U.S. Midstream Oil & Gas Equipment Market By Product Type (Pipe, Gas Treating & Processing Equipment, Rail Tank Cars, Compressor, Pumps, Valves, Instrumentation Equipment, Storage Tanks, Other Equipment); By Application (Gas Processing Tanks, Pipelines, LPG Facilities, Crude by Rail and Others); By Regions, Segments & Forecast, 2018 - 2026

- Published Date:Oct-2018

- Pages: 100

- Format: PDF

- Report ID: PM1483

- Base Year: 2017

- Historical Data: 2015-2016

Report Outlook

The U.S. Midstream Oil & Gas Equipment Market is estimated to grow at a CAGR of 4.9% between 2018 to 2026.

Equipment demand in the U.S. from the midstream oil & gas processing industry has experienced a moderate growth during the past three years; owing to the low crude oil price era, which limited the growth in oil production. Moreover, the U.S. midstream infrastructure became better adapted to the recent shifts in energy production within the country. The industry for equipment manufacturing and rental services sector dramatically fell owing to sudden decrease in well count and completions in 2015 & 2016. But it is expected to return to achieve healthy growth by 2019, as the upstream sector is benefiting from the slow recovery of the oil prices and also additional export opportunities that was not available for both LNG and crude oil.

The rapidly increasing gas production in the Utica and Marcellus shale plays of the Appalachian Basin has increased the need for a high level of gas processing and transportation infrastructure to primarily drive the U.S. Midstream Oil & Gas Equipment market. This ultimately has urged the need for high level of investment to accommodate the changing regional requirements of gas transportation; by 2019 the demand for ongoing construction will begin to ebb.

Even though the projection for LNG export facilities has been clouded by the current uncertainty in crude prices market fundamentals will drive the eventual construction of many facilities over the forecast period further influencing the growth of U.S. Midstream Oil & Gas Equipment . Many of these projects are likely to be under construction till 2020. The facilities will be the primary application sites and will drive the market for a wide range of equipments including valves, pumps and compressors. Moreover, many new facilities will introduce the need for further construction of LNG storage tanks that are expected to make major component of overall project cost owing to their sheer structures and heavy equipment and engineering requirements.

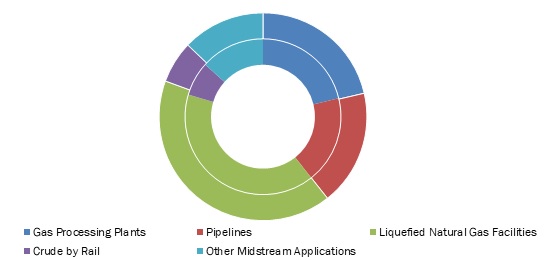

U.S. Midstream Oil & Gas Equipment Market Share By Application Type, 2017-2026

Know more about this report: request for sample pages

Segment Analysis:

The U.S. midstream oil & gas equipment market is segment based on product type, end-use and region markets. Based on products the U.S. midstream oil and gas equipment market is segmented into pipe (plastic & steel), gas treating & processing equipment, rail tank cars, compressor (centrifugal and reciprocating & others), pumps (positive displacement, centrifugal, parts, accessories, others), valves (conventional and automatic), instrumentation equipments, storage tanks, other equipments. The application segment is further segmented into gas processing plants, pipelines, LPG facilities, crude by rail, and other midstream applications.

The pipe segment is expected to remain the major product category in the U.S. Midstream Oil & Gas Equipment market with the demand to recover fully and post modest gains by the end of 2020 despite the sharp declines in 2015 and 2016. Demand for natural gas infrastructure equipments including processing and treating equipments and compressors that are applied in pipelines and other applications. Gas treating and processing equipments was the second largest product segment in 2017 and is expected to be the fastest growing over the forecast period.

Know more about this report: request for sample pages

Regional Analysis:

Southwest region was the largest regional market in 2017. This region has the highest number of refineries in the country with many export facilities in the cost. The region has the country’s largest oil & gas reserves which create additional opportunities for processing in the field vicinities. Recovery in drilling and completion operations in 2018, and an expected development of the region’s upstream sector by the end of 2019 will drive the U.S. midstream oil & gas equipment market over the forecast period.

Competitive Analysis:

Some of the leading industry participants in the U.S. midstream oil & gas equipment market include Abbot Group, Transocean, Zenith Oilfield Technology, National Oilwell Varco Incorporated, Schlumberger, Weatherford International, Halliburton Company, ENI, Baker Hughes, Cameron International, FMC Technologies, Aker Solutions.