Hearing AID Market Share, Size, Trends, Industry Analysis Report, By Product (Hearing AID devices and Hearing implant); By type; By Patient; By technology; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM1210

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

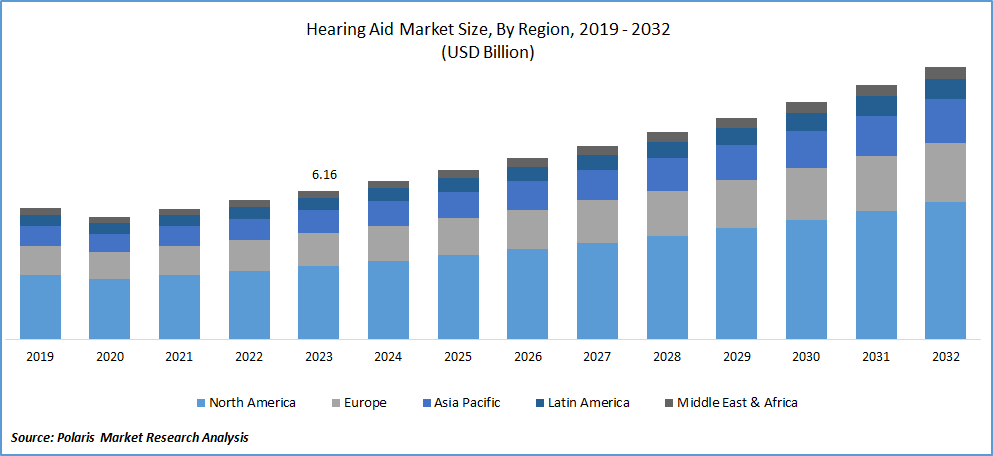

Hearing AID market size was valued at USD 6.16 billion in 2023. The market is anticipated to grow from USD 6.58 billion in 2024 to USD 11.29 billion by 2032, exhibiting the CAGR of 7.0% during the forecast period.

Industry Overview

A hearing aid is an electronic device used for patients with mild to moderate hearing loss. It contains a microphone, amplifier, and speaker. It runs on traditional batteries and also rechargeable batteries. Hearing aids are adjustable devices; if one cannot hear the sound at a specific Hz, the device is adjusted at a specific volume. The life of any hearing aid device is 6 to 7 years. Mainly, the use of these devices is in the geriatric population.

Growing awareness about hearing health and the acceptance of hearing aids as effective solutions for hearing loss contribute to market expansion. Efforts in public health campaigns and education about hearing impairment play a role in increasing the adoption of hearing aids. Many governments and healthcare organizations worldwide are implementing initiatives to address hearing health issues. Supportive policies, subsidies, and programs promoting access to hearing healthcare services and devices positively impact the hearing aid market. An increase in the older age population aimed at a boost to hearing aid devices.

To Understand More About this Research:Request a Free Sample Report

- For instance, according to the data given by the World Health Organization, more than one billion people who are above the age of 60 years lost their hearing ability in the year 2020, and by the year 2028, it will increase. Increasing in higher noise in concerts and other events has caused damaged to the ear drums in adults and continuously to grow among the young crowd.

The severity is also seen with ear infections and the use of earbuds, headphones, and others. Unnecessary or excessive use of ear cleaning equipment and drops can harm the inner ear. It increases the inflammation in the ear. All of these reasons for impairment and loss of hearing are adapting to the use of this device. Due to the low cost of these devices, any class of people can afford them.

The easy availability of the device and the initiative taken by governments and companies or organizations across the globe regarding the awareness of the devices show the growth of hearing devices in the coming year. Furthermore, increased numbers of birth complications also increase the market for hearing aid devices. Companies are working on the technology to make it more cost-effective and the quality of speakers embedded in it, which plays the most crucial role in the device that drives the market.

COVID-19 impacted the devices market negatively; due to the closure of ENT clinics and the focus of doctors on the infected patients of COVID-19, there was a tremendous fall in hearing aid devices. Imports of Chinese products have been banned in India, which again affected the manufacturers. The increase in the utilization of artificial agencies and growing technology has enhanced the use of hearing aid devices.

Key Takeaways

- North America dominated the largest market and contributed to more than xx% of share in 2023

- Asia Pacific anticipated to experience the fastest hearing AID market during the forecast period

- By product category, hearing AID device segment held the largest revenue share in 2023

- By patient category, the pediatrics segment is projected to grow at fastest CAGR during the projected period

What are the market drivers driving the demand for Hearing AID Market?

- Increasing Prevalence of geriatric population

The rising number of elderly individuals facing hearing disabilities is a primary driver for the hearing aid. The increased incidence of hearing disorders in the geriatric demographic has led to a significant surge in the sales of hearing aid devices. The prevalence of hearing disabilities in infants and newborns has raised concerns about the impact on early development. Factors such as improper maternal diet and alcohol consumption during pregnancy contribute to potential hearing issues in newborns. The senior citizen population experiences a heightened prevalence of hearing disorders. Factors like age-related vascular diseases and inflammation contribute to hearing impairment, including the risk of complete hearing loss.

Furthermore, vascular diseases, prevalent in the aging population, have a direct impact on hearing capabilities. The connection between vascular conditions and hearing impairment underscores the importance of addressing overall health for auditory well-being. Compared to other regulatory bodies, the approval and regulation processes for manufacturing hearing aid devices are relatively less stringent. This flexibility in regulatory frameworks facilitates innovation and market growth.

