Ethernet Test Equipment Market Size, Share, Trends, Industry Analysis Report

By Type (10G Test Equipment, 25/40G Test Equipment), By Function, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6494

- Base Year: 2024

- Historical Data: 2020-2023

Overview

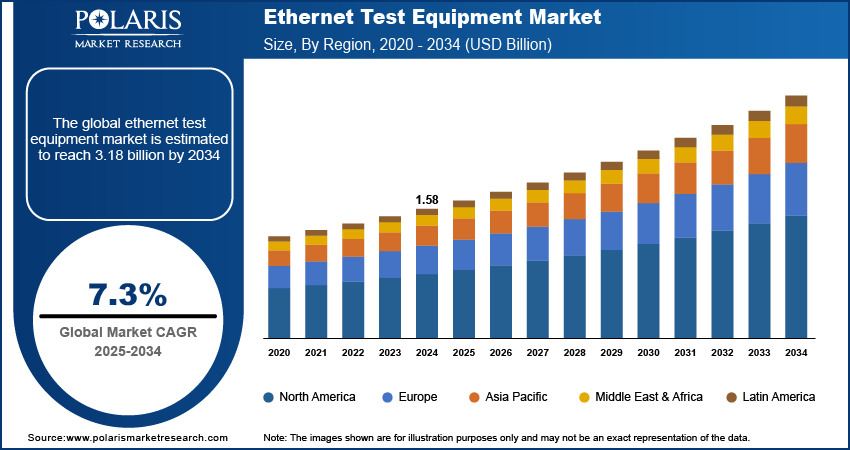

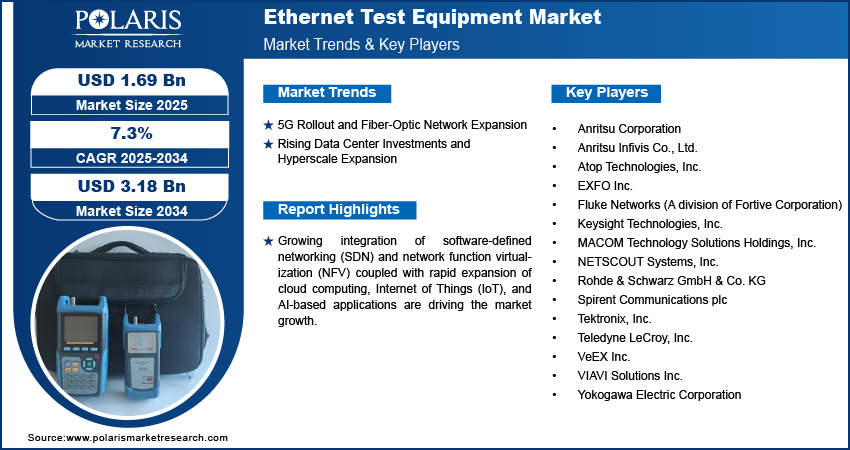

The global ethernet test equipment market size was valued at USD 1.58 billion in 2024, growing at a CAGR of 7.3% from 2025 to 2034. 5G rollout and fiber-optic network expansion along with rising data center investments and hyperscale expansion is propelling the market growth.

Key Insights

- 100G test tools led the market in 2024, fueled by increasing adoption of high-speed Ethernet networks within data centers and telco infrastructure.

- Manufacturing testing held dominating share, driven by the upsurge in Ethernet component, switch, and transceiver production.

