E-commerce Market Size, Share, Trends, Industry Analysis Report

: By Business Model [Business-to-Consumer (B2C), Business-to-Business (B2B), Consumer-to-Consumer (C2C), Consumer-to-Business (C2B), Direct-to-Consumer (D2C), and Others], Product Category, Platform Type, Payment Mode, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034.

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5657

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

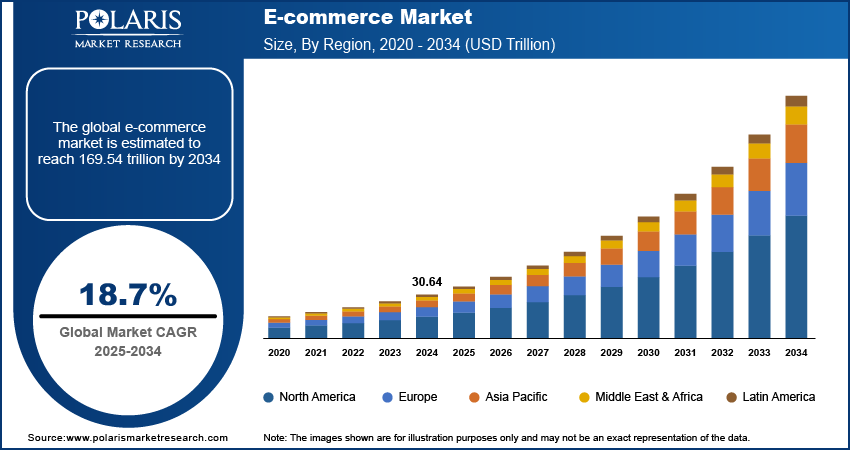

E-commerce market size was valued at USD 30.64 trillion in 2024. The e-commerce industry is projected to grow from USD 36.30 trillion in 2025 to USD 169.54 trillion by 2034, exhibiting a CAGR of 18.7% during 2025-2034. The e‑commerce market is booming due to widespread internet access, mobile and social commerce growth, logistics infrastructure improvements, convenience and personalization, expanding digital payments, globalization of retail, shifting consumer behavior post‑pandemic, and retailers adopting omnichannel strategies.

Key Insights

- The business-to-consumer (B2C) segment dominated the e-commerce market share in 2024, driven by the rapid adoption of online retail platforms, increasing smartphone and internet penetration, and growing consumer preference for convenient, 24/7 shopping experiences across diverse regions.

- The electronics & media segment held a significant market share in 2024, fueled by strong demand for smartphones, laptops, smart home devices, and digital entertainment, supported by technological advancements and consumers’ increasing reliance on connected devices.

- The food & grocery segment is projected to register the fastest growth, driven by rapid urbanization, hectic lifestyles, rising demand for contactless and home delivery services, and increasing awareness of fresh and organic food options through digital channels.

- Asia Pacific accounted for a major share in 2024, propelled by a rapidly expanding digital population, rising disposable incomes, improved internet infrastructure, and widespread adoption of mobile commerce platforms in both urban and rural areas.

- North America’s market is expected to grow rapidly, supported by high smartphone penetration, sophisticated logistics and delivery networks, increasing consumer demand for personalized shopping experiences, and the integration of AI and machine learning in e-commerce platforms for better customer engagement.

Industry Dynamics

- Growing demand for convenient, fast, and personalized shopping experiences is driving e-commerce market growth, as consumers increasingly prefer online platforms that offer seamless browsing, quick checkout, and reliable delivery services.

- Expanding adoption of mobile commerce, social commerce, and AI-powered recommendation engines is unlocking new opportunities, supported by rising smartphone penetration, improved internet access, and shifting consumer preferences toward digital purchasing.

- Challenges such as logistical complexities, cybersecurity concerns, and fragmented regulatory environments hinder broader e-commerce adoption, especially in emerging markets with underdeveloped infrastructure and inconsistent policies.

- Innovations in AI, big data analytics, and augmented reality are revolutionizing the e-commerce landscape, enabling personalized customer journeys, enhanced security, and immersive shopping experiences tailored to a digitally connected global audience.

