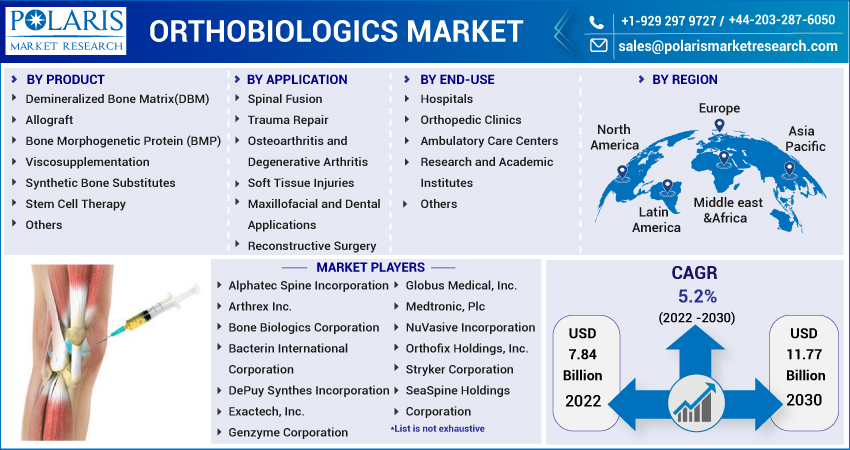

Orthobiologics Market Share, Size, Trends, Industry Analysis Report, By End-Use (Hospitals, Orthopedic Clinics, Ambulatory Care Centers, Research & Academic Institutes, Others); By Product; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM1394

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

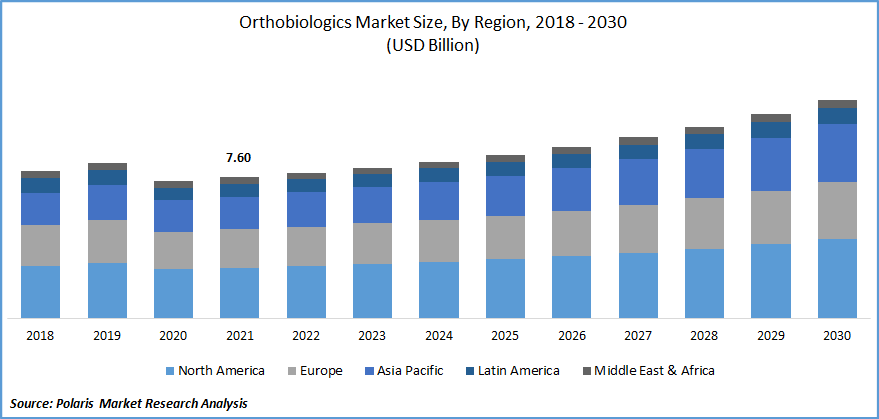

The global orthobiologics market was valued at USD 7.60 billion in 2021 and is expected to grow at a CAGR of 5.2% during the forecast period. The growing frequency and severity of maxillofacial fractures as a result of automobile accidents, as well as the overconsumption of orthobiologic products by sports science physicians worldwide, are driving the Market. Orthobiologics are being widely used by sports physicians to enhance the recovery of the shoulder, knee, and elbow injuries.

Know more about this report: Request for sample pages

Orthobiologics refers to the treatment of natural or organic compounds found in the human body to cure musculoskeletal issues such as ligament, joint, and muscle injuries and chronic illnesses such as osteoarthritis. Treatment with orthobiologic materials may reduce the requirement for pain medication, increase rehabilitation, and speed up healing, establishing itself as a viable alternative to surgery.

Orthobiologics help professional and leisure athletes recover quickly from sports-related illnesses. Individuals' rising interest in sports and physical activities is one of the primary factors positively impacting the market. Aside from that, tendon tears can occur in older persons as a result of degenerative changes in the body. This, together with the expanding geriatric population, is driving orthobiologics market expansion.

Furthermore, sedentary lifestyles, bad food choices, and the frequency of chronic conditions can all raise the chance of getting osteoarthritis. Furthermore, several orthobiologics used in invasive operations can be covered through insurance, bolstering the orthobiologics market growth.

However, the increase in the cost of orthobiologics-based treatments is expected to restrict the expansion of the market throughout the forecast period. The negative effects of Bmp-based treatments may pose a significant obstacle to the expansion of the industry shortly.

Since its inception, the current coronavirus pandemic has created a new challenge to health systems in addition to other corporate sectors. To slow the spread of the disease and conserve key resources like PPE and ventilators, numerous countries, notably the United States, imposed a brief moratorium on elective surgery from March to May 2020.

The increasing number of orthopedic patients who were unable to seek medical assistance during the crisis as a result of such actions hampered the industry's continuous growth. This large delay in treatment is expected to result in a backlog of surgeries. As a result, demand for orthobiologic implants in the post-COVID era may increase as a viable non-surgical treatment option for individuals suffering from orthopedic difficulties.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growing number of senior persons, as well as the consequent growth in the prevalence of knee osteoarthritis, are the primary reasons driving market penetration. According to Rhuematologist.org, Knee OA affects around 250 million people globally, and approximately 14 million individuals in the United States have been identified with the illness in the last 20 years.

Furthermore, strong development potential in developing countries, technologically advanced product development, and an increase in demand for sophisticated treatment are projected to open up new opportunities for market participants during the projection period. For instance, in June 2022, SeaSpine Holdings Corporation officially launched its 3D-printed WaveForm TO (TLIF Oblique) Implants System.

