Polypropylene (PP) Market Share, Size, Trends, Industry Analysis Report, By Polymer Type (Homopolymer, Copolymer), By Process, By Application, By End-User Industry, By Region, Segments & Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1296

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

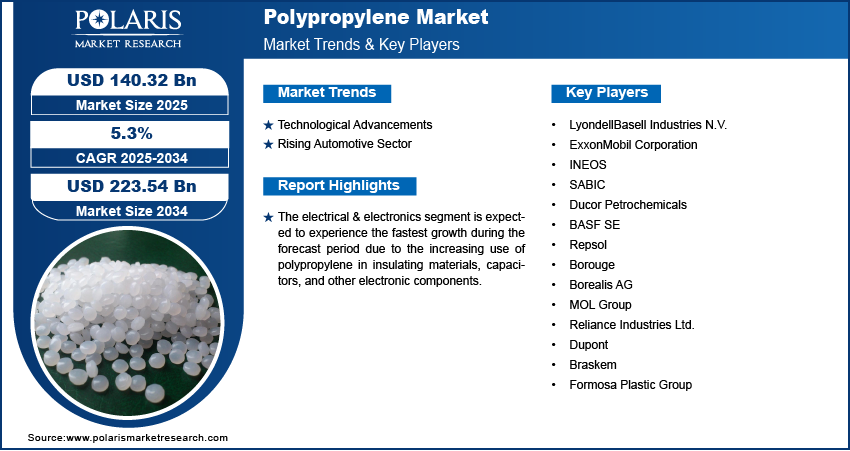

The global polypropylene market was valued at USD 126.61 Billion in 2023 and is expected to grow at a CAGR of 5.40% in the forecast period. The primary factor influencing the market growth is the widening scope of the application of polypropylene in construction, automobiles, packaging, and consumer goods. The increasing demand for effective plastic packaging and the need for lightweight plastics from the automotive, electronics, and consumer goods industries are expected to boost the market in the forecast period.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Polypropylene Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Market.png)

To Understand More About this Research: Request a Free Sample Report

Polypropylene is a thermoplastic polymer that is widely used in many industries. It is a versatile material with a high melting point, good chemical resistance, and low density. It is a member of the polyolefin family and is made from propylene monomer. The polymer is widely known and used for its wider essential characteristics favorable for various end-use applications. It resists most chemicals, including acids, bases, and organic solvents. It is also corrosion-resistant and does not absorb water, making it an ideal material for harsh chemical environments.

One of the most common uses of PP in automobiles is for producing interior and exterior trim parts. Interior parts include door panels, dashboard components, and seat backs, while external parts include bumper fascia, fender liners, and wheel covers. For instance, as per the Society of Indian Automobile Manufacturers, the total automobile production reached 22,933,230 in FY 2022 from 26,353,293 in FY 2020. The rising production of automobiles has clearly indicated the growth of market in the last few years.

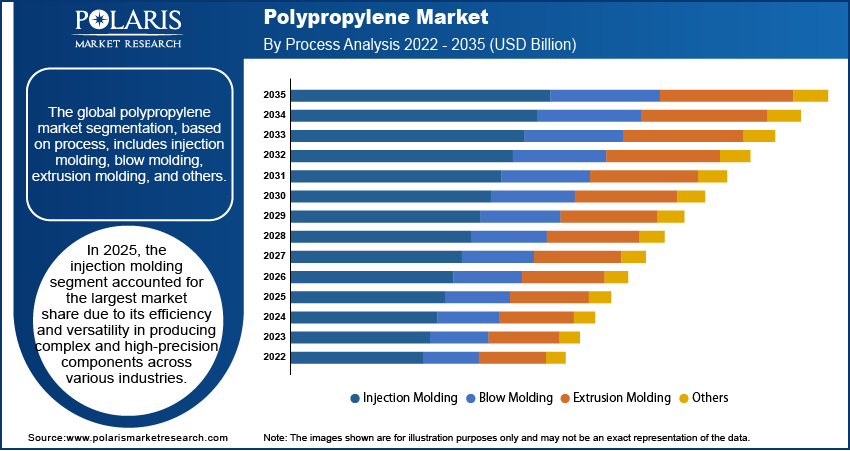

It is a lightweight material with a low density, which makes it easy to handle and transport. It has good tensile strength, which means it can withstand heavy loads without breaking. It is also resistant to impact and has a high melting point, making it suitable for high-temperature applications. It is easy to process and can be molded into various shapes using different techniques, such as injection molding, extrusion, and blow molding. It makes it a versatile material that can be used in multiple applications.

