Secure Logistics Market Share, Size, Trends, Industry Analysis Report

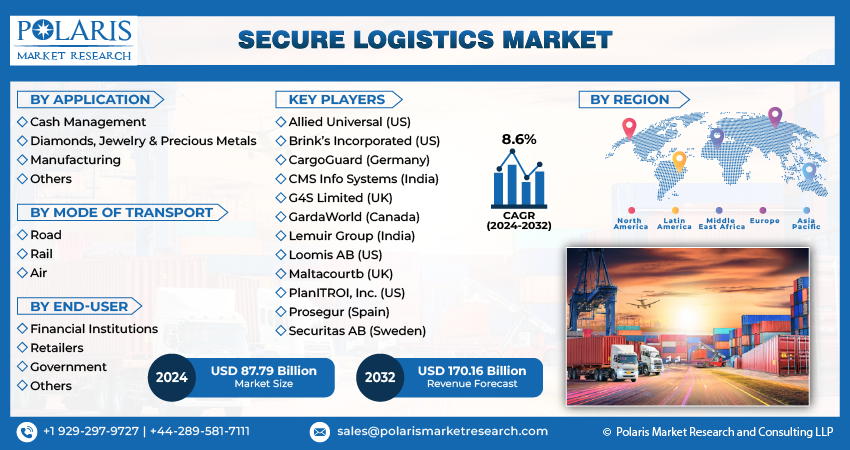

By Application (Cash Management, Diamonds, Jewelry & Precious Metals, Others); By Mode of Transport; By End-User; By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 119

- Format: PDF

- Report ID: PM4887

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

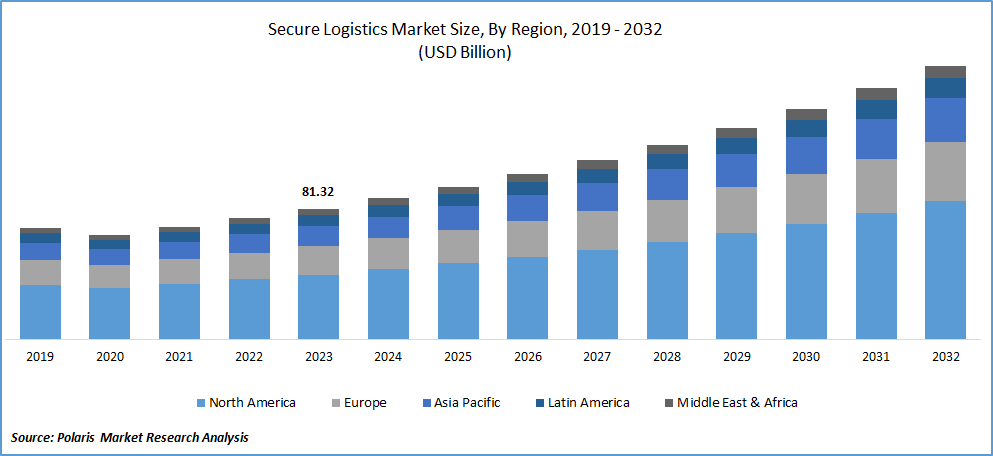

Secure Logistics Market size was valued at USD 81.32 billion in 2023. The market is anticipated to grow from USD 87.79 billion in 2024 to USD 170.16 billion by 2032, exhibiting the CAGR of 8.6% during the forecast period.

Market Overview

The growth of the secure logistics market is highly influenced by the increasing prevalence of cargo theft in the marketplace. Logistics operations are crucial in transiting goods from one place to another, which are gaining utility in international trade. Furthermore, the rising necessity for cash management tools with the establishment of ATMs (automated teller machines) is significantly boosting the demand for secure logistics. This is enforcing market players to develop efficient secure logistic operations tools and solutions in the marketplace along with the strategic expansion activities.

To Understand More About this Research:Request a Free Sample Report

For instance, in January 2024, Allied Universal, a security services provider, announced its plan to acquire J.E. Security Systems & Services Inc. with the aim of extending its global outreach of its security services.

Moreover, growing technological advancements in the global marketplace are altering the way businesses operate in multiple areas. The use of artificial intelligence and machine learning capabilities in logistic operations is gaining utility in extending security services in logistics management operations. For instance, in April 2023, GardaWorld introduced a hybrid security solution named Force Multiplier with a view to protecting the valuables of companies from theft by combining manned guarding and artificial intelligence technologies.

However, the prevalence of higher costs for secure logistics solutions and limited knowledge about the functioning of new security services are likely to lower the demand and growth of the global secure logistics market.

Growth Drivers

The Rising Incidence of Security Breaches

The growing demand for goods and services with the increasing disposable income is creating the need for specialized transport services. The presence of online purchase options with the e-commerce evolution is enabling people to buy valuables, such as mobiles, jewelry, and other products from their doorstep, which is grabbing attention from the criminals, leading to increased crime rates, specifically warehouse theft and unauthorized access. According to the G4S and Allied Universal’s World Security Report 2023, around USD 1 trillion revenue is being lost by the companies due to physical security incidents in 2022. Additionally, 25% of the publicly listed companies announced the loss of worth driven by security challenges. This trend is significantly supporting the need for use of effective secure logistic solutions to minimize the losses due to the theft.

Increasing Measures Taken by the Government to Promote Manufacturing

The growing government policies to support the production capacity and promote goods exports are anticipated to facilitate significant opportunities for the market growth in the study timeframe. For instance, in December 2023, the Commerce and Industry Ministry unveiled its strategy to enhance domestic manufacturing of goods, with a view to increase exports to USD 500 billion by 2030 from automobiles, textiles, pharma, and other.