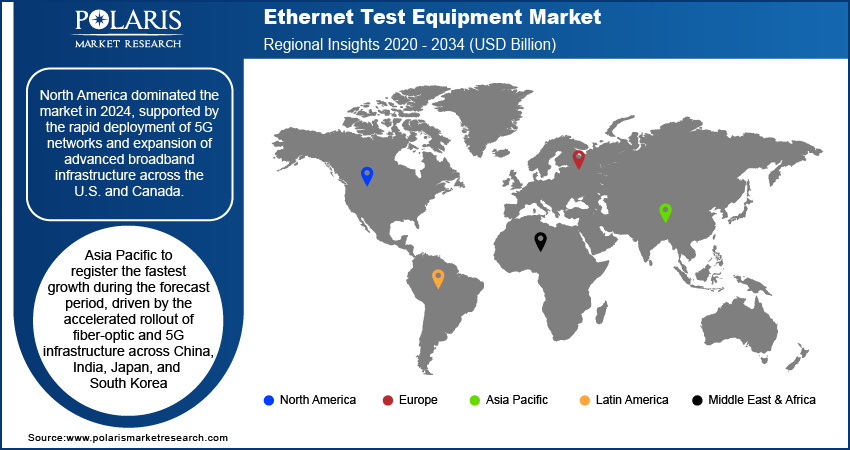

- North America contributed large market share in 2024, supported by accelerated deployment of 5G networks and enhancement of high-end broadband infrastructure in the US and Canada.

- The U.S. dominated the North American market, driven by top tech players spreading out data center and cloud infrastructure.

- Asia Pacific is anticipated to grow at a rapid pace, fueled by rapid deployment of fiber-optic and 5G networks in China, India, Japan, and South Korea.

- India led the market in Asia Pacific, propelled by enhanced investment in smart city and IoT infrastructure through government programs.

- Key players operating in the market include Anritsu Corporation, Anritsu Infivis Co., Ltd., Atop Technologies, Inc., EXFO Inc., Fluke Networks (a division of Fortive Corporation), Keysight Technologies, Inc., MACOM Technology Solutions Holdings, Inc., NETSCOUT Systems, Inc., Rohde & Schwarz GmbH & Co. KG, Spirent Communications plc, Tektronix, Inc., Teledyne LeCroy, Inc., VeEX Inc., VIAVI Solutions Inc., and Yokogawa Electric Corporation.

Industry Dynamics

- 5G deployment and fiber expansion are fueling demand for high-end Ethernet test tools in telecom and enterprise networks.

- Growth in data center investment and hyperscale growth is driving the demand for high-speed testing solutions.

- High cost of equipment is restraining the market adoption among small businesses and emerging economies.

- AI-powered automation of testing offers compelling opportunities through predictive maintenance, smart traffic analysis, and adaptive network optimization.

Market Statistics

- 2024 Market Size: USD 1.58 Billion

- 2034 Projected Market Size: USD 3.18 Billion

- CAGR (2025–2034): 7.3%

- North America: Largest Market Share

The ethernet test equipment market includes sophisticated devices and equipment to measure, analyze, and confirm the performance of Ethernet networks in different applications. These devices are extensively utilized across telecommunications, data centers, and business networks to guarantee speed, reliability, and conformance with increasing standards. Ongoing innovation in high-speed testing of Ethernet, automation, and cloud-based analytics is enhancing precision and operational efficiency.

The increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) is driving robust demand for flexible and scalable ethernet test platforms. These technologies necessitate highly flexible testing solutions that validate intricate, dynamic, and programmable network environments.

Rising adoption of cloud computing, Internet of Things (IoT), and applications based on artificial intelligence (AI) is fueling the demand for sophisticated network testing capabilities. As per IoT Analytics' State of IoT Summer 2024 report, connected IoT devices numbered 16.6 billion as of the end of 2023, representing a 15% growth from 2022. This hyper-connectivity is compelling network operators and businesses to adopt high-capacity Ethernet test tools to manage higher levels of data traffic and provide low latency in connected ecosystems.

Drivers & Opportunities

5G Rollout and Fiber-Optic Network Expansion: Global 5G deployment and fiber-optic network expansion are increasing the demand for high-accuracy Ethernet test gear. According to a 5G America report, global 5G connections totaled 1.76 billion by 2023, a year-over-year increase of 66%, and are expected to hit 7.9 billion by 2028. The mass deployment of next-generation networks boosts the need for sophisticated test platforms that measure bandwidth, latency, and signal quality in next-generation communication environments.

Rising Data Center Investments and Hyperscale Expansion: The increasing proliferation of data centers and hyperscale facilities is fueling demand for ongoing network monitoring and performance optimization solutions. In July 2025, Google announced USD 6 billion investment to develop a 1-gigawatt data center and power infrastructure in Andhra Pradesh, India, marking intensified data center construction in emerging economies. These centers rely on high-performance ethernet test equipment to ensure uptime, improve throughput, and accommodate the growing data burden fueled by cloud and AI workloads.

