Positive Displacement Pumps Market Size, Share, Trends, Industry Analysis Report

By Type (Reciprocating, Rotary, and Peristaltic), By Pressure Rating, By End-user Industry, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6488

- Base Year: 2024

- Historical Data: 2020-2023

What is the positive displacement pumps market size?

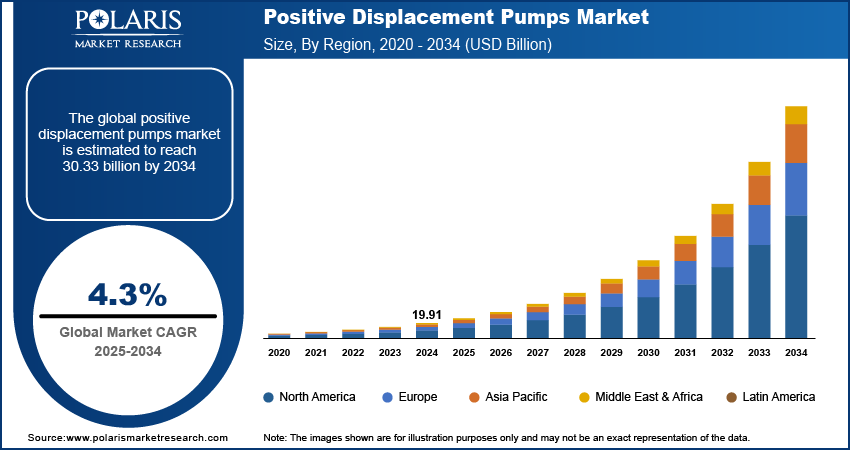

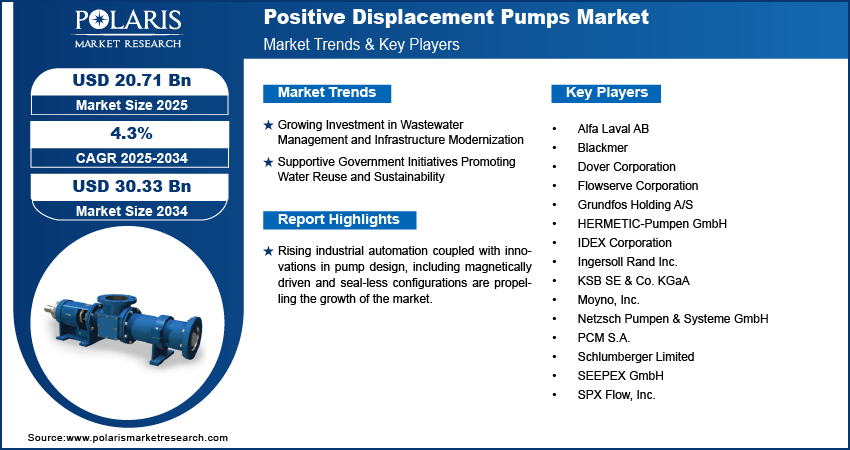

The global positive displacement pumps market size was valued at USD 19.91 billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034. Increase in investment towards wastewater management and infrastructural upgradation as well as encouraging government policies favoring water reuse and sustainability is leading to the market's growth.

Key Insights

- Rotary pumps controlled the market in 2024 due to efficiency in conveying high-viscosity fluids and ensuring a constant flow, hence being suitable for chemical processing, food, and lubrication industries.

- The 51–150 bar pressure rating category is anticipated to witness strong growth, driven by uses in power generation, mining, and midstream oil & gas activities requiring moderate pressure control.