It is a thermoplastic polymer that is synthesized through a process called polymerization. The process involves the chemical reaction of propylene monomer with a catalyst to produce a polymer. Several methods of polymerizing propylene include Ziegler-Natta polymerization, metallocene polymerization, and Phillips polymerization.

The market is a large and important market for thermoplastic polymers. However, several factors can potentially restrict the growth of this market. One of the major factors is the increasing concern about the environmental impact of plastic waste. Governments and consumers are increasingly focused on reducing plastic waste and promoting more sustainable alternatives, which could lead to reduced demand.

Another factor that could affect the market is fluctuating raw material prices. The price of the raw materials used in the production, such as propylene and ethylene, can be volatile and subject to fluctuations. It can affect the cost of production and make it difficult for manufacturers to maintain a stable pricing structure.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising demand from end-use industries is one of the key driving factors of the polypropylene market. It is a versatile material that is used in a wide range of applications in various end-use industries such as automotive, packaging, construction, and healthcare.

One of the major end-use markets for PP is the packaging industry. PP is widely used in packaging due to its excellent mechanical properties, such as high impact resistance, good stiffness, and toughness. Another key end-use market is the automotive industry. It produces various automotive components such as interior and exterior trim parts, battery cases, fuel tanks, and air cleaner housings.

The construction industry is also a significant end-use market for PP. Due to its excellent chemical resistance and low moisture absorption, it is used in construction applications such as pipes, fittings, insulation, and roofing membranes. The increasing demand for sustainable and energy-efficient construction materials is expected to drive the demand in the construction industry. In the healthcare industry, it is used to produce medical devices and packaging materials due to its biocompatibility, sterilization resistance, and transparency. The growing demand for healthcare products and services is expected to drive the demand for in the healthcare industry.

Overall, the rising demand from end-use industries is expected to be a major driving factor in the market. Manufacturers will need to continue innovating and developing newer applications to meet the evolving needs of end-use industries.

Report Segmentation

The market is primarily segmented based on polymer type, process, application, end-user, and region

|

By Polymer Type |

By Process |

By Application |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Copolymer segment is expected to account for the largest market share in the forecast period.

Several factors are driving the growth of the copolymer segment. One of the main drivers is the increasing demand for lightweight and fuel-efficient vehicles in the automotive industry. Copolymer PP is used more frequently in producing automotive components due to its lower weight and improved impact resistance. The growing demand for electric vehicles also drives the need for copolymer, which makes battery cases and other components.

Another factor driving the growth of the copolymer segment is the increasing demand for flexible packaging materials in the food and beverage industry. Copolymer is used more frequently in flexible packaging films due to its improved flexibility and lower cost than other materials.

The injection Molding segment is anticipated to dominate the market in the forecast period.

Injection molding is a versatile process that can produce a wide range of PP products, including automotive components, packaging materials, toys, and household items. The process is highly efficient, as it can produce large parts with high accuracy and consistency. It is also a cost-effective method for creating complex shapes and designs, as the tooling costs are relatively low compared to other manufacturing processes.

The packaging segment is anticipated to witness a significant CAGR in the forecast period.

The packaging segment of the market is experiencing significant growth due to several factors. It is widely used in the packaging industry due to its excellent properties, such as high stiffness, good impact resistance, and excellent chemical and moisture resistance. The growing demand for flexible packaging, such as bags, pouches, and films, is gaining popularity due to its convenience, lightweight, and cost-effectiveness. It is also widely used in flexible packaging materials due to its excellent mechanical properties, high clarity, and lower cost than other materials.

