Organic Cereals Market Share, Size, Trends, & Industry Analysis Report By Source (Wheat, Rice, Oat, Corn, Barley, Others); By Type; By Distribution Channel; By Region, Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1536

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

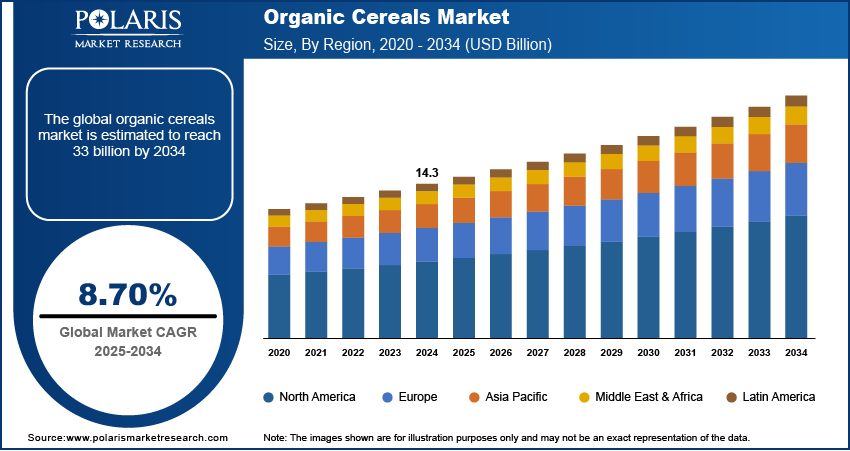

The global organic cereals market was valued at USD 20.73 Billion in 2023 and is predicted to exhibit a CAGR of 8.2% over the forecast period.

As consumers increasingly focus on their dietary choices, organic cereals have emerged as an important point within the broader organic food sector. The market is comprised of a diverse array of breakfast cereals, including oats, granola, muesli, and cornflakes, all produced through organic farming practices that eschew synthetic pesticides, herbicides, and GMOs.

To Understand More About this Research: Request a Free Sample Report

One of the important factors driving the growth of the organic cereals market is the growing awareness of the environmental and health impacts associated with conventional farming methods. Consumers are showing a clear preference for products that align with ethical and sustainable agricultural practices. This has led to a surge in demand for organic cereals, which not only meet stringent organic certification standards but also adhere to principles of traceability, transparency, and ethical sourcing. Also, the organic cereals market is enjoyed by the broader movement toward healthier lifestyles. Organic cereals, positioned as nutritious and wholesome breakfast options, cater to consumers who are conscious of their dietary choices and seek products that contribute positively to their overall well-being. The market response to this demand has seen both established food companies and innovative startups investing significantly in research and development, introducing new flavors, incorporating functional ingredients, and employing strategic marketing initiatives to capture a share of the growing organic cereals market.

Despite the growing popularity of organic cereals, certain factors restrain the market's growth, such as higher costs associated with organic farming practices. Organic cereals are often more expensive to produce due to the use of labor-intensive and environmentally friendly methods, resulting in increased production costs. This elevated cost is then transferred to consumers, making organic cereals relatively pricier compared to conventional alternatives. This pricing differential limits the market's expansion.

Industry Dynamics

Growth Drivers

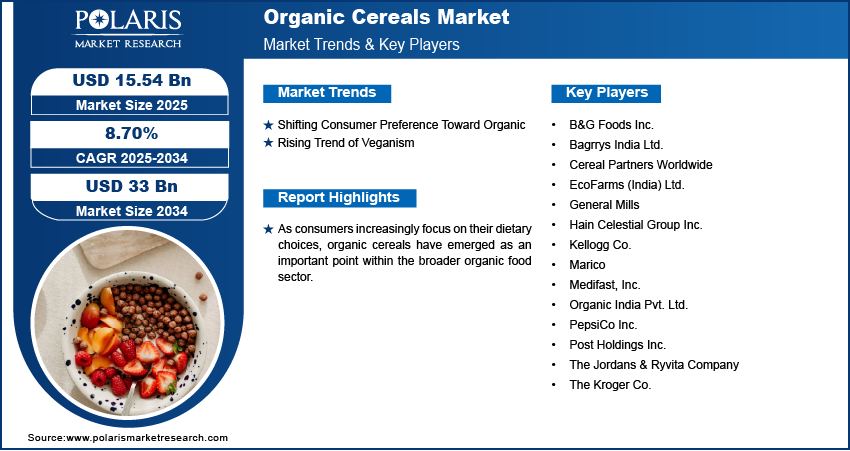

Shifting consumer preference towards organic and the rising trend of veganism.

