Smart Home Appliances Market Share, Size, Trends, Industry Analysis Report, By Product (Washing Machines, Refrigerators, Air Purifiers, Smart TV, Others); By Distribution Channel (Online, Offline), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 115

- Format: PDF

- Report ID: PM2190

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

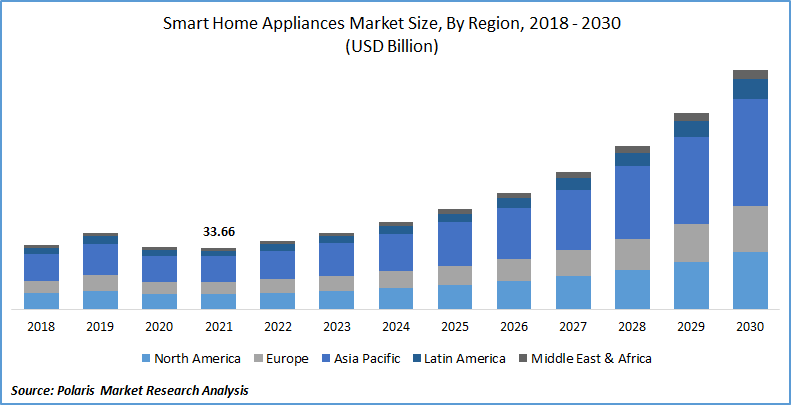

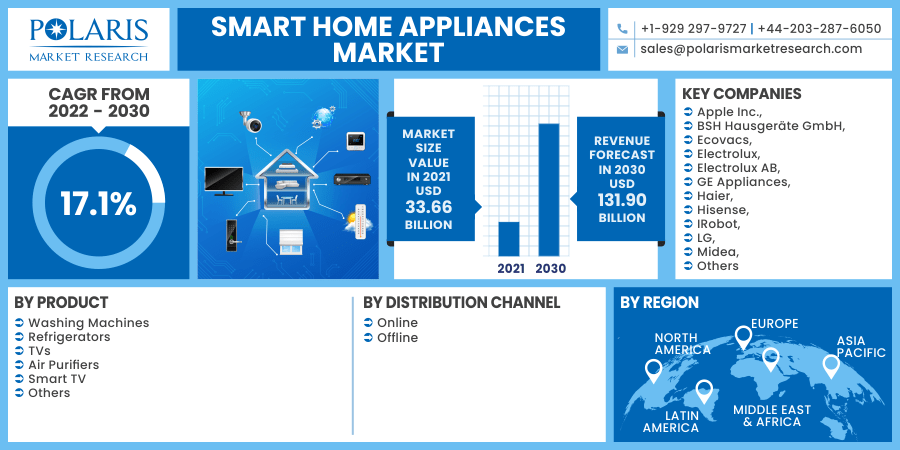

The global smart home appliances market was valued at USD 33.66 billion in 2021 and is expected to grow at a CAGR of 17.1% during the forecast period. The smart home appliances industry has seen substantial development in recent years, owing primarily to growing smartphone demand and increased internet penetration. The increased availability of wireless solutions is projected to significantly enhance the smart home appliances market over the forecast period.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The worldwide population's modern lifestyle is surrounded by intelligent devices such as remote controls and smartphones, which are used to do many daily activities. According to the OECD, disposable income is rising, the disposable income growth rate ranged from 0.2 percent in Spain to 7.4 percent in Costa Rica, and other European and North American countries are also observing the development at a higher pace.

