Next Generation Sequencing Market Share, Size, Trends, Industry Analysis Report, By Application; By Technology; By Product; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1100

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

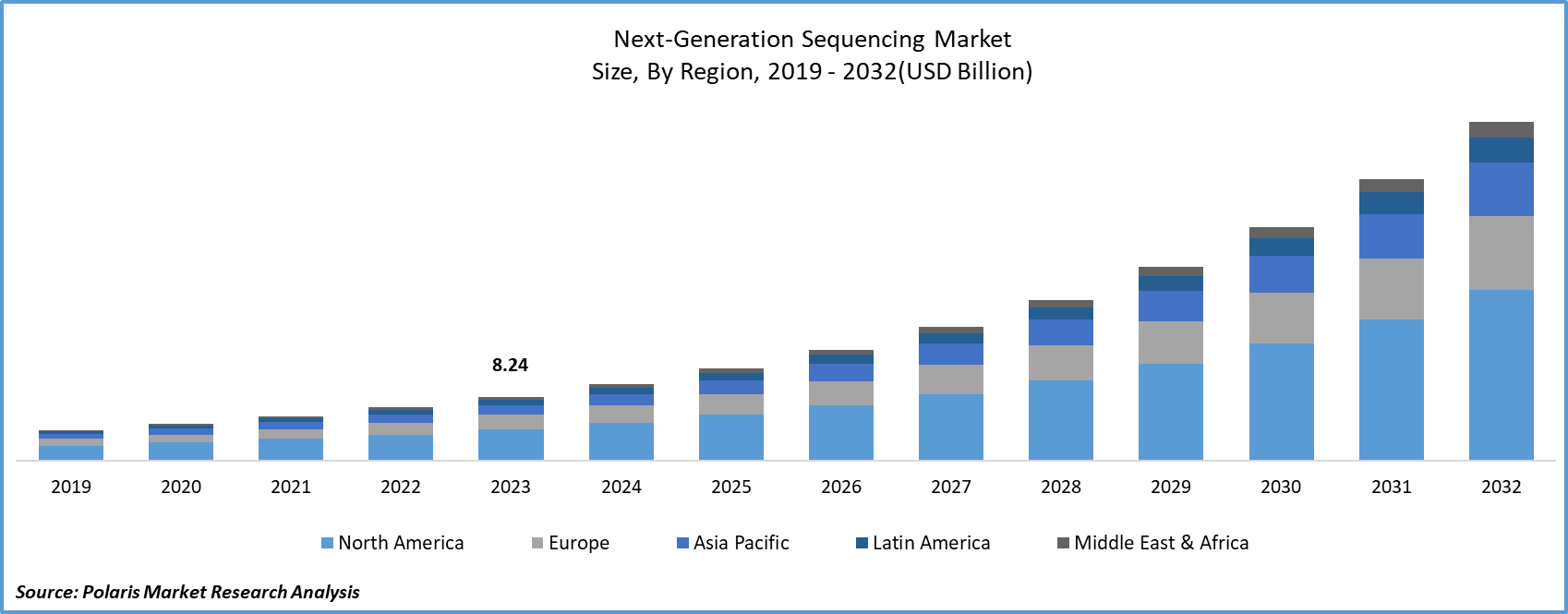

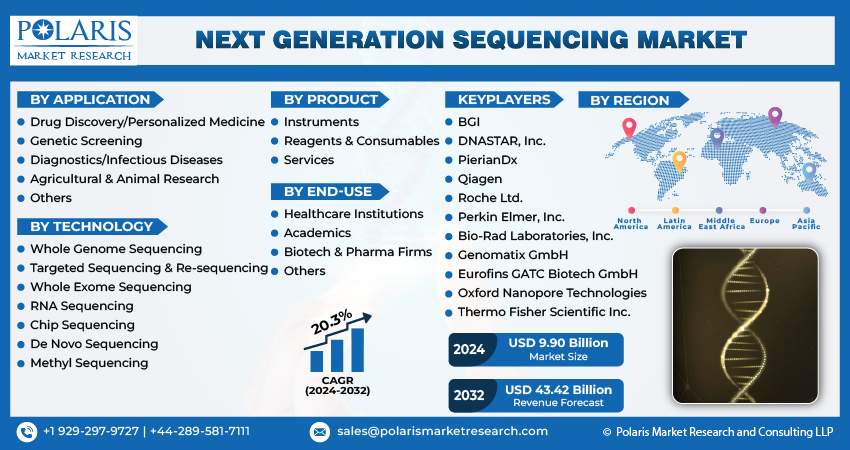

The global next generation sequencing market was valued at USD 8.24 billion in 2023 and is expected to grow at a CAGR of 20.3% during the forecast period.

Next-generation sequencing is an advanced technology used for DNA and RNA sequencing, as well as the detection of genetic variants and mutations. Next Generation Sequencing can quickly sequence hundreds or even thousands of genes or entire genomes. Next Generation Sequencing identified sequence variants and mutations are utilized extensively in disease diagnosis, prognosis, therapeutic decision-making, and patient monitoring during follow-up.

Several factors are driving the growth of the next generation sequencing market. Increasing prevalence of cancer and genetic disorders, surging appetite for customized medicine, and the rising use of next generation sequencing technology in the research and clinical applications. NGS technology is in high demand in research and clinical applications owing to its ability to identify genetic variants quickly and accurately, which is aided by the generation of large amounts of data. The decreasing cost of sequencing and the development of innovative NGS platforms with increased speed and precision contribute to the widespread adoption of this technology.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI), whole genome sequencing (WGS) can offer exceptionally pertinent insights into the genome of the malaria parasite, thereby contributing valuable information to the study of malaria pathology.

The next generation sequencing market is growing owing to an increasing number of developments in genomics research. Significant advances have been made in genomics research; next-generation sequencing has a critical role in driving these advancements. The rapid and accurate sequencing of entire genomes has seen significant advancements due to next generation sequencing technology. This next-generation sequencing technology is essential in the analysis of large amounts of genetic data, assisting in the identification of the underlying causes of various diseases.