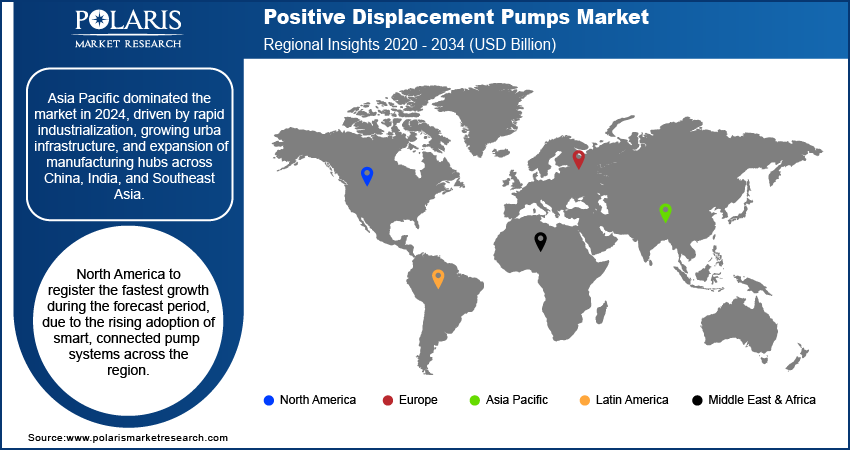

- Asia Pacific held the largest market share in 2024, led by rapid industrialization at high speeds, expansion of manufacturing hubs, and urban infrastructure development in China, India, and Southeast Asia.

- India dominated the market in Asia Pacific, fueled by the growing wastewater treatment sector and rising uptake of new pumping technologies.

- North America anticipated to grow rapidly, driven by rising adoption of intelligent, networked pump systems in industrial and municipal applications.

- The U.S. dominated the North American market, due to the upgradation of old water and wastewater plants and government programs encouraging infrastructure modernization.

- Prominent players in the market are Alfa Laval AB, Blackmer, Dover Corporation, Flowserve Corporation, Grundfos Holding A/S, HERMETIC-Pumpen GmbH, IDEX Corporation, Ingersoll Rand Inc., KSB SE & Co. KGaA, Moyno, Inc., Netzsch Pumpen & Systeme GmbH, PCM S.A., Schlumberger Limited, SEEPEX GmbH, and SPX Flow, Inc.

Industry Dynamics

- Growing investment in wastewater treatment and infrastructure renewal is driving demand for positive displacement pumps.

- Government policy initiatives towards water recycling, sustainability, and process efficiency are propelling growth for the market.

- Resultant high initial investment in sophisticated positive displacement pump systems continues to hinder market uptake in small industrial units.

- IoT and smart sensor convergence presents opportunities through real-time monitoring, predictive maintenance, and remote control.

Market Statistics

- 2024 Market Size: USD 19.91 Billion

- 2034 Projected Market Size: USD 30.33 Billion

- CAGR (2025–2034): 4.3%

- Asia Pacific: Largest Market Share

What is positive displacement pumps?

The positive displacement pumps industry includes precision-designed systems that are optimized to transfer fluids at a fixed flow rate irrespective of pressure fluctuations. These pumps are widely utilized across various industries like oil and gas, chemicals, food and beverages, water treatment, and pharmaceuticals for precise fluid handling and dosing purposes. Ongoing developments in pump design, material durability, and sealing technology are increasing durability, efficiency, and reliability.

Increasing industrial automation is fueling demand for sophisticated positive displacement pumps that maximize operating efficiency, minimize downtime, and enable precise fluid management. Integration of smart pumping systems enables real-time monitoring, predictive maintenance, and better process control in industries like oil & gas, chemicals, and food processing. In May 2025, Roto Pumps introduced its versatile P-Range of positive displacement pumps in applications such as oil & gas, mining, wastewater treatment, and food processing. This move is likely to propell double-digit growth and contribute immensely towards the company's anticipated revenue of USD 100 million by 2028.

Advancement in pump design, such as magnetically driven and seal-less designs, are enhancing reliability, energy efficiency, and lifespan of positive displacement pumps. Such developments enable the pumps to process abrasive, viscous, and corrosive fluids with lower maintenance requirements, addressing changing requirements of new industrial processes. Ongoing developments in materials and engineering design are allowing manufacturers to provide reliable solutions for demanding operating conditions.

Drivers & Opportunities

Which are the factors driving positive displacement pumps market growth?

Growing Investment in Wastewater Management and Infrastructure Modernization: The growing interest in sustainable water management and industrial infrastructure upgrade is boosting the demand for high-performance positive displacement pumps. In July 2025, Singaporean water technology startup raised USD 4.75 million from strategic investors, comprising government-backed and private venture capital funds, taking its total amount of funding to almost USD 12 million. This highlights a wider investment trend in technologies that improve wastewater treatment efficiency and reliability.

