Peripheral Nerve Stimulators Market Size, Share, Trends, & Industry Analysis Report

By Product Type, By End User (Hospitals and Outpatient Centers), and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6496

- Base Year: 2024

- Historical Data: 2020-2023

Overview

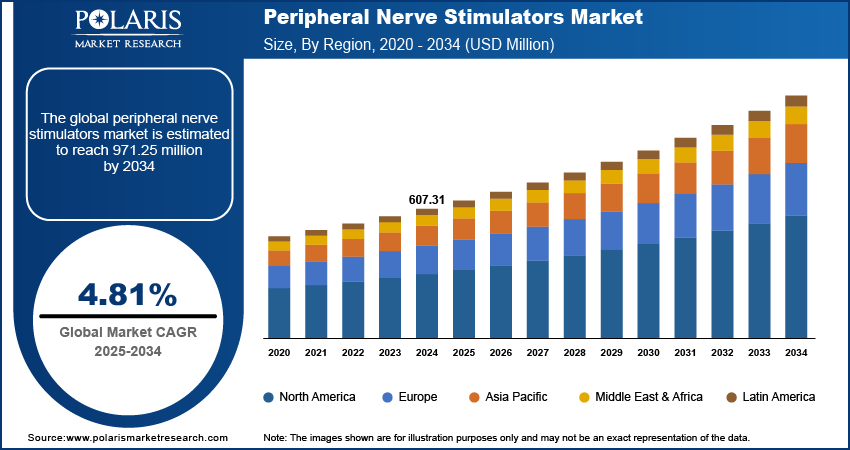

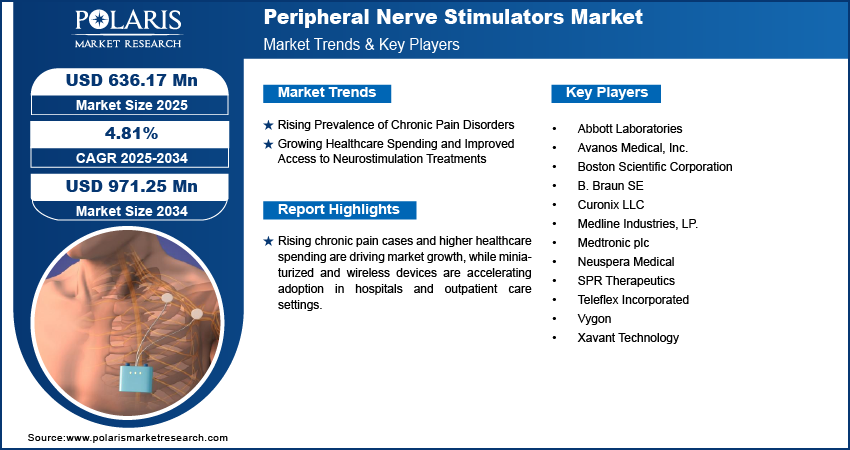

The peripheral nerve stimulators market was valued at USD 607.31 million in 2024 growing at a CAGR of 4.81% from 2025-2032. Growing chronic pain cases and rising healthcare spending in emerging markets are driving demand for peripheral nerve stimulators.

Key Insights

- The implantable segment led in 2024 with the highest clinical adoption and long-term performance.

- The outpatient centers segment expected to expand the fastest with the growth of minimally invasive procedures and portable devices.

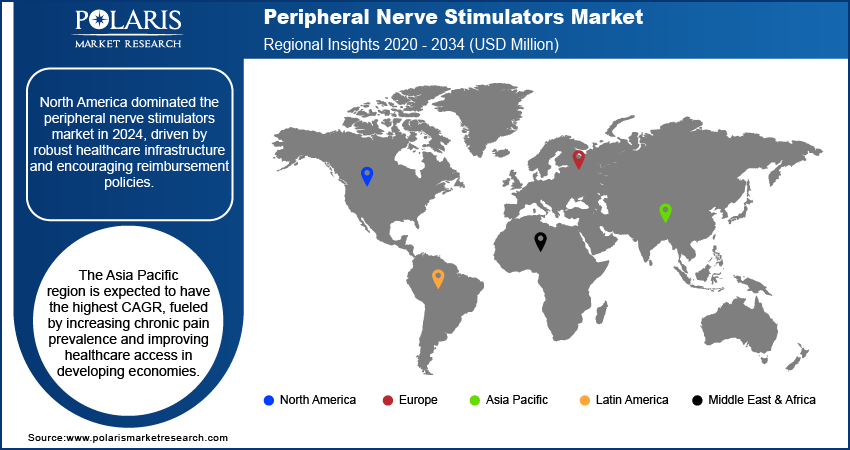

- North America dominated the global market in 2024 through advanced healthcare infrastructure and chronic pain prevalence.

- The U.S. dominated North America with strong hospital networks and favorable reimbursement policies.

- Asia Pacific growing at fastest CAGR with the growth of increasing cases of chronic pain and improving access to healthcare.

- China held dominating position in Asia Pacific due to increasing healthcare expenditure and government support for advanced medical devices.

Industry Dynamics

- Rising prevalence of chronic pain disorders is increasing the demand for peripheral nerve stimulation therapies.