The COVID-19 has a significant impact on the next generation sequencing market. During the COVID-19 pandemic, there has been a significant increase in the use of next-generation sequencing testing, which is known to be a useful tool for detecting viruses within the human body. Several companies have introduced NGS-based diagnostic tests developed specifically for COVID-19 detection. Concurrently, researchers have increasingly used Next Generation Sequencing Technology in drug discovery efforts with the aim of developing COVID-19 virus treatments.

The increased use of telemedicine during the pandemic has accelerated the use of next-generation sequencing testing. As a result, the COVID-19 pandemic has played a crucial role in facilitating the growth of the next-generation sequencing market. However, certain NGS-reliant research projects have been put on hold, and the pandemic's global supply chain disruptions have decreased demand for next-generation sequencing instruments and reagents. As a result, the overall growth of the next-generation sequencing market has been slightly hindered.

Industry Dynamics

Growth Drivers

- Improvements in the sequencing technologies will drive the growth of the market

The improvements in the sequencing technologies will drive the growth of the next-generation sequencing market. Technological advancements have significantly accelerated the determination of DNA and RNA sequences. Next-generation sequencing platforms can analyze a greater number of samples concurrently, leading to higher efficiency. This capability is especially useful in research and clinical scenarios that require extensive sequencing, such as genomics research and diagnostic testing. Continuous advancements in next-generation sequencing platforms have increased speed and precision, and also cost-effectiveness. These incremental improvements make next generation sequencing more accessible and appealing to researchers and healthcare providers.

The lowering costs of sequencing has resulted in a greater use of next-generation sequencing in disease diagnosis. The emergence of various test kits and testing services, particularly in non-invasive prenatal testing, cancer diagnosis, genetic testing, and other diagnostic applications, is driving the growth of the market.