With the rising environmental concern, there is an increasing demand for sustainable packaging materials. PP is a recyclable material that can produce sustainable packaging materials and is driving the need in the packaging industry.

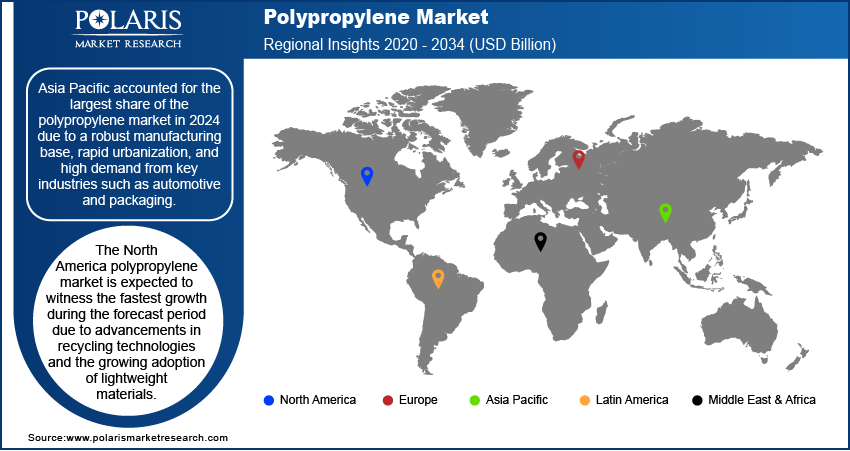

Asia Pacific region is projected to account for a major market share in the forecast period.

The Asia Pacific region is experiencing significant growth in the PP market due to several factors. The Asia Pacific region is home to a large and growing population, with increasing urbanization and industrialization driving demand in various end-use industries such as packaging, automotive, construction, and consumer goods.

Manufacturers in the Asia Pacific region invest in research and development to improve their product offerings, increase efficiency, and reduce costs. It is driving innovation in the industry and enabling manufacturers to produce higher quality and more cost-effective products. Polypropylene manufacturers in the Asia Pacific region are investing heavily in expanding their production capacity to meet growing demand from end-use industries.

Competitive Insight

Some of the prominent key players operating in the polypropylene market includes LyondellBasell Industries N.V., ExxonMobil Corporation, INEOS, SABIC, Ducor Petrochemicals, BASF SE, Repsol, Borouge, Borealis AG, MOL Group, Reliance Industries Ltd., Dupont, Braskem, Formosa Plastic Group.

Recent Developments

- December 2022: Exxon Mobil Corporation has established its new polypropylene production unit in Baton Rouge, Louisiana, to meet the growing demand for high-performance products.

- August 2021: BASF SE has provided its non-discoloring processing stabilizer, Irgastab, to LOTTE Chemical, for producing the polypropylene (PP) required for medical applications.

Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 131.56 Billion |

|

Revenue forecast in 2032 |

USD 200.26 Billion |

|

CAGR |

5.40% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Polymer Type, By Process, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

LyondellBasell Industries N.V., ExxonMobil Corporation, INEOS, SABIC, Ducor Petrochemicals, BASF SE, Repsol, Borouge, Borealis AG, MOL Group, Reliance Industries Ltd., Dupont, Braskem, Formosa Plastic Group |

Want to check out the Polypropylene Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

Browse Our Top Selling Reports:

Anatomic Pathology Market Size, Share 2024 Report

Pharmaceutical Processing Seals Market Size, Share 2024 Report

Medical Exoskeleton Market Size, Share 2024 Report

Cell Isolation/Cell Separation Market Size, Share 2024 Report

Sodium Hyaluronate-Based Products Market Size, Share 2024 Report

FAQ's

The polypropylene market report covering key segments are polymer type, process, application, end-user, and region.

Polypropylene Market Size Worth $200.26 Billion By 2032.

The global polypropylene market expected to grow at a CAGR of 5.23% in the forecast period.

Asia Pacific is leading the global market.

key driving factors in polypropylene market are increasing demand for energy-efficient construction materials.