Europe Orthopedic Devices Market Share, Size, Trends, Industry Analysis Report

By Product (Hip, Knee, Spine, Cranio-Maxillofacial, Dental, SET); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 114

- Format: PDF

- Report ID: PM4904

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

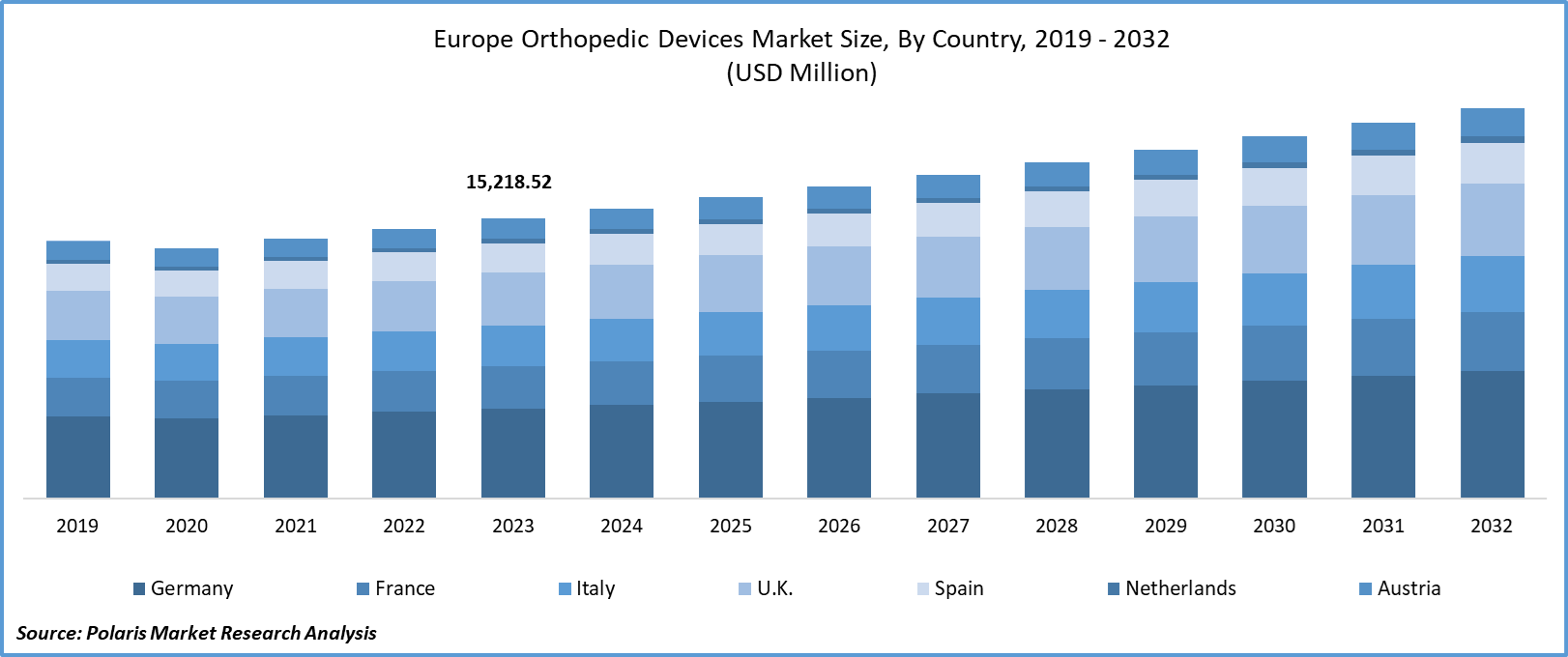

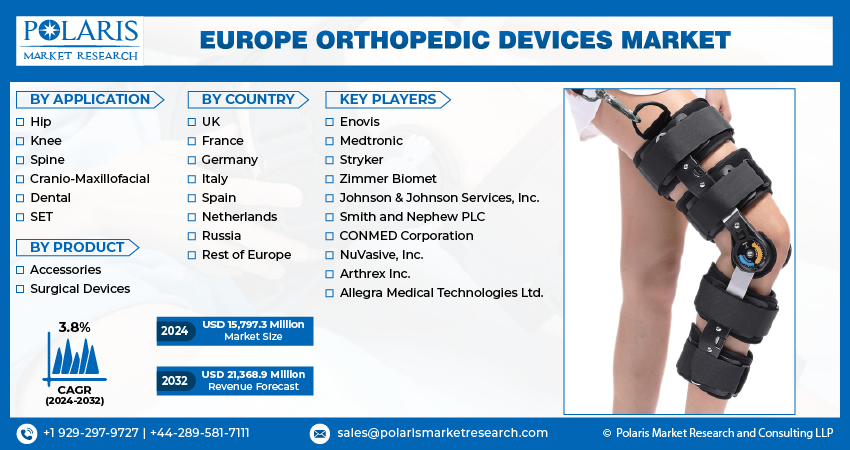

Europe Orthopedic Devices market size was valued at USD 15,218.52 million in 2023. The market is anticipated to grow from USD 15,797.3 million in 2024 to USD 21,368.9 million by 2032, exhibiting the CAGR of 3.8% during the forecast period.

