Graphene Market Share, Size, Trends, Industry Analysis Report, By Product (Graphene Nanoplatelets, Graphene Oxide, Reduced Graphene Oxide, Monolayer Graphene, and Others); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM1642

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

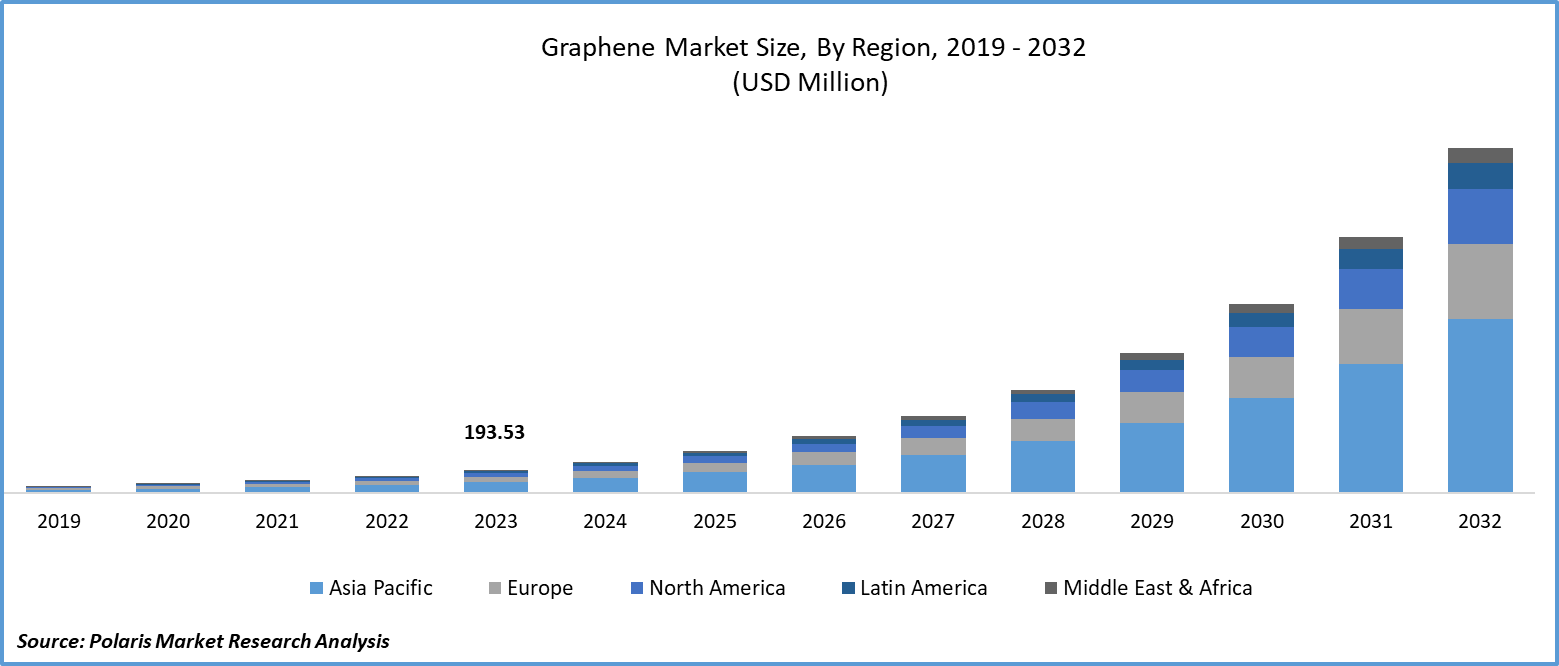

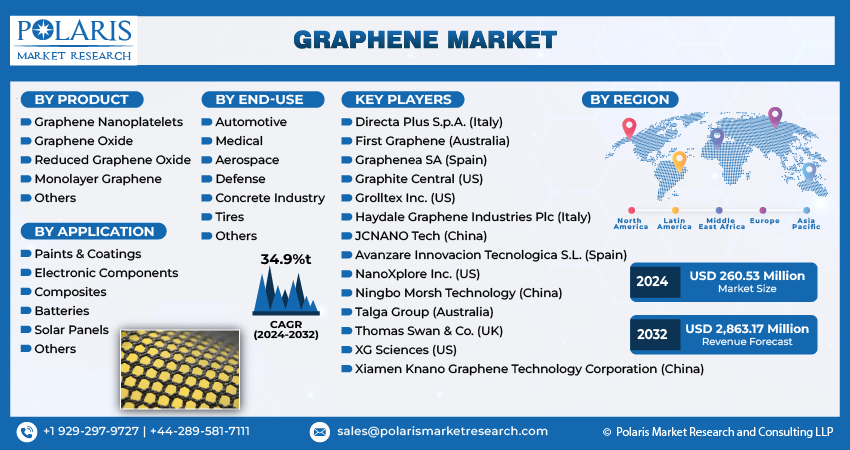

Graphene market size was valued at USD 193.53 million in 2023. The market is anticipated to grow from USD 260.53 in 2024 to USD 2,863.17 by 2032, exhibiting the CAGR of 34.9% during the forecast period.

