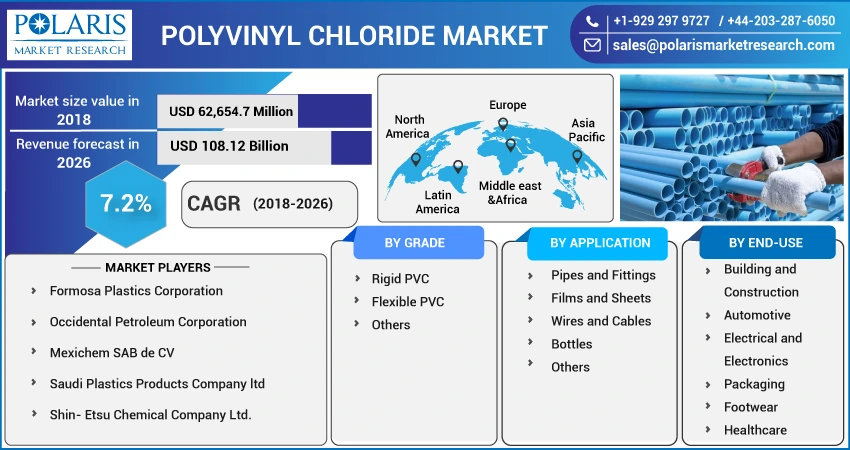

Polyvinyl Chloride (PVC) Market Share, Size, Trends & Industry Analysis Report [By Grade (Rigid PVC, Flexible PVC, Others); By Application (Pipes & Fittings, Films & Sheets, Wire & Cables, Bottles, Others); By End-Use (Building & Construction, Automotive, Electrical & Electronics, Packaging, Footwear, Healthcare), By Regions] Segments & Forecast, 2019 - 2026

- Published Date:May-2019

- Pages: 120

- Format: PDF

- Report ID: PM1448

- Base Year: 2018

- Historical Data: 2015-2017

Report Outlook

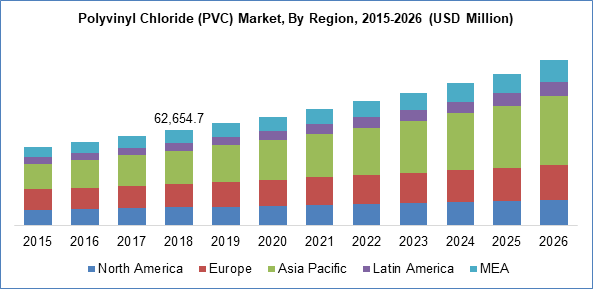

The global polyvinyl chloride (PVC) market size was estimated to be 62,654.7 million in 2018 and is expected to grow at a CAGR of 7.2% during forecast period. PVC resins are the synthetic polymer and are the third most widely manufactured after polypropylene (PP) and polyethylene (PE). PVC resins are a part of vinyl chain which also includes other types of vinyl polymers.

PVC polymers mainly comprise two very significant grades; they are rigid and flexible PVC. The classic ability of polyvinyl chloride to blend with numerous additives has been fed into a large number of end-use applications. Its properties such as innate resistance to oil and chemicals, non-flammability, durability, ease of processing and molding and mechanical ability have got PVC polymers a distinct name for itself as a significant and reputed synthetic polymer.

Know more about this report: request for sample pages

The global polyvinyl chloride market witness’s handsome growth primarily fostered by rapid growth rate of construction industry, automotive, electrical and electronics and packaging industry. Rigid polyvinyl chloride is used in construction of pipes, doors and window frames. Increasing disposable incomes with urbanization and driving population has given buoyancy to construction spending which spells a steady demand for commodity chemical products. Increase in use of unplasticized PVC in place of wood used in window frames and sils will boost demand for PVC in Construction sector over the forecast period.

There apparently exists a potential growth for PVC in consumer applications such as Furniture, clothing, footwear and sportswear. This comes to the fore because of low cost and high water resist as compared to leather and rubber. Increasing disposable incomes in countries such as India, China and Brazil are also one of the major demand converters for PVC along with driving growth in consumer electronics industry.

PVC is used for selective packaging such as medical devices and apparatus packaging, bottle sleeving and packaging of electronic and other consumer products. Growing packaging industry, mainly using plastics is anticipated to boost PVC market. China and India are makers of major packaging units globally and hence making way for uniting growth in the region.

Brazil and South Africa are also promising starters in packaging market which gives manufacturers an opening in the market. Increasing sales of convenience food has brought packaging into the picture that will once again drive demand for Polyvinyl Chloride. This goes for packaging of non-food products also with consumer electronics gearing up to take compulsive demand for market. An increasing use of plastics in aircraft carriers in place of metal alloys stacks up growth for PVC products.

Know more about this report: request for sample pages

Polyvinyl Chloride (PVC) Market Report Scope

By Grade |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Application Outlook

The many vistas of application extend to wires and cable insulations, doors, tubes, windows, cable, wire, sliding, sheets, film and flooring. An overwhelming demand for consumer goods and latest bevy of electronic products has fueled demand for flexible polyvinyl chloride. A thriving automotive industry across the globe has resulted in the increasing spurt in flexible polyvinyl chloride.

Polyvinyl chloride being petrochemical derivative has increasing price variations though not labeled a highly priced synthetic polymer. Polyvinyl chloride has its share of negative reviews with heated debate on its environmental impact with differing reactions on its scientific and technical applications. Polyvinyl chloride is subject to many governing regulations from different agencies such as Medical and Health Products Regulatory Agency. (MHRA)

End-Use Outlook

One of the largest end-user industries for polyvinyl chloride is Building and Construction where the product finds its way into cables, pipes, wall and floor coverings, fencing and landfill liners. The other end-user industry is the diverse electrical and electronics industry which is witnessing multiple expansions in consumer electronic products.

The two grades of PVC are rigid and flexible kinds of which flexible has witnessed untiring growth in packaging industry and rigid has been used immensely in the construction industry.

Regional Outlook

Asia Pacific comprises a major market chunk with China being the main producer of PVC resins in the region, incomparable to any other country. China in tandem with India, Indonesia and Vietnam has been the forerunner in strong PV consumptions. North America is the second largest market for PVC where the major market stems from the burgeoning construction industry of the United States. Western Europe too follows USA in identical market trends with both being mature markets with excessive capacities.

Competitive Analysis

The key PVC market players in PVC market include Formosa Plastics Corporation, Occidental Petroleum Corporation, Mexichem SAB de CV, Saudi Plastics Products Company ltd and Shin- Etsu Chemical Company Ltd.