Smart Fleet Management Market [By Mode of Transport (Automotive, Rolling Stock, Marine); By Mode of Application; By Mode of Communication; By mode of Solutions; By Mode of Region]: Market size & Forecast, 2024-2032

- Published Date:Mar-2023

- Pages: 114

- Format: PDF

- Report ID: PM1115

- Base Year: 2023

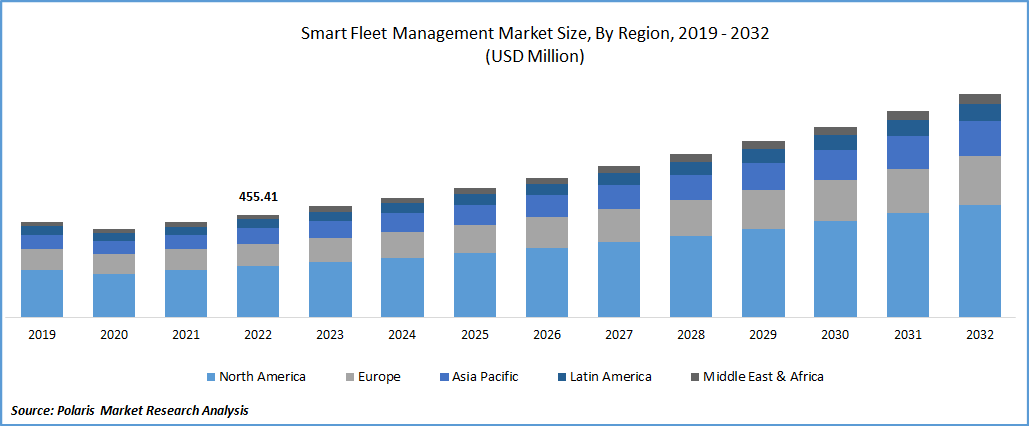

- Historical Data: 2019-2022

Report Outlook

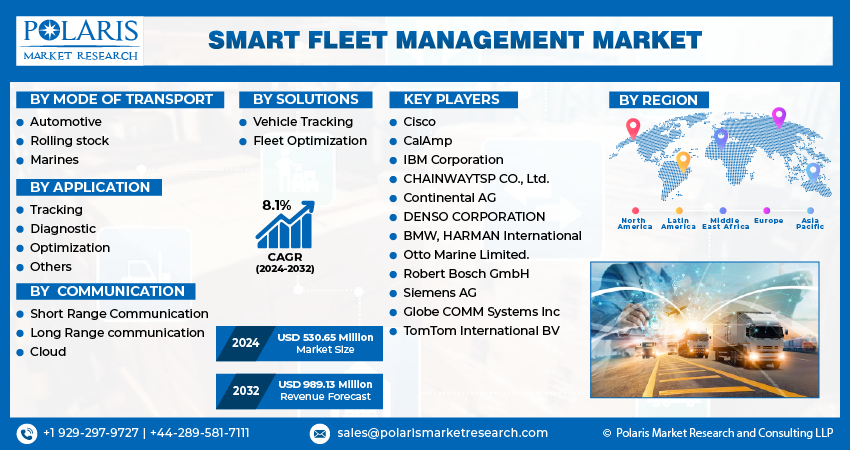

The global smart fleet management market was valued at USD 491.53 million in 2023 and is expected to grow at a CAGR of 8.1% during the forecast period. Several technological techniques, like cameras, GPS tracking, accelerometers, direct feeds from the electronic control module, and even cameras incorporated into the car itself, can be used to monitor driver safety data. Together, they give a complete picture of driving effectiveness. To help organizations manage their fleets more effectively, smart fleet management combines software, hardware, and analytics.

Know more about this report: Request for sample pages

Real-time fleet monitoring systems are increasingly being incorporated into cars, cloud-based technology is being used more frequently for smart fleet management solutions, and vehicle monitoring and fuel management have improved. These factors are driving the growth of the smart fleet management market.

The expansion of the market is also fueled by the integration and introduction of IoT and information, communication, and technology (ICT) into sectors including transportation, logistics, and the automotive industry. Additionally, the industry has grown significantly as a result of ongoing driver behavior monitoring, driver management, real-time visibility, vehicle tracking, and other factors.

Fleet operators can track their vehicles in real-time and check if drivers are following the suggested path or if there are diversions. For such cloud-based solutions such as IoT, AI, and, big data fleet management are used to collect primary data.

Technology for smart fleet management is still relatively young. The market for smart fleet management might be constrained by things like unauthorized access to various vehicle connection solutions or interruptions in the in-car connectivity system. The primary security analysis reveals that the hacker has access to both the vehicle's computer system and the data that it gathers and saves.