Market Overview

Growing use of graphene in a wide range of applications such as energy storage, composites, sensors, and electronic devices due to its beneficial properties like mechanical strength, flexibility, and higher conductivity, driving the global market growth. Additionally, graphene-based materials offer various environmentally friendly benefits over traditional materials. For example, they can reduce the weight of vehicles, reduce carbon emissions, minimize plastic consumption, and improve fuel efficiency, which results in greater demand for these materials globally.

- For instance, in October 2023, Gerdau Graphene introduced its new graphene-infused packaging for Gerdau’s nail product line. The new graphene packaging is expected to reduce the company’s plastic consumption by around 25% or over 72 tons per year.

As graphene has the potential to revolutionize the semiconductor and electronics industry because it can be used to develop efficient and faster electronic devices such as integrated circuits, transistors, and displays. Thus, with the constantly increasing demand for consumer electronics, including smartphones and tablets worldwide, the need for graphene to create efficient devices is growing substantially.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to the International Telecommunication Union, 73 percent of the world’s population aged 10 and above own a mobile phone in 2022, and mobile phone ownership is continuously rising globally.

The Graphene Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Growth Factors

- Growing demand for graphene from automotive & transportation industry to drive market growth

The lightweight, strong, and conductive properties of graphene make it a highly suitable material to be used in various automobile components such as batteries, tires, anti-braking systems, and engine parts. Thereby, with the rise in automobile production and the growing transportation sector, the demand for graphene also increases.

For instance, in May 2023, according to the European Automobile Manufacturers Association, approx. 85.4 million motor vehicles were produced across the globe in 2022, with a significant increase of 5.7% compared to 2021.

- Advancements in material science and investments in R&D boosting the market growth

Rising advancements in material science led to the creation of new potential applications for graphene across different verticals and an increasing number of companies and research institutes focusing on R&D to make it cost-efficient and improve the production process, further boosting the market’s growth.

For instance, in October 2022, Researchers from the laboratory of Nai-Chang Yeh performed new studies on graphene and said that graphene can significantly improve electrical circuits required for flexible and wearable electronics.

Restraining Factors

- Lack of industrialization and regulatory uncertainty hampering the market growth

As graphene is currently in its initial stages and has an absence of globally accepted industry standards for the production or characterization, companies are producing different types of graphene that result in the creation of fake graphene. Also, the regulatory framework for graphene is underdeveloped and still evolving, and it also has several uncertainties that create a hurdle for market growth.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

- Graphene oxide segment accounted for the largest share in 2023

The graphene oxide segment accounted for the largest share. Segment’s dominance is attributed to its widespread use with different types of polymers and materials in order to enhance their properties like conductivity, tensile strength, and elasticity. Additionally, graphene oxide is highly fluorescent, which makes it suitable to be used in disease detection, bio-sensing, antibacterial materials, and drug carriers.

The graphene nanoplates segment will grow rapidly on account of its exceptional properties, including high surface area, electrical conductivity, thermal conductivity, and greater mechanical strength. Also, rising demand for lightweight composite constituents in aerospace and automotive industries further escalates demand for graphene nanoplates.

By Application Insights

- Electronic components segment held the significant share in 2023

The electronic components segment held the majority revenue share. This dominance is attributable to the surging demand for graphene in the electronics industry to manufacture several components as it provides high permeability, conductivity, and thinness. In addition, growing R&D to develop semiconductors with the help of graphene to increase energy efficiency and electron mobility into semiconductors drives the segment’s growth.

By End-Use Insights

- Medical segment is expected to witness highest growth during the forecast period

The medical segment will grow at the highest growth rate in the market forecast period. Segment’s growth is attributed to the emergence of graphene as an innovative and crucial material in the medical field because of its potential to treat severe diseases, including cancer. Also, graphene-based materials are being studied or researched globally for drug delivery applications due to their high surface area, which, in turn, bodes well for the segment’s growth.

For instance, in November 2023, the Indian Institute of Technology Guwahati announced that they had discovered the use of modified graphene oxide in biomedical applications as it offers low cytotoxicity and large surface area.

