boilers and other sources. There are two types of Wet Limestone-Gypsum FGD: double contact flow scrubber (DCFS) and spray tower scrubber.

Moreover, the deterioration of global air quality due to industrialization and urbanization has become a significant issue. As a result, economies such as the U.S., China, India, France, and others focus on air pollution reduction. As a result, the whole market for flue desulfurization is being driven. Furthermore, governments have enacted severe legislation to ensure that air quality criteria are met. This is expected to drive the growth of the flue gas desulfurization system market over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

According to the International Energy Agency, with energy demand exceeding low-carbon supply and gas prices on the rise, worldwide coal power capacity is on track to climb by 9% in 2021 to 10 350 terawatt-hours (TWh), a record high. However, coal's proportion of the worldwide power mix is predicted to be 36% in 2021, 5 percentage points lower than its 2007 peak. Coal power generation in the U.S. and the European Union is expected to expand by 20% in 2021. In comparison, anticipated growth rates of 12% in India and 9% in China will propel coal power output to new highs in both nations. Considering the rise in global industrial output, global coal demand is predicted to grow by 6% in 2021, approaching the record levels seen in 2013 and 2014.

Further, in December 2021, at the United Nations Climate Change Conference (COP26) in Glasgow, Prime Minister Narendra Modi stated India's goal of achieving net-zero emissions by 2070, as well as a commitment to generate 500 GigaWatt of installed electrical capacity from non-fossil fuel sources by 2030. India is mulling a proposal to prohibit the construction of new coal-fired power plants as it devises a strategy to achieve COP26 pledges.

Report Segmentation

The market is primarily segmented based on type, end-use, installation, and region.

|

By Type |

By End-Use |

By Installation |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Based on the end-use segment, the power generation segment is the most significant revenue contributor in the global flue gas desulfurization system market in 2021 and is expected to retain its dominance in the foreseen period. Due to the use of high sulfur concentration coals in power plants, coal-fired power plants are the largest source of sulfur pollution. As a result, more significant power generation is the cause for the power generating segment's dominance over other end-use industries.

Geographic Overview

In terms of geography, North America had the highest flue gas desulfurization system market share in 2021. The existence of a solid manufacturing base for flue gas desulfurization (FGD) and a growing emphasis on R&D activities, and the participation of leading businesses all contribute to market growth. In the United States, expanding industry is blamed for increased air pollution. As a result, the government has imposed strict controls on industrial plants to control the production of air pollutants. Furthermore, given the expanding population, the cement sector is booming due to increased construction and development activity.

Moreover, Asia Pacific flue gas desulfurization system market witnessed a high CAGR in the global market in 2021. The rapidly expanding energy demand, industrialization, and awareness about limiting air pollution are significant drivers of rising demand for flue gas desulfurization in the Asia Pacific. The Asia Pacific nation's chemical sector is expanding rapidly, which is projected to fuel the expansion of the FGD market over the forecast period. The Asia Pacific region's market growth can also be ascribed to the expanding cement production and metal smelting industries.

Competitive Insight

Some of the major players operating in the global flue gas desulfurization system market are Andritz AG, Babcock & Wilcox Enterprises Inc., China Boqi Environmental (Holding) Co. Ltd., Chiyoda Corporation, Doosan Lentjes GmbH, Ducon Technologies Inc., FLSmidth & Co., General Electric Company, Hamon Group, Kawasaki Heavy Industries Ltd., LAB S.A., Marsulex Environmental Technologies, Mitsubishi Heavy Industries Ltd., Rafako S.A, Shandong Baolan Environmental Protection Engineering Co. Ltd., Steinmuller Engineering GmbH, and Thermax Ltd.

Flue Gas Desulfurization System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 19.68 billion |

|

Revenue forecast in 2030 |

USD 31.03 billion |

|

CAGR |

5.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Installation, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Andritz AG, Babcock & Wilcox Enterprises Inc., China Boqi Environmental (Holding) Co. Ltd., Chiyoda Corporation, Doosan Lentjes GmbH, Ducon Technologies Inc., FLSmidth & Co., General Electric Company, Hamon Group, Kawasaki Heavy Industries Ltd., LAB S.A., Marsulex Environmental Technologies, Mitsubishi Heavy Industries Ltd., Rafako S.A, Shandong Baolan Environmental Protection Engineering Co. Ltd., Steinmuller Engineering GmbH, and Thermax Ltd. |