Segmental Insights

By Type

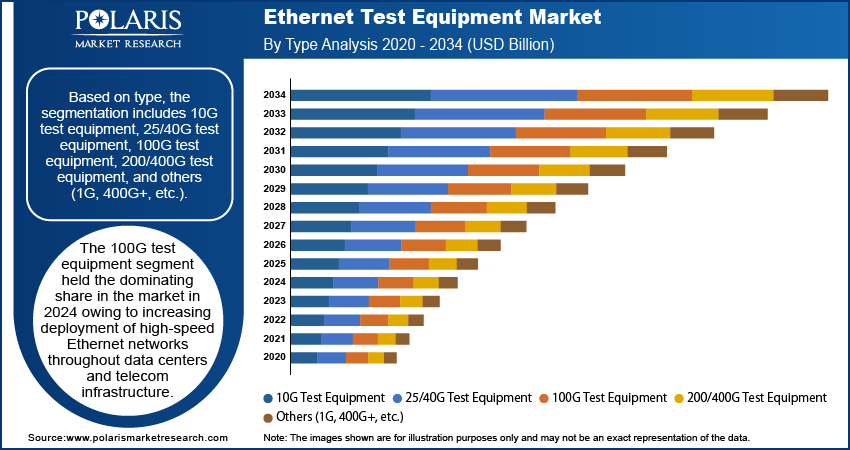

Based on type, the ethernet test equipment market is divided into 10G test equipment, 25/40G test equipment, 100G test equipment, 200/400G test equipment, and others (1G, 400G+, etc.). The 100G test equipment segment held the dominating share in the market in 2024 owing to increasing deployment of high-speed Ethernet networks throughout data centers and telecom infrastructure.

The 200/400G test equipment market is expected witness rapid growth in the forecast period, driven by increasing hyperscale data center adoption and bandwidth demand for supporting cloud computing and 5G networks.

By Function

On the basis of function, the market is divided into installation & certification testing, manufacturing testing, research & development testing, and monitoring & troubleshooting. Installation & certification testing captured a largest share in 2024 due to the growing demand for network validation, conformity, and performance verification in infrastructure rollouts.

The manufacturing test segment is anticipated to grow at a fast pace due to the booming production of ethernet components, switches, and transceivers.

By End Use

Based on end use, the ethernet test equipment market is classified into telecommunications, data centers, cloud service providers, enterprises, government & defense, and others. The telecommunications segment dominated the market in 2024 driven by large-scale deployment of 5G networks, fiber-optic backhaul systems, and broadband expansion initiatives.

Data centers are anticipated to witness strong growth during the forecast period, driven by growing virtualization, high-speed interconnects, and scalable infrastructure needs.

Regional Analysis

North America leads the ethernet test equipment market, driven by the swift rollout of 5G networks and growth of next-generation broadband infrastructure in the US and Canada. Increasing investments in network performance monitoring tools, testing solutions, and network automation are assisting telecom operators and businesses to enhance the reliability of networks and operational efficiency.

The U.S. Ethernet Test Equipment Market Overview

The U.S. led the market in North America, driven by expanding data center and cloud infrastructure led by major technology players. In October 2025, Google announced a USD 9 billion investment in South Carolina through 2027 to expand its Berkeley County data center campus and develop two additional facilities in Dorchester County. This mass investment supports the nation's increasing position as a center of digital infrastructure, fueling demand for high-speed ethernet test solutions to provide reliable connectivity and uptime.

Asia Pacific Ethernet Test Equipment Market Insights

Asia Pacific is expected to witness rapid growth over the forecast period, led by the expansion of fiber-optic and 5G infrastructure in China, India, Japan, and South Korea. The growing data center infrastructure and growing adoption of cloud computing and IoT applications are also fueling demand for sophisticated Ethernet testing and certification solutions.

