Artificial Cornea and Corneal Implant Market Size, Share, Trends, Industry Analysis Report

By Implant Type, By Transplant Type, By Disease Indication, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM6484

- Base Year: 2024

- Historical Data: 2020-2023

What is the artificial cornea and corneal implant market size?

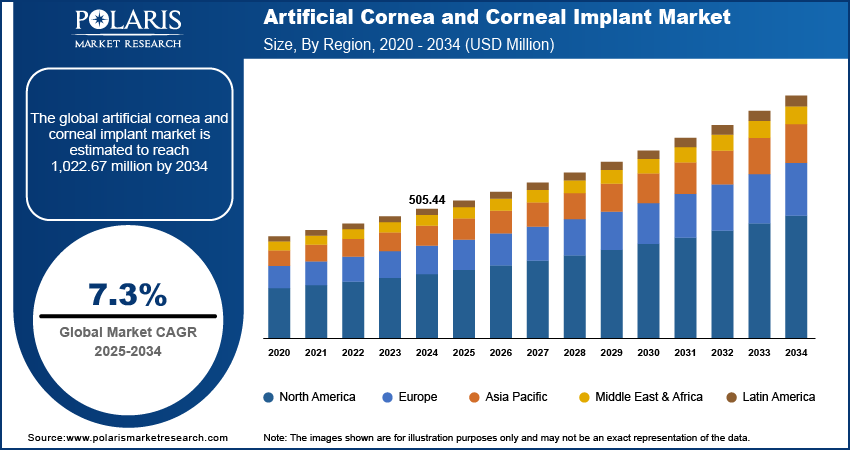

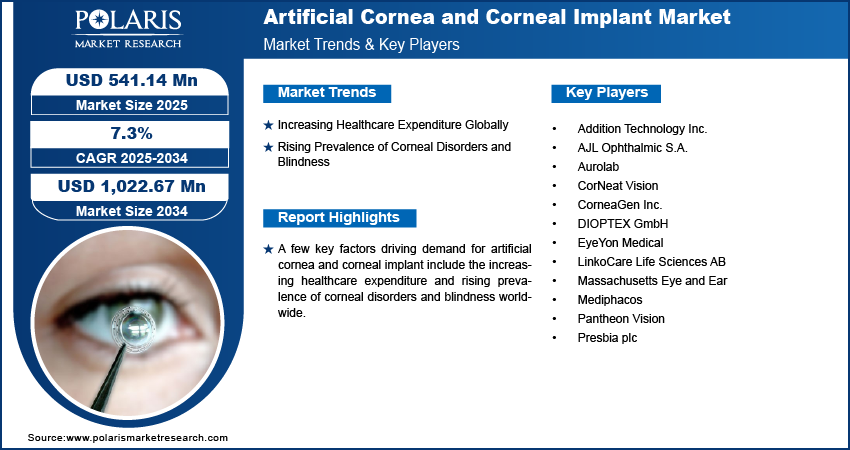

The global artificial cornea and corneal implant market size was valued at USD 505.44 million in 2024, growing at a CAGR of 7.3% from 2025 to 2034. Key factors driving demand for artificial cornea and corneal implant include the increasing healthcare expenditure and rising prevalence of corneal disorders and blindness worldwide.

Key Insights

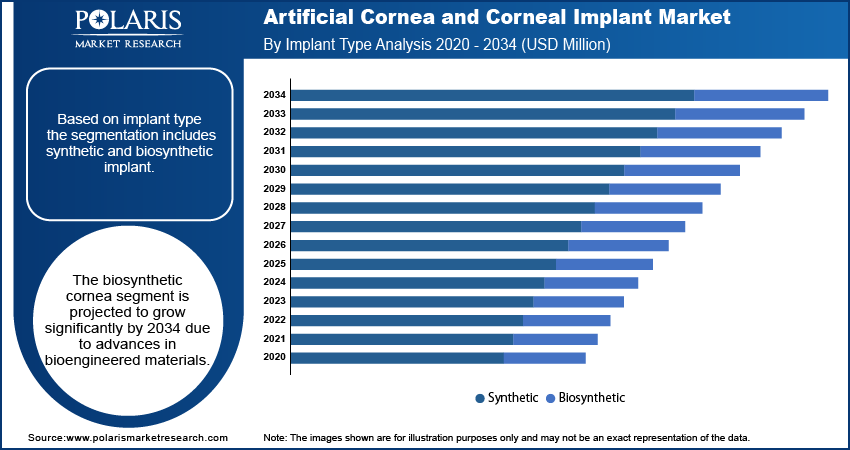

- The synthetic implant segment dominated the market share in 2024.