Report Segmentation

The market is primarily segmented based on product, technology, application, end-use, and region.

|

By Application |

By Technology |

By Product |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

- The diagnostics/infectious diseases segment accounted for the largest revenue share

The diagnostics/infectious diseases segment held the largest revenue share, owing to an advancement in the liquid biopsies in the diagnosis of cancer and the rise of the COVID-19 disease across the world. The next-generation sequencing based liquid biopsy utilizes a circulation tumor DNA as a cancer biomarker for a real time diagnosis of the cancer.

Furthermore, next-generation sequencing provides exceptional sensitivity with low error rates when diagnosing low-level circulating tumor DNA (ctDNA) in the bloodstream. Fulgent Genetics, Inc., a company specializing in next-generation sequencing services based in the United States, unveiled a COVID-19 test based on next-generation sequencing technology in March 2020.

By Product Analysis

- The instruments segment accounted for the highest market share during the forecast period

The instruments segment held the highest market share during the forecast period. Because of accurate and reliable genetic information is critical in clinical diagnosis and illness treatment, highlighting a significant demand for advanced sequencing equipment. Continuous technological advancements have resulted in the development of high-throughput sequencing tools, allowing for faster and more efficient DNA and RNA sequencing.

On the other hand, services segment is anticipated to witness fastest growth throughout the forecast period. As the demand for data analysis and interpretation services grows, the services are becoming more crucial for understanding complex genetic information. The ability of researchers and healthcare professionals to access and analyze vast amounts of genetic data, facilitated by the availability of cloud-based computing systems, is attributed to the increase in demand.

Regional Insights

- North America accounted for the largest market share

North America held the largest market share in the next generation sequencing market. Several factors contribute to the widespread adoption of next-generation sequencing technologies in the region. These include a well-established healthcare infrastructure, an increasing prevalence of chronic diseases, and government funding for genomics research. Also, the presence of key market players in the region, as well as easy access to advanced genomic research technology, are anticipated to drive the growth of the next generation sequencing market in the region.

Asia Pacific region is witnesses for the fastest growth in the next generation sequencing market, due to the increased investments in research & development activities, surging prevalence of chronic diseases and a government funds getting for genomics research. The availability of advanced genomics technologies and the presence of key players in the region are also expected to drive the growth of the market in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- BGI

- Bio-Rad Laboratories, Inc.

- DNASTAR, Inc.

- Eurofins GATC Biotech GmbH

- Genomatix GmbH

- Oxford Nanopore Technologies

- Perkin Elmer, Inc.

- PierianDx

- Qiagen

- Roche Ltd.

- Thermo Fisher Scientific Inc.

Recent Developments

- In January 2023, QIAGEN has partnered with Helix, a prominent population genomics company based in California, aimed at progressing the development of next-generation sequencing companion diagnostics for hereditary diseases.

- In September 2022, Illumina Inc. has launched the NovaSeq X Series (including the NovaSeq X and NovaSeq X Plus), innovative next-generation sequencers developed to improve sequencing speed, capability, and sustainability on a larger production scale.

- In March 2022, Thermo Fisher Scientific has launched the Ion Torrent Genexus Dx Integrated Sequencer, a CE-IVD-marked next-generation sequencing (NGS) platform. This automated system can deliver results in a single day.

Next Generation Sequencing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.90 billion |

|

Revenue forecast in 2032 |

USD 43.42 billion |

|

CAGR |

20.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Application, By Technology, By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

Custom Market Research Services

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

key companies in next generation sequencing market are BGI, Bio-Rad Laboratories, Inc., DNASTAR, Inc., Eurofins GATC Biotech GmbH, Genomatix GmbH, Oxford Nanopore Technologies

The global next generation sequencing market is expected to grow at a CAGR of 20.3% during the forecast period.

The next generation sequencing market report covering key segments are product, technology, application, end-use, and region.

key driving factors in next generation sequencing market are improvements in the sequencing technologies will drive the growth of the market

The global next generation sequencing market size is expected to reach USD 43.42 billion by 2032