Open Banking Market Share, Size, Trends, Industry Analysis Report, By Financial Services (Banking and Capital Markets, Payments, Digital Currencies); By Distribution Channels (Bank Channels, App Markets, Distributors, Aggregators); By Deployment Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2577

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

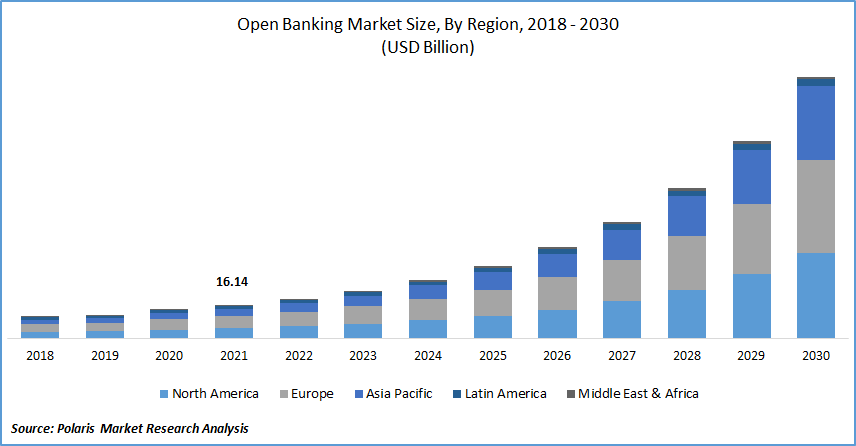

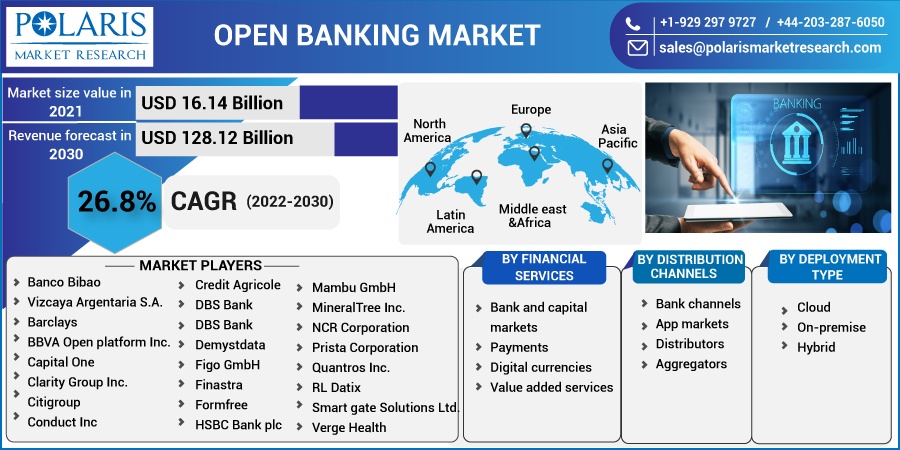

The global open banking market was valued at USD 16.14 billion in 2021 and is expected to grow at a CAGR of 26.8% during the forecast period. The growing demand for an open banking market is expected to be driven by the increasing use of the online platform for payments, which includes sharing and transferring financial information in electronic form.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Open banking has replaced many local payment methods, and with digitization, there has been a rapid growth in digital payments. Moreover, more use of e-commerce platforms, better internet connectivity, and consumer awareness about application programming interfaces are propelling the development of the industry.

The COVID-19 pandemic has positively impacted the growth of the open banking market. Due to covid infection, less contact with others has significantly impacted open banking. The increased adoption of more contactless payments and more application interfaces has resulted in the expansion of the open banking market.

Moreover, many banks and fintech companies had given novel digital solutions and introduced applications for multiple payment methods during the period, which now significantly is a significant factor in driving the industry.

As digital technologies have innovated more rapidly, it has led to customer satisfaction with low operational costs. Open banking has offered secured payments and usage of various applications, which has resulted in demand for open banking across developing countries even after the post-pandemic. In addition, government guidelines mandating to open APIs for banks are anticipated to complement industry growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The industry is likely to be driven by the rising adoption of the open banking system in the Asia Pacific owing to the increasing implementation of big data analytics in the open banking sector to customize services and improve user experience. The primary factor contributing to the growth of open banking is an increase in the number of people using new wave applications and services. Furthermore, the association between traditional banking and financial service providers has created lucrative opportunities in the Asia Pacific region to grow and positively impact the industry growth.

