Non-Meat Ingredients Market Share, Size, Trends, Industry Analysis Report By Ingredient (Texturing Agents, Extenders, Binders, Fillers, Flavoring Agents, Coloring Agents, Preservatives & Salts, Others); By Meat; By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM2509

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

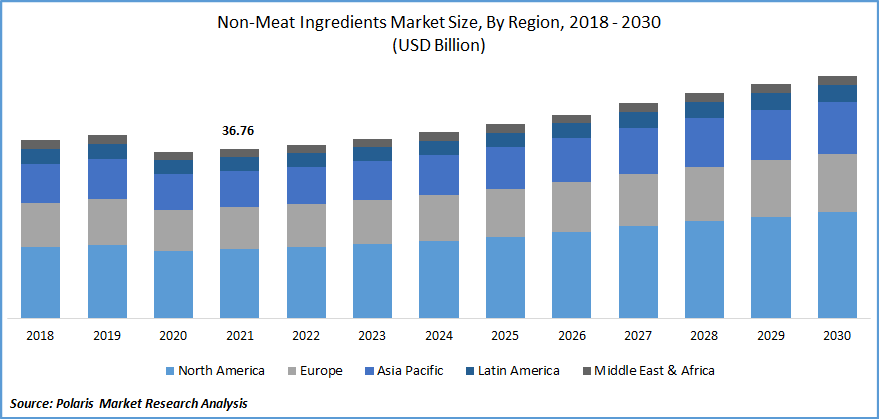

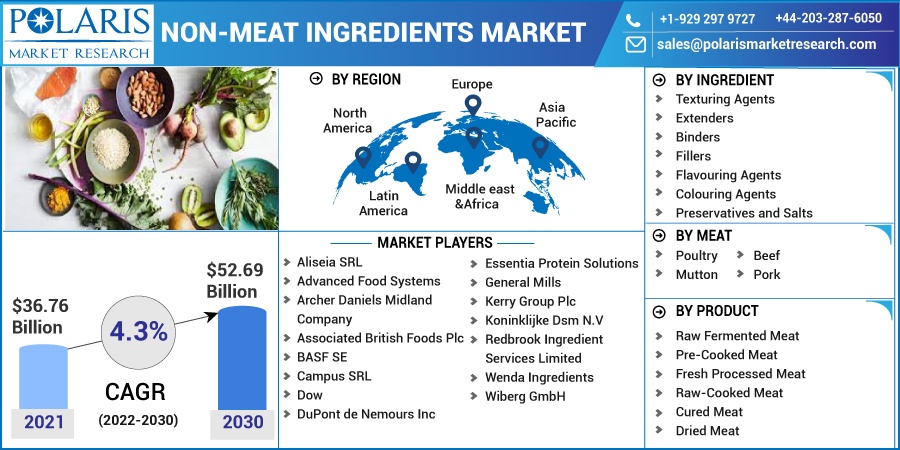

The global non-meat ingredients market was valued at USD 36.76 billion in 2021 and is expected to grow at a CAGR of 4.3% during the forecast period. The demand for non-meat ingredients has increased over the years owing to greater demand for convenience food products and a rise in consumer awareness. The addition of non-meat ingredients such as texturing agents, extenders, binders, and fillers, among others, results in enhanced flavor, improved texture, superior meat quality, reduced costs, and health benefits.

Know more about this report: Request for sample pages

The significant growth in the consumption of convenience food across the globe is expected to fuel the growth of this market. The per-capita consumption of convenience food has increased considerably in recent years, primarily in developing markets such as China and India. Increased consumption of fast food, growth in disposable income, and rising middle-class aspirational spending has increased the demand for non-meat ingredients, especially in emerging economies.

Non-meat ingredients are additives used in processing raw, partially cooked, fully cooked, ready-to-eat, fermented, dried, marinated, and dry-cured products to obtain desirable properties. The addition of flavoring agents to meat products offers alternate flavor choices for consumers. Flavoring agents such as dehydrated ingredients, ground spices, or spice extractives are also added to conceal undesirable flavors from other ingredients such as potassium lactate or sodium lactate.

The COVID-19 outbreak has disrupted the supply chain across the globe. The scarcity of raw material and reduced workforce has severely impacted the non-meat ingredients market. Countries worldwide have regulated the movement of individuals and goods, resulting in decreased deliveries, roadblocks, and other logistic issues, hampering the market growth for non-meat ingredients.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing population and increasing consumption of convenience food are expected to drive the market. There has been increased awareness among consumers regarding health benefits associated with meat consumption and nutritional needs, which supplements the growth of this market. Greater penetration of fast-food restaurants, increasing health concerns, growing health and fitness consciousness, and changing lifestyle & food habits have fueled the growth of the global non-meat ingredients market.