WaveForm TO was created for both PLIF and TLIF operations. Both significant effect injection and insert-and-rotate procedures are supported by the technology. WaveForm TO is a flexible lumbar spinal solution for surgeons, with such a broad set of compression, disc preparations, and implant placement instruments that are interoperable with the NanoMetalene-based Reef TO technology.

Report Segmentation

The market is primarily segmented based on product, application, end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Viscosupplementation segment is expected to witness the fastest growth

Viscosupplements are dermal filler injections that are injected directly into the tendons. Viscosupplements are widely utilized in the treatment of knee osteoarthritis, which is one of the most common disorders among the elderly. Quality product costs, new manufacturer entry, and recent advertising approvals are the factors linked to the growth of viscosupplements.

Furthermore, better payment standards for viscosupplements benefit the viscosupplement sector. This is due to an increasing senior population that is at risk of osteoarthritis, as well as quick product uptake as an ideal therapeutic choice for these patients to alleviate symptoms and postpone the necessity for procedures.

A large delay in R&D activity across the viscosupplementation sector, on the other hand, may impede segment growth to some extent. Given the foregoing, the increased demand for viscosupplements is expected to fuel global market expansion throughout the forecast period.

The spine fusion segment industry accounted for the highest market share in 2021

This is owing to the large senior population, which is predisposed to osteoarthritis. Because of the benefits provided by orthobiologics in the treating spine, such as biologic healing, which accelerates spinal fusion, the spinal fusion sector is expected to hold the highest market share over the forecast period.

Other advantages of orthobiological solutions in spinal fusion, including quick cell stimulation to stimulate bone growth, shorter hospital stays, and fewer visits, are thought to be responsible for a bigger part of the application segment. The significant share acquired by orthobiologics is also thought to be a result of the emergence of third-party insurance and reimbursement accessible for fusion enhancement products, which has fueled the expansion.

Hospitals are expected to hold the significant revenue share

The increase in the adoption of orthobiological products in a broad range of spinal and reconstructive treatments performed in hospitals is a fundamental factor attributed to market share dominance. In addition, specialist patient care and simple access to a wide choice of orthobiologics in clinics are likely to fuel segment growth. Furthermore, significant patient turnover, frequent readmission rates, and high procedure volumes all contributed to the segment share. The supportive infrastructure promotes precise operational procedures, which is expected to boost growth potential.

The demand in North America is expected to witness significant growth

The existence of the majority of the significant players active in promoting quality healthcare and implementing new product development methods may be linked to this region's contribution. Furthermore, reimbursement regulations for soft tissue healing and fusion augmentation treatments significantly contribute to the regional share.

The higher incidence of degenerative bone diseases and the expanding trend of orthopedic procedures in outpatient clinics are factors that may increase the market in North America. Due to the increased occurrence of the bulk of the main companies, North America dominates the market. Furthermore, the growing older population will drive the expansion of the region's market during the projection period.

Further, due to the new marketing authorization for Cingal, a viscosupplement in Europe, Europe is expected to be the second dominating region in terms of sales, with a considerable part of the market. Furthermore, an expansion in research, developments, and innovation activities, and an improvement in orthobiologics awareness are all contributing factors to the expansion of the market in Asia Pacific. Other factors driving the growth of the Asia Pacific market include a rise in the incidence of persistent arthritis, osteoarthritis, as well as other orthopedic diseases. These reasons have increased the demand for orthobiologics in Asia-Pacific.

The market is expected to grow significantly as physician awareness levels rise. Furthermore, rising healthcare spending and disposable income are expected to drive the expansion of the region's market in the approaching years. Asia Pacific is driven by the increasing need for viscosupplements in India and an increase in the number of freestanding orthopedic clinics.

Competitive Insight

Some of the major players operating in the global orthobiologics market include Alphatec Spine Incorporation, Arthrex Inc., Bone Biologics Corporation, Bacterin International Corporation, DePuy Synthes, Incorporation, Exactech, Inc., Genzyme Corporation, Globus Medical, Inc., Globus Medical, Inc., Harvest Technologies Corporation, Integra Lifesciences Corporation, Medtronic, Plc, NuVasive, Incorporation, Orthofix Holdings, Inc., Ortho Regenerative Technologies Inc., Stryker Corporation, SeaSpine Holdings Corporation, Wright Medical Group N.V., and Zimmer Biomet, Inc.

Recent Developments

In May 2022, the "USPTO granted a patent to Ortho Regenerative Technologies Inc for its ORTHO-R soft tissue regeneration technology. In January 2021, Stryker has announced the purchase of OrthoSensor, Inc. OrthoSensor quantifies orthopedics using smart systems and data services, enabling physicians and hospitals to provide evidence-based therapy to all healthcare entities. Sensor technology developments, together with enhanced data analytics and increased processing capacity, will reinforce the foundation of Stryker's digital environment.

Orthobiologics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 7.84 billion |

|

Revenue forecast in 2030 |

USD 11.77 billion |

|

CAGR |

5.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Alphatec Spine Incorporation, Arthrex Inc., Bone Biologics Corporation, Bacterin International Corporation, DePuy Synthes, Incorporation, Exactech, Inc., Genzyme Corporation, Globus Medical, Inc., Globus Medical, Inc., Harvest Technologies Corporation, Integra Lifesciences Corporation, Medtronic, Plc, NuVasive, Incorporation, Orthofix Holdings, Inc., Ortho Regenerative Technologies Inc., Stryker Corporation, SeaSpine Holdings Corporation, Wright Medical Group N.V., and Zimmer Biomet, Inc. |