- The biosynthetic implant segment is expected to grow rapidly as it offers better biocompatibility and promotes natural tissue regeneration.

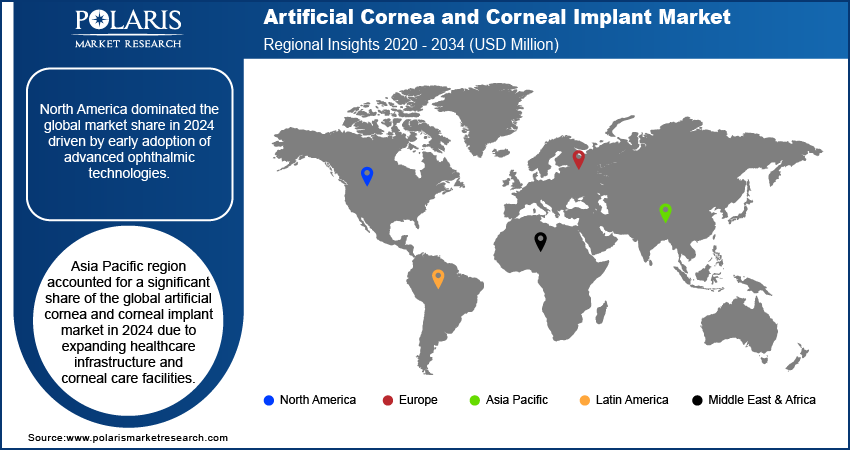

- The North America artificial cornea and corneal implant market dominated the global market share in 2024.

- The U.S. artificial cornea and corneal implant market is growing due to rising use of innovative corneal treatments and surgical procedures.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, propelled by increasing corneal disorder cases and healthcare investments.

- China and Japan drive regional growth with strong manufacturing and expanding ophthalmic care.

Industry Dynamics

- Increasing healthcare spending worldwide is boosting market growth by increasing access to advanced corneal procedures.

- Rising prevalence of corneal disorders and blindness worldwide is driving the demand due to growing number of patients with vision loss and damaged corneas.

- The rising demand for bioengineered corneas is expected to create lucrative opportunities during the forecast period.

- The high cost of implants and surgical procedures is anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD 505.44 Million

- 2034 Projected Market Size: USD 1,022.67 Million

- CAGR (2025–2034): 7.3%

- North America: Largest Market Share

What is artificial cornea and corneal implants?

Artificial cornea and corneal implants are high-tech ophthalmic equipment that are intended to restore vision in patients with damaged or diseased corneas. They replicate the natural cornea to improve the quality of vision and are implanted to correct conditions such as keratoconus, scarring of the cornea and burns. It is composed of biocompatible materials and reduce rejection rates and enhance healing. Improvements in biomaterials and surgical techniques are improving implant performance and its scope across the globe.

Increasing elderly population is propelling demand for artificial cornea and corneal implants owing to the increasing incidence of age-related eye diseases among elderly individuals. WHO approximates the population of individuals aged 60 and more at 2.1 billion by 2050 from 1 billion in the year 2020. The trend is enhancing the demand for advanced vision restoration products to enhance vision and quality of life among older adults.

Technological progress in ophthalmic and regenerative medicine is propelling the need for artificial cornea and corneal implants. Innovations in bioengineered tissues, stem cell therapy, and biocompatible materials are improving transplant success and recovery. New corneal substitutes and surgical methods are expanding access and clinical use worldwide.

