Water Heater Market Size, Share, Trends, Industry Analysis Report

By Capacity, By Product, By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6490

- Base Year: 2024

- Historical Data: 2020-2023

What is water heater market size?

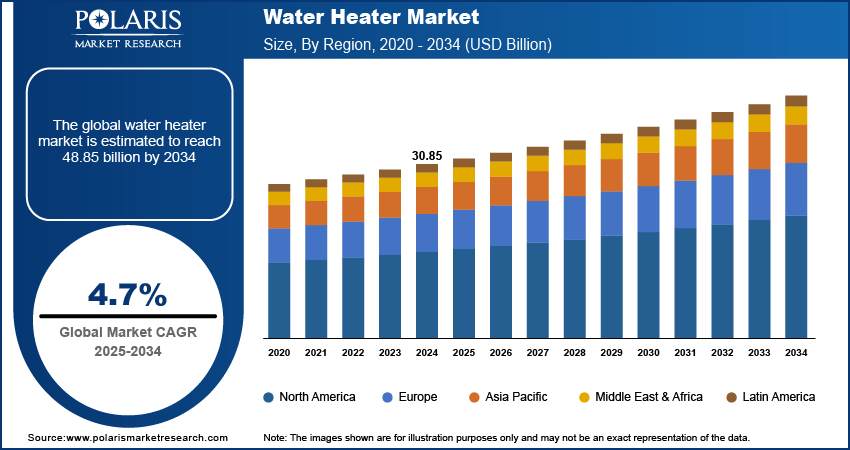

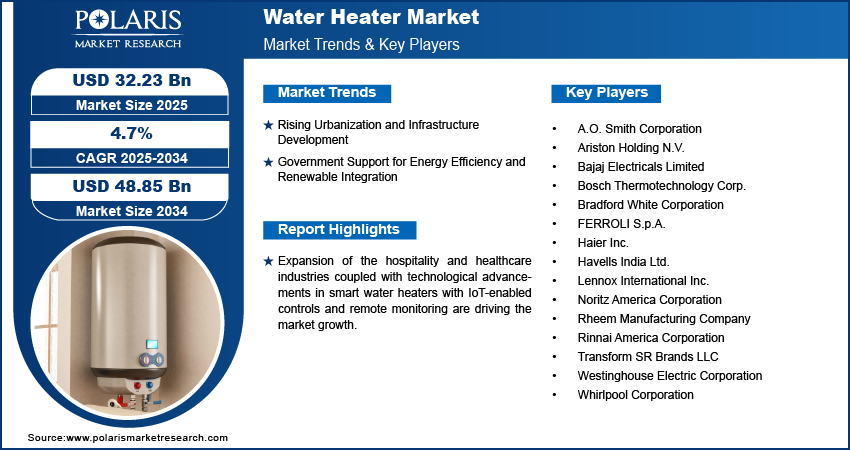

The global water heater market size was valued at USD 30.85 billion in 2024, growing at a CAGR of 4.7% from 2025 to 2034. Increasing urbanization and infrastructure development coupled with supportive government initiatives promoting renewable energy integration and energy-efficient appliances driving the market growth.

Key Insights

- Solar water heaters dominated the market in 2024, propelled by growing adoption of renewable energy products and government incentives.

- The 30–100 liters capacity segment anticipated to grow at a high rate, due to rising adoption in small to medium-sized homes and small commercial installations.

- North America accounted for the largest share in 2024, driven by replacement demand for old water heating systems for residential and commercial applications.

- The U.S. led the North American market, fueled by growing adoption of smart and internet-connected water heaters that are interoperable with home automation platforms.

- Asia Pacific is expected to have the highest growth rate, driven by urbanization and growing residential and commercial building development in India, China, and Southeast Asia.

- China held marjor contributor to the Asia Pacific market, driven by government programs supporting renewable energy and the take-up of solar water heaters.

