Medical Adhesives Market Share, Size, Trends, Industry Analysis Report, By Resin (Acrylic, Polyurethane, Epoxy, Silicone, Others), By Technology (Water based, Solvent based, Hot melt, Reactive & others), By Application (Dental, Medical device & equipment, Internal medical application, External medical application), By Region, Segment Forecasts, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2243

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

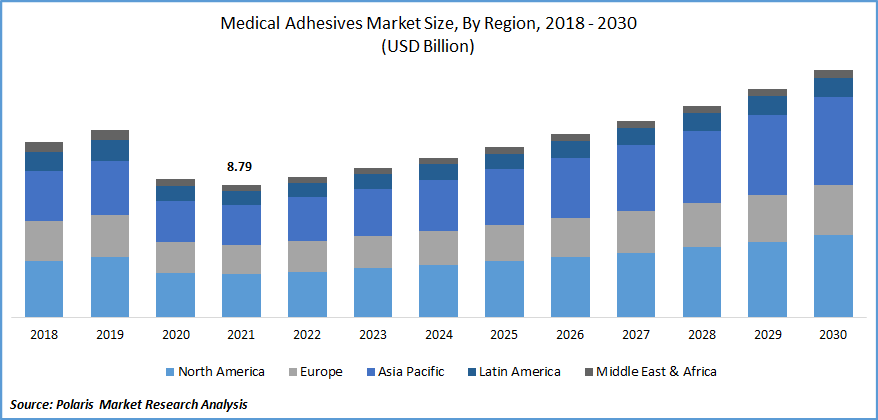

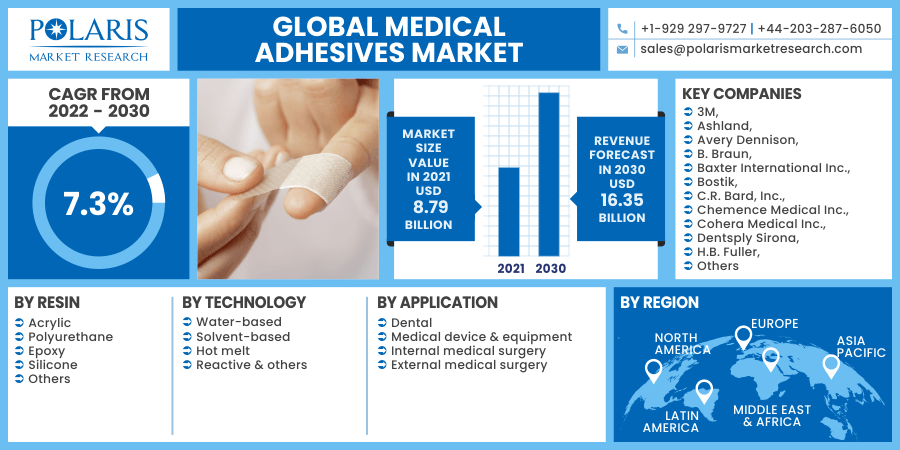

The global medical adhesives market was valued at USD 8.79 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period. The significant rise in clinical implants is a fundamental element for the demand for medical adhesives. In the anticipated period, the surgical industry in the APAC region is expected to expand, which also results in industry demand. Moreover, in developing nations, the rising population, higher economic levels, and improved health awareness are the further factor, which is attributed to the industry growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Furthermore, rising incidences of wounds & injuries are also associated with the industry demand. For instance, in the United States of America, there are nearly over 6.5 million sufferers per year. Thereby, wound closure is effectively done by the usage of these adhesives derived from natural or synthetic materials that aid in proficient closure of wounds as well as also limit infection transmission, which, in turn, surge the industry demand.