Supportive Government Initiatives Promoting Water Reuse and Sustainability

Regulatory environments to curtail wastage of water and encourage sustainable industrial practice are propelling positive displacement pump market. For example, the Indian government introduced stricter regulations to minimize water wastage by requiring bulk consumers to recycle 50% of their wastewater by 2031. These efforts give a steady demand for pumps that are able to handle and transport treated water effectively while being compliant with the environment.

Segmental Insights

By Type

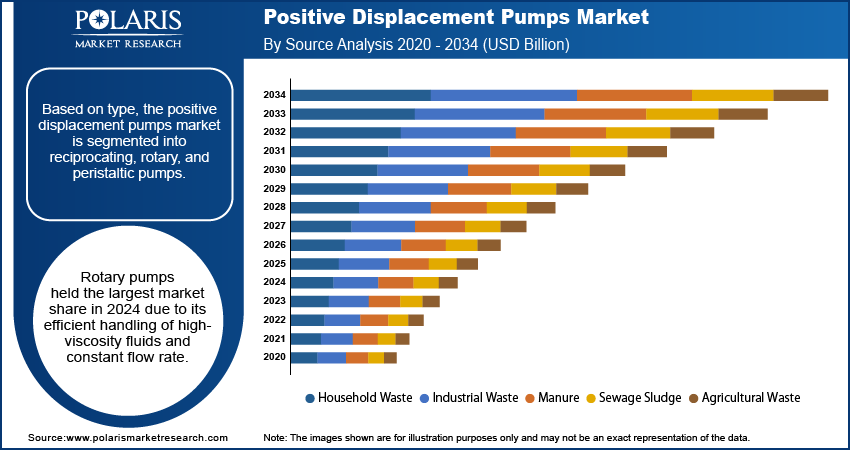

Based on type, the positive displacement pumps market is segmented into reciprocating, rotary, and peristaltic pumps. Rotary pumps held the largest market share in 2024 due to its efficient handling of high-viscosity fluids and constant flow rate, which makes them ideal for chemical processing, food, and lubrication industries.

Reciprocating pumps are anticipated to show robust growth, driven by their capability of producing high pressure and precision in metering applications, ideal for the oil & gas and power generation industries.

By Pressure Rating

On the basis of pressure rating, the market is categorized into up to 50 bar, 51 to 150 bar, and above 150 bar. Up to 50 bar pressure-rated pumps dominated the market in 2024, driven by widespread use in low-pressure fluid transfer in water and wastewater treatment as well as food processing applications.

The 51 to 150 bar segment is anticipated to grow at a fast pace driven by increasing demand from power generation, mining, and midstream oil & gas operations calling for moderate pressure handling.

By End-User Industry

Based on end-user industry, the market is segmented into oil and gas, power generation, water and wastewater, chemical and petrochemical, food and beverage, pharmaceutical and biotechnology, mining and minerals, pulp and paper, and others. The oil and gas segment accounted for the highest share in the market in 2024 due to widespread applications of positive displacement pumps in crude oil pumping, drilling mud recycling, and refining processes.

The petrochemical and chemical segment is anticipated for robust growth, as precise dosing and chemical handling demand boost adoption in processing plants.

Regional Analysis

Asia Pacific dominated the market in 2024, fueled by rapdi industrialization, increasing urban infrastructure, and growth of manufacturing centers in China, India, and Southeast Asia. The growing demand for effective water treatment, desalination facilities, and industrial fluid management is fueling adoption of durable positive displacement pumps.

India Positive Displacement Pumps Market Overview

India led the market share in Asia Pacific due to the growing wastewater treatment industry, which created significant demand for positive displacement pump suppliers. As per the International Trade Administration, India is the 5th largest water and wastewater treatment market among all countries, at about USD 11 billion, and is expected to grow beyond USD 18 billion by 2026. This growth is pushing investments in high-performance pumping technology that guarantee durability, energy efficiency, and operational reliability.

North America Positive Displacement Pumps Market Insights

The North America market is projected to develop strongly, owing to the implementation of smart, connected pump systems throughout the region, as industrial and municipal operators look for energy-saving solutions and predictive maintenance opportunities. Growing investment in public drinking water infrastructure is further fueling demand for advanced positive displacement pumps. In October 2025, the EPA made USD 9.5 million in grant awards for medium and large public drinking water systems, funding projects strengthening system resilience, such as water reuse projects. This reflects government push for upgrading vital water infrastructure, thus driving the growth of the market.