Market Statistics

- 2024 Market Size: USD 30.64 Trillion

- 2034 Projected Market Size: USD 169.54 Trillion

- CAGR (2025-2034): 18.7%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

E-commerce refers to the buying and selling of goods and services over the internet. It has revolutionized the way businesses operate and how consumers shop, offering convenience, speed, and access to a vast range of products and services without geographic limitations. The rise of smartphones, including 5G smartphones, secure payment gateways, and user-friendly interfaces, has made online shopping a preferred choice for millions globally. E-commerce platforms support sectors such as travel, entertainment, education, and financial services. Small and medium-sized enterprises also use these platforms to scale their operations, expand customer bases, and compete with larger companies. Social media integration, virtual shopping assistant product recommendations, and secure logistics have further enhanced the effectiveness of e-commerce platforms.

The rising disposable income globally is propelling the e-commerce market growth. Higher disposable income encourages consumers to explore a wider range of products, including premium and imported goods, which e-commerce platforms readily offer. The Bureau of Economic Analysis (BEA) published a report in January 2025 stating that the US disposable personal income increased by USD 194.3 billion, or 0.9%. Additionally, greater financial flexibility allows shoppers to take advantage of discounts, bulk purchases, and subscription services, further driving online sales. The growing middle class in emerging markets, with high disposable income, also adopts digital shopping habits faster, expanding the e-commerce customer base. Therefore, the rising disposable income globally is fueling the e-commerce market revenue.

The e-commerce market demand is driven by the rising urbanization worldwide. Urban areas have better digital infrastructure, including widespread internet access and reliable e-commerce logistics networks, which support seamless e-commerce transactions. According to data published by the World Bank, the urban population worldwide is expected to double by 2050. The flock of tech-savvy populations in urban areas accelerates the adoption of mobile shopping and digital payment methods, further driving e-commerce sales. Additionally, urban consumers often face limited physical retail space and higher in-store prices, pushing them toward the wider selection and competitive pricing of e-commerce. The rise of urban living also increases demand for quick commerce services, such as same-day delivery and instant groceries, which e-commerce platforms provide. Therefore, the rising urbanization globally is fueling the e-commerce consumer base.

E-commerce Market Dynamics

Growing Advancement in Technology

Innovations such as artificial intelligence and machine learning are personalizing recommendations, improving user experience, and encouraging repeat purchases. Faster internet speeds enable seamless browsing, quick load times, and smooth mobile transactions, attracting more shoppers toward e-commerce platforms. Secure digital payment systems, such as digital wallets and biometric authentication, build consumer trust and reduce checkout timing, fueling consumers to purchase from e-commerce platforms. Automation and robotics streamline logistics, ensuring faster deliveries and better inventory management, which increases customer satisfaction and propels them to repeat purchases, leading to a wide consumer base for e-commerce. Therefore, as technology evolves, e-commerce platforms integrate these innovations, creating a smoother, more engaging shopping experience that drives higher demand.

Rising Penetration of Smartphones Worldwide

Smartphones allow users to participate in e-commerce by helping them to browse, compare, and purchase products anytime and anywhere, eliminating the need for physical store visits. Mobile payment solutions such as digital wallets and one-click checkout further streamline the purchasing process, encouraging impulse buys and frequent transactions. Additionally, personalized recommendations, push notifications, and exclusive mobile deals enhance the shopping experience, driving higher engagement and sales. Therefore, as more consumers adopt smartphones, e-commerce platforms expand their reach, tapping into new markets and demographics that previously had limited access to online shopping. According to the Groupe Speciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, 54% of the global population owns a smartphone, and the number is expected to grow in the coming years. This widespread smartphone usage ultimately fuels the growth of the e-commerce market globally.