Which factor is restraining the demand for Hearing AID?

- High Initial Costs

Advanced hearing aid technologies often come with high development and manufacturing costs. This can lead to expensive devices, making them less accessible to a broader population, especially in regions or among demographics with lower purchasing power. The cost associated with incorporating cutting-edge technologies into hearing aids may result in limited affordability for a significant portion of the population. This can be a barrier for individuals who require hearing aids but cannot access the latest technological advancements due to financial constraints. Also, technological barriers extend to the limitations of battery technology. Advanced features in hearing aids may demand more power, leading to challenges in developing compact, long-lasting batteries. Battery constraints can impact the overall performance and user experience.

Report Segmentation

The market is primarily segmented based on product, type, patient, technology and region.

|

By Product |

By Type |

By Patient |

By Technology |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

- By Product Insights

Based on product analysis, the market is segmented on the basis of hearing aid devices and hearing implants. In 2023, the hearing aid devices held the largest revenue share. This product can easily be altered to Bluetooth if connectivity is provided. Depending upon the ear type of device it will have a larger market share in the upcoming years. The hearing aid products are compatible with Bluetooth, so the demand for this product is expected to grow tremendously. The use of wired hearing devices has been slower down, and significant use of Bluetooth devices is used. A hearing aid device is an ear-shaped small device that can be perfectly fitted onto the ear and can be used conveniently. A hearing aid does not require any surgery, so it’s a cost-effective treatment, so preferentially, it is always the first option for the hearing-disabled person.

- By Patient Insights

Based on patient analysis, the market has been segmented on the basis of adults and pediatrics. The pediatrics patient segment is projected to grow at fastest CAGR during the forecast period in the hearing aid market. The predominant use of hearing aid devices is observed among adults compared to the pediatric population, primarily due to the prevalence of age-related hearing loss. The increasing number of adults experiencing hearing impairment has become more commonplace, due to heightened awareness and acceptance of hearing aid usage.

According to the National Institute on Deafness and Other Communication Disorders, approximately 29 million individuals in the country could benefit from hearing aid devices. The primary factor contributing to this significant number is the age-related decline in hearing abilities among adults. The exposure to unwanted noise and environmental factors often leads to impaired hearing capacity in the adult population.

As a result, there is a growing emphasis on hearing care and the adoption of hearing aid solutions among adults. The awareness of the importance of addressing hearing loss in the adult demographic has contributed to the increased acceptance and utilization of hearing aid devices to enhance auditory experiences and improve overall quality of life.

Regional Insights

North America

North America region dominated the largest market share in 2023, driven by various factors such as a higher incidence of hearing impairment in both children and older people, as well as the extensive distribution networks established by market players.

The hearing aid industry has seen continuous technological advancements, including digital signal processing, wireless connectivity, and miniaturization of devices. North America, being a hub for technology and innovation, often adopts and drives these advancements. The aging population in North America, particularly in the United States, is a key demographic factor. As people age, the likelihood of experiencing hearing loss increases, driving the demand for hearing aids. Growing awareness about the impact of untreated hearing loss on overall health and well-being has led to increased acceptance of hearing aids. Efforts to reduce the stigma associated with hearing loss and promote accessibility to hearing healthcare services contribute to market growth.

Asia Pacific

The Asia Pacific region is anticipated to experience the fastest hearing AID market during the forecast period. Asia is home to the world's largest population, which naturally translates into a substantial market size. The sheer volume of potential consumers creates opportunities for the growth of various industries, including the hearing aid market.

Among Asia's vast population, there is a notable increase in the elderly demographic. As people age, the prevalence of hearing loss tends to rise. The growing aging population in Asia is contributing to an increased demand for hearing aids, as these devices become essential for addressing age-related hearing impairments. Thus, there is a growing awareness and acceptance of hearing aids in Asia. As education and awareness campaigns about hearing health become more prevalent, individuals are increasingly seeking solutions for hearing impairments, thus driving the hearing Aid industry growth.

Competitive Landscape

The hearing aid market is predicted to witness competition due to various players' presence. Prominent market players are constantly introducing new products to strengthen their position in the market. These players focus on collaboration, product advancements, and partnership to achieve a competitive advantage over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Adicus

- Audina hearing instruments, Inc.

- Eargo. Inc,

- GN store nord A/S

- Horentek hearing diagnostics

- Jabra

- MD hearing

- Sebotek hearing system, LLC

- Sonova

- Starkey laboratories

- WS Audiology

Recent Developments

- In December 2022, Hysound Group, which is the major audiological care clinic in China, was acquired by Sonova 2022; they had more than 200 clinics across the country. The acquisition has broadened the Sonovas hearing solution and directed consumers' access to the hearing aid market.

- In January 2023, Sonova introduced Conversation Clear Plus earbuds, aiming to pioneer a new product category within the early-entry hearing solutions market.

Report Coverage

The hearing aid market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, types, patient, technology and their futuristic growth opportunities.

Hearing AID Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.58 billion |

|

Revenue forecast in 2032 |

USD 11.29 billion |

|

CAGR |

7.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Type, By Patient, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Hearing AID Market report covering key segments are product, type, patient, technology and region.

Hearing AID Market Size Worth $ 11.29 Billion By 2032

Hearing AID market exhibiting the CAGR of 7.0% during the forecast period.

North America is leading the global market.

The key driving factors in Hearing AID Market are Rapid increase in technological development has increases the connectivity of the product to other devices like Bluetooth, smartphones