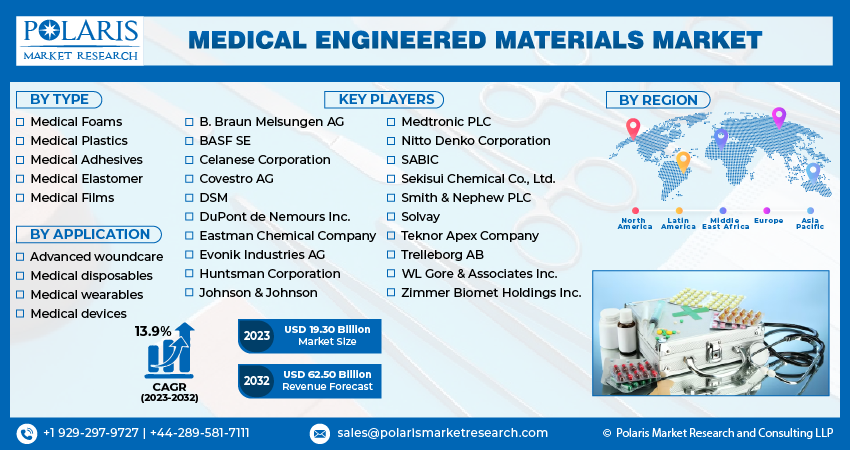

Medical Engineered Materials Market Share, Size, Trends, Industry Analysis Report, By Type (Medical Foams, Medical Plastics, Medical Adhesives, Medical Elastomer, Medical Films); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Dec-2023

- Pages: 116

- Format: PDF

- Report ID: PM2127

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

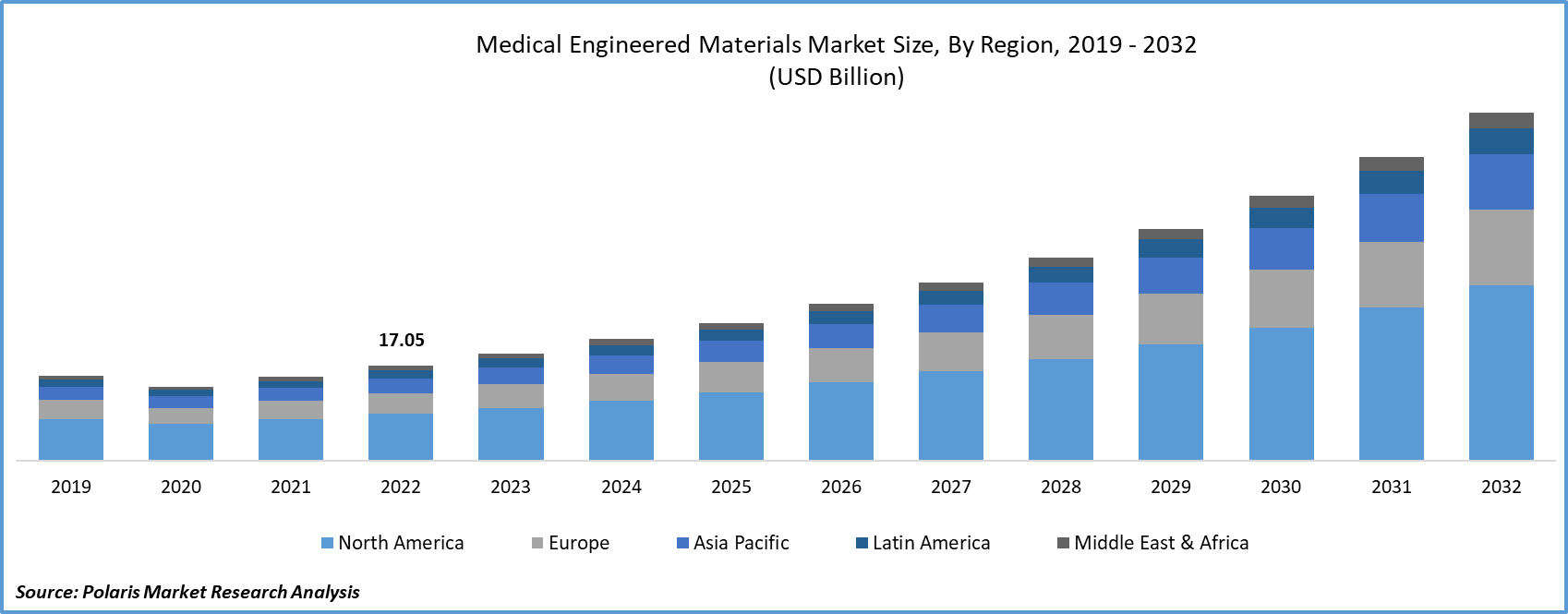

The global medical engineered materials market was valued at USD 17.05 billion in 2022 and is expected to grow at a CAGR of 13.9% during the forecast period.

Medical Engineered Materials (MEM) refer to materials employed in the manufacturing of medical products, including implants, disposables, and more. These materials undergo design and approval processes specifically for use in the production, safety, and assembly of medical devices. MEM represents high-value-added materials known for consistently surpassing the performance of conventional materials. This leads to the creation of products that are thinner, possess broader service temperature ranges, offer multifunctionality, or demonstrate enhanced life-cycle performance.

