Oilfield Chemicals Market Share, Size, Trends, Industry Analysis Report, By Product (Rheology Modifiers, Inhibitors, Others), By Application (Drilling, Production, Cementing, Workover & Completion) By Location (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1134

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

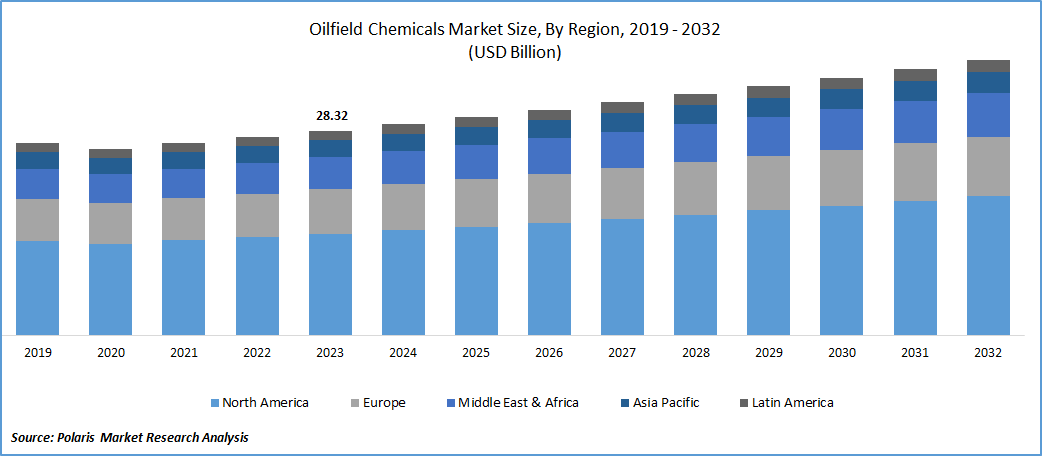

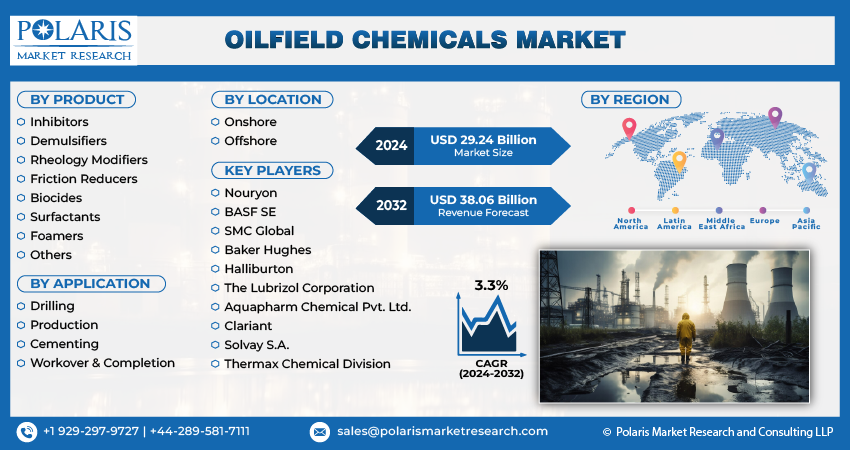

The global oilfield chemicals market was valued at USD 28.32 billion in 2023 and is expected to grow at a CAGR of 3.3% during the forecast period.

Growth is primarily driven by the resurgence in oil exploration and production activities, fueled by the shale gas revolution and advancements in technology enabling the extraction of oil and gas from mature and aged wells. Oilfield chemicals are integral to multiple stages of crude oil production, playing a vital role in enhancing the efficiency, safety, and environmental sustainability of oilfield operations. These chemicals are employed in various processes, including drilling, production, well stimulation, and reservoir recovery. Their application contributes to optimizing extraction processes, ensuring the safety of operations, and adhering to environmental standards.

To Understand More About this Research: Request a Free Sample Report

Advancements in technology, the adoption of enhanced oil recovery techniques, and a growing global demand for oil products have led to an uptick in onshore exploration activities worldwide, particularly in developing economies. For instance, the Oil and Gas Producers Association in Brazil (ABPIP) notes that small and medium-sized oil companies in Brazil are projected to invest approximately USD 7.74 billion in onshore fields by 2029. This reflects a trend where industry players are directing significant investments towards onshore exploration to meet the rising demand for oil and capitalize on technological advancements in the sector.

The growing adoption of renewable energy sources, such as solar and wind power, aims to diminish reliance on fossil fuels. As countries and industries shift towards cleaner energy alternatives, there might be a decline in the demand for traditional oil and gas exploration and production activities. This shift is expected to curb the need for specific oilfield chemicals utilized in these activities. Furthermore, the transition to renewable energy may lead to a reduction in oil and gas exploration endeavors. With a diminished focus on expanding oil and gas reserves, there is likely to be a decrease in the demand for exploration-related oilfield chemicals market, including drilling fluids and reservoir assessment chemicals.

As per the U.S. Energy Information Administration (EIA), the United States holds the top position as the world's leading producer of oil products, with an average production of 12.3 million barrels per day recorded in 2022. Currently, a significant portion of the country's oil is obtained through unconventional drilling methods, as conventional deposits have been extensively tapped. Advanced technologies have empowered companies to expand offshore oil extraction efforts, involving drilling at greater depths beneath the ocean bed. Consequently, the increasing demand for deep drilling activities in the U.S. is expected to boost the demand for oilfield chemicals in the foreseeable future.