The onset of the COVID-19 exhibits the downtrend of the market growth, owing to the indecisive markets demand and increasing financial stress. The rising limitations on the traveling activities, as well as a prolonged lockdown, will result in a demand collapse in various regions. Movement restrictions in key nations like Europe, India & Southeast Asia, and United States are leading the huge economic disruptions. Thereby, the unavailability of the raw materials and disruption in the transport & logistics facilities is also hampering the medical adhesives market growth. However, the gradual opening of lockdown and availability of the raw materials is leading the development of the industry over the forthcoming scenario.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Single-use healthcare items and single-use disposable products are becoming more popular, as they offer various benefits over traditional stainless-steel systems. The usage of injection-molded plastic for making disposable devices that are attached with bonding, ultrasonic welding, gluing, or radio-frequency welding is bolstering the medical adhesives market growth. Owing to the production of the high volume of single-use items, the rising requirements for reducing human touch. In addition, the decreasing impact of the cross-contamination, minimal legal worries, lowered validating requirements for cleanliness systems, cost-effective capital investment, better mobility, and scalability, along with high hygiene assurance are the several benefits that may surge the demand for the single-use disposable medicinal products.

The industry for single-use disposable items is expected to increase at a pace of 17-20 percent over the next several years, according to Dow Corning. Furthermore, the rising competitive edge in the industry due to the strategic initiatives by the players such as mergers & acquisitions, and new product developments is also surging the medical adhesives market demand. For instance, in April 2017, Baxter International- leading manufacturing surgical adhesives, introduced its novel designs to boost the company’s FLOSEAL and TISSEEL hemostatic product line.

Report Segmentation

The market is primarily segmented on the basis of resin, technology, application and region.

|

By Resin |

By Technology |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Resin

Acrylics captured dominant with the largest revenue shares in the global industry. Acrylics are used in a variety of applications such as dentistry, building, healthcare devices, and equipment. Furthermore, these are also used in both internal and external medicinal operations, including skin tissue adhesives.

Moreover, silicone-based adhesives are exhibiting the highest CAGR during the forecasting period. This is primarily due to its ability to stick to the Silicon, and limited cross-reactivity with other metals. Furthermore, as compared to acrylics, they offer superior environmental protection and prolonged durability. Medical tapes are the most common type of external application for them. However, because these resins are substantially more expensive than conventional resins, their usage is limited.

Geographic Overview

North America dominated the industry with the largest share for industry owing to the increasing geriatric population, increasing knowledge and awareness towards the advantages of non-invasive surgery techniques, as well as continuous technical development activities across the health industry is majorly attributing to the growth of the regional industry. Moreover, the rising usage of these adhesives in major territories like the United States and Canada is also penetrating the adoption of these adhesives. Furthermore, North America has observed a rise in popularity for implant operations including artificial hips and knees, which resulted in an expansion in the production of these specialty items throughout the nation. Therefore, these factors are driving the demand for the regional market.

Moreover, Asia Pacific is the fastest-growing region for medical adhesives during the foreseen period. The rising presence of the leading players, growing prospects for market growth across the various emerging nations is projected to impel the market growth. The growing use of adhesive in many application sectors like dental, surgical, and others is largely responsible for the regional market growth. Additionally, escalating populating majorly in the nations like China and India are acting as catalyzing factors for the market demand. Furthermore, the rising numbers of the R&D activities are also leading the developments in the medical adhesives, which are more economical and present maximum protection from infection, and reducing skin irritation for patients, thus, in turn, fuels the market demand in the approaching years.

Competitive Insight

Some of the major players operating in the global market include 3M, Ashland, Avery Dennison, B. Braun, Baxter International Inc., Bostik, C.R. Bard, Inc., Chemence Medical Inc., Cohera Medical Inc., Dentsply Sirona, H.B. Fuller, Heartland Adhesives, LLC, Henkel AG & Co. KGaA, Nitto Denko Corporation, The Dow Chemical Company.

Medical Adhesives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 8.79 billion |

|

Revenue forecast in 2030 |

USD 16.35 billion |

|

CAGR |

7.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Resin, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3M, Ashland, Avery Dennison, B. Braun, Baxter International Inc., Bostik, C.R. Bard, Inc., Chemence Medical Inc., Cohera Medical Inc., Dentsply Sirona, H.B. Fuller, Heartland Adhesives, LLC, Henkel AG & Co. KGaA, Nitto Denko Corporation, The Dow Chemical Company |