Drivers & Opportunities

Which are the factors driving the artificial cornea and corneal implants market growth?

Growing Healthcare Spend Worldwide: Growing government healthcare spending is driving the artificial cornea and corneal implants market due to escalated investments in advanced surgical equipment, medical facilities and vision rehabilitation initiatives. As per the World Health Organization, overall world health expenditure stood at about USD 9 trillion in 2021. In addition, government expenditure in 2023 on health accounted for 10.1% of German GDP and 9.5% of that of Japan. This augmented funding is increasing availability of high-technology surgery and driving the evolution of corneal implants.

Increasing Number of Corneal Disease and Blindness Cases: Surging cases of blindness and corneal disease are fueling demand for artificial cornea and implants owing to the growing incidence of keratoconus, ulcers, and trauma-related injuries. Furthermore, better eye care infrastructure and patient awareness are also pushing the market ahead.

Segmental Insights

Implant Type Analysis

By type, the market is bifurcated into synthetic and biosynthetic implants. The synthetic segment led the market in 2024 due to its strength, clarity, and long-term stability in treating severe corneal damage. For example, in September 2025, scientists at LV Prasad Eye Institute and IIT-Guwahati created a new technique for culturing healthier artificial corneal cells in the laboratory, giving hope to patients waiting for transplants as donor shortages persists.

The biosynthetic segment is expected to grow the fastest through 2034 due to its ability to mimic natural corneal tissue and promote regeneration. These implants combine biological and synthetic materials for better compatibility and healing.

Transplant Type Analysis

By transplant type, the market is divided into hard keratoprosthesis and soft keratoprosthesis. The hard keratoprosthesis segment led the market in 2024 due to its proven success in treating severe corneal blindness and strong durability. These are made with PMMA and restore the patient's vision in the case of corneal damage.

The soft keratoprosthesis segment is projected to grow the fastest through 2034 due to advances in pliable biomaterials and improved tissue integration. The implants are more comfortable, reduces risk of extrusion and are easier to heal.

Disease Indication Analysis

By disease indication the market is segmented into fuchs’ dystrophy, keratoconus, fungal keratitis, and other diseases. Fuchs’ dystrophy led in 2024 due to its high prevalence and effective treatment options. Increasing consciousness and early detection initiatives are additionally fueling this segment.

Keratoconus is projected to grow the fastest due to its increasing incidence and innovations in corneal cross-linking and hybrid implants. Increasing access to advanced treatments is further propelling segment growth.

End User Analysis

By end user the market is segmented into hospitals and ophthalmic centers. Hospitals dominated in 2024 due to advanced infrastructure, skilled surgeons, and donor network access. They remain the main centers for complex transplant procedures.

The ophthalmic centers segment is anticipated to register the fastest growth over the forecast period due to increasing preference for specialized, outpatient-based surgeries and the growing number of dedicated eye care facilities.

Regional Analysis

North America dominated the market for artificial cornea and corneal implants in 2024 owing to the prevalence of high rates of corneal disorders, well-established healthcare infrastructure, and early adaptability towards superior eye technologies. Rising vision impairment is increasing demand, while government programs and insurance coverage improve access to treatments.

U.S. Artificial Cornea and Corneal Implant Market Insights

Increasing healthcare expenditure in the U.S. is driving the market of artificial cornea and corneal implants upward through increasing investment in advanced eye treatment and surgery. Based on the Centers for Medicare & Medicaid Services (CMS), U.S. health expenditure reached about USD 4.9 trillion in 2023, up from USD 4.1 trillion in 2020. This increase improves access to innovative corneal procedures and expands vision-restoration services.

Europe Artificial Cornea and Corneal Implant Market Assessments

The European market is expected to account for a significant revenue share in 2034 with consistent demand from geriatric populations and strong awareness of eye diseases. Germany, France, and the U.K. are increasing specialized eye care and embracing advanced corneal treatments backed by regulatory assistance.

Asia Pacific Artificial Cornea and Corneal Implant Market Trends

Asia Pacific is expected to grow fastest due to increasing corneal blindