Oleochemicals Market Share, Size, Trends, Industry Analysis Report, By Type (Fatty Acid, Fatty Alcohol, Specialty Esters, Glycerol Esters, Others); By Material Type; By Process; By Application; By Region, And Segment Forecasts, 2024-2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1103

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

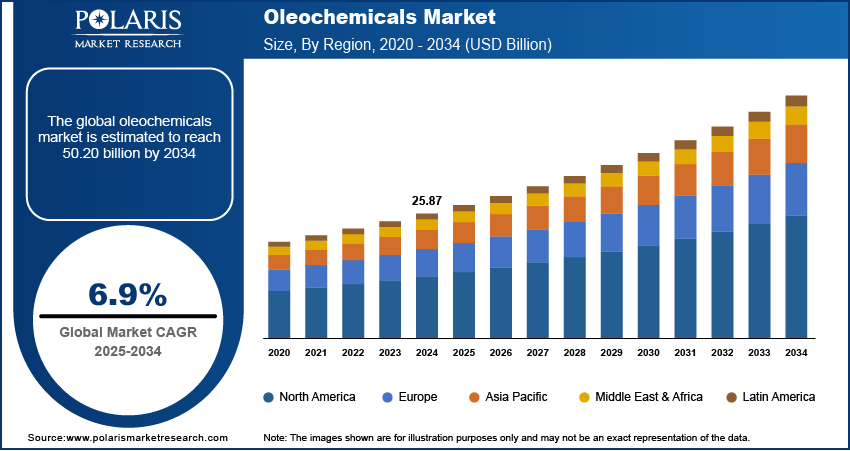

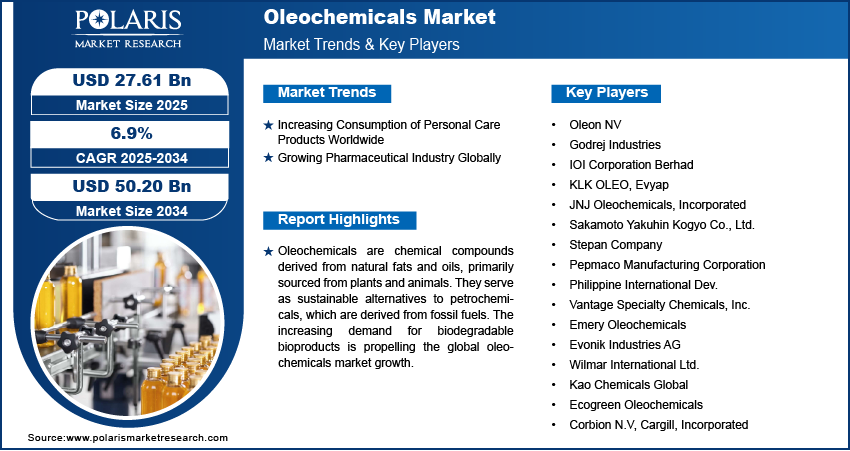

The global oleochemicals market was valued at USD 25.08 billion in 2023 and is expected to grow at a CAGR of 8.80% during the forecast period. The use of oleochemicals in multiple industries, including textiles, industrial, pharmaceuticals, food processing, and personal care & cosmetics, is expected to drive the demand for these products. The COVID-19 outbreak resulted in a significant decline in the oleochemicals market. The personal care and cosmetics industry, the largest consumer of oleochemicals, experienced a substantial drop due to enforced lockdown measures in many economies. Despite the ongoing demand for necessities, the personal care sector has been functioning moderately. However, there has been a sharp decline in the need for makeup products, fragrances, perfumery, and color cosmetics.

To Understand More About this Research: Request a Free Sample Report

Oleochemicals are products that are derived from fats and oils. They can be manufactured from a range of sources, including fossil fuels such as petrochemicals and natural sources like plant and animal oils and fats. Manufacturers can produce oleochemicals using a variation of enzymatic or chemical reactions.

Some primary oleochemical compounds include glycerol, fatty amines, fatty acid methyl esters, and fatty acids. These compounds are also used in the production of intermediary chemicals, such as alcohol ether sulfates, sugar esters, diacylglycerol (DAG), structured triacylglycerol (TAG), quaternary ammonium salts, monoacylglycerol (MAG), alcohol ethoxylates, and alcohol sulfates.

The rising demand for biodegradable products has led to petrochemical restrictions, positively impacting the need for specialty oleochemical products in the coming years. However, an increased risk is associated with operating vegetable oil for industrial objectives due to the unpredictable pricing of essential oils and concerns about food security in several developing nations.

