Opioid Market Share, Size, Trends, Industry Analysis Report, By Class (Natural, Semi-synthetic, and fully synthetic); By Release Type; By Product; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 124

- Format: PDF

- Report ID: PM1368

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

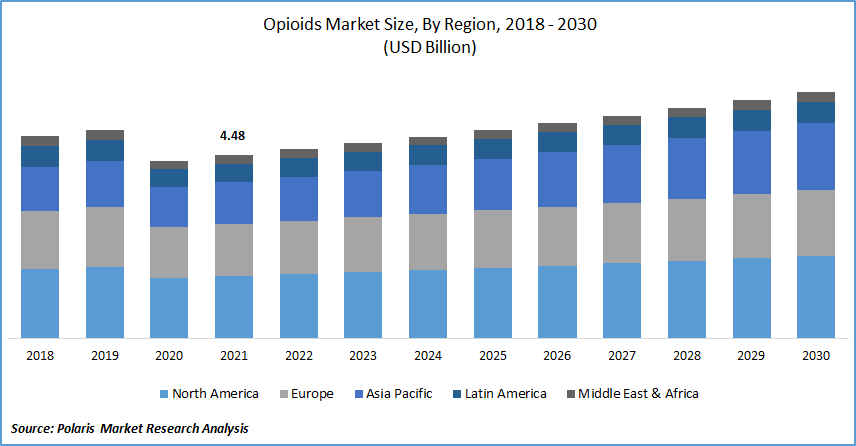

The global opioid market was valued at USD 4.48 billion in 2021 and is expected to grow at a CAGR of 3.3% during the forecast period. Opioids are meditations taken to treat serious pain, such as chronic migraines and back pain, by people recuperating from surgery or dealing with severe pain brought on by cancer, and by people who have been seriously hurt in falls, car accidents, or even other accidents as well as by adults and youngsters who have been injured playing sports. Opioids are classified as drugs. Depending on the individual patient, the circumstance, and the kind and severity of pain, doctors may prescribe a variety of opioids in a variety of strengths and delivery methods. The most often recommended drugs for treating moderate to severe chronic pain are opioids. These painkillers treat severe chronic pain in individuals with terminal conditions and manage pain in cancer patients.

Know more about this report: Request for sample pages

The market for opioids is expected to grow significantly throughout the period due to a surge in demand for the finest treatments for pain, cough, and diarrhea. Additionally, as more people have surgical procedures, opioid sales are increasing globally as they help patients manage post-operative pain, hasten recovery, and lower their risk of complications like pneumonia and blood clots. In addition, there have been more severe injury events as a result of children participating in professional sports and physical activities. This is driving up the demand for opioids to treat severe pain, along with parents' growing concern about their kids' physical health. However, the stringent nature of government regulations is shifting the preference to adopting alternative painkillers and avoiding harmful opioids.

Due to a decrease in the number of patients seeking surgery, including cancer surgery, in hospitals and clinics, the overall impact of COVID-19 on the market is still negative. For instance, the Centers for Medicare & Medicaid Services (CMS) published recommendations about elective planned operations and surgeries based on the demand of life-threatening circumstances. The recommendations push surgeons to perform procedures on patients who need them immediately and to postpone them if they don't, which has harmed the market's demand for opioid goods because these medications are used to limit the number of chronic surgeries.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising prevalence of chronic diseases such as cancer and diabetes, among others, is driving market growth during the forecast period. For instance, according to the IDF (International Diabetes Federation), in 2019, the whole adult population in the US with diabetes was 31.0 million, while in Canada was 2.8 million. This prevalence is projected to rise to 12.8% in 2045. As per the IDF, China had the highest prevalence of diabetes in 2019, with around 116.5 million cases, followed by India, with around 77 million cases.

Further, with the growth of patients with chronic diseases, healthcare spending is increasing. For instance, according to the Centers for Disease Control and Prevention, around 90% of the annual healthcare expenditure ($4.1 trillion) of the US is for people with chronic and mental health conditions. Besides, in the US, 12% of the population with five or more chronic conditions contributes 41% of the total healthcare spending. Population above the age of 65 is accounted to spend more on chronic diseases than other age groups.

Alzheimer's disease, a kind of dementia, is an incurable, degenerative brain illness that affects around 5.7 million people in the US. It is the sixth major cause of death in people overall and the fifth leading cause of death in those 65 and older. Alzheimer's disease treatment cost was expected to be between $159 billion and $215 billion in 2010. These expenses are expected to double by 2040. Moreover, with the growth in chronic conditions, the market for opioids is supposed to gain continuous growth. As the old age population prefers to opt for painkiller methods, the drugs for pain suppression are estimated to grow substantially.