India Ethernet Test Equipment Market Analysis

India is leading the market in Asia Pacific, due to increasing spending on smart city and IoT infrastructure under government initiatives. As part of Union Budget 2024–25, USD 19.67 billion was allocated to the smart cities mission, with 93% of 8,062 projects completed by March 2025. This rapid development in digital and urban infrastructure is fueling demand for Ethernet test equipment to enable mass-scale network rollout.

Europe Ethernet Test Equipment Market Assessment

Europe held significant market share due to increasing emphasis on network modernization and digitalization across businesses and telecom operators. Strong 5G availability in Q2 2025 was reported by Nordic and Southern European nations, led by large 700 MHz band deployments, which supported double-digit coverage increases in nations such as Sweden and Italy. Additionally, the ongoing rollout of FTTH and 5G infrastructure in key EU countries continues to boost the local demand for ethernet test equipment and verification tools.

Key Players & Competitive Analysis

The global market for ethernet test equipment is experiencing intense competition, driven by rapid developments in high-speed network technologies and continuing digitization across sectors. Market leaders are focusing on the creation of next-gen testing products that will support 400G, 800G, and future terabit ethernet applications. Firms are expanding their portfolios with automated, portable, and software-based testing systems to provide better network performance, reliability, and interoperability in a variety of environments. Growing demand for testing in data centers, 5G backhaul validation, and enterprise network optimization is also driving the market.

Key players in the global ethernet test equipment market include Anritsu Corporation, Anritsu Infivis Co., Ltd., Atop Technologies, Inc., EXFO Inc., Fluke Networks (a division of Fortive Corporation), Keysight Technologies, Inc., MACOM Technology Solutions Holdings, Inc., NETSCOUT Systems, Inc., Rohde & Schwarz GmbH & Co. KG, Spirent Communications plc, Tektronix, Inc., Teledyne LeCroy, Inc., VeEX Inc., VIAVI Solutions Inc., and Yokogawa Electric Corporation.

Key Players

- Anritsu Corporation

- Anritsu Infivis Co., Ltd.

- Atop Technologies, Inc.

- EXFO Inc.

- Fluke Networks (A division of Fortive Corporation)

- Keysight Technologies, Inc.

- MACOM Technology Solutions Holdings, Inc.

- NETSCOUT Systems, Inc.

- Rohde & Schwarz GmbH & Co. KG

- Spirent Communications plc

- Tektronix, Inc.

- Teledyne LeCroy, Inc.

- VeEX Inc.

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Ethernet Test Equipment Industry Developments

In August 2025, Spirent Communications partnered with Telescent Inc. to integrate automated optical switching with its Velocity test lab portfolio, boosting Ethernet test automation and efficiency across AI/ML labs, data centers, and enterprise networks.

In March 2025, Keysight Technologies introduced the Interconnect and Network Performance Tester 1600GE, a compact platform for validating Ethernet devices from 200GE to 1600GE, enabling faster, more efficient testing for AI and data center networks.

Ethernet Test Equipment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- 10G Test Equipment

- 25/40G Test Equipment

- 100G Test Equipment

- 200/400G Test Equipment

- Others (1G, 400G+, etc.)

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Installation & Certification Testing

- Manufacturing Testing

- Research & Development Testing

- Monitoring & Troubleshooting

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Telecommunications

- Data Centers

- Cloud Service Providers

- Enterprises

- Government & Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ethernet Test Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.58 Billion |

|

Market Size in 2025 |

USD 1.69 Billion |

|

Revenue Forecast by 2034 |

USD 3.18 Billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.58 billion in 2024 and is projected to grow to USD 3.18 billion by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Anritsu Corporation, Anritsu Infivis Co., Ltd., Atop Technologies, Inc., EXFO Inc., Fluke Networks (a division of Fortive Corporation), Keysight Technologies, Inc., MACOM Technology Solutions Holdings, Inc., NETSCOUT Systems, Inc., Rohde & Schwarz GmbH & Co. KG, Spirent Communications plc, Tektronix, Inc., Teledyne LeCroy, Inc., VeEX Inc., VIAVI Solutions Inc., and Yokogawa Electric Corporation.

The 100G test equipment segment dominated the market revenue share in 2024

The manufacturing testing segment is projected to witness the fastest growth during the forecast period.