North America Fruits & Vegetables Market Size, Share, Trends, & Industry Analysis Report

By Product (Fresh, Dried, Frozen), By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5974

- Base Year: 2024

- Historical Data: 2020-2023

Overview

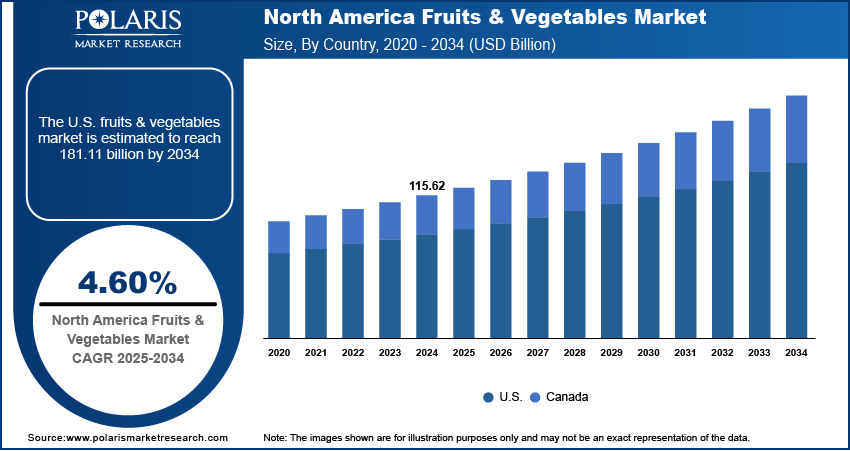

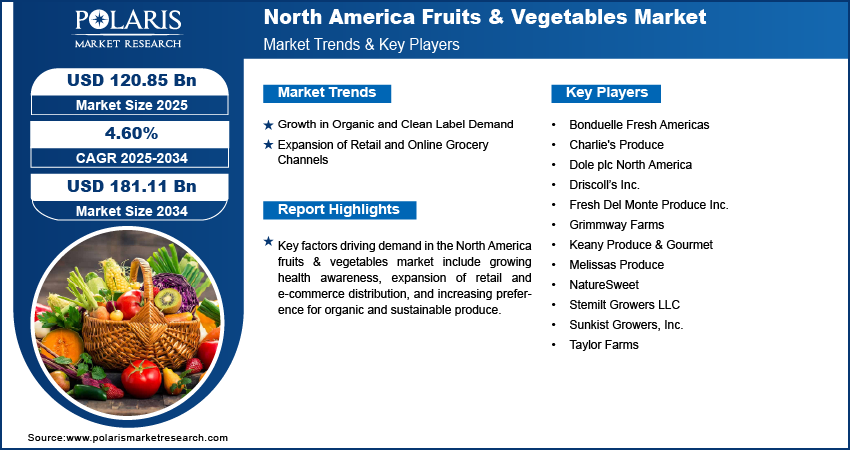

The North America fruits & vegetables market size was valued at USD 115.62 billion in 2024, growing at a CAGR of 4.60% from 2025–2034. Increasing demand for organic and clean-label fruits & vegetables, coupled with the expansion of retail and online grocery channels, is boosting the growth of the fruits & vegetables across the region.

Key Insights

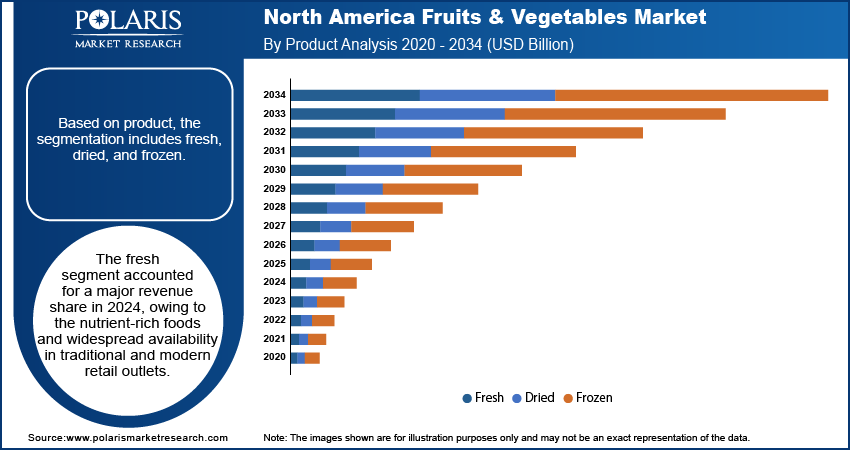

- The fresh segment accounted for 80.8% market share in 2024, driven by strong consumer demand for unprocessed and nutrient-rich fruits and vegetables.

- The frozen segment is projected to grow at the fastest rate over the forecast period, owing to the rising demand for convenient, year-round availability and extended shelf life of fruits & vegetables among urban households and foodservice operators.

- The US fruits & vegetables market held 78.0% of the North America market share in 2024, fueled by high consumption volumes, strong retail infrastructure and growing demand for organic and value-added produce.