Industry Dynamics

Growth Drivers

Expansion of Shale Gas Exploration

The shale gas revolution has revitalized the oil and gas industry, leading to increased exploration and production activities. Additionally, technological advancements have facilitated the extraction of oil and gas from previously considered uneconomical or challenging reservoirs, such as mature and aged wells. As a result, the demand for oilfield chemicals has seen a notable upswing, as they are essential for addressing the unique challenges associated with diverse extraction scenarios.

Chemicals formulated for use in oil drilling and gas exploration contribute significantly to improving the efficiency and productivity of these operations, as noted by RIMPRO India. These chemicals play a crucial role in protecting equipment and pipelines from corrosion while aiding in the separation of oil and water. Additionally, they help prevent the formation of emulsions during the oil drilling process. The increasing demand for oil and gas is expected to be a driving factor for the heightened demand for these products in the region throughout the forecast period.

Report Segmentation

The market is primarily segmented based on product, application, location, and region.

|

By Product |

By Application |

By Location |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Rheology modifiers segment accounted for the largest market share in 2023

Rheology modifiers segment accounted for the largest share. This dominance is explained by the role of rheology modifiers in modifying the rheological properties of oil wells. They serve as additives in synthetic-based drilling fluids, as well as in water and oil emulsions. Rheology pertains to the deformation and flow of materials under applied stress or force. In the context of an oil well, rheological properties encompass crucial characteristics like yield, stress, viscosity, responsiveness to change, and the time taken for relaxation.

Micro-fibrillated cellulose (MFC) stands out as a crucial rheological modifier in oilfield operations. It offers stabilization under low shear rates while maintaining ease of pumping compared to alternatives like xanthan gum, thanks to its high viscosity. In the context of fracturing liquids, MFC plays a key role in transporting small particles beneath the reservoir surface, facilitating their flow in water while remaining suspended. Its capacity to function effectively in challenging conditions, coupled with its composition of cellulose—a widely occurring natural polymer—positions it as a reliable and safe alternative suitable for diverse environments.

Inhibitors segment will grow rapidly. Corrosion poses a significant challenge in oilfield exploration endeavors, causing damage to equipment and infrastructure and incurring a global cost exceeding USD 1.3 billion in 2022, as reported by the Saudi Association of Corrosion Engineers (SACE). The impurities present in the derived oil products, such as CO2 & hydrogen sulfide, react with the metal surfaces of oil transportation pipelines, leading to corrosion. To mitigate this, water soluble inhibitors, including amides, long chain amines are employed to regulate the corrosion rate by forming a protective layer on metal surfaces.

By Application Analysis

Workover & completion segment held the significant market share in 2023

Workover & completion segment held the significant market share. This dominance can be attributed to the utilization of workover and completion chemicals by oil companies post-oil extraction from wells. These chemicals, often in the form of solid-free fluids employed for drilling, play a crucial role in various tasks, including fracture stimulation, water shut-off, gravel packing, acid stimulation, cleanout of wax, and perforations.

Drilling segment is expected to gain substantial growth rate. These chemicals play a vital role in various aspects of drilling, including the separation of water and oil and the prevention of corrosion in pipes and other equipment used in the project. Additionally, the heavy equipment and pipes employed in the drilling process are prone to damage from corrosion due to exposure to carbon dioxide, oxygen. This susceptibility results in losses & high maintenance costs for organizations engaged in drilling projects. To counteract this, layers of the corrosion inhibitors are applied as a coating on the equipment, reacting with the corrosion agents like O2 to render them in-active.

Regional Insights

North America dominated the global market in 2022

North America region dominated the global market. Canada boasts a robust offshore oil and gas industry, ranking as the world's fourth-largest producer of crude oil. The country hosts significant oil-producing facilities, particularly in the provinces of Alberta, where the oil reserves amount to approximately 161.7 billion barrels, and British Columbia, with a crude oil production of around 12,000 barrels per day in 2021. The primary locations for off-shore oil exploration in Canada are concentrated in the regions of Labrador & Newfoundland, hosting 6 major exploration sites. About, 30% of the total crude oil produced in the Canada undergoes domestic processing, while the remaining portion is refined & purified at the U.S. refineries.

Key Market Players & Competitive Insights

The oilfield chemicals market exhibits a moderate degree of fragmentation, characterized by companies engaging in various strategic initiatives to strengthen their position and capitalize on market opportunities. Partnerships, expansions, mergers, and acquisitions are prevalent strategies within the oilfield chemicals industry.

Some of the major players operating in the global market include:

- Nouryon

- BASF SE

- SMC Global

- Baker Hughes

- Halliburton

- The Lubrizol Corporation

- Aquapharm Chemical Pvt. Ltd.

- Clariant

- Solvay S.A.

- Thermax Chemical Division

Recent Developments

- In August 2023, NexTier Oilfield Solutions and Patterson-UTI have announced their intention to merge through an all-stock transaction. With this, it became 2nd largest oil services company in the North America.

Oilfield Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 29.24 billion |

|

Revenue forecast in 2032 |

USD 38.06 billion |

|

CAGR |

3.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Location, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the market dynamics of the 2024 Oilfield Chemicals Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Oilfield Chemicals Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse for Our Top Selling Reports

AI in oncology Market Size & Share

Smart Pills Market Size & Share

FAQ's

Product, application, location, and region are the key segments in the Oilfield Chemicals Market.

The global oilfield chemicals market size is expected to reach USD 38.06 billion by 2032

The global oilfield chemicals market is expected to grow at a CAGR of 3.3% during the forecast period.

North America region is leading the global market.

Expansion of Shale Gas Explorationare the key driving factors in Oilfield Chemicals Market.