E-commerce Market Assessment by Segment

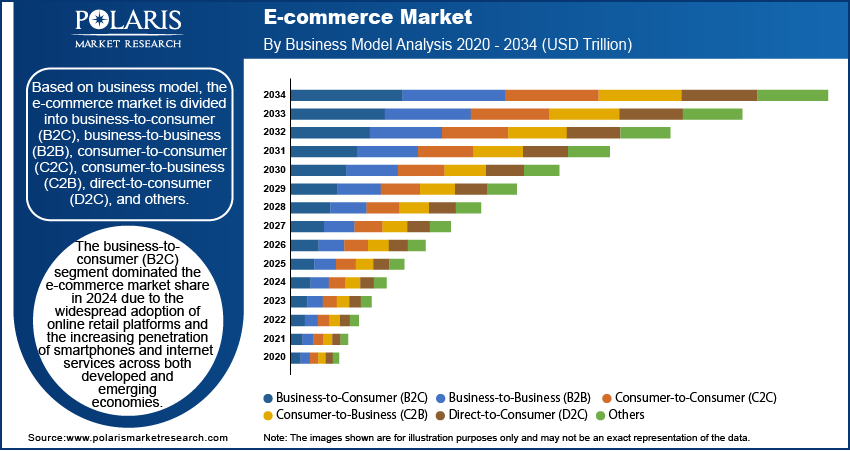

E-commerce Market Evaluation by Business Model

Based on business model, the e-commerce market is divided into business-to-consumer (B2C), business-to-business (B2B), consumer-to-consumer (C2C), consumer-to-business (C2B), direct-to-consumer (D2C), and others. The business-to-consumer (B2C) segment dominated the e-commerce market share in 2024 due to the widespread adoption of online retail platforms and the increasing penetration of smartphones and internet services across both developed and emerging economies. Consumers consistently turned to business-to-consumer online channels for a seamless and personalized shopping experience, driven by convenience, competitive pricing, and access to a wider product range that traditional retail does not offer. Major global players such as Amazon, Alibaba, and Walmart aggressively expanded their digital footprints, further strengthening the segment's dominance. Additionally, the proliferation of digital payment systems and advancements in delivery solutions significantly enhanced the efficiency and reliability of transactions, contributing to consumer trust and loyalty in the business-to-consumer (B2C) model.

E-commerce Market Insight by Product Category

In terms of product category, the e-commerce market is segregated into electronics & media, fashion & apparel, home & furniture, beauty & personal care, food & grocery, automotive, health & wellness, and others. The electronics & media hold a major e-commerce market share in 2024 due to high consumer demand for smartphones, laptops, smart home devices, and streaming services. The rapid pace of technological innovation encouraged frequent upgrades, while competitive pricing and seasonal online sales events such as Black Friday and Cyber Monday significantly boosted transaction volumes on e-commerce platforms. Major brands and retailers enhanced the digital shopping experience through virtual try-outs, augmented reality tools, and expert chat support, further fueling the growth of the segment. Moreover, the rising popularity of online gaming, digital books, and subscription-based media services contributed to sustained segment dominance.

The food & grocery segment is expected to grow at the fastest pace in the coming years, owing to urbanization, busier lifestyles, and a growing preference for contactless services. Retailers and service providers are optimizing delivery logistics, implementing advanced inventory management systems, and partnering with local suppliers to ensure speed, freshness, and product availability. The widespread adoption of app-based grocery platforms and the integration of AI-driven recommendation engines have made shopping more personalized and efficient, contributing to segment growth. Additionally, the expansion of quick commerce models that promise delivery within minutes has redefined consumer expectations, positioning food & grocery as a rising category in the evolving e-commerce market.

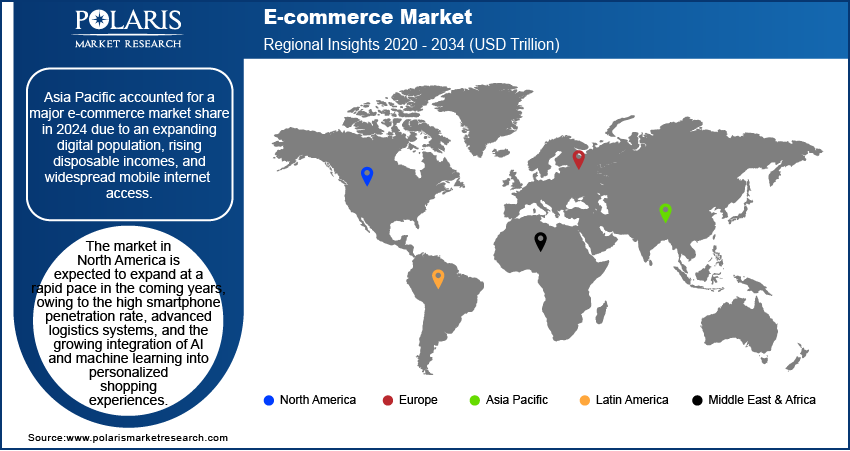

E-commerce Market Regional Outlook

By region, the e-commerce market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific accounted for a major e-commerce market share in 2024 due to an expanding digital population, rising disposable incomes, and widespread mobile internet access. Countries across the region witnessed accelerated digital transformation, with China leading the charge. China maintained its dominance due to a well-established digital infrastructure, massive consumer base, and the success of platforms such as Alibaba’s Taobao and JD.com. Local tech giants invested heavily in artificial intelligence, logistics automation, and mobile payment ecosystems, creating a seamless end-to-end online shopping experience, thereby propelling market growth. Additionally, government initiatives promoting digital inclusion, cross-border trade, and e-commerce platforms supported sustained e-commerce market expansion across the region. For instance, in April 2022, the government of India announced to launch open-source e-commerce platform to onboard 30 million sellers and 10 million merchants online while covering at least 100 cities and towns.

The market in North America is expected to expand at a rapid pace in the coming years, owing to the high smartphone penetration rate, advanced logistics systems, and the growing integration of AI and machine learning into personalized shopping experiences. For instance, Pew Research Center published a report in November 2024 stating that about 91% of Americans own a smartphone, including 5G smartphone, up from just 35% in 2011

Retailers in the US are actively investing in mobile-based e-commerce platforms and seamless app-based interfaces to improve user engagement and drive conversions. Moreover, the widespread adoption of digital wallets and one-click checkout solutions enhances convenience, contributing to a sharp increase in purchases from e-commerce platforms. E-commerce platforms in the region are estimated to be the first choice of consumers for the purchase of products as their expectations shift toward speed, personalization, and accessibility.

E-commerce Key Market Players & Competitive Analysis Report

The global e-commerce market is highly competitive, characterized by strategic mergers, acquisitions, partnerships, and collaborations. Key players in the market are trying to expand their market share and enhance their product portfolios. Amazon, the market leader, has aggressively pursued acquisitions such as Whole Foods to strengthen its grocery delivery segment and partnered with third-party sellers to diversify its offerings. Similarly, Walmart has boosted its e-commerce presence through acquisitions such as Jet.com and Flipkart, enhancing its digital capabilities and global reach. Alibaba leverages strategic partnerships, including collaborations with luxury brands and local retailers, to dominate Asia’s e-commerce market while investing in logistics and fintech to streamline operations. Additionally, tech giants are entering the market through partnerships to intensify competition. Companies in the market are increasingly focusing on AI-driven personalization, sustainability, and omnichannel strategies to retain customers. The e-commerce market remains dynamic, with mergers, acquisitions, and alliances shaping the future.

The e-commerce market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Alibaba.com; Amazon.com; ASOS; BigBasket; Costco Wholesale Corporation; Dangdang; eBay Inc.; FirstCry; JioMart; Lazada; Meesho; MercadoLibre S.R.L.; Nykaa; Shopee; Shopify; Tata CLiQ; Walmart; Wayfair LLC; and Zalando.

Amazon.com is a global e-commerce and technology giant, revolutionizing online retail since its founding in 1994. The company has grown into the world’s largest digital marketplace, offering millions of products across categories such as automotive electronics, apparel, and groceries. The company’s success is driven by its customer-centric approach, innovative logistics network, and Prime membership program, which provides fast shipping, streaming entertainment, and exclusive deals to over 200 million subscribers worldwide. Amazon’s fulfillment centers, powered by automation and artificial intelligence, enable efficient same-day and next-day deliveries. Additionally, Amazon supports third-party sellers, fostering a vast marketplace.

eBay Inc. is a global e-commerce pioneer, operating one of the world’s largest online marketplaces for buying and selling new and used goods. Founded in 1995, eBay revolutionized digital commerce by introducing an auction-style sales model. Unlike Amazon’s inventory-heavy approach, eBay functions primarily as a platform connecting buyers and sellers, offering a diverse range of products from electronics and fashion to collectibles and industrial equipment. The company differentiates itself with a focus on unique, rare, and refurbished items, attracting niche markets. Key features offered by eBay, like "Buy It Now," seller ratings, and buyer protection programs, enhance trust and convenience. eBay serves over 190 markets, with a significant presence in the US, UK, and Germany.

Key Companies in the E-commerce Market

- Alibaba.com

- Amazon.com, Inc.

- ASOS

- BigBasket

- Costco Wholesale Corporation

- Dangdang

- eBay Inc.

- FirstCry

- JioMart

- Lazada

- Meesho

- MercadoLibre S.R.L.

- Nykaa

- Shopee

- Shopify

- Tata CLiQ

- Walmart

- Wayfair LLC

- Zalando

E-commerce Market Developments

May 2025: Huawei eKit opened its first overseas e-commerce store on Shopee via a three-way partnership with Thai distributor AIOT, delivering network hardware to Southeast Asian SMEs with 24/7 virtual support and local warehousing.

April 2025: South Korean grocery player Kurly partnered with Naver to embed Naver Pay and live-commerce features, boosting Kurly’s unit economics while expanding Naver’s grocery range on its shopping platform.

February 2024: Wix.com Ltd. announced a strategic partnership with Global-e Online Ltd to facilitate cross-border eCommerce directly to consumers by offering Wix merchants an advanced international cross-border selling solution.

November 2023: Amazon signed a memorandum of understanding (MoU) with the West Bengal Industrial Development Corporation (WBIDC) to boost e-commerce exports from West Bengal.

October 2020: Carrefour, a multinational retailer, announced the launch of a new e-commerce platform to provide a unified experience for its millions of customers

E-commerce Market Segmentation

By Business Model Outlook (Revenue, USD Trillion, 2020-2034)

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Consumer-to-Consumer (C2C)

- Consumer-to-Business (C2B)

- Direct-to-Consumer (D2C)

- Others

By Product Category Outlook (Revenue, USD Trillion, 2020-2034)

- Electronics & Media

- Fashion & Apparel

- Home & Furniture

- Beauty & Personal Care

- Food & Grocery

- Automotive

- Health & Wellness

- Others

By Platform Type Outlook (Revenue, USD Trillion, 2020-2034)

- Web-based

- Mobile-based

- Others

By Payment Mode Outlook (Revenue, USD Trillion, 2020-2034)

- Digital Wallets

- Credit/Debit Cards

- Cash on Delivery (COD)

- Bank Transfers

- Others

By Regional Outlook (Revenue, USD Trillion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

E-commerce Market Report Scope

|

Report Attributes |

Details |

|

E-commerce Market Value in 2024 |

USD 30.64 Trillion |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 36.30 Trillion |

|

Revenue Forecast in 2034 |

USD 169.54 Trillion |

|

CAGR |

18.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Trillion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global e-commerce market size was valued at USD 30.64 trillion in 2024 and is projected to grow to USD 169.54 trillion by 2034.

The global market is projected to grow at a CAGR of 18.7% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are Alibaba.com; Amazon.com; ASOS; BigBasket; Costco Wholesale Corporation; Dangdang; eBay Inc.; FirstCry; JioMart; Lazada; Meesho; MercadoLibre S.R.L.; Nykaa; Shopee; Shopify; Tata CLiQ; Walmart; Wayfair LLC; and Zalando

The business-to-consumer (B2C) segment dominated the e-commerce market revenue in 2024.

The food & grocery segment is expected to grow at the fastest pace in the coming years.