North America fruits and vegetables supply supports daily nutrition across households, foodservice establishments, and institutional catering sectors. The market covers fresh, frozen food, canned, dried, and processed categories, with robust distribution networks across retail, wholesale and online platforms. For example, in December 2024, Fresh Del Monte’s Mann Packing launched the first-ever Newman’s Own Salad Kits across North America, combining premium ingredients with branded dressings.

High-income populations in the U.S. and Canada are increasingly prioritizing plant-based nutrition for its role in disease prevention and weight management. Rising per capita consumption of fresh produce is further driven by public health campaigns and dietary guidelines issued by agencies such as the United States Department of Agriculture (USDA) and Health Canada. The demand for these products is rapidly increasing due to the high consumption of berries, citrus fruits, leafy greens, avocados, and cruciferous vegetables, driven by their rich nutrient content and strong antioxidant properties. In addition, retailers and suppliers are investing in cold chain infrastructure, automated packing systems, and supply chain traceability solutions to ensure freshness, safety, and regulatory compliance.

The shift towards sustainable agriculture and local sourcing is accelerating the adoption of precision farming, controlled-environment agriculture (CEA), and regenerative practices across North America. Farmers are integrating smart irrigation, crop sensors, and climate monitoring tools to improve yield efficiency and reduce resource inputs. In urban areas, vertical farming and hydroponics are growing significantly to meet year-round demand for fresh greens. Additionally, rising concerns about pesticide residues and environmental impact are fueling growth in organic and non-GMO segments in this region. Rising demand for convenience foods is boosting the growth of pre-cut, ready-to-eat fruits and vegetables that are offered through supermarkets and e-commerce platforms. However, the industry faces challenges related to labor shortages, post-harvest losses, and price volatility due to climate variability and logistics disruptions.

Industry Dynamics

- Shifting consumer preferences toward health-oriented and plant-based diets are driving demand for fresh, organic, and nutrient-rich produce.

- Expansion of retail and e-commerce channels is enhancing product accessibility and convenience across urban and suburban markets.

- Growing investments in vertical farming, hydroponics, and greenhouse technologies is creating opportunities for the market to offer scalable and sustainable production solutions in urban settings.

- Labor shortages in agricultural operations are restraining the growth of the market.

Growth in Organic and Clean Label Demand: Rising consumer preference for organic, non-GMO, and pesticide-free produce is driving significant shifts in the North America fruits and vegetables market. According to the American Frozen Food Institute (AFFI) retail sales report 2025, frozen fruit & vegetable sales recorded a 2.7% increase in unit volume over the 52-week period, compared to the same timeframe in 2024. Health-conscious consumers are adopting clean-label products to meet dietary transparency and sustainability values. Moreover, retailers are expanding organic assortments, while farmers are adopting certified cultivation practices to capture this high-margin segment. The trend is evident among millennials and urban populations that prioritize ethical sourcing and food safety in their purchasing decisions.

Expansion of Retail and Online Grocery Channels: The rapid growth of modern retail formats and digital grocery platforms is enhancing consumer access to fresh fruits and vegetables across North America. The expansion of supermarkets, hypermarkets, and club stores is increasing the availability of freshly produced fruits & vegetables, while e-commerce platforms such as Instacart, Amazon Fresh, and Walmart+ are enhancing doorstep delivery through improved cold chain logistics. According to Brick Meets Click, US eGrocery sales reached USD 9.7 billion in March 2025, reflecting a 21% year-over-year growth and marking the eighth straight month with sales surpassing USD 9.5 billion. The pandemic-driven shift toward online grocery shopping compelled suppliers to invest in packaging innovations and real-time inventory systems. These developments are boosting greater market penetration, product visibility, and consumption frequency in urban and convenience-driven settings.

Segmental Insights

Product Analysis

Based on the product, the segmentation includes fresh, dried, and frozen. The fresh segment accounted for 80.8% revenue share in 2024, due to high consumer preference for natural, unprocessed produce. Availability through traditional retail outlets, coupled with increasing demand for locally grown and organic varieties, is driving stable consumption across urban and semi-urban markets. Moreover, health awareness and rising per capita spending on whole foods are driving growth for fresh fruits & vegetables. The presence of large-scale supermarket chains is enhancing their fresh produce assortments with improved storage and display solutions. The continued shift toward plant-based diets and clean-label foods is sustaining the segment’s dominant position in the overall fruits and vegetables industry.

The frozen segment is projected to grow at the fastest pace during the forecast period, owing to rising consumer demand for convenience and year-round availability. For instance, in April 2025, Pitaya Foods launched the first-ever Regenified certified regenerative and organic frozen fruit line at Whole Foods Market nationwide. The move supports rising demand for sustainable produce and strengthens its position in the clean-label frozen foods segment. Advancements in individual quick freezing (IQF) technology are improving the texture and nutritional retention of frozen produce, making it a preferred choice for health-conscious consumers. Rising adoption across foodservice outlets, institutional kitchens, and working households is further pushing the sales of frozen products. In addition, retailers and online grocery platforms are expanding frozen assortments with new product launches, including pre-cut, organic, and ready-to-cook options that reduce preparation time while minimizing food waste.