- Key players operating in the market include A.O. Smith Corporation, Ariston Holding N.V., Bajaj Electricals Limited, Bosch Thermotechnology Corp., Bradford White Corporation, FERROLI S.p.A., Haier Inc., Havells India Ltd., Lennox International Inc., Noritz America Corporation, Rheem Manufacturing Company, Rinnai America Corporation, Transform SR Brands LLC (owner of the Kenmore brand), Westinghouse Electric Corporation, and Whirlpool Corporation.

Industry Dynamics

- Rising urbanization and infrastructure growth, particularly in emerging markets, are fueling demand for water heating technologies.

- Government policies favoring integration of renewable energy and energy-efficient appliances are contributing to market growth.

- High initial costs of smart and advanced water heaters continue to restrain the market growth.

- AI and IoT-capable smart water heaters offer growth opportunities through remote monitoring, energy optimization, and predictive maintenance.

Market Statistics

- 2024 Market Size: USD 30.85 Billion

- 2034 Projected Market Size: USD 48.85 Billion

- CAGR (2025–2034): 4.7%

- Asia Pacific: Largest Market Share

What is water heaters market?

The water heaters market is composed of high-performance and energy-efficient equipment that is capable of delivering safe and hot water for household, commercial, and industrial uses. Water heaters are commonly utilized throughout homes, hotels, hospitals, and factories to supply comfort, hygiene, and process effectiveness. Improvements in materials, insulation technologies, and energy-efficient engineering are improving performance, minimizing operating expenses, and encouraging sustainability.

Growth in the hospitality and healthcare industries is fueling demand for efficient and effective water heating systems. Hotels, hospitals, and spas need constant hot water supply for sanitation, cleaning, and guest amenities, which is propelling large-scale adoption of high-end water heaters. Manufacturers are encouraged by this trend to develop high-capacity, energy-efficient systems specifically for commercial applications.

Advancements in intelligent water heaters with IoT-enabled controls and remote monitoring are additionally driving the market growth. Modern models allow customers to remotely adjust temperature settings, energy usage, and maintenance alerts through mobile apps, thus improving convenience and efficiency. In June 2025, V-Guard Industries unveiled a new generation of intelligent water heaters based on advanced thermocline technology to deliver up to 38% more available hot water, representing the trend in the industry to smart and green water heating solutions.

Drivers & Opportunities

Which are the major factor driving water heater market growth?

Rising Urbanization and Infrastructure Development: Ongoing urbanization and widespread infrastructure development in developing markets, are driving residential and commercial water heater demand. According to United Nations Department of Economic and Social Affairs, currently 55% of the global population reside in cities, with estimation to reach 68% by 2050 representing substantial long-term market growth.

Government Support for Energy Efficiency and Renewable Integration: Supportive government policies for adopting renewable energy and home energy management system are fueling growth of the market. For instance, the U.S. Inflation Reduction Act (IRA) was introduced in August 2022, which offers tax credits for clean energy technologies. These programs are encouraging consumers and manufacturers to adopt cost-effective and eco-friendly water heating technology.

Segmental Insights

By Capacity

Based on capacity, the water heater market is divided into below 30 liters, 30–100 liters, 100–250 liters, 250–400 liters, and above 400 liters. The 30–100 liters segment dominated the market in 2024 due to its suitability in small to medium-sized family homes and small business installations.

Products with more than 400 liters of volume are anticipated to grow rapidly, driven by increasing demand from hotels, hospitals, and large-capacity industrial parks requiring large-volume hot water supply.

By Product

By Product

Based on product type, the market is segmented into electric, solar, and gas water heaters. Electric water heaters led the market in 2024, propelled by high availability, end-user convenience, and ease of integration with home automation systems.

Solar water heaters are projected to register strong growth during the forecasting period, fueled by increasing adoption of renewable energy systems and green technology patronage from the government.

By Technology

Based on technology, the market is classified into tankless, storage, and hybrid systems. Storage water heaters had the largest market share in 2024 due to cost-effectiveness, reliability, and simplicity of installation on residential and commercial premises.

Tankless water heaters are projected to grow at a high rate, due to its energy-efficiency, and it provide on-demand heating with small designs well-positioned for city homes.

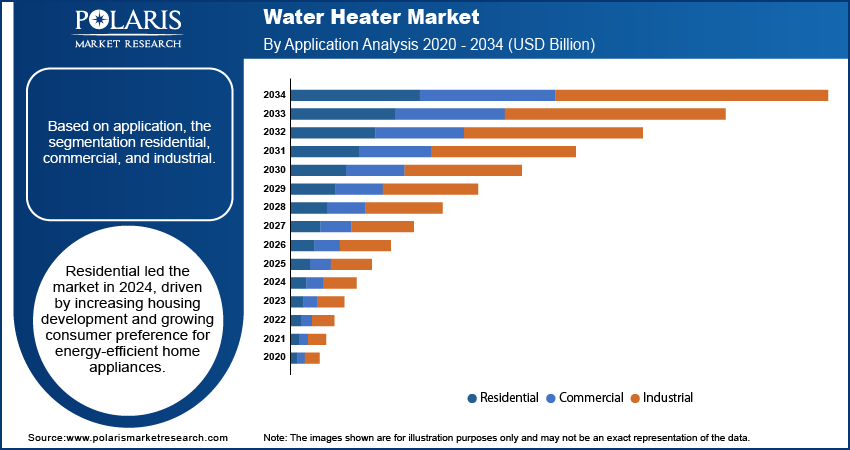

By Application

In terms of application, the market is segmented into residential, commercial, and industrial. Residential segment led the market in 2024, propelled by rising housing construction and consumer demand for energy-saving home appliances.

The commercial segment is expected to grow steadily, owing to the increasing installation in hospitality, healthcare, and education sectors.

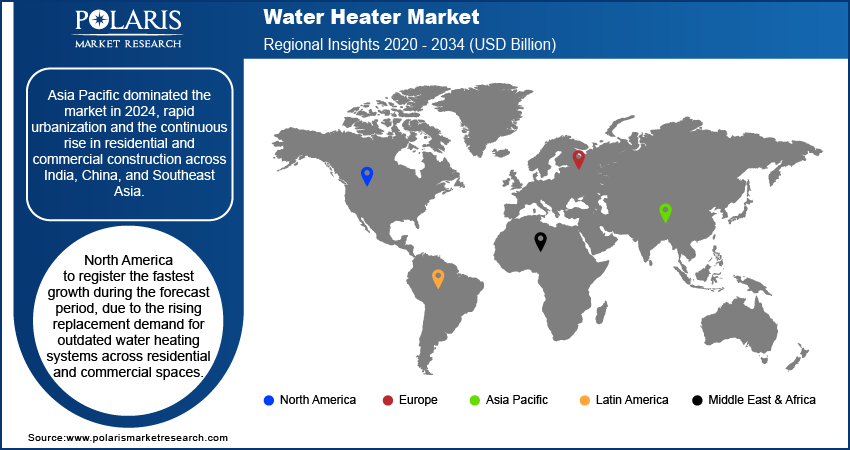

Regional Analysis

The Asia Pacific held the dominating market share in 2024. This growth is driven by rising urbanization and increasing residential and commercial building development in India, China, and Southeast Asia. Increasing hospitality and healthcare industries are also fueling hot water use, leading to a strong demand for both electric and solar water heaters. Governments in the region are focusing on energy-efficient technologies along with the integration of renewable energy source, pushing green heating solutions for long-term energy efficiency.

China Water heater Market Overview

China held the regional market leadership in Asia Pacific driven by government policies encouraging renewable energy utilization fueling solar water heater adoption in the country. China's 14th Five-Year Plan for Renewable Energy, released in June 2022, targets 33% of electricity by the end of 2025 from renewables, up from 29% in 2021. This policy guidance is boosting the shift towards greener and more efficient water heating options, making solar-driven systems a popular choice in residential and commercial settings.

North America Water Heater Market Insights

The North America market is anticipated to grow at a fast pace, attributed to the increasing replacement demand for aging water heating equipment in residential and commercial settings. Consumers are moving towards energy-efficient, tankless, and hybrid water heaters to reduce operation costs and environmental footprint. Moreover, the increasing emphasis on sustainability and the implementation of smart home ecosystems are driving the adoption of internet-connected water heating systems throughout the region.

