Cell Culture Media Market Size, Share, Trends, Industry Analysis Report

By Type (Liquid Media, Semi-solid and Solid Media), By Product, By Application, By End-use – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6492

- Base Year: 2024

- Historical Data: 2020-2023

Overview

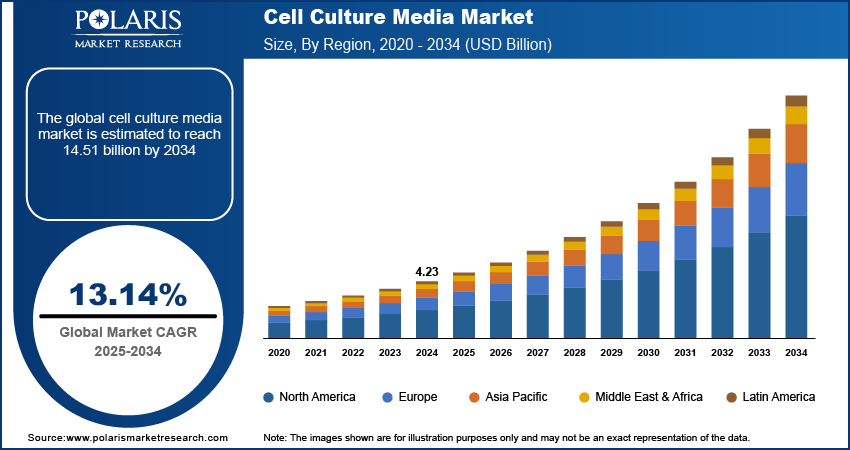

The global cell culture media market size was valued at USD 4.23 billion in 2024, growing at a CAGR of 13.14% from 2025 to 2034. Rising investments in life sciences infrastructure along with growing demand for biopharmaceuticals and vaccines driving the market growth.

Key Insights

- Liquid media led in terms of market share in 2024, driven by its viability for mass cell culture, biopharmaceutical manufacturing, and research in the lab.

- Research and academic institutions held the dominating market share, due to the growing funding for cell biology, genetics, and drug discovery.

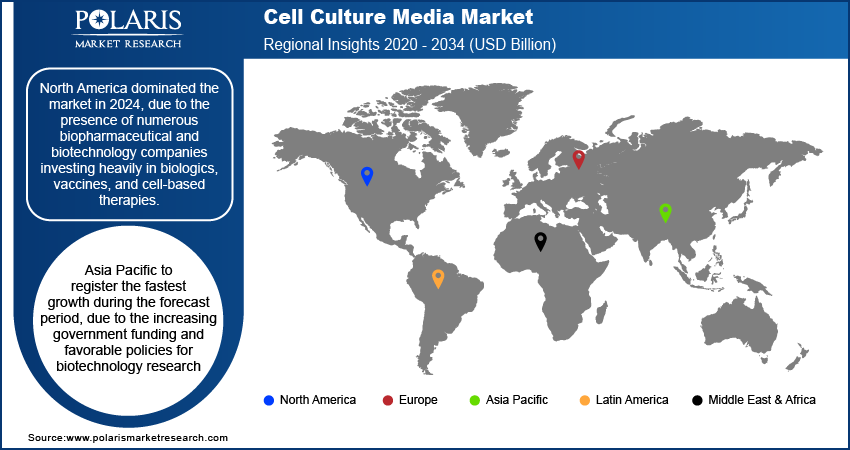

- North America held the largest share in 2024, with strong support from biopharma and biotech firms investing in biologics, vaccines, and cell therapies.

- The U.S. dominated the North American market, driven by growing incidence of chronic and orphan diseases widening research and clinical uses.

- Asia Pacific expected to grow at the highest rate, supported by government support, increased biomanufacturing, and supportive biotech policies.

- India led the market in Asia Pacific, driven by pharmaceutical and biotech R&D growth and emphasis on local vaccine manufacturing.

- Key players operating in the market include BD (Becton, Dickinson and Company), Cell Biologics, Inc., Danaher Corporation, FUJIFILM Corporation, Lonza Group Ltd, Merck KGaA, PromoCell GmbH, Sartorius AG, STEMCELL Technologies Inc., Thermo Fisher Scientific Inc., Avantor, Inc., Corning Incorporated, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., and Caisson Laboratories, Inc.

Industry Dynamics

- Growing investments in life sciences infrastructure and biomanufacturing facilities are fueling market growth in developed and emerging economies.

- Increasing need for biopharmaceuticals and vaccines continues to drive widespread adoption of high-quality, performance-optimized cell culture media.

- Higher cost of advanced and specialty media continues to restrain the market growth among small research institutions and emerging markets.

- Media optimization with AI offers robust opportunities for innovation, allowing for precise formulation design, enhanced reproducibility, and faster process development.

Market Statistics

- 2024 Market Size: USD 4.23 Billion

- 2034 Projected Market Size: USD 14.51 Billion

- CAGR (2025–2034): 13.14%

- North America: Largest Market Share

Cell culture media market encompasses nutrition-based formulations to sustain cell growth, maintenance, and storage for industrial and laboratory applications. The media is used in biopharmaceutical production, vaccine production, regenerative medicine, and research institutions to ensure optimum cell viability and productivity. The evolution of serum-free and chemically defined media is enhancing reproducibility, scalability, and product quality.

The continued growth of biotech and pharma research operations is leading to strong demand for higher-performance cell culture media. Organizations are concentrating on developing biologics, biosimilars, and cell therapy, that are consistent and dependable media solutions needed to ensure optimal cell productivity and growth.

Sustained innovation in serum-free, chemically defined, and specialty media formulations is improving cell culture efficiency, scalability, and reproducibility. In June 2025, Multus, a UK biotech company launched an animal component-free (ACF) medium specifically for porcine adipose-derived stem cells, reflecting the trend among the industry toward ethical and performance-based options. Such progress is allowing for control over the growth environment of cells, minimizing variability, and optimizing downstream processing yields.

Drivers & Opportunities

Rising Investments in Life Sciences Infrastructure: Governments and private organizations are boosting investment in biotechnology and life sciences facilities, in developing economies. A report released by a U.S. commission in April 2025, recommended a USD 15-billion government investment to strengthen the country’s leadership in the biotechnology sector. Such investments are boosting in-country research capacities and speed up the building of biomanufacturing centers.

Growing Demand for Biopharmaceuticals and Vaccines: Increasing need for vaccines, biopharmaceuticals including monoclonal antibodies, and recombinant proteins are propelling the market for cell culture media. According to the World Health Organization (WHO), vaccines saved over 150 million lives in the past 50 years, which is accountable for 40% of the reduction in infant mortality globally. This growth in biologic and vaccine manufacturing is driving the use of effective, scalable, and contamination-free media solutions in pharma manufacturing.

Segmental Insights

By Type

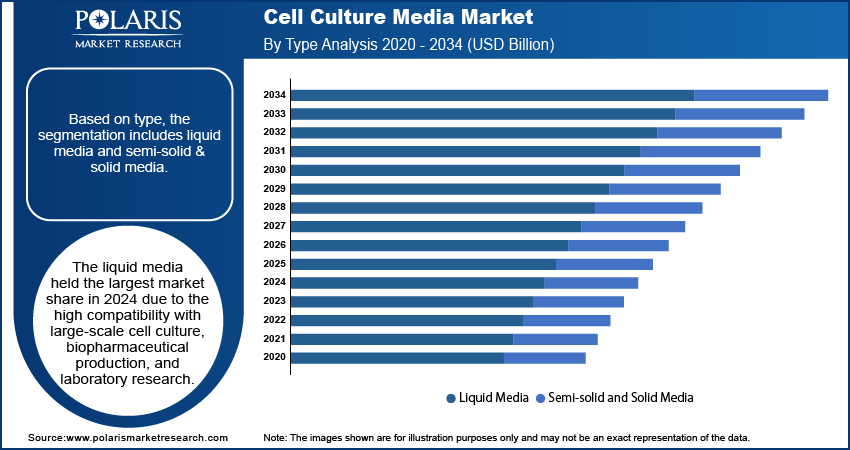

On the basis of type, the cell culture media market is categorized into liquid media and semi-solid & solid media. The liquid media held the largest market share in 2024 due to the high compatibility with large-scale cell culture, biopharmaceutical production, and laboratory research.

Semi-solid and solid media are expected to witness steady growth during the forecast period, driven by its usage for microbial colony isolation, hybridoma development, and specific tissue culture applications requiring surface-dependent cell growth.

By Product

On the basis of product, the market is classified into serum-free media, classical media, stem cell culture media, immunology media, specialty media, chemically defined media, and other cell culture media. Serum-free media accounted for the largest market share in 2024, fueled by its ability to minimize variability, improve reproducibility, and comply with regulatory standards for biopharmaceutical production.

Stem cell culture media are projected to grow rapidly as research in regenerative medicine, cell-based therapies, and personalized treatments continues to expand.

By Application

Based on application, the market is divided into biopharmaceutical production, diagnostics, drug screening and development, and tissue engineering & regenerative medicine. Biopharmaceutical production dominated the market in 2024 due to increasing demand for recombinant proteins, vaccines, and monoclonal antibodies.

Drug screening and development applications are anticipated to develop steadily because pharmaceutical companies are increasingly using cell-based assays in preclinical studies and toxicity testing.

By End-Use

By end-use, the market is segmented into pharmaceutical and biotechnology companies, hospitals and diagnostic laboratories, research and academic institutes, and other end uses. Pharmaceutical and biotechnology firms accounted for the majority of the market in 2024, owing to widespread application of sophisticated media formulations for biologics production and cell-based research.

Research and academic institutions are anticipated to experience steady growth, fueled by increased funding for cell biology and genetic research.