The market growth of organic cereals is majorly influenced by the shifting consumer preference towards organic products and the rising trend of veganism. As consumers become more health conscious and environmentally aware, there is a notable shift in preferences towards food items that are perceived as cleaner, healthier, and produced with sustainable practices. Organic cereals, being free from synthetic pesticides, genetically modified organisms (GMOs), and other additives, align well with these consumer values.

Also, the growing trend of veganism, driven by concerns about animal welfare and environmental impact, has led to an increased demand for plant-based food options. Organic cereals, often comprising grains, nuts, seeds, and fruits, resonate with the principles of veganism, making them a favored choice among individuals following plant-based diets. For instance, according to a study by the Plant-Based Foods Association and The Good Food Institute, the plant-based food market in the United States witnessed a remarkable growth of 27% in 2020, reaching a total market value of $7 billion.

The intersection of these two trends creates a mutual effect, propelling the growth of the organic cereals market as consumers increasingly seek products that not only promote personal well-being but also align with ethical and sustainable dietary choices.

Report Segmentation

The market is primarily segmented based on product type, application type, and region.

|

By Source |

By Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

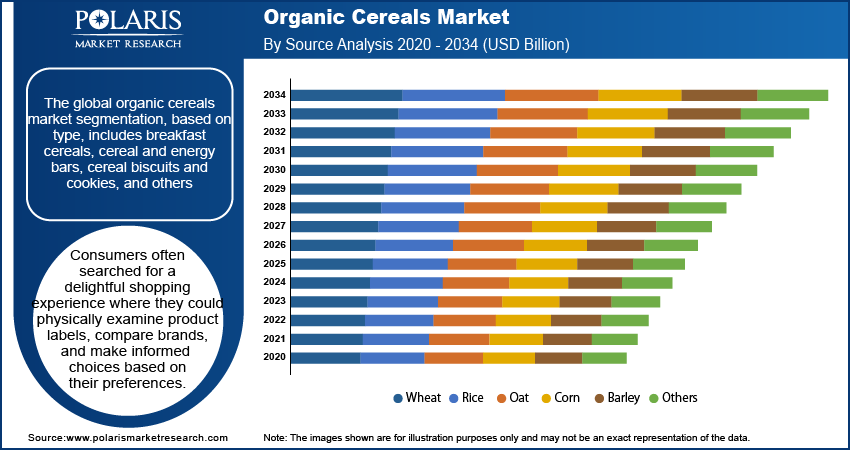

By Source Analysis

Oat-based breakfast cereals are expected to dominate the market in the forecast period.

Oats have emerged as a powerhouse ingredient, known for their health benefits, including high fiber content and essential nutrients. Oats align with the broader consumer shift towards healthier dietary choices, promoting heart health and providing sustained energy. As individuals increasingly seek nutritious and wholesome breakfast options, the appeal of oat-based cereals has surged, propelling their prominence in the organic cereals market.

Beyond their nutritional profile, oats are well-suited for organic farming practices, being a versatile crop that requires fewer synthetic inputs. Also, the versatility of oats allows for diverse product offerings within the organic cereal market, including granolas, mueslis, and various flavored oat cereals, catering to a broad spectrum of consumer tastes and preferences. The forecasted dominance of oat-based breakfast cereals underlines not only their popularity among health-conscious consumers but also their strategic alignment with the core principles of the organic cereals market. As the demand for nutritious, sustainably produced, and organic breakfast options continues to rise, oat-based cereals are poised to play a leading role in shaping the market landscape in the foreseeable future.

By Distribution Channel Analysis

Offline Stores dominated the global market in 2023

Offline Stores dominated the revenue share of organic cereals in the historical period because physical retail outlets, including grocery stores, supermarkets, and specialty health food stores, played an important role in catering to consumer demand and driving sales. Consumers often searched for a delightful shopping experience where they could physically examine product labels, compare brands, and make informed choices based on their preferences. The trust associated with physically inspecting and selecting products contributed to the prominence of offline stores in the organic cereals market. Along with this, the established presence of organic and healthy food sections within retail stores provided a dedicated space for organic cereals, attracting consumers specifically looking for healthier and environmentally conscious options. This visibility within physical stores helped create awareness and familiarity with organic cereal brands, contributing to their market share.