Industry Trends

The Europe orthopedic devices market has witnessed significant growth in recent years, driven by the increasing cutting-edge orthopedic devices integrated with advanced technology to offer efficient treatment for orthopedic conditions and enhance patient surveillance and diagnosis. These devices incorporate electronic elements, communication capabilities, sensors, and data analysis to deliver instant feedback on the implants’ functionality and the patient’s general well-being. The advanced healthcare infrastructure, favorable reimbursement policies, and high healthcare expenditure expected to witness rapid expansion primarily because of its large patient pool, increased healthcare awareness, improved healthcare infrastructure, and rising disposable income.

To Understand More About this Research: Request a Free Sample Report

The integration of improved biocompatible materials with the patient's natural tissues ensures that there are no adverse reactions. These devices have the capability to monitor various characteristics such as implant stability, joint mobility, and tissue healing. With the help of sensors, innovative implants can transmit real-time data to surgeons, enabling them to remotely monitor the patient's progress.

The development of biocompatible materials and surface coatings has significantly reduced the chances of immunological responses, infections, and implant rejection. Furthermore, the use of modern imaging techniques and 3D printing allows for the production of customized orthopedic devices that provide a more precise fit to the patient's anatomy. 3D printing also enables the creation of intricate lattice structures that mimic bone characteristics, leading to improved integration with the patient's natural bone and faster healing. Additionally, augmented reality (AR) has emerged as a valuable tool for pre-operative planning, precise implant placement, and guiding surgeons during complex operations. By enhancing surgical accuracy and reducing errors, AR is making orthopedic surgery more efficient and safer.

However, there is limited adoption of these devices owing to high cost of implementation hence, collaborative endeavors among device manufacturers, healthcare providers, and regulatory bodies are essential in overcoming compatibility challenges that arise from diverse technologies and systems. These obstacles can impede the smooth integration of various components, resulting in inefficiencies and possible complications during surgical procedures. To tackle these technological barriers, it is crucial to establish standardized protocols, facilitate training programs, and ensure the interoperability of technologies.

Key Takeaways

- Germany dominated the market and contributed over 25% of the market share

- By Application category, the knee segment accounted for the largest Europe orthopedic devices market share

- By Product category, the accessories segment is anticipated to grow with a lucrative CAGR over the Europe orthopedic devices market forecast period

What are the market drivers driving the demand for market?

Technological advancements drive the European orthopedic devices market growth.

The market is experiencing significant growth due to robot-assisted orthopedic surgeries are gaining popularity as they offer advantages such as improved accuracy and precision in surgical outcomes, enhanced reproducibility, reduced technical variability, decreased pain, and quicker recovery time. These advanced technologies empower orthopedic surgeons to conduct minimally invasive procedures more accurately, thereby lowering risks and improving recovery times. The rising use of robotics in orthopedic surgeries enables complex tasks like joint replacements to be carried out with unparalleled precision, assisting surgeons with real-time, three-dimensional mapping and enhancing implant placement accuracy. The incorporation of robotics presents a lucrative opportunity for manufacturers, fueling growth in the orthopedic devices industry.

Which factor is restraining the demand for market?

Concerns about the longevity and extended performance of orthopedic devices affects the European market growth.

The European orthopedic devices market faces concern regarding the durability and long-term performance. This is because these devices need to endure the demands of daily activities for extended periods. Although advancements in materials and design have enhanced the lifespan of orthopedic implants, issues like wear, corrosion, and mechanical failure can still occur over time. Both patients and healthcare providers are increasingly prioritizing the reliability and longevity of orthopedic devices, especially considering the aging population and the desire for lasting solutions.

Report Segmentation

The market is primarily segmented based on application, product and country.

|

By Application |

By Product |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Application Insights

Based on application analysis, the market is segmented into hip, knee, spine, cranio-maxillofacial, dental, and SET. The dominance of the knee segment in Europe's Orthopedic Devices market is due to the aging population in Europe, which has resulted in a higher incidence of conditions like osteoarthritis and injuries necessitating knee surgeries and replacements. Moreover, the progress in medical technology and healthcare infrastructure across European nations has enhanced the safety, accessibility, and success rates of knee surgeries, prompting both patients and healthcare providers to choose knee orthopedic interventions.