Palm and kernel oil are among the primary feedstocks used to manufacture oleochemicals. Refiners have traditionally held a strong grip on farmers and plantation companies, allowing them to earn substantial profit margins. However, as plantation companies have taken over conventional palm cultivation and acquired vast tracts of land, refiners have needed more options for suppliers. As a result, the cost of doing business has skyrocketed for refiners. Crude palm kernel and crude palm oil are produced by crushing gathered palm fruit bunches. Most of the world's palm oil is grown in Asia, particularly in Malaysia and Indonesia. As a result, most industry participants are based in this region and primarily export to North America and Europe.

Industry Dynamics

Growth Drivers

Oleochemicals has various applicatio in several sectors, such as personal care, cosmetics, pharmaceuticals, food & beverages, and plastics. They are widely used in skincare and hair care products. The growing demand for chemical-free and hypoallergenic ingredients in cosmetics and personal care is expected to drive oleochemicals market growth. In addition, the increasing adoption of sustainable practices by cosmetics and personal care product manufacturers is boosting the demand for oleochemicals.

Furthermore, using bio-based chemicals in the food sector is a significant growth driver. These chemicals are utilized in food packaging approved by the FDA and as thickening and flow agents. For example, calcium stearate is used as a flow agent and food emulsifier in candy production.

Oleochemicals are produced from both plant and animal sources. Waste vegetable oil is an attractive feedstock for oleochemical production due to its renewability, sustainability, low cost, and low toxicity. They serve as a viable petroleum-based chemical alternative. The sulfonation of waste vegetable oils, epoxidation, and transesterification can produce biosurfactants or surface-active agents extensively used in the petroleum industry.

Moreover, these renewable feedstocks have significant advantages over petroleum-based feedstocks as they have high efficiency and productivity. Palm oil, for example, is a major feedstock due to its low cost, high efficiency, and productivity. These factors are expected to contribute to the increasing demand for oleochemicals during the forecast period.

Report Segmentation

The market is primarily segmented based on type, material type, process, application, and region.

|

By Type |

By Material Type |

By Process |

By Application |

By Region |

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

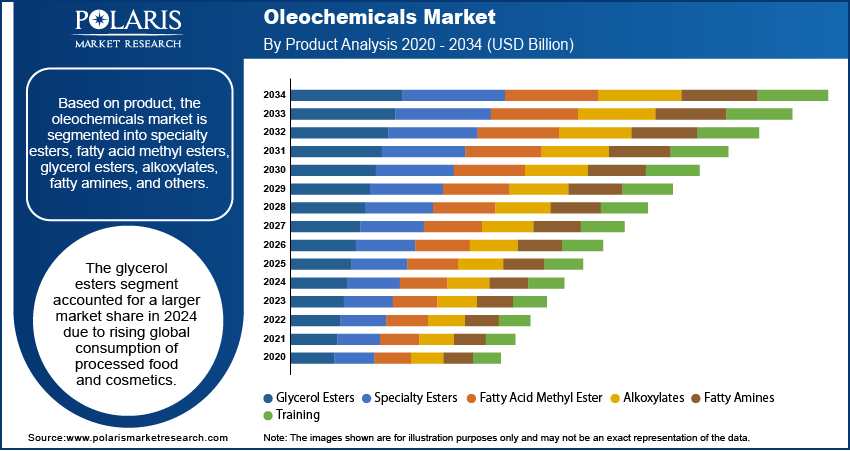

The glycerol esters segment held the largest market share in 2022

In 2022, glycerol esters held the largest market share in the global oleochemicals industry. Their unique chemical composition is mainly due to increasing use in various end-user industries such as food & beverages, personal care & cosmetics. Additionally, these esters are commonly used as emulsifiers and thickeners in producing specialty confectionery and food products.

Specialty esters are being increasingly utilized in place of petroleum-based chemicals and materials for various applications. The Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) guidelines encourage using bio-based resources in environmentally sensitive applications to reduce the carbon footprint, which manufacturers and consumers are enforcing. As a result, the demand for specialty esters is expected to rise during the forecast period.

The personal care & cosmetics segment held the highest market share in 2022

In 2022, the personal care & cosmetics segment held the highest market share in the global market. The segment's dominance can be attributed to the growing demand for a wide range of personal care products, including skin care creams, hair care products, sun care products, and oral care products. Oleochemicals are used in the formulation of these personal care and cosmetics products.

The industrial sector is another significant end-use application for oleochemicals, with frequent utilization in various products such as pulp & paper chemicals, oilfield chemicals, lubricant additives, construction chemicals, agrochemicals, metalworking fluids, rubber processing, and water management chemicals. Specialty oleochemical derivatives are highly sought after in several industries, including construction, metalworking, rubber processing, pulp & paper, and oilfield, due to their unique physicochemical properties, which have increased their demand in the production of lubricants and oil additives.