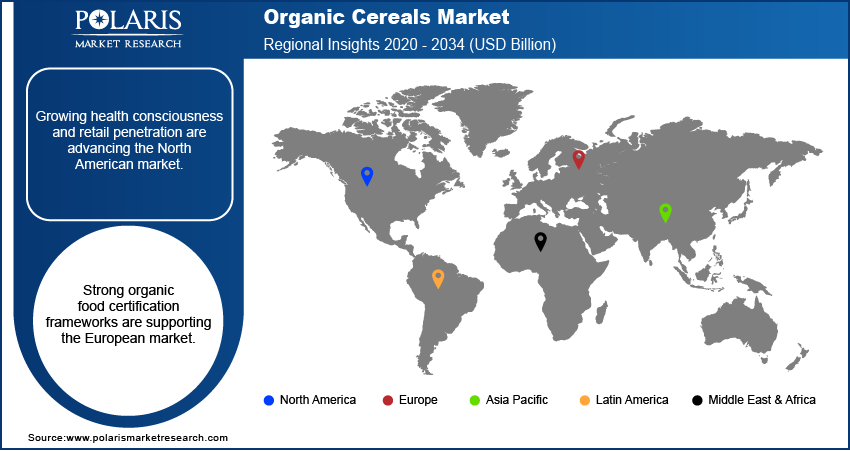

Regional Insights

Asia Pacific dominated the global market in 2023

Asia Pacific has emerged as the dominating region in the organic cereals market because of a noticeable surge in consumer awareness regarding health and wellness in Asia Pacific, leading to an increased preference for organic and nutrient-rich food products. As a result, Organic cereals, with their perceived health benefits, have gained widespread acceptance among consumers in the region. The region has witnessed a growing focus on environmental friendly agricultural methods, which resemble the core principles of organic cereal production. Also, the organic cereals market is growing due to the increase in obese and geriatric population in this region. Increasing disposable incomes in developing countries of this region, rising awareness about the health benefits of diet food, and the sedentary lifestyle of consumers further foster the growth in this region. As these trends continue, Asia Pacific is likely to maintain its leading position in the organic cereals market.

North America is poised to be the fastest-growing region in the organic cereals market, and this projection can be attributed to factors such as a significant and sustained shift in consumer preferences towards healthier and organic food choices in North America. Increasing awareness about the potential health benefits of organic cereals, coupled with a growing consciousness about environmentally friendly practices, has fueled the demand for these products. Also, the region boasts a mature and well-established organic food infrastructure, including a robust distribution network, retail presence, and awareness campaigns, which facilitate the accessibility of organic cereals.

Key Market Players & Competitive Insights

Leading players are introducing innovative products in the organic cereals market to cater to the growing demand for consumers. Global players are entering new markets in developing regions to expand their customer base, strengthen their market presence, and increase their organic cereals market share.

Some of the major players operating in the global Organic Cereals market include:

- B&G Foods Inc.

- Bagrrys India Ltd.

- Cereal Partners Worldwide

- EcoFarms (India) Ltd.

- General Mills

- Hain Celestial Group Inc.

- Kellogg Co.

- Marico

- Medifast, Inc.

- Organic India Pvt. Ltd.

- PepsiCo Inc.

- Post Holdings Inc.

- The Jordans & Ryvita Company

- The Kroger Co.

Recent Developments

- In 2022, pioneering organic brand Doves Farm announced the launch of four new organic and plant-based breakfast cereals, which included Ancient Grain Breakfast Flakes, Ancient Grain Fruit & Fibre Flakes, Ancient Grain Cereal Hoops, and Wholegrain Cocoa Rice Pops.

- In 2021, Cereal Partners UK (CPUK) announced the launch of its new Organic Honey and Chocolate CHEERIOS, which has been certified by Ecocert.

Organic Cereals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22.35 billion |

|

Revenue Forecast in 2032 |

USD 42.04 billion |

|

CAGR |

8.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Source, By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

Explore the market dynamics of the 2024 Organic Cereals Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Organic Cereals Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Bakery Premixes Market Size, Share 2024 Research Report

Collagen Market Size, Share 2024 Research Report

Aerospace Riveting Equipment Market Size, Share 2024 Research Report

Latin America Industrial Pumps Market Size, Share 2024 Research Report

FAQ's

The Organic Cereals Market report covering key segments are product type, application type, and region.

The global organic cereals market size is expected to reach USD 42.04 Billion by 2032

The global organic cereals market s predicted to exhibit a CAGR of 8.2% over the forecast period

Asia Pacific regions is leading the global market.

Shifting consumer preference towards organic and the rising trend of veganism driving the market growth are the key driving factors in Organic Cereals Market