Additionally, there is a cultural emphasis on maintaining an active lifestyle and mobility in European societies, fueling the demand for knee treatments that can improve or restore functionality. These factors collectively contribute to the prevalence of knee orthopedic devices in European healthcare markets. Orthopedic devices are the most prevalent type of devices in the EU, with a significant focus on their application in constructing orthopedic devices. Total knee replacement stands out as a major milestone in orthopedic surgery.

By Product Insights

Based on product analysis, the market has been segmented into accessories and surgical devices. The accessories segment is expected to experience significant growth with a lucrative CAGR, and the surgical devices segment has dominated the market over the forecast period in Europe's Orthopedic Devices market owing to a robust healthcare system having well-established surgical specialties fostering innovation and the adoption of advanced surgical techniques and technologies, including surgical devices. Moreover, there is a growing inclination towards minimally invasive surgeries in Europe, driven by factors such as shorter recovery periods, reduced hospital stays, and lower healthcare expenses. Additionally, regulatory frameworks in Europe prioritize patient safety and effectiveness, resulting in rigorous approval processes that ensure only high-quality surgical devices are introduced to the market.

Country-wise Insights

Germany

Germany leads the Orthopedic Devices market in Europe, and the Netherlands is expected to grow at the fastest CAGR over the forecast period. Germany is said to be a global technology hub with a strong healthcare system. Strong infrastructure, adoption, and integration of technologies into orthopedic devices and advanced data centers provide a solid foundation for deploying orthopedic device architectures in Germany. Germany fosters a dynamic ecosystem conducive to the growth of orthopedic device solutions. Also, the regulation of medical devices in Germany is governed by directives, standards, and safety regulations set forth by both the German government and the European Union.

Competitive Landscape

The competitive landscape for the European Orthopedic Devices market is characterized by intense competition among key players striving to gain market share and differentiate themselves through innovation and strategic collaborations. Companies are focusing comprehensive Orthopedic Devices solutions tailored to patient needs to enhance the patient outcomes. Amidst this landscape, collaboration between technology integrators, service providers, and industry stakeholders remains crucial for driving innovation, expanding market reach, and addressing evolving patient and healthcare demands in the European Orthopedic Devices market.

Some of the major players operating in the European market include:

- Enovis

- Medtronic

- Stryker

- Zimmer Biomet

- Johnson & Johnson Services, Inc.

- Smith and Nephew PLC

- CONMED Corporation

- NuVasive, Inc.

- Arthrex Inc.

- Allegra Medical Technologies Ltd.

Recent Developments

- In February 2024, Maxx Orthopedics entered into a collaborative partnership with THINK Surgical to enhance robotic total knee arthroplasty. As part of this collaboration, Maxx Orthopedics' cutting-edge implants, such as the Freedom® Knee System, will be integrated into THINK Surgical's ID-HUB™. This exclusive database houses a wide range of implant modules that can be utilized with the advanced TMINI™ Miniature Robotic System developed by THINK Surgical.

- In February 2024, WA Med-tech REX Ortho received vital support from the AO Foundation to advance the development of its orthopedic surgical device. In partnership with the AO, REX Ortho will now embark on the creation of a groundbreaking spinal screw named S-REX. The AO, a non-profit organization with an extensive network of surgeons worldwide, will play a pivotal role in this collaborative endeavor.

- In January 2024, Extremity Medical and Ossium Health formed a strategic partnership to distribute OssiGraft Viable Bone Matrix. This collaboration aims to create innovative solutions that improve human health. By introducing OssiGraft, we are not only extending the reach of each donor's contribution but also pushing the boundaries of patient care advancements.

Report Coverage

The Europe orthopedic devices market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application and their futuristic growth opportunities.

Europe Orthopedic Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15,797.3 million |

|

Revenue forecast in 2032 |

USD 21,368.9 million |

|

CAGR |

3.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Europe Orthopedic Devices Market are Enovis, Medtronic, Stryker, Zimmer Biomet, Johnson & Johnson Services, Inc., Smith and Nephew PLC

Europe Orthopedic Devices market exhibiting the CAGR of 3.8% during the forecast period.

The Europe Orthopedic Devices Market report covering key segments are application, product and country.

key driving factors in Europe Orthopedic Devices Market are increasing demand for efficient data processing and reduced latency

The Europe Orthopedic Devices market size is expected to reach USD 21,368.9 Million by 2032