- Growing healthcare spending and improved access to neurostimulation treatments in emerging markets are driving market growth.

- High implantation and maintenance costs continue to restrain the adoption of peripheral nerve stimulators.

- Growing uses in neuropathic and post-operative pain treatment creates opportunity for the market.

Market Statistics

- 2024 Market Size: USD 607.31 Million

- 2034 Projected Market Size: USD 971.25 Million

- CAGR (2025-2034): 4.81%

- North America: Largest Market Share

Peripheral nerve stimulators (PNS) are implantable or wearable devices that are used to treat chronic pain by sending mild electrical impulses to specific peripheral nerves. They reduce the transmission of pain signals to the brain and provide a useful alternative treatment compared to opioid therapies.

Growing incidence of chronic pain diseases and rising healthcare expenditure in emerging markets are driving the use of nerve stimulation therapies. Device manufacturers are working towards creating miniaturized, wireless, and rechargeable devices to provide real time patient comfort and treatment results. In September 2025, Nervonik completed preclinical tests showing its PNS system that sense neural activity in real time, improving therapy precision and patient outcomes.

Healthcare providers across regions are integrating peripheral nerve stimulation into multidisciplinary pain management programs to reduce opioid dependency and improve patient quality of life. Top industry players are building out their R&D pipelines and partnering with hospitals to develop next-generation neurostimulation systems integrating AI-based monitoring and closed-loop feedback for enhanced clinical outcomes.

Drivers & Opportunity

Rising Prevalence of Chronic Pain Disorders: The increasing prevalence of chronic pain disorders like neuropathic pain, lower back pain, and post-surgical pain is propelling the use of peripheral nerve stimulation treatments. Based on World Health Organization (WHO) statistics, low back pain afflicted 619 million individuals globally in 2020, and the number is predicted to grow to 843 million by 2050 based on population growth and aging. Patients and practitioners are increasingly moving towards minimally invasive and non-opioid options to effectively control chronic pain. This growth has contributed to increasing use of implantable and external nerve stimulators in hospitals and specialist pain clinics, facilitating steady market expansion in developed and emerging countries.

Growing Healthcare Spending and Improved Access to Neurostimulation Treatments: Increasing healthcare budgets, broader insurance coverage, and enhanced access to advanced medical technology are favoring adoption across emerging markets. Indian Economic Survey 2024-25 estimates India's public expenditure on health at 1.9% of GDP in FY26 and the government has allocated USD 1.08 billion under PMJAY in FY26, a growth of 28.8% over FY25. Asia Pacific and Latin American nations are seeing better investment in pain management facilities, enabling hospitals to provide peripheral nerve stimulation as part of the broader care packages. Furthermore, support from governments encouraging advanced medical devices and heightened awareness among patients are also supporting market growth.

Segmental Insights

Product Type Analysis

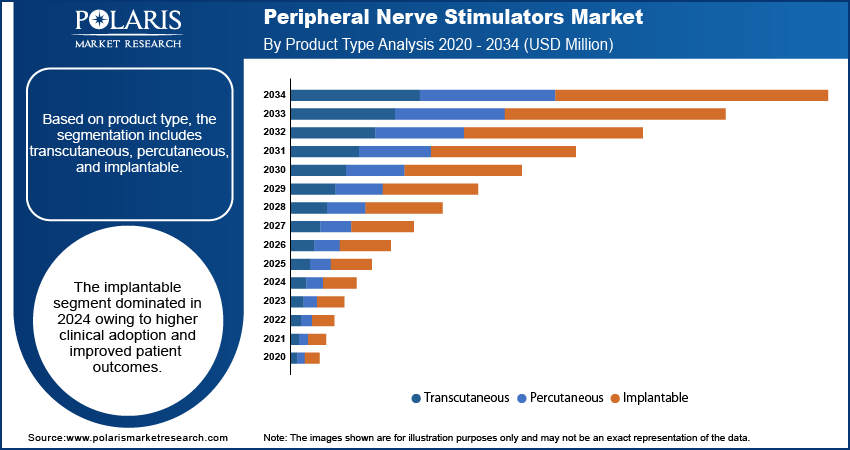

Based on product type, the segmentation includes transcutaneous, percutaneous, and implantable. The implantable segment led the market in 2024 due to its established long-term effectiveness and increasing clinical favor for chronic pain treatment. Furthermore, technology advances in miniaturized implants and rechargeable battery systems are improving patient comfort and procedural success, facilitating ongoing adoption in specialized pain centres.

The percutaneous segment is expected to advance at the highest CAGR through the forecast period on account of its minimally invasive nature and reduced recuperation periods. In addition, the increasing use of ultrasound-guided implantation techniques is improving procedural precision and expanding adoption among outpatient pain management facilities.

End User Analysis

Based on end user, the segmentation includes hospitals and outpatient centers. The hospital segment held the market share in 2024, with the presence of advanced surgical facilities and specialty neurology departments contributing to it. In addition, rising hospital-based clinical trials and usage of neurostimulation devices for chronic pain treatment are enhancing their status as primary treatment centers.

