Railway Cybersecurity Market Share, Size, Trends, Industry Analysis Report, By Offering, By Security (Application Security, Network Security, Data Protection, Endpoint Security, System Administration), By Type, By Rail Type, By Region, Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 118

- Format: PDF

- Report ID: PM2193

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

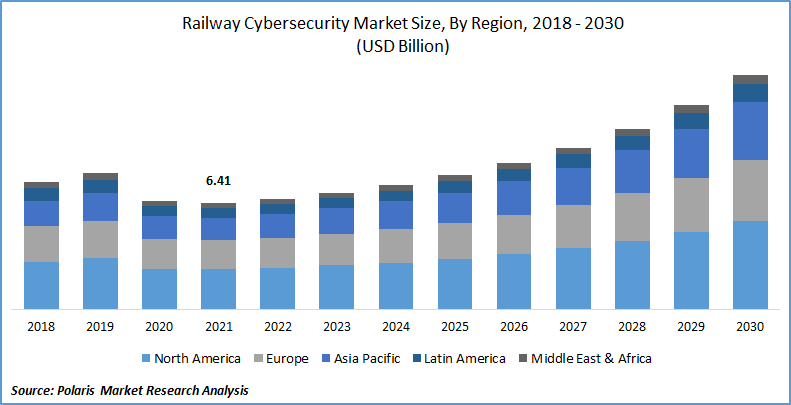

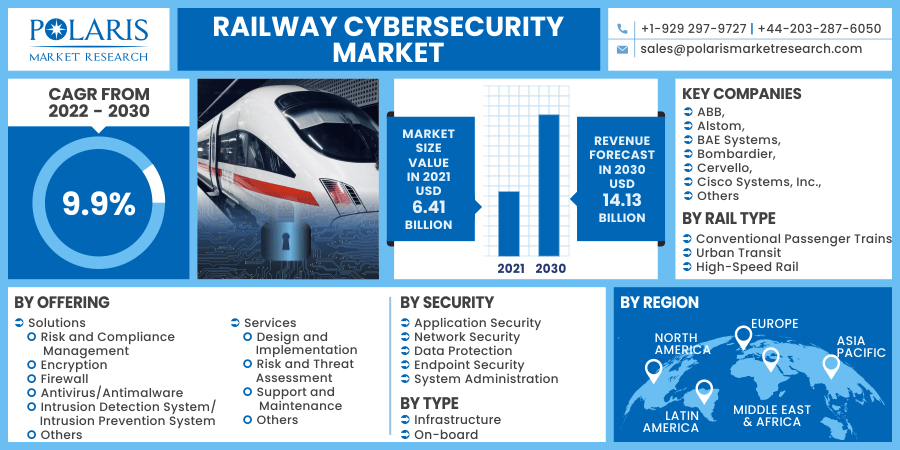

The global railway cybersecurity market was valued at USD 6.41 billion in 2021 and is expected to grow at a CAGR of 9.9% during the forecast period. The growing demand for the cybersecurity service due to the rising occurrence of cyberattacks is anticipated to fuel the market demand. Railway cybersecurity is utilized to protect digital resources and safeguard infrastructure and information from hackers; thereby, it is essential to deploy these solutions to protect from malicious threats.

Know more about this report: request for sample pages

Furthermore, increasing integration of the IoT, AI, and automated technologies in railways coupled with government regulation for the deployment of security solutions are some factors that in turn is boosting the railway cybersecurity market growth. The widespread COVID-19 pandemic has shown a major downfall in the global market because of the economy's weak performance. The imposition of lockdowns across various regions restricted the people's transportation activities, and social distancing norms also impacted the market. The chief risky factors of the industry participants are dependency on labor, supply chain execution, working capital management, regulatory & policy changes, and liquidity & solvency management.

As per the Deutsche Bahn, regional and long-distance train passengers were reduced to 15% compared before the pandemic. Moreover, this period also reflects the delay of several train cybersecurity development projects. Therefore, the COVID-19 exhibit a short term impact on the industry, which is more likely to get back on track with the help of high investments in HS (High Speed) and VHS (Very High Speed) rail infrastructures, which, in turn, fuels the market growth in the upcoming years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growing number of cyberattacks is a significant propelling factor for industry growth. Modern railways are deployed with advanced systems that need active internet to control their operation by receiving and transferring signals with the control station. Thereby, hackers can easily hack the systems as they find the loophole that makes the higher chances of getting system attack.