Regional Analysis

North America is dominating the cell culture media market due to the rising investment in biologics, vaccines, and cell-based therapies by several biopharmaceutical and biotech firms. The region also experiences expansive growth of cell and gene therapy manufacturing units, further driving demand for high-end media solutions.

The U.S. Cell Culture Media Market Overview

The U.S. market is propelled by an increasing incidence of chronic and rare diseases, thus there is a growing demand for innovative drug discovery platforms and development of biologics. The U.S. Centers for Disease Control and Prevention (CDC) states that 42% of Americans have two or more chronic conditions, and 12% have five or more. This surging number are boosting demand for highly advanced cell culture media to facilitate R&D for the development of treatments.

Asia Pacific Cell Culture Media Market Insights

The Asia Pacific region is anticipated to grow rapidly, driven by growing government support and policies conducive to biotechnology research. Expanding clinical trial activity and the presence of biologics manufacturing facilities in emerging markets are also boosting the market growth.

India Cell Culture Media Market Analysis

India is dominating the market in Asia Pacific, due to the growing pharmaceutical and biotechnology research, with increasing clinical trials activity for quality cell culture media. The Indian pharmaceutical market is estimated to reach USD 120 billion by 2030 as per the Federation of Indian Chambers of Commerce and Industry (FICCI). Moreover, the Promotion of Research and Innovation in Pharma MedTech (PRIP) scheme, with a budget of USD 600 million, is funding the establishment of Centers of Excellence and enhancing the national R&D ecosystem.

Europe Cell Culture Media Market Assessment

Europe held significant market share, driven by regulatory emphasis on quality assurance and GMP-aligned biomanufacturing processes, which boosts demand for advanced cell culture media. The growth of research collaborations between pharmaceutical firms, CROs, and academic institutions is also propelling market growth. In October 2025, BioNTech revealed a significant expansion of its R&D footprint in the U.K., committing around USD 1.33 billion over a period of ten years. The U.K. government also committed to provide a grant of up to USD 171.2 million over the same timeframe to fund this effort, propelling robust public-private cooperation in biotechnology research.

Key Players & Competitive Analysis

The global cell culture media market is characterized by strong competition and continuous technological advancement, driven by the expanding biopharmaceutical, diagnostics, and research sectors. Leading firms are investing in the creation of high-performance, serum-free, and chemically defined media to facilitate large-scale biologics production, vaccine production, and regenerative medicine applications. With the growing trend towards precision medicine and cell-based therapeutics, manufacturers are investing significantly in R&D to optimize formulation consistency, maximize nutrient composition, and increase scalability for bioprocessing.

Major companies in the world cell culture media market are BD (Becton, Dickinson and Company), Cell Biologics, Inc., Danaher Corporation, FUJIFILM Corporation, Lonza Group Ltd, Merck KGaA, PromoCell GmbH, Sartorius AG, STEMCELL Technologies Inc., Thermo Fisher Scientific Inc., Avantor, Inc., Corning Incorporated, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., and Caisson Laboratories, Inc.

Key Players

- BD (Becton, Dickinson and Company)

- Cell Biologics, Inc.

- Danaher Corporation

- FUJIFILM Corporation

- Lonza Group Ltd

- Merck KGaA

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- Avantor, Inc.

- Corning Incorporated

- Bio-Rad Laboratories, Inc.

- HiMedia Laboratories Pvt. Ltd.

- Caisson Laboratories, Inc.

Cell Culture Media Industry Developments

In May 2025, PL BioScience (Germany) collaborated with South Korea's DewCell Biotherapeutics to launch scalable artificial human platelet lysate, a completely animal‑free cell culture medium for the world cell therapy market. The union is anticipated to drive the utilization of standardized, xeno‑free media across research and commercial cell therapy use.

In April 2025, Capricorn Scientific partnered with Turkey's florabio AS to introduce animal‑free, high‑yield cell culture media, merging experience in scalable, defined formulation to aid biotech and vaccine R&D across the globe. The collaboration is designed to improve reproducibility and efficiency in large‑scale cell culture processes for both industrial use and research.

Cell Culture Media Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Liquid Media

- Semi-solid and Solid Media

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Serum-free Media

- Classical Media

- Stem Cell Culture Media

- Immunology Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Production

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End user

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Culture Media Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.23 Billion |

|

Market Size in 2025 |

USD 4.78 Billion |

|

Revenue Forecast by 2034 |

USD 14.51 Billion |

|

CAGR |

13.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.23 billion in 2024 and is projected to grow to USD 14.51 billion by 2034.

The global market is projected to register a CAGR of 13.14% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are BD (Becton, Dickinson and Company), Cell Biologics, Inc., Danaher Corporation, FUJIFILM Corporation, Lonza Group Ltd, Merck KGaA, PromoCell GmbH, Sartorius AG, STEMCELL Technologies Inc., Thermo Fisher Scientific Inc., Avantor, Inc., Corning Incorporated, Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., and Caisson Laboratories, Inc.

The liquid media segment dominated the market revenue share in 2024.

The stem cell culture media segment is projected to witness the fastest growth during the forecast period.