Extrusion Machinery Market Size, Share, Trends, Industry Analysis Report

By Material (Plastics, Metal, and Others), By Type, By End-Use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6495

- Base Year: 2024

- Historical Data: 2020-2023

Overview

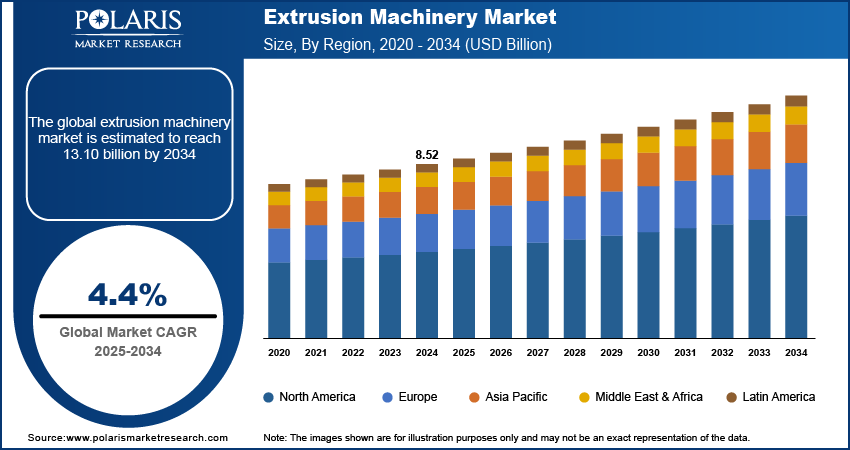

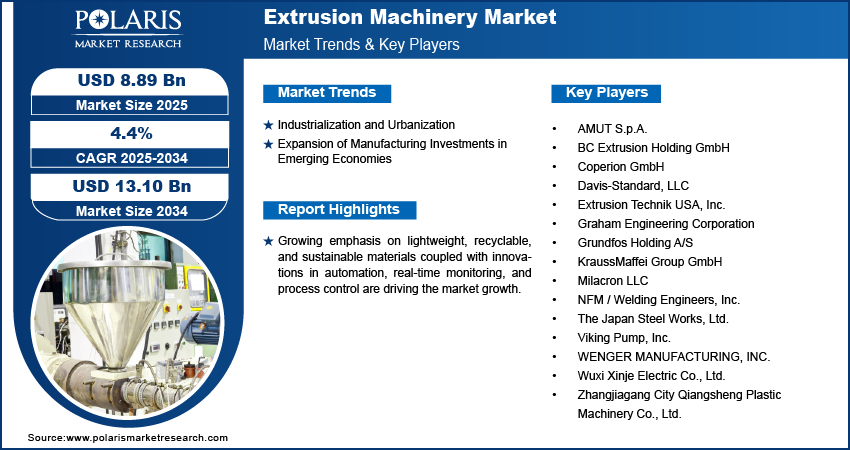

The global extrusion machinery market size was valued at USD 8.52 billion in 2024, growing at a CAGR of 4.4% from 2025 to 2034. Industrialization and urbanization coupled with expansion of manufacturing investments in emerging economies is propelling the market growth.

Key Insights

- Plastics dominated the market in 2024, led by increasing plastic component demand in packaging, construction, and automotive industries.

- Single-screw extrusion machinery led the market share, driven by its simplicity, flexibility, and economical production of normal plastic profiles, sheets, and films.