As a result of changes in nations like China and India, a rise in income and the population's market demand for comfort-oriented appliances in Asia Pacific are providing significant potential in the smart home appliances market. Similarly, as per OECD statistics, Household income per capita in Canada and the United States increased by 11.0 percent and 10.1 percent, respectively, due to broad-based monetary transfers to the household sector in reaction to COVID-19. Ireland (3.6 percent), Australia (2.7 percent), and Finland (3.6 percent) all had smaller gains in real household income per capita (1.1 percent). Thus, rising disposable personal income across different geographies is further creating lucrative growth opportunities for the adoption of intelligent home appliances in the coming years.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Smart washing machines led the global market in 2021 due to increased smartphone usage, which assists in the adoption of intelligent home-based equipment. Moreover, the growing technology revolution is driving up the market demand for connected appliances, including intelligent washers as a source of luxury and convenience. Furthermore, increased use of the automatic washing process as a necessary component of daily housekeeping activities in the European region has also boosted the development potential in the area.

Smart home air purifiers segment is anticipated to grow at the fastest rate over the forecast period. The rise of intelligent air purifiers is fueled by increased attention to the hygiene aspect throughout the world, particularly due to the outbreak of the COVID-19 pandemic.

Insight by Distribution Channel

Offline emerged out as the leading market segment in 2021. The increased market demand for convenience, specialty, and branded retailers can be attributed to this. Moreover, the ability to compare pricing and product features, as well as the availability of a wide selection of items supplied by different companies, are some of the elements that are predicted to boost the segment growth.

Geographic Overview

Geographically, owing to the greater adoption of intelligent appliances in Europe, the region is expected to be a viable regional market over the forecast period. The increased willingness of customers throughout the EU to purchase energy-efficient products drives the market demand for intelligent home appliances in this region. For instance, as per the European Commission report, by 2024, over 225 Mn intelligent electricity meters and 51 Mn gas meters are expected to install in European Union (EU). This may result in a USD 55.3 billion investment. Furthermore, according to statistics from pilot programs, intelligent meters save an average of USD 270.7 for gas and USD 317.8 for electricity per metering point, as well as an average energy reduction of at least 2% and as high as 10%.

North America is driven by the surging adoption of intelligent devices along with strategic initiatives taken by the private organizations indulged in offering intelligent home cloud platforms. According to the Voicebot report, around 1 in 5 adults in the U.S. hold access to an intelligent device. The intelligent devices are trending devices such as connected devices that are precisely used in residential spaces and are referred to as primary adopted intelligent home equipment precisely calling for the need for intelligent home cloud platforms which act as a base for the connectivity of IoT enabled devices & gadgets.

In the present scenario, around 47.3 million adults in the U.S. precisely hold ownership of these voice-powered devices, which is around 20% of the U.S. adult population. Moreover, a combination of intelligent speakers and internet-connected speakers equipped with digital voice assistants would amount to sales of around 164 million units in 2019 compared to 98 million units in 2018. Also, around 70 million residential spaces would be equipped with intelligent speakers, pushing the total number of installed devices to around 175 million by the end of the year 2022 from around 42 million in the year 2017, further fueling the growth of smart home appliances market in this region.

Asia-Pacific holds the largest share in 2021 due to technological developments in developing economies such as China and India. According to the China Internet Network Information Center (CNNIC), China has a 59.3% internet penetration rate. Smart home appliances usage is expected to increase due to new product advancements across the sector.

Competitive Insight

Some of the major players operating the global smart home appliances market include Apple Inc., BSH Hausgeräte GmbH, Ecovacs, Electrolux, Electrolux AB, GE Appliances, Haier, Hisense, IRobot, LG, Midea, Miele & Cie, Neato, Panasonic, Philips, Samsung, Sony Group Corporation, Whirlpool, and Xiaomi Corporation.

Smart Home Appliances Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 33.66 billion |

|

Revenue forecast in 2030 |

USD 131.90 billion |

|

CAGR |

17.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Apple Inc., BSH Hausgeräte GmbH, Ecovacs, Electrolux, Electrolux AB, GE Appliances, Haier, Hisense, IRobot, LG, Midea, Miele & Cie, Neato, Panasonic, Philips, Samsung, Sony Group Corporation, Whirlpool, and Xiaomi Corporation. |