The outpatient centers market is expected to exhibit the highest CAGR over the forecast period owing to the increasing demand for minimally invasive procedures and lower hospitalization costs. Moreover, enhanced reimbursement policies and accessibility of transportable PNS systems are fueling uptake in ambulatory care settings.

Regional Analysis

North America dominated the market for peripheral nerve stimulators owing to excessive cases of chronic pain disorders and robust adoption of advanced neuromodulation devices in the U.S. and Canada. Moreover, favorable reimbursement frameworks and continuous clinical research are strengthening regional growth.

The U.S. Peripheral Nerve Stimulators Market Insights

The U.S. expanding rapidly in the peripheral nerve stimulators market owing to growing aging population and increasing preference for non-opioid pain management therapies. In addition, strong regulatory support for innovative neurostimulation technologies and extensive hospital networks are fostering higher product utilization. For instance, in August 2025, Bioventus received FDA clearance for two PNS devices, TalisMann and StimTrial to improve chronic pain treatment and enable patient response trials.

Asia Pacific Peripheral Nerve Stimulators Market Insights

Asia Pacific is the fastest growing market driven by rising chronic pain prevalence and improving healthcare infrastructure in countries such as China, Japan, and India. Furthermore, increasing medical tourism and government incentives for advanced treatments are speeding up market uptake.

China Peripheral Nerve Stimulators Market Insights

China is witnessing rapid peripheral nerve stimulators adoption due to expanding healthcare expenditure and increasing awareness of non-invasive pain therapies. As per the Chinese National Health Commission (NHC), China’s 2024 healthcare reforms include bulk procurement of 500 drugs, pilot price reforms in three provinces, 5,500 hospitals offering “one-stop” services, and 3,000 institutions providing online medical care. Furthermore, local manufacturers are making investments in low-cost neurostimulation technologies, enhancing device affordability and fostering widescale adoption among hospital and ambulatory care centers.

Europe Peripheral Nerve Stimulators Market Insights

Europe holds the substantial share in the peripheral nerve stimulators market driven by early adoption of implantable neurostimulation systems across Germany, the UK, and France. Moreover, rising healthcare investments and collaborative clinical studies are pushing the use of advanced pain management solutions across the region.

Key Players & Competitive Analysis Report

The peripheral nerve stimulators market is moderately competitive with players concentrating on creating advanced implantable and external stimulation systems. Furthermore, investments in artificial intelligence supported neuromodulation, integration of wireless devices, and partnership with hospitals and pain centers are enhancing clinical efficiency, patient access, and geographic reach.

Major companies operating in the peripheral nerve stimulators market are Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, B. Braun SE, Medline Industries, LP., Curonix LLC, SPR Therapeutics, Avanos Medical, Inc., Teleflex Incorporated, Curonix LLC, Xavant Technology, Vygon, and Neuspera Medical.

Key Players

- Abbott Laboratories

- Avanos Medical, Inc.

- Boston Scientific Corporation

- B. Braun SE

- Curonix LLC

- Medline Industries, LP.

- Medtronic plc

- Neuspera Medical

- SPR Therapeutics

- Teleflex Incorporated

- Vygon

- Xavant Technology

Industry Development

- August 2025: Nalu Medical introduced a 39% smaller and lighter Therapy Disc for its wearable neurostimulation system, enhancing patient comfort and expanding treatment options for chronic pain through peripheral nerve stimulation.

- July 2025: Bioventus received FDA clearance for two next-generation PNS devices, TalisMann and StimTrial, to expand its chronic pain management offerings.

- April 2023: Neuspera Medical received FDA clearance for its ultra-miniaturized, wireless PNS system, designed to treat chronic nerve pain with greater comfort and flexibility.

Peripheral Nerve Stimulators Market Segmentation

By Product Type (Revenue, USD Million, 2020–2034)

- Transcutaneous

- Percutaneous

- Implantable

By End User (Revenue, USD Million, 2020–2034)

- Hospitals

- Outpatient Centers

By Region (Revenue, USD Million, 2020–2034)

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Latin America

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of South Africa

Peripheral Nerve Stimulators Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 607.31 Million |

|

Market Size in 2025 |

USD 636.17 Million |

|

Revenue Forecast by 2034 |

USD 971.25 Million |

|

CAGR |

4.81% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2025-2034 |

|

Forecast Period |

2025-2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

FAQ's

The global market size was valued at USD 607.31 million in 2024 and is projected to grow to USD 971.25 million by 2034.

The global market is projected to register a CAGR of 4.81% during the forecast period.

North America dominated the peripheral nerve stimulators market in 2024 due to a high prevalence of chronic pain disorders and advanced healthcare infrastructure.

A few of the key players in the market are Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, B. Braun SE, Medline Industries, LP., Curonix LLC, SPR Therapeutics, Avanos Medical, Inc., Teleflex Incorporated, Curonix LLC, Xavant Technology, Vygon, and Neuspera Medical.

The implantable segment dominated in 2024 due to long-term efficacy and growing clinical preference for chronic pain management.

The outpatient centers segment projected to expand at the highest rate with the lead taken by minimally invasive treatments and increasing use of portable neurostimulation systems.