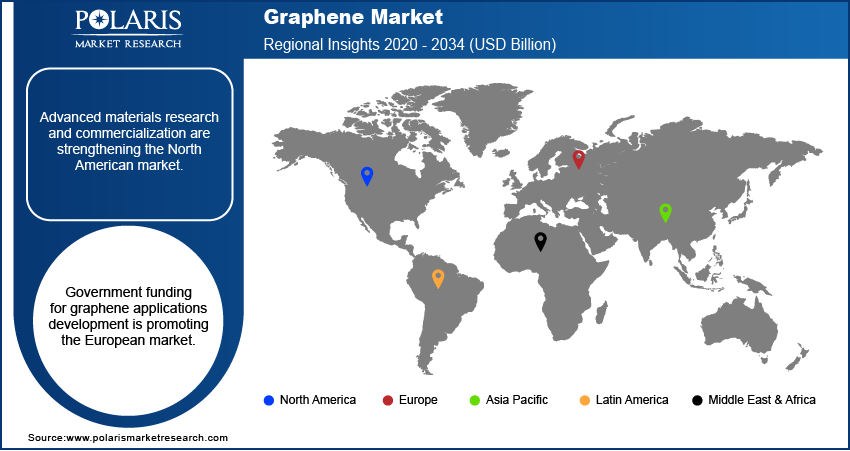

Regional Insights

- Asia Pacific region dominated the global market in 2023

The Asia Pacific region dominated the global market. Region’s dominance is accelerated by the robust presence of graphene manufacturers and consumers coupled with the exponential rise in production volumes across various sectors such as automotive, defense, and aerospace. Also, the rising number of favorable policies by government authorities, academic research, and funding promote the development of new graphene applications and improvements in the production process, fostering the region’s growth. For instance, in August 2023, The Ministry of Electronics & Information Technology, India, announced the launch of the ‘Graphene Aurora program’ in order to bolster graphene engineering.

The North America region is projected to gain a substantial growth rate owing to a rapid increase in demand for graphene from the automobile and aerospace industries. Additionally, the rising number of collaborations among product manufacturers and research institutions to focus on research & development activities and increase end-use applications of graphene is likely to bode well for the region’s growth.

Key Market Players & Competitive Insights

- Improvements in product quality and automation driving the market competition

The graphene market is highly fragmented and is witnessing significant competition from various regional and global players. Key companies in the market are highly focused on adopting several growth strategies to increase their foothold in the market. Also, companies are competing on factors such as improving the purity of graphene, automating production methods, cost-efficiency, improving supply chain & distribution networks, and developing customized solutions. For instance, in November 2023, EnyGy announced its plan to launch a graphene-based super-capacitor in 2024, which will provide higher energy storage capabilities across a wide range of applications.

Some of the major players operating in the global market include:

- Avanzare Innovacion Tecnologica S.L. (Spain)

- Directa Plus S.p.A. (Italy)

- First Graphene (Australia)

- Graphenea SA (Spain)

- Graphite Central (US)

- Grolltex Inc. (US)

- Haydale Graphene Industries Plc (Italy)

- JCNANO Tech (China)

- NanoXplore Inc. (US)

- Ningbo Morsh Technology (China)

- Talga Group (Australia)

- Thomas Swan & Co. (UK)

- XG Sciences (US)

- Xiamen Knano Graphene Technology Corporation (China)

Recent Developments in the Industry

- In June 2023, PETRONAS announced the launch of its second graphene-based solution named “ProCharge+.” This is a conductive additive for Lithium-ion batteries used in electric vehicles and the robotics sector. The new solution is developed to enhance conductivity and thermal performance.

- In December 2022, Graphenea S.A., the world’s leading graphene producer, announced the launch of its new spin-off company, “KIVORO”, a specialty chemicals company focused on creating solutions for various industrial challenges.

- In April 2023, Universal Matter UK Limited announced that they had successfully acquired Applied Graphene Materials UK Limited and Applied Graphene Materials LLC, against a total consideration of USD 1.3 million. This acquisition will accelerate the company’s growth of novel graphene-based solutions.

Report Coverage

The graphene market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, end-use, and their futuristic growth opportunities.

Graphene Market Research Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 260.53 million |

|

Revenue forecast in 2032 |

USD 2,863.17 million |

|

CAGR |

34.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Graphene Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2029, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Abaca Pulp Market Size, Share 2024 Research Report

Healthcare Finance Solutions Market Size, Share 2024 Research Report

Hirsutism Market Size, Share 2024 Research Report

Bring Your Own Device Market Size, Share 2024 Research Report

FAQ's

key companies in graphene market are First Graphene, XG Sciences, NanoXplore Inc., Graphenea SA, Avanzare Innovation Tecnologica

Graphene market exhibiting the CAGR of 34.9% during the forecast period.

The graphene market report covering key segments are product, application, end-use, and region.

key driving factors in graphene market are growing demand for graphene from automotive & transportation industry to drive market growth

The global graphene market size is expected to reach USD 2,863.17 million by 2032