Additionally, the increasing cases of unauthorized access to the inventory is encouraging companies to enhance their warehouse protection with the real-time streamlining technologies. According to CargoNet, the incidence of cargo thefts increased by more than 57% in 2023, in line with 2022. Further, around USD 130 million worth of goods have been robbed in 2023. The potential to protect companies from theft, damage, and unauthorized access to the goods is influencing the growth of the global secure logistics market.

Restraining Factors

The Use of Smart Phones for e-payment is Likely to Impede Market Growth

The growing usage of smart mobiles in the world is propelling the use of digital banking services, certainly lowering the demand for liquid cash in the marketplace, leading to the lower deployment of ATMs, in a way reduces the need for secure logistics. Based on the statistics of the Reserve Bank of India, the number of transactions through the unified payment interface (UPI) increased by 168%, reaching Rs 139 lakh crore in the financial year (FY) 2022-23 from Rs 1 lakh crore in FY 2017-18. However, the significant uptick in digital crimes is anticipated to alter the use of online payment to the traditional cash-based transactions, which will positively influence the secure logistics market growth in the study period.

Report Segmentation

The market is primarily segmented based on application, mode of transport, end-user, type, and region.

|

By Application |

By Mode of Transport |

By End-user |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Application Analysis

Cash Management Segment is Expected to Witness the Highest Growth During the Forecast Period

The cash management segment will grow rapidly, owing to growing development of ATMs. For instance, CMS Info Systems, a banking technology, and logistics provider announced the installation of over 17,500, which is more than 50% of ATMs in FY 23 compared to FY 22. As more ATMs are placed in the world, there will be a significant need for armored security along with advanced secure solutions.

Moreover, people around the world are showing significant interest in utilizing cash over online payment, credit card and debit cards, aiming to lower expenditure and promote money consciousness. According to the British Retail Consortium Survey 2023, among the people, around 19% of the consumption is made up of the use of cash and coins in 2022 from 15% in 2021, which is an initial growth in the past 10 years.

Diamonds, jewelry and precious metals segment led the market with a substantial revenue share in 2023, driven by growing purchasing power, with the increasing income levels among the consumers. According to the Gem & Jewellery Export Promotion Council, the diamond trade in India is projected to witness 20% growth in the consumption of diamonds in 2024 in line with the previous year due to the increasing demand for solitaires and small diamonds. This increasing trade in precious metals and jewelry is likely to facilitate a favorable market for secure logistics.

By Mode of Transport Analysis

Road Segment Accounted for the Largest Market share in 2023

The road segment held the substantial share. This dominance is due to the presence of well-established road infrastructure among the nations, with a view to promoting economic activities and limiting the costs to the companies involved in the logistic operations. For instance, the Indian finance ministry increased the funds for the Road Transport and Highways Ministry to Rs 1.68 lakh crore in 2024-2025 from the revised estimate of Rs 1.67 crore in the earlier year, which is aiming to build 13,813 km of highways in FY2024. These initiatives are encouraging manufacturing companies, cash management, and jewelry companies to adopt road transit over other expensive alternatives.

The air segment is expected to grow at the fastest rate because of the lower cost of transportation, leading to increased convenience and safety. The increasing efforts to improve the air cargo facility are likely to create demand for secure logistics during the study period. For instance, in May 2023, Swedavia announced the development of its new air cargo and logistics center covering 144,400 m2 in the Stockholm region.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share in the global market. This is driven by growing crimes in the region, specifically cyber fraud and theft. According to the U.S. Treasury Department subsidiary, Financial Crimes Enforcement Network, banks are witnessing 84% growth in the prevalence of check fraud in 2022. Furthermore, ATM crime in the United States increased by 600% from 2019 to 2022. This is accelerating the demand for secure logistics.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period. The growing technological advancements in the region, primarily in the banking and financial services industries, are driving the innovation of new security management solutions. For instance, in November 2023, FSS introduced artificial intelligence, machine learning, and Internet of Things-supported ATM sites to enhance ATM operations in Chennai, India, and limit 60% of ATM-related problems remotely.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The secure logistics market is fragmented. The growing security breaches and dynamic thefts are encouraging investments in the development of effective technologies for secure logistics solutions by major companies. The growing collaborations and acquisitions to gain a competitive advantage over others are boosting the competition in the global market. For instance, in July 2023, Loomis acquired Cima S.p.A. with an investment of EUR 132 million to expand its offering of automated solutions.

Some of the major players operating in the global market include:

- Allied Universal (US)

- Brink’s Incorporated (US)

- CargoGuard (Germany)

- CMS Info Systems (India)

- G4S Limited (UK)

- GardaWorld (Canada)

- Lemuir Group (India)

- Loomis AB (US)

- Maltacourtb (UK)

- PlanITROI, Inc. (US)

- Prosegur (Spain)

- Securitas AB (Sweden)

Recent Developments in the Industry

- In June 2023, Janssen Group of Companies, a logistics solutions provider, announced the acquisition of Maltacourt Global Logistics to promote its presence in the UK market.

Report Coverage

The secure logistics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, application, mode of transport, end-user, type, and their futuristic growth opportunities.

Secure Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 87.79 billion |

|

Revenue forecast in 2032 |

USD 170.16 billion |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Secure Logistics Market Allied Universal, Brink’s Incorporated, CargoGuard, CMS Info Systems (CMS), G4S Limited

Secure Logistics Market exhibiting the CAGR of 8.6% during the forecast period.

Secure Logistics Market report covering key segments are application, mode of transport, end-user, type, and region.

The key driving factors in Secure Logistics Market are the rising incidence of security breaches

Secure Logistics Market Size Worth $ 170.16 Billion By 2032