Moreover, open banking uses different APIs to access consumer activities about banking and transactions from banks and NBFCs and develop innovative products and services to enhance the consumer experience.

Additionally, an open banking platform has many advantages, including better accessibility of financial operations, centralization of services, as well as improved customer experience. In addition, increased customer retention and solutions to the customer's needs are expected to drive the industry's growth. Consumers can access premium banking services and advanced financial products to help them choose according to their financial needs. Such products are expected to drive the industry.

Report Segmentation

The market is primarily segmented based on financial services, Distribution channels, Deployment type and region.

|

By Financial services |

By Distribution channels |

By Deployment type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Bank and Capital markets accounted for the largest share in 2021

Bank and capital segment accounted for the highest revenue share in 2021, owing to the growing demand to maintain finances effectively among Gen Z, which in turn, is expected to drive the segment growth. With modernization, payment options have replaced traditional methods, and consumer adoption of more AI-based platforms that meet customer needs is expected to create opportunities in the segment.

The payment segment is expected to record the fastest growth over the forecast period as consumers frequently move to different online payment platforms, and banks can collaborate with such platforms and develop a position in the market by laying hands on this opportunity.

App market is expected to spearhead the market growth

Based on the distribution channels, the app market is supposed to be dominating the industry as the consumer is more aware of online transactions and the ease of availability of smartphones worldwide. Moreover, the availability of various apps for transactions has been developing, such as PayPal, google pay, Zelle, and many more, which have made buying and selling easier with just one click, is expected to drive the segment.

The distributor segment has witnessed incurring growth owing to its extensive network, and provides different products through this network. Banks collaborating with third-party providers to allow customers to obtain particular services on a commission basis gives an advantage to pure service providers to grow in this particular segment.

Cloud segment is expected to witness faster growth

The cloud segment is expected to showcase faster growth over the forecast period as it delivers huge consumer data with full security. The cloud segment stores data, analyses it, and deliver customizable solutions to the consumer. Due to its ease of use, convenience, and real-time experience, the cloud segment is expected to drive industry growth.

On-premise segment dominates the industry growth because many fintech companies and even banks offer their built APIs and their banking applications which interacts with users about their financial data and offer novel services to the customer.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

The Asia Pacific is the largest region for the implementation and expansion of online payments and is expected to witness faster growth over the forecast period owing to the high digital adoption rate and awareness in the region, such as India, China, and Japan, about the benefits of open banking.

Europe has dominated the open banking market and is expected to continue on account of the growing need for security by the consumer in online transactions and government directives compelling banks to develop their APIs, and many industry players in this region could boost the revenue growth.

Competitive Insight

Some of the major players operating in the global market include Banco Bibao Vizcaya Argentaria S.A., Barclays, BBVA Open platform Inc., Capital One, Clarity Group Inc., Citigroup, Conduct Inc, Credit Agricole, DBS Bank, DBS Bank, Demystdata, Figo GmbH, Finastra, Formfree, HSBC Bank plc, Jack Henry & Associate Inc, Mambu GmbH, MineralTree Inc. NCR Corporation, Prista Corporation, Quantros Inc., RL Datix, Smart gate Solutions Ltd., Verge Health.

Recent Developments

In July 2022, Finastra and HSBC collaborated together and would be working on API-driven connectivity to offer banking as a service FX capability for mid-sized banks.

In September 2022, Jack Henry & Associates, Inc. collaborated with google cloud to advance a multi-year next-generation technology which focuses to help community and financial institutions to innovate quickly and respond to changing needs of account holders.

Open Banking Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 16.14 billion |

|

Revenue forecast in 2030 |

USD 128.12 billion |

|

CAGR |

26.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Financial services, Distribution channels, Deployment type and region.

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Banco Bibao Vizcaya Argentaria S.A., Barclays, BBVA Open platform Inc., Capital One, Clarity Group Inc., Citigroup, Conduct Inc, Credit Agricole, DBS Bank, DBS Bank, Demystdata, Figo GmbH, Finastra, Formfree, HSBC Bank plc, Jack Henry & Associate Inc, Mambu GmbH, MineralTree Inc. NCR Corporation, Prista Corporation, Quantros Inc., RL Datix, Smart gate Solutions Ltd., Verge Health

|