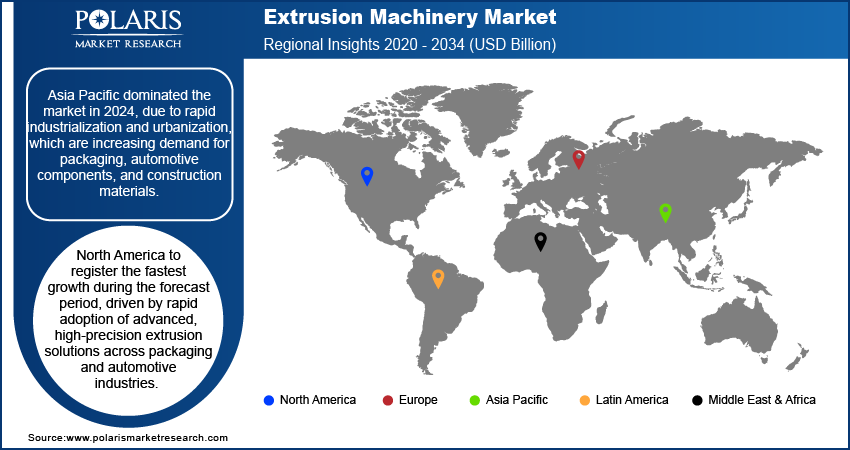

- Asia Pacific dominated the global market in 2024, driven by fast industrialization, urbanization, and the growth of manufacturing bases in China, India, and Southeast Asia.

- India played a major role in regional development, driven by increasing investments in packaging, automobile, and construction sectors demanding high-volume extrusion manufacturing.

- North America expected to grow at a high rate, fueled by the use of sophisticated, high-accuracy extrusion equipment in packaging, automotive, and consumer goods sectors.

- The U.S. led the North America market due to upgradation of production plants, integration of automation, and increased demand for high-quality extruded products.

- Key players operating in the market include AMUT S.p.A., BC Extrusion Holding GmbH, Coperion GmbH, Davis-Standard, LLC, Extrusion Technik USA, Inc., Graham Engineering Corporation, Grundfos Holding A/S, KraussMaffei Group GmbH, Milacron LLC, NFM / Welding Engineers, Inc., The Japan Steel Works, Ltd., Viking Pump, Inc., WENGER MANUFACTURING, INC., Wuxi Xinje Electric Co., Ltd., and Zhangjiagang City Qiangsheng Plastic Machinery Co., Ltd.

Industry Dynamics

- Industrialization and urbanization continue to fuel demand for extrusion equipment in the manufacturing, construction, and packaging sectors.

- Expansion of manufacturing investments in emerging economies is boosting installation of advanced extrusion systems to meet rising production needs.

- Operational and maintenance costs are still major constraints, with machines needing skilled labor, constant maintenance, and high-power consumption.

- Cloud-connected and IoT-enabled systems are creating market opportunities with remote monitoring, process optimization, and predictive maintenance, improving productivity and decreasing downtime.

Market Statistics

- 2024 Market Size: USD 8.52 Billion

- 2034 Projected Market Size: USD 13.10 Billion

- CAGR (2025–2034): 4.4%

- Asia Pacific: Largest Market Share

The extrusion equipment market includes strong and accurate devices used to form materials like plastics, metals, and composites into constant profiles that are utilized for industrial purposes. They are extensively utilized across packaging, automotive, construction, and consumer goods industries to provide consistency, efficiency, and maximum production levels. Innovations in automation, energy efficiency, and modular configurations are improving the operation performance and material wastage.

Increasing focus on light-weight, recyclable, and green materials is fueling the use of extrusion equipment, in automotive and packaging applications. Industry makers are increasingly seeking to substitute traditional materials with plastics and polymers that are lighter in weight and similar in strength and durability.

Advancement in automation, real-time monitoring, and process control are optimizing operating efficiency and minimizing downtime in extrusion processes. In April 2025, Bausano, launched the E-GO R series of single-screw extruders at the GREENPLAST exhibition in Milan. The systems are designed to enhance recycling efficiency for polyolefins like HDPE, LDPE, and PP, obtained from industrial and post-consumer waste, keeping pace with the increased interest in circular economy programs.

Drivers & Opportunities

Industrialization and Urbanization: High industrial production and rapid global urbanization are driving high demand for extrusion equipment-made products, such as plastics, polymers, and metals. The UN estimates that 55% of the world's population resides in cities with projection to reach 68% by 2050. This shift is driving infrastructure growth and manufacturing, thus increasing the demand for extrusion systems.