Distribution Channel Analysis

By end user, the market includes offline and online. The offline segment held the largest revenue share in 2024. These outlets offer a wide product variety, competitive pricing, and in-store quality inspection that drives the growth of this segment. In North America, large-format stores are investing in cold storage upgrades, private-label assortments, and seasonal promotions to support year-round fruit and vegetable sales. Farmers' markets and community-supported agriculture (CSA) models are further boosting the offline channels among consumers seeking locally sourced produce.

The online segment is anticipated to grow at the fastest rate, owing to the expansion of digital grocery platforms and evolving consumer preferences for contactless shopping. E-commerce providers such as Amazon Fresh, Instacart, and Walmart+ are optimizing logistics to ensure the timely delivery of perishable items with minimal spoilage. Real-time inventory tracking, personalized recommendations, and subscription models are enhancing user experience and driving repeat purchases. Additionally, packaging innovations and cold chain improvements address key perishability concerns, allowing a wider range of fruits and vegetables to be delivered directly to consumers' doorsteps in major urban centers.

Regional Analysis

U.S. Market for Fruits and Vegetables in North America

The growth of the U.S. fruits and vegetables market is driven by rising consumer demand for healthier and plant-based dietary options. Increasing awareness about the nutritional benefits of fresh produce is encouraging greater consumption across diverse age groups. Additionally, the expansion of organic farming practices and advancements in cold chain logistics are enhancing product availability and shelf life, further supporting market expansion.

Key Players & Competitive Analysis Report

The North America fruits and vegetables market is moderately fragmented and competitive, with leading players actively expanding product portfolios, enhancing cold chain infrastructure, and strengthening retail and e-commerce partnerships to meet evolving consumer demand. Companies include large agribusinesses, integrated producers, and regional cooperatives that are expanding their fresh and organic product lines. Moreover, these companies are investing in cold storage, digital supply chains, and controlled environment farming to strengthen their market presence. Market players are partnering with retailers, growing their e-commerce reach, and launching branded packaged products to meet demand from health-focused consumers. Technology adoption is helping improve traceability and meet food safety standards while sustainable farming methods are used to reduce environmental impact.

Major companies operating in the North America fruits & vegetables industry include Dole plc North America, Fresh Del Monte Produce Inc., Taylor Farms, Grimmway Farms, Driscoll’s Inc., NatureSweet, Stemilt Growers LLC, Bonduelle Fresh Americas, Sunkist Growers, Inc., Melissas Produce, Keany Produce & Gourmet, Pitaya Foods, and Charlie's Produce.

Key Players

- Bonduelle Fresh Americas

- Charlie's Produce

- Dole plc North America

- Driscoll’s Inc.

- Fresh Del Monte Produce Inc.

- Grimmway Farms

- Keany Produce & Gourmet

- Melissas Produce

- NatureSweet

- Stemilt Growers LLC

- Sunkist Growers, Inc.

- Taylor Farms

Industry Developments

- March 2025: Fresh Del Monte Produce Inc. partnered with The Nunes Company, Inc., to expand the distribution of its Broccolini and baby broccoli products across the US and Canada. The partnership aims to strengthen Del Monte’s branded fresh produce portfolio and broaden its retail reach through Nunes' established grower network and customer base.

- April 2025: Taylor Farms launched its “Get Your Salad Together” initiative to boost engagement in the chopped salad kit category through digital ads, CTV spots, and in-store promotions. The initiative targets over 1.4 billion impressions, highlighting the brand’s focus on healthy, convenient meal solutions.

- July 2025: BranchOut Food shipped the first batch of its new product line to the largest US retailer, marking the launch of its second contract under a three-deal agreement totaling USD 8 million.

North America Fruits & Vegetables Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Fresh

- Dried

- Frozen

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Supermarkets & Hypermarkets

- Specialty Stores

- Other Offline Channels

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

North America Fruits & Vegetables Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 115.62 Billion |

|

Market Size in 2025 |

USD 120.85 Billion |

|

Revenue Forecast by 2034 |

USD 181.11 Billion |

|

CAGR |

4.60% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

North America |

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 115.62 billion in 2024 and is projected to grow to USD 181.11 billion by 2034.

The market is projected to register a CAGR of 4.60% during the forecast period.

The US dominated the market in 2024, holding 78.0% share.

A few of the key players in the market are Dole plc North America, Fresh Del Monte Produce Inc., Taylor Farms, Grimmway Farms, Driscoll’s Inc., NatureSweet, Stemilt Growers LLC, Bonduelle Fresh Americas, Sunkist Growers, Inc., Melissas Produce, Keany Produce & Gourmet, Pitaya Foods, and Charlie's Produce.

The fresh segment dominated the market in 2024, holding 80.8% share. This is due to its strong consumer preference for natural, unprocessed foods and increasing availability across retail and foodservice channels.

The online segment is expected to witness the fastest growth during the forecast period, owing to the rising popularity of e-grocery platforms and increasing home delivery adoption.