Report Segmentation

The market is primarily segmented based on class, release type, product, application, and region.

|

By Class |

By Release Type |

By Product |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The extended-release segment is expected to witness the fastest growth

ER analgesics provide more reliable and enhanced nighttime pain control, less need for patients with chronic noncancer pain to wake up in the middle of the night to take another dose of pain medicine, and less clock-watching on their part. Due to its widespread use in treating chronic pain, ER is the segment with the highest growth. But these medications' overuse and misuse have led to a significant public health catastrophe. This led to the U.S. FDA issuing its final Opioid Analgesic Risk Evaluation and Mitigation Strategy (REMS) for IR and ER opioids in September 2018. The overall exposure to these substances will be decreased as a result of this plan, which will also help to lower the rate of addiction.

Pain management segment industry accounted for the highest market share in 2021

The market segment with the highest market share is pain management, and this position is anticipated to hold during the projected period. This market is predicted to grow rapidly because of the sharp rise in the number of people experiencing chronic headaches and back pain; patients recovering from surgery or experiencing excruciating pain from cancer; and people hurt while participating in sports, in auto accidents, or in other incidents.

The disease affecting the peripheral or central nervous system or nerve injury generally results in neuropathic pain. Pain associated with neuropathic characteristics is generally more severe and can result in worse health conditions in every measured dimension than non-neuropathic pain.

Morphine is expected to hold the significant revenue share

Given their widespread use and easy access, morphine opioids would be a priority for generic medicine producers to invest in. Throughout the projection period, the category is anticipated to maintain its significant market share due to the introduction of affordable generic morphine opioids throughout Asian nations.

The demand in North America is expected to witness significant growth

The largest share belongs to North America, which is expected to continue during the projected period due to an increase in the number of products approved by regulatory agencies like the American Food and Drug Administration. The U.S. Food and Drug Administration (FDA) permitted Trevena Inc. in August 2020 for Olinvyk (oliceridine). This opioid drug is demonstrated for short-term injectable use in hospitals or other governed clinical settings, such as during both inpatient and outpatient processes.

Also, increased chronic disease patients among people with age 65 years or more is the primary factor boosting the growth in the region. As per an estimate by United Nation, 22% of the US population will be above the age of 65 years by 2030, with individuals post 75 years of age being the fastest-growing subgroup. The population aged 65 years or above in Finland, Portugal, and Greece is just under 22% of the country’s population, and in China, it is around 12% of the Chinese population. Comparable numbers are to be expected in Asia, Europe, and even Latin America, where the rate of individuals beyond 65 years and above is likely to reach 12%, 24%, and 12%, respectively, by 2030.

The government provides the most funding for the well-known and universal British healthcare system. It is one of the world's most effective healthcare systems. The United Kingdom has the greatest level of spending in Europe, which is not surprising. The use of non-abusive opioids, knowledge of palliative care, and opioid maintenance therapy (OMT) as a means of treating opioid dependence (OD) have all benefited from favorable payment rules by German regulatory authorities, which have created business potential. Germany has also passed legislation allowing doctors and other healthcare professionals to recommend digital application channels with health advantages covered by the nation's healthcare system.

Competitive Insight

Some of the major players operating in the global Opioid market include Aurobindo Pharma Limited, Assertio Therapeutics, Inc., AbbVie Inc., Actavis Plc., Amneal Pharmaceuticals LLC, Boehringer Ingelheim International GmbH, Cadila Healthcare Limited, Fresenius Kabi, Mallinckrodt Pharmaceuticals, Endo International plc, Johnson & Johnson Corporation, Lupin Limited, Nesher Pharmaceuticals (USA) LLC, Purdue Pharma L.P., Pfizer Inc., Rhodes Pharmaceuticals L.P., Sun Pharmaceutical Industries Limited, Trevena Inc., and Teva Pharmaceutical Industries Ltd.,

Recent Developments

In July 2021, Maxigesic IV, a non-opioid therapy for post-operative pain, was introduced to the European market by Hyloris Pharmaceuticals SA. Infusions of 1000 mg of paracetamol and 300 mg of ibuprofen make up the revolutionary, patented, non-opioid therapy for postoperative pain known as Maxigesic IV.

Opioid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.48 billion |

|

Revenue forecast in 2030 |

USD 6.02 billion |

|

CAGR |

3.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Class, By Release Type, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aurobindo Pharma Limited, Assertio Therapeutics, Inc., AbbVie Inc., Actavis Plc., Amneal Pharmaceuticals LLC, Boehringer Ingelheim International GmbH, Cadila Healthcare Limited, Fresenius Kabi, Mallinckrodt Pharmaceuticals, Endo International plc, Johnson & Johnson Corporation, Lupin Limited, Nesher Pharmaceuticals (USA) LLC, Purdue Pharma L.P., Pfizer Inc., Rhodes Pharmaceuticals L.P., Sun Pharmaceutical Industries Limited, Trevena Inc., and Teva Pharmaceutical Industries Ltd. |