To Understand More About this Research: Request a Free Sample Report

The market is propelled by the escalating healthcare expenses in developing economies and a rising geriatric population, leading to an augmented demand for advanced medical technology and products. Advancements in minimally invasive surgical procedures further fuel the increasing global demand for medical-engineered materials. Additionally, significant drivers of the Medical Engineered Materials market include progress in the design of medical electronic components.

The growth of healthcare infrastructure in emerging economies and a surge in chronic disease cases are anticipated to be key drivers for the Medical Engineered Materials Market, consequently increasing the demand for such materials.

For Specific Research Requirements: Request for Customized Report

The market is propelled by the escalating healthcare costs in developing markets and a expanding geriatric population, necessitating the utilization of advanced medical technology and equipment. The increasing global demand for Medical Engineered Materials is also fueled by advancements in minimally invasive surgical techniques.

Industry Dynamics

Growth Drivers

- An increasing elderly population necessitates advanced medical technologies and devices.

Medical devices and equipment are utilized across diverse diagnostic, procedural, and surgical applications, frequently incorporating the use of medical-engineered materials in their production. The demand for these materials in medical devices is propelled by shifting demographics, marked by an aging population and the emergence of new strains of diseases. The worldwide rise in the elderly population is exerting a significant influence on both product design and manufacturing methods. Moreover, there is a growing preference for comfortable designs within the elderly demographic. Anticipated advancements, such as the introduction of new materials like soft-touch TPEs and technologies like over-molding, are expected to contribute to the increased demand for medical-engineered materials in the forecast period.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Medical Plastics segment held the largest revenue share in 2022

Medical plastics constitute the largest segment in the market, playing a pivotal role in diverse healthcare applications. Their use spans the manufacturing of medical devices, tools, and diagnostic equipment, contributing significantly to the overall market size. The expanding healthcare infrastructure in emerging economies and the rising prevalence of chronic diseases are anticipated to boost the medical devices market, consequently driving the demand for medical plastics.

Medical adhesives find application in wound closure and the assembly of medical devices, whereas medical elastomers offer flexibility and durability in various applications, including catheters and prosthetics.

By Application Analysis

- The Medical disposables segment accounted for the highest market share during the forecast period

Medical plastics constitute the largest segment in the market, playing a vital role in numerous healthcare applications, such as the production of medical devices, tools, and diagnostic equipment, contributing significantly to the market's substantial size. The expanding healthcare infrastructure in emerging economies and the rising prevalence of chronic diseases are anticipated to stimulate the medical devices market, consequently driving the demand for medical plastics.

Advanced wound care pertains to materials utilized for optimizing wound healing, encompassing items like dressings, bandages, and tissue engineering products. These applications play a crucial role in enhancing healthcare outcomes and ensuring patient comfort.

Regional Insights

- Asia Pacific dominated the largest market in 2022

The Asia Pacific healthcare engineered materials market is projected to experience substantial growth in the forecast period. The rising population, increasing instances of lifestyle-related diseases, and enhancements in healthcare infrastructure have heightened the demand for engineered materials in the region's healthcare sector.

Factors contributing to this growth include expanding research and development endeavors and technological advancements in 3D printing and medical manufacturing. The outbreak of COVID-19 has notably heightened the demand for disposables and devices, including ventilators, to cater to critically ill patients in the region.

China stands as the foremost market for medically engineered materials in the region, serving not only as the largest consumer but also as a vital producer, thanks to its expansive manufacturing base. Beyond China, rapid growth is anticipated in India, Japan, and South Korea in the coming years. The substantial expansion in this sector can be attributed to the escalating adoption of digitization and contemporary technologies like 3D printing in the production of medical equipment.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- B. Braun Melsungen AG

- BASF SE

- Celanese Corporation

- Covestro AG

- DSM

- DuPont de Nemours Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Huntsman Corporation

- Johnson & Johnson

- Medtronic PLC

- Nitto Denko Corporation

- SABIC

- Sekisui Chemical Co., Ltd.

- Smith & Nephew PLC

- Solvay

- Teknor Apex Company

- Trelleborg AB

- WL Gore & Associates Inc.

- Zimmer Biomet Holdings Inc.

Recent Developments

- In March 2023, DSM Biomedical has joined forces with 3D Systems to collaborate on the development and commercialization of 3D-printed medical devices. This partnership is poised to expedite the advancement and acceptance of 3D-printed medical devices.

- In February 2023, Covestro AG has successfully acquired Heraeus Medical Components, a notable manufacturer of medical implants. This strategic acquisition is anticipated to enhance Covestro's footprint in the market for medical implants.

- In January 2023, Evonik Industries AG has acquired PolyMedix, Inc., a company specializing in the development of bioresorbable polymers. This acquisition is anticipated to bolster Evonik's portfolio of bioresorbable materials tailored for medical applications.

Medical Engineered Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 19.30 billion |

|

Revenue forecast in 2032 |

USD 62.50 billion |

|

CAGR |

13.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Medical Engineered Materials market size is expected to reach USD 62.50 billion by 2032.

Key players in the market are B. Braun Melsungen AG, BASF SE, Celanese Corporation, Covestro AG, DSM, DuPont de Nemours Inc

Asia Pacific contribute notably towards the global medical engineered materials market

The global medical engineered materials market is expected to grow at a CAGR of 13.9% during the forecast period.

The medical engineered materials market report covering key segments are type, application, and region.