Furthermore, governments are also taking initiatives for smart railways cybersecurity that may also support industry growth. Growing urbanization may result in innovative city development for which governments are taking various industries to present improved transportation services. For instance, in March 2020, the Government of India has projected to build up 100 smart cities in the upcoming years. Likewise, The Government of Singapore is deploying digital technology across transportation services to achieve its Smart Nation vision.

Report Segmentation

The market is primarily segmented on the basis of offering, security, type, rail type, and region.

|

By Offering |

By Security |

By Type |

By Rail Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The onboard train cybersecurity segment accounts for the most considerable revenue in the global industry. It is the most advanced set of solutions or services in train cybersecurity that enable improved operational efficiency, safety, and system administration.

The rise in the number of rapid railways primarily integrated with sophisticated onboard systems for safety and convenience is growing at an unprecedented rate. These innovative features comprised an infotainment system, IP cameras, and automatic doors. Moreover, the increase in the number of advanced components in onboard train cybersecurity systems is likely to increase for better convenience and safety, which in turn will become a key factor for train cybersecurity providers and vendors across the globe over the forecast period.

Insight by Security

The data protection segment has the largest shares in 2021 and is expected to lead the industry in the forecasting years. Data protection emphasizes securing critical databases, such as data, database servers, applications, and systems that act as a catalyzing factor for the segment demand worldwide. In addition, it also facilitates and is intended at maintaining integrity, confidentiality, and availability of data, which ensures the successful prevention of data breaches. Accordingly, the proliferation of data protection in railway cybersecurity eventually boosted the segment demand and paved the way for railway cybersecurity market growth.

This segment is also projected to be the fastest-growing segment across the market. It is the most approachable security solution by rail operators or end-users, owing to the surging incident of cyber breaches. For instance, in January 2019, the authorized online booking platform of the China Railways (CR) grieved a massive data breach. Therefore, these factors may stimulate market demand over the forecast period.

Geographic Overview

Geographically, Asia-Pacific is accounted with the highest shares in the global railway cybersecurity market in 2021 and is likely to dominate the industry over the upcoming scenario. Over the last decades, these countries have faced numerous barriers to railway cybersecurity infrastructure, which will be a fundamental problem causing data breaches, freight information and analytics, rail analytics, and passenger infotainment.

Furthermore, increasing penetration of advanced technologies, rising investments in railway infrastructure, and surge in passenger and freight capacity demand are likely to impel the market demand. In addition, the continual development and rapid expansion of the existing rail network, especially in China and India, on the back of urban transit and high-speed rail. Therefore, these factors may fuel the market demand across North America in the forthcoming years.

Moreover, North America and Europe are also expected to contribute a significant share in the global market during the forthcoming years. Factors such as rising R&D activities in railway cybersecurity, coupled with the robust demand for such solutions and services to protect the critical railway's infrastructure from cyber threats.

Competitive Insight

Some of the major players operating in the global railway cybersecurity market include ABB, Alstom, BAE Systems, Bombardier, Cervello, Cisco Systems, Inc., Cylus Ltd., General Electric, Hitachi Ltd., Huawei Technologies Co., Ltd., International Business Machine Corporation, Nokia Corporation, Raytheon Technologies Corporation, Siemens AG, Thales Group, and Webtec Corporation.

Railway Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.41 billion |

|

Revenue forecast in 2030 |

USD 14.13 billion |

|

CAGR |

9.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Type, By Security, By Rail Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ABB, Alstom, BAE Systems, Bombardier, Cervello, Cisco Systems, Inc., Cylus Ltd., General Electric, Hitachi Ltd., Huawei Technologies Co., Ltd., International Business Machine Corporation, Nokia Corporation, Raytheon Technologies Corporation, Siemens AG, Thales Group, and Webtec Corporation |