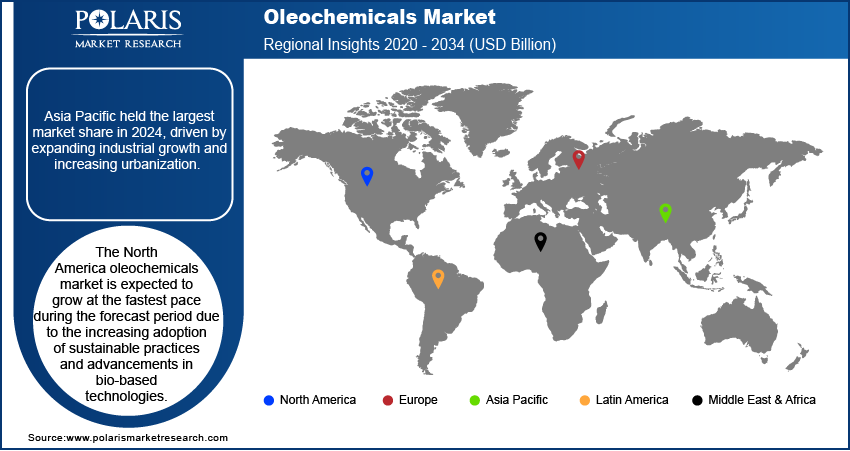

Asia Pacific is expected to dominate the market during forecast period

Asia Pacific is expected to dominate the market in the upcoming years. It is attributed to the significant presence of manufacturers in the marketplaces, especially in Malaysia and Indonesia. Also, producers have been encouraged to enlarge the market and the raw materials like kernel oil and palm oil.

Europe anticipated to be driven by favorable regulatory regulations by Authorization of Chemicals (REACH), Evaluation, and Registration to boost petrochemical alternatives and sustainable chemicals. Also, the need methyl ester sulfonate oleochemicals is expected to increase due to the raised stake in biodiesel as a replacement for conventional fuel, which is petroleum-based.

The United States (U.S.) is the main user of the market, with players like Vantage Specialty Chemicals, BASF SE, Cargill Inc., and Evonik Industries being the most established in the market. The U.S. is a big importer of coconut and rapeseed oil producer of soybean oil, which are necessary feedstocks for synthesizing oleochemicals. Also, Canada ships about 80% of its rapeseed oil production, making it one of the biggest producers in the world. By the forecast period, the need for bio-based goods will grow with productive raw materials available.

Competitive Insight

The major global oleochemicals market players include Emery Oleochemicals, Wilmar International Ltd., Vantage Specialty Chemicals, Inc., Oleon NV, IOI Corporation Berhad, Kao Chemicals Global, Ecogreen Oleochemicals, Evonik Industries AG, Incorporated, Godrej Industries, Philippine International Dev., Inc.KLK OLEO, Incorporated, Corbion, Cargill, Sakamoto Yakuhin kogyo Co., Ltd., JNJ Oleochemicals, Pepmaco Manufacturing Corporation, Stephan Company.

Recent Developments

- In August 2022, The DavosLife E3, which can be used in nutrition and food applications, was offered by the Kuala Lumpur Kepong Berhad Group. As per the company of Kuala Berhad, the product has clinically verified health advantages for the heart and wide-reaching brain and liver health.

- In July 2022, based on coconut oil BASF SE presented the first personal care ingredients rainforest alliance-certified. The company launched a renewable supply chain, allowing the company to maximize its revenue.

- In April 2022, Oleon N.V. began building a new plant in Baytown, Texas, by investing USD 50 million for international expansion.

- In September 2020, under the brand name Emery E, the company Emery Oleochemicals declared its fatty acid ester product line. These fatty esters offer biodegradability, low odor, good color stability.

Oleochemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 27.21 billion |

|

Revenue forecast in 2032 |

USD 53.52 billion |

|

CAGR |

8.80% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Material Type, By Process, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Emery Oleochemicals, Wilmar International Ltd., Vantage Specialty Chemicals, Inc., Oleon NV, IOI Corporation Berhad, Kao Chemicals Global, Ecogreen Oleochemicals, Evonik Industries AG, Incorporated, Godrej Industries, Philippine International Dev., Inc.KLK OLEO, Incorporated, Corbion, Cargill, Sakamoto Yakuhin kogyo Co., Ltd., JNJ Oleochemicals, Pepmaco Manufacturing Corporation, Stephan Company |

FAQ's

The oleochemicals market report covering key segments are type, material type, process, application, and region.

Oleochemicals market Size Worth $53.52 Billion By 2032.

The global oleochemicals market expected to grow at a CAGR of 8.8% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in oleochemicals market are increased demand for sustainable and biodegradable products.