The U.S. Positive Displacement Pumps Market Analysis

The U.S. market is witnessing strong growth due to the upgradation of aged water and wastewater facilities across the country. In October 2025, Pennsylvania American Water made a USD 30 million investment to upgrade Kane Borough's wastewater treatment plants in Pennsylvania. The program is aimed to increase infrastructure capacity, efficiency, and reliability to meet the growing demand for clean water.

Europe Positive Displacement Pumps Market Assessment

Europe's market growth is fueled by stringent energy efficiency and lower emission laws fueling pump system modernization. Strong growth in renewable energy, biofuel production, and chemical production is fueling demand for precise fluid transfer solutions. For example, during May 2022, the European Commission proposed raising the EU's 2030 renewable energy target to 45% under the REPowerEU Plan with an installed capacity of 1,236 GW. These advancements are facilitating the usage of high-performance positive displacement pumps throughout the region.

Key Players & Competitive Analysis

The global positive displacement pumps market is competitive and influenced by innovation, precise engineering, and growing industrial applications. Key players are concentrating on enhancing pump efficiency, reliability, and performance to satisfy the growing demand in industries like oil and gas, water and wastewater, organic food and beverage, and chemicals. Firms are investing more in innovative sealing technologies, digital monitoring systems, and energy-efficient designs to reduce operating downtime and improve process control. Strategic actions such as mergers, capacity upgrades, and OEM partnerships are allowing key industry players to consolidate their positions in developed and emerging markets alike.

Key players in the global positive displacement pumps market include Alfa Laval AB, Blackmer, Dover Corporation, Flowserve Corporation, Grundfos Holding A/S, HERMETIC-Pumpen GmbH, IDEX Corporation, Ingersoll Rand Inc., KSB SE & Co. KGaA, Moyno, Inc., Netzsch Pumpen & Systeme GmbH, PCM S.A., Schlumberger Limited, SEEPEX GmbH, and SPX Flow, Inc.

Key Players

- Alfa Laval AB

- Blackmer

- Dover Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- HERMETIC-Pumpen GmbH

- IDEX Corporation

- Ingersoll Rand Inc.

- KSB SE & Co. KGaA

- Moyno, Inc.

- Netzsch Pumpen & Systeme GmbH

- PCM S.A.

- Schlumberger Limited

- SEEPEX GmbH

- SPX Flow, Inc.

Positive Displacement Pumps Industry Developments

In June 2025, Chart Industries and Flowserve agreed to an all-stock merger worth around USD 19 billion with a focus on delivering USD 300 million of annual cost synergies. The merged entity will be well-positioned to enhance its global presence and enhance capabilities in industrial and energy markets.

In June 2025, Honeywell finalized the acquisition of Sundyne in USD 2.16 billion, adding engineered pumps and compressors for the renewable fuel industry. The acquisition is part of Honeywell's strategy to expand its product offerings and propel growth in sustainable process solutions and clean energy.

Positive Displacement Pumps Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Reciprocating

- Rotary

- Peristaltic

By Pressure Rating Outlook (Revenue, USD Billion, 2020–2034)

- Up to 50 bar

- 51 to 150 bar

- Above 150 bar

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Oil and Gas

- Power Generation

- Water and Wastewater

- Chemical and Petrochemical

- Food and Beverage

- Pharmaceutical and Biotechnology

- Mining and Minerals

- Pulp and Paper

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Positive Displacement Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.91 Billion |

|

Market Size in 2025 |

USD 20.71 Billion |

|

Revenue Forecast by 2034 |

USD 30.33 Billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 19.91 billion in 2024 and is projected to grow to USD 30.33 billion by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Alfa Laval AB, Blackmer, Dover Corporation, Flowserve Corporation, Grundfos Holding A/S, HERMETIC-Pumpen GmbH, IDEX Corporation, Ingersoll Rand Inc., KSB SE & Co. KGaA, Moyno, Inc., Netzsch Pumpen & Systeme GmbH, PCM S.A., Schlumberger Limited, SEEPEX GmbH, and SPX Flow, Inc.

The rotary pumps segment dominated the market revenue share in 2024.

The 51 to 150 bar pressure segment is projected to witness the fastest growth during the forecast period.