Expansion of Manufacturing Investments in Emerging Economies: Increasing investments in manufacturing units in emerging economies are boosting the use of advanced, high-capacity extrusion equipment. In India, manufacturing sector FDI crossed USD 165.1 billion during the last decade under production-linked incentive (PLI) programs, rising by 69% over the decade. During the last five years, overall FDI inflows totalled USD 383.5 billion, which helped in the modernization of manufacturing assets and increasing the demand for higher-end extrusion systems.

Segmental Insights

By Material

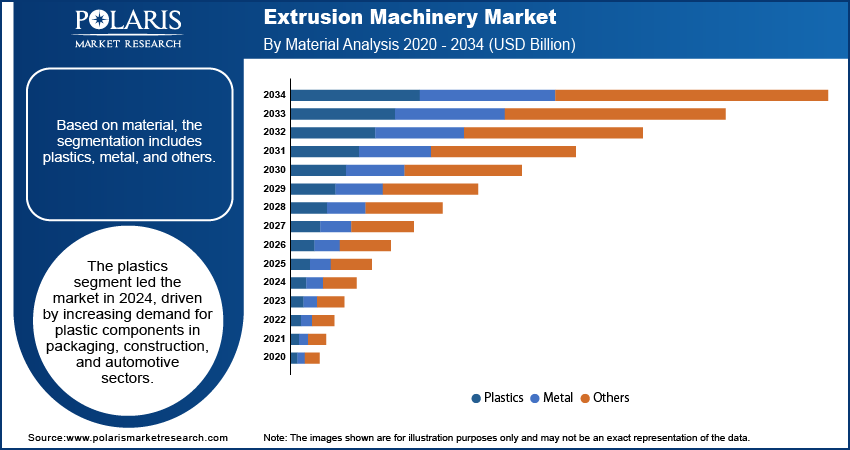

On the basis of material, the extrusion machinery market is categorized into plastics, metal, and others. The plastics segment led the market in 2024, driven by increasing demand for plastic components in packaging, construction, and automotive sectors.

Metal extrusion machinery is anticipated to experience steady growth over the forecast period, due to growing production of aluminum and steel components for automotive, aerospace, and construction uses.

By Type

Based on type, the market is divided into single-screw, twin-screw, and others. Single-screw extrusion equipment accounted for a significant share in 2024 due to its simplicity, versatility, and cost advantage in manufacturing generic plastic profiles and sheets.

Twin-screw extrusion equipment anticipated to grow at a rapid pace over the forecast period driven by its effective mixing, high output, and application for compounding, reactive extrusion, and specialty polymer applications.

By End-Use

On the basis of end-use, the market for extrusion machinery is divided into construction, consumer goods, automotive, packaging, and others. The construction segment dominated the market in 2024, due to high demand for pipes, profiles, and insulation materials used in residential and commercial construction.

The packaging sector is expected to register robust growth during the forecast period due to increasing use of flexible and green packaging solutions.

Regional Analysis

Asia Pacific dominates the global extrusion machinery market, driven by fast-paced industrialization and urbanization, which is raising demand for packaging, automotive parts, and construction materials. Plastic and polymer-based manufacturing clusters expanding in China, India, and Southeast Asia are also promoting machinery use.

China Extrusion Machinery Market Overview

China dominated the Asia Pacific market share with increasing exports of consumer products, giving rise to a demand for high-volume extrusion manufacturing. China's total imports and exports stood at USD 854 billion in 2023, with exports totaling USD 3.44 trillion, an increase of 0.6% year over year, according to customs data. Such robust manufacturing activity is promoting demand for advanced, high-performance extrusion equipment.

North America Extrusion Machinery Market Insights

North America is anticipated to grow at a fast rate over the forecast period, due to the rapid growth of sophisticated, high-precision extrusion equipment in packaging and automotive sectors. Firms are more frequently incorporating twin-screw, co-extrusion, and automated systems to enhance productivity and ensure uniformity of product quality.