Additionally, technological advancements and a significant rise in investments in research and development further augment the market growth. New product launches and acquisitions by leading players in the market, coupled with increasing meat consumption, have increased the demand for non-meat flavorings across the globe.

Increasing awareness regarding nutrition and the hectic lifestyles of consumers further boosts the non-meat ingredients market growth. There has been an increased demand for premium meat products owing to increasing awareness regarding healthy eating habits. Market players in the region are introducing products with local tastes and flavors to cater to the growing demand for non-meat flavorings.

Report Segmentation

The market is primarily segmented based on ingredient, meat, product, and region.

|

By Ingredient |

By Meat |

By Product |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Flavoring agents accounted for a significant share in 2021

Flavoring agents accounted for a significant share in 2021. The major factors driving the growth of this industry include growing awareness regarding nutrition among consumers, increasing demand for convenience and on-the-go meal options, and rising disposable income. Consumers are consciously making efforts to switch to healthier food products with local and authentic flavors.

Binders and extenders are also extensively used in meat processing. Extenders such as dry milk powder, cereal flour, and soy protein are added to meat products to enhance emulsion and batter stability and improve yields and slicing properties.

Fresh processed meat accounted for a significant share in 2021

Fresh processed meat held a significant revenue share in 2021. There has been increased consumption of nutritious food products across the globe owing to changing lifestyles and the rising disposable income of consumers. Moreover, the growing popularity of fast-food restaurants in developing economies also boosts the growth of this segment.

Greater demand for processed meat products from developed and developing economies, changing consumer attitudes toward the consumption of processed meat products, and rising health concerns drive the growth of this segment.

The pork segment accounted for a major share in 2021

The pork segment held a dominant revenue share in 2021. This segment is also influenced by the rising population, growing urbanization, and increasing demand for on-the-go meals. There has been increased consumption of fast food across the globe owing to changing lifestyles and rising disposable income of consumers, driving the growth of this segment.

Non-meat flavorings enhance the quality of pork by improving juiciness, tenderness, and flavor. In addition, non-meat flavorings also enhance color, increase shelf-life, improve safety, or increase water-holding capacity.

The demand for non-meat ingredients in North America is expected to increase during the forecast period

The demand for non-meat ingredients is expected to increase in North America due to urbanization, growing research and development activities, the presence of international players in this region, and technological advancements. The high disposable incomes and rising health concerns further drive the growth of this region.

Rising technological advancements in food technology and growing demand for fast food has increased the demand for non-meat flavorings. Consumers in the region are moving toward flavorful, convenient, and nutritious food products. Several companies in the region are offering meat-based snacks, thereby driving the growth of the non-meat ingredients market.

The industry for non-meat ingredients in Asia Pacific region is expected to offer lucrative growth opportunities for industry players during the forecast period. Increasing adoption of western lifestyle & eating habits and rising disposable income of consumers are significant factors that would drive growth. This region offers potential opportunities to industry players to launch premium products. Leading industry players are focusing on expanding their business in this region to increase their customer base and improve geographical outreach.

Competitive Insight

Some of the major players operating in the global market include Aliseia SRL, Advanced Food Systems, Archer Daniels Midland Company, Associated British Foods Plc, BASF SE, Campus SRL, Dow, DuPont de Nemours Inc, Essentia Protein Solutions, General Mills, Kerry Group Plc, Koninklijke Dsm N.V, Redbrook Ingredient Services Limited, Wenda Ingredients, and Wiberg GmbH among others.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands.

Recent Developments

In June 2020, Essentia Protein Solutions declared to launch a new functional hybrid for their range of products. These new products will contain pea protein and functional pork. The company's objective is to use this product to target consumers who want to follow a partially plant-based diet while keeping meat's nutritional and textural value.

The product, ExcelPro Plus PP 50, is a functional ingredient option offering high water binding capacity. It is developed to be heat-stable and aimed at maintaining its functionality while heated and afterward. The product offers improved yields while maintaining juiciness and flavor.

In September 2021, Kerry Group Reached completed the acquisition of Niacet, which offers preservation constituents for meat and plant-based food products. The acquisition is focused on enhancing Kerry's food protection and preservation strategy, expanding its offerings, exploring new technologies, and strengthening its market presence in non-meat ingredients industry.

Non-Meat Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 36.76 billion |

|

Revenue forecast in 2030 |

USD 52.69 billion |

|

CAGR |

4.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Ingredients, By Meat, By Product, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aliseia SRL, Advanced Food Systems, Archer Daniels Midland Company, Associated British Foods Plc, BASF SE, Campus SRL, Dow, DuPont de Nemours Inc, Essentia Protein Solutions, General Mills, Kerry Group Plc, Koninklijke Dsm N.V, Redbrook Ingredient Services Limited, Wenda Ingredients, and Wiberg GmbH |