Liver Disease Diagnostics Market Share, Size, Trends, Industry Analysis Report, By Diagnosis Technique (Imaging, Laboratory Tests, Endoscopy, Biopsy, Others); By End-Use (Hospitals, Laboratories, Others), By Regions; Segment Forecast, 2021 - 2028

- Published Date:Mar-2021

- Pages: 108

- Format: PDF

- Report ID: PM1810

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

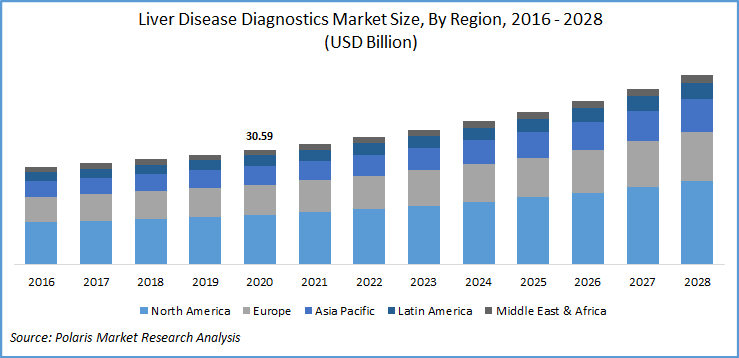

The global liver disease diagnostics market was valued at USD 30.59 billion in 2020 and is expected to grow at a CAGR of 6.7% during the forecast period. A global rise in acute and chronic liver disorders is the most prominent factor responsible for the market growth for liver disease diagnostics. For instance, as per the estimates of the World Health Organization (WHO), in 2018, there were around 841,080 new cases of liver cancer and approximately 781,631 people died with it.

Moreover, advancements in rapid tests by the key players in the liver disease diagnostics market for a specific section of the population such as HIV-positive patients and pregnant women also boosted the market growth. In line with this, Abbott Labs, in February 2019, received a CE mark for its HBsAg 2 test. It is an easy-to-use, rapid test for the detection of hepatitis B in the market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Rising research & development spend towards accurate and early diagnosis for better patient outcomes have propelled the market growth for liver disease diagnostics. Key players in the market for liver disease diagnostics are focused on introducing innovative products and services to improve diagnosis time. In this line, in 2020, Roche Ltd received breakthrough device designation for its Elecsys GALAD product. The product was developed by the Roche Diagnostics Liver indication program to enhance diagnosis workflow and much-needed help for the healthcare practitioners to provide accurate information.

Know more about this report: request for sample pages

Moreover, the introduction of novel procedures to diagnose liver diseases is also likely to have a positive impact on the future growth of the market for liver disease diagnostics. Earlier, in 2017, Ortho Clinical Diagnostics developed a new innovative method for the measurement of Alanine Aminotransferase (ALT) using VITROS ALTV Slides, developed through dry slide technology. This new method has reduced the sample requirement, increased sensitivity, and enhanced diagnostics capabilities.

Liver Disease Diagnostics Market Report Scope

The market is primarily segmented on the basis of diagnosis technique, end-use, and region.

|

By Diagnosis Technique |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Diagnosis Technique

In 2020, the imaging market segment held the liver disease diagnostics industry share, among all. Such a high share is attributed to an increasing number of strategic initiatives taken by key players in the marketplace to launch advanced imaging services. First lab tests are carried out using blood, and fluid samples to diagnose abnormalities in liver functioning. While CT scans, MRI, and ultrasounds are imaging non-invasive techniques for the diagnosis.

Insight by End-Use

In 2020, the hospital market segment accounted for the largest share of the global liver disease diagnostics industry. This high share is attributed to the fact that the majority of the patient relies on hospitals, as they are better equipped with disease diagnostics capabilities. Hospitals also provide optimal care to patients and enable early disease diagnosis. Moreover, further advancements in the healthcare infrastructure also boosted the segment’s growth prospects.

The laboratory market segment is projected to grow at the fastest growth rate over the assessment period of the liver disease diagnostics market. Several labs and institutes have introduced awareness initiatives to diagnose hepatic abnormalities. For instance, in 2017, Mylan Labs collaborated with the Delhi-based Institute of the liver and Biliary Sciences to carry out awareness programs. The collaboration aimed to provide appropriate disease screening and testing capabilities to over 1,000 patient-based in Delhi. It also carried out tests for Hepatitis B and C, and ALT.

Geographic Overview

Geographically, the global liver disease diagnostics market is bifurcated into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. North America is the largest revenue contributor followed by Europe and the Asia Pacific region. In 2019, the North American region accounted for over 43% percent of the global market for liver disease diagnostics.

North America is projected to maintain its dominance over the assessment period. Regional factors boosting such growth include a high investment of the key players in research & development. The region has many organizations which provide information regarding disease diagnosis with better clinical facilities is also expected to fuel the region’s market growth for liver disease diagnostics. For instance, the region has GetPalliativeCare.org, which deals with palliative care initiatives related to CT scans, biopsy, and endoscopy.

Competitive Insight

Key players in the market for liver disease diagnostics are implementing a multitude of strategies to develop innovative technologies to advance patient-centered care. The prominent players operating in the liver disease diagnostics industry are Horiba Medical, Abbott, Fujifilm Corporation, Roche Ltd, Randox Laboratories Ltd., Boston Scientific Corporation, Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, and Siemens Healthcare GmbH.