Real-time fleet monitoring systems are increasingly being incorporated into cars, cloud-based technology is being used more frequently for smart fleet management solutions, and vehicle monitoring and fuel management have improved. These factors are driving the growth of the smart fleet management market. The expansion of the market is also fueled by the integration and introduction of IoT and information, communication, and technology (ICT) into sectors including transportation, logistics, and the automotive industry. Additionally, the industry has grown significantly as a result of ongoing driver behavior monitoring, driver management, real-time visibility, vehicle tracking, and other factors.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers:

During the forecast period, APAC will overtake North America and Europe as one of the biggest markets. The expansion of transportation infrastructure and stricter safety standards in developing nations like China, Japan, and India will propel the APAC region's smart fleet management market.

The expansion of the Smart fleet market is driven by the increasing requirement to manage and monitor fleets to boost operational effectiveness and save expenses. To improve productivity and manage large numbers of fleets, industries are progressively implementing Smart fleet management systems. The deployment of Smart fleet systems is accelerating due to the increased demand for high-speed networks.

Report Segmentation

The market is primarily segmented based on Mode of transport, application, communication, Solutions and region.

|

By mode of transport |

By Application |

By Communication |

By Solutions |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Diagnostic segment accounted for the largest market share in 2022

Based on hardware, the smart fleet management industry is divided into four categories: optimization, ADAS, tracking, and diagnostic. The diagnostic can help you avoid costly repairs by spotting faults long before they result in serious problems in the engine bay. Nevertheless, the ADAS category experienced the fastest growth rate over the anticipated period due to its availability of adaptive features, including automated brakes, GPS navigation, automated lighting, cruise control, and interaction with smart devices to send alerts.

Optimization segment projected to grow at high CAGR over the forecast period

Optimization and tracks make up the largest chunk of solutions-based segments of the smart fleet management industry. Due to the rising need for tracking software in the automotive industry, the fleet management systems market growth in the tracking category was noticeably high in 2022. However, due to the rising demand for route optimization algorithms in the automobile industry, optimization will have the strongest growth in the upcoming years.

Cloud communication segment accounted for the significant market share in 2022

The market is segmented into long-range communication, short-range communication, and cloud communication based on connection. The market for smart fleet management was dominated by the short-range communication segment. The projection period saw a substantial increase in the cloud communication market due to its improved security features that protect sensitive data gathered from various sources and used in business.

Rolling stock segment expected to grow at high CAGR over the forecast period

The market has been divided into marine, rolling stock, and automobile categories based on transportation. The automotive segment commanded a substantial market share in 2022. Through connected vehicle technologies, numerous processes, including fuel management, idle time management, route optimization, and predictive maintenance, may be remotely monitored and managed. However, due to ongoing government restrictions and measures for vehicle and road safety, rolling stock is the category with the quickest rate of growth.

The Asia-Pacific region is estimated to be the largest market for smart fleet management

The Asia-Pacific region is expected to have the largest market during the forecast period due to the rise in transport facilities in developing countries such as Japan, India, and China. Moreover, the rising demand the smart fleet management and stringent safety regulations are expected to drive the market. With an increase in the acquisition of connectivity technology, the market for telematics and ADAS would rise in the Asia-Pacific region.

North America held the second-largest market share in the industry due to the widespread adoption of real-time tracking solutions across industries for efficient corporate operations. Vehicle monitoring systems are being more widely used by US automakers like General Motors, Ford, and Fiat-Chrysler. A factor influencing the expansion of the sector in this region is the region's early adoption of digital technologies.

Key players covered in the smart fleet management market

Some of the key players operating across the globe include Cisco, CalAmp, IBM Corporation, CHAINWAYTSP CO., Ltd., Continental AG, DENSO CORPORATION, BMW, HARMAN International, Otto Marine Limited., Robert Bosch GmbH, Siemens AG, Globe COMM Systems Inc and TomTom International BV.

Recent Developments

- June 2022, the Siemens Xcelerator, which is an open digital business platform to accelerate digital transformation, is launched, by Siemens.

- May 2022, the new sensors to safeguard the battery of electrified vehicles were launched by Continental AG company.

- In May 2022, Denso Corporation's partnership with Honeywell to develop an e-motor for Lilium's all-electric jet.

- In June 2021, Cisco System Inc. introduced an App-Dynamics Cloud to deliver exceptional digital experiences.

Smart Fleet Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 530.65 million |

|

Revenue forecast in 2032 |

USD 989.13 million |

|

CAGR |

8.1% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Transport, By Application, By communication, By Solution, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cisco, CalAmp, IBM Corporation, CHAINWAYTSP CO., Ltd., Continental AG, DENSO CORPORATION, BMW, HARMAN International, Otto Marine Limited., Robert Bosch GmbH, Siemens AG, Globe COMM Systems Inc and TomTom International BV. |

FAQ's

The smart fleet management market report covering key segments are Mode of transport, application, communication, Solutions and region.

Smart Fleet Management Market Size Worth $989.13 Million By 2032.

The global smart fleet management market expected to grow at a CAGR of 8.1% during the forecast period.

Asia-Pacific is leading the global market.

Key driving factors in smart fleet management market increase in use of cloud-based technology for smart fleet management solutions and development of intelligent transportation system.