The U.S. Extrusion Machinery Market Analysis

The U.S. is leading the North America market, owing to the rising construction and infrastructure activities are driving demand for plastic pipes, profiles, and other extruded parts. In January 2025, the U.S. government announced private sector investment of up to USD 500 billion into infrastructure projects for AI and intelligent technologies, indirectly boosting expansion in industrial equipment, including extrusion machinery.

Europe Extrusion Machinery Market Assessment

Europe held significant market share driven by strong emphasis on green and recyclable materials, fueling demand for enhanced extrusion technologies. Organizations are adopting automation, real-time monitoring, and industry 4.0 connectivity to enhance efficiency, minimize waste, and achieve strict environmental regulations.

Key Players & Competitive Analysis

The global market of extrusion machinery is extremely competitive, fueled by ongoing innovation in polymer processing, precision manufacturing, and automation techniques. High-efficiency, energy-efficient, and flexible extrusion systems with a broad material handling capability are the focus areas for leading players. Market expansion is accelerated by increasing demand in packaging, automobile, building, and consumer goods sectors, as manufacturers require dependable machinery to enhance productivity and product quality.

Key players in the global extrusion machinery market include AMUT S.p.A., BC Extrusion Holding GmbH, Coperion GmbH, Davis-Standard, LLC, Extrusion Technik USA, Inc., Graham Engineering Corporation, Grundfos Holding A/S, KraussMaffei Group GmbH, Milacron LLC, NFM / Welding Engineers, Inc., The Japan Steel Works, Ltd., Viking Pump, Inc., WENGER MANUFACTURING, INC., Wuxi Xinje Electric Co., Ltd., and Zhangjiagang City Qiangsheng Plastic Machinery Co., Ltd.

Key Players

- AMUT S.p.A.

- BC Extrusion Holding GmbH

- Coperion GmbH

- Davis-Standard, LLC

- Extrusion Technik USA, Inc.

- Graham Engineering Corporation

- Grundfos Holding A/S

- KraussMaffei Group GmbH

- Milacron LLC

- NFM / Welding Engineers, Inc.

- The Japan Steel Works, Ltd.

- Viking Pump, Inc.

- WENGER MANUFACTURING, INC.

- Wuxi Xinje Electric Co., Ltd.

- Zhangjiagang City Qiangsheng Plastic Machinery Co., Ltd.

Extrusion Machinery Industry Developments

In January 2024, Davis-Standard complete the acquisition of Extrusion Technology Group (ETG), such as battenfeld-cincinnati, exelliq, and Simplas, expanding its worldwide market share through the merger of sophisticated technologies and industry experience.

In November 2023, KraussMaffei re-introduced the ZE 28 BluePower laboratory extruder at the Fakuma fair, adding its extrusion machine lineup. The twin-screw extruder features greater efficiency and ease-of-use, specific to customer needs.

Extrusion Machinery Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastics

- Metal

- Others

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-Screw

- Twin Screw

- Others

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Consumer Goods

- Automotive

- Packaging

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Extrusion Machinery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.52 Billion |

|

Market Size in 2025 |

USD 8.89 Billion |

|

Revenue Forecast by 2034 |

USD 13.10 Billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.52 billion in 2024 and is projected to grow to USD 13.10 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are AMUT S.p.A., BC Extrusion Holding GmbH, Coperion GmbH, Davis-Standard, LLC, Extrusion Technik USA, Inc., Graham Engineering Corporation, Grundfos Holding A/S, KraussMaffei Group GmbH, Milacron LLC, NFM / Welding Engineers, Inc., The Japan Steel Works, Ltd., Viking Pump, Inc., WENGER MANUFACTURING, INC., Wuxi Xinje Electric Co., Ltd., and Zhangjiagang City Qiangsheng Plastic Machinery Co., Ltd.

The plastics segment dominated the market revenue share in 2024.

The twin-screw extrusion machinery segment is projected to witness the fastest growth during the forecast period.