The U.S. Water heater Market Analysis

The U.S. market is experiencing robust growth fueled by the penetration of smart and connected water heaters that are compatible with home automation systems. In June 2025, GE Appliances introduced the GE Profile GEOSPRING Smart Hybrid Heat Pump Water Heater, which provides up to 4.7× more energy efficiency than conventional electric models and boasts remote monitoring and control via a mobile app. These innovations reflect the move towards smart, energy-efficient residential water heating solutions with better convenience and sustainability.

Europe Water heater Market Assessment

Europe held significant share in water heater market driven by a robust policy emphasis on sustainability and rigorous EU regulations encouraging low-emission and energy-efficient systems. The shift from fossil-fuel-powered water heaters to electric and heat pump versions is gaining momentum as consumers and builders move toward green building protocols. Continuous innovation of hybrid and renewable-driven systems enhances performance and price, further propelling the demand in residential and commercial applications.

Key Players & Competitive Analysis

The global water heater market is very competitive, influenced by ongoing innovation, changing energy parameters, and growing smart technology adoption. Major players are concentrating on designing energy-efficient, IoT-compliant, and environmentally friendly systems serving residential, commercial, and industrial markets. Firms are diversifying their product range with hybrid, tankless, and solar-powered models to suit sustainability objectives and government efficiency standards.

Who are the key players in water heater market?

Key players in the global Water Heater market include A.O. Smith Corporation, Ariston Holding N.V., Bajaj Electricals Limited, Bosch Thermotechnology Corp., Bradford White Corporation, FERROLI S.p.A., Haier Inc., Havells India Ltd., Lennox International Inc., Noritz America Corporation, Rheem Manufacturing Company, Rinnai America Corporation, Transform SR Brands LLC (owner of the Kenmore brand), Westinghouse Electric Corporation, and Whirlpool Corporation.

Key Players

- A.O. Smith Corporation

- Ariston Holding N.V.

- Bajaj Electricals Limited

- Bosch Thermotechnology Corp.

- Bradford White Corporation

- FERROLI S.p.A.

- Haier Inc.

- Havells India Ltd.

- Lennox International Inc.

- Noritz America Corporation

- Rheem Manufacturing Company

- Rinnai America Corporation

- Transform SR Brands LLC (owner of the Kenmore brand)

- Westinghouse Electric Corporation

- Whirlpool Corporation

Water heater Industry Developments

In June 2025, LG Electronics purchased Norway's OSO Group, a premium stainless-steel water heater specialist, to enhance its HVAC line in Europe. OSO technology will back LG's integrated water heating and heat pump solutions, and the company will maintain independence in operations under LG ownership.

In May 2025, Ariston Group and Lennox announced joint venture to introduce Lennox-branded residential water heaters in North America by 2026. Ariston has a 50.1% stake and Lennox has 49.9%. The products will be distributed through Lennox's dealer network and distributors, and Ariston will keep selling its existing brands independent of one another.

Water heater Market Segmentation

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Below 30 Liters

- 30 - 100 Liters

- 100 - 250 Liters

- 250 - 400 Liters

- Above 400 Liters

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Electric

- Solar

- Gas

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Tankless

- Storage

- Hybrid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Water heater Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 30.85 Billion |

|

Market Size in 2025 |

USD 32.23 Billion |

|

Revenue Forecast by 2034 |

USD 48.85 Billion |

|

CAGR |

4.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 30.85 billion in 2024 and is projected to grow to USD 48.85 billion by 2034.

The global market is projected to register a CAGR of 4.7% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are A.O. Smith Corporation, Ariston Holding N.V., Bajaj Electricals Limited, Bosch Thermotechnology Corp., Bradford White Corporation, FERROLI S.p.A., Haier Inc., Havells India Ltd., Lennox International Inc., Noritz America Corporation, Rheem Manufacturing Company, Rinnai America Corporation, Transform SR Brands LLC (owner of the Kenmore brand), Westinghouse Electric Corporation, and Whirlpool Corporation.

The 30–100 liters segment dominated the market revenue share in 2024.

The solar water heaters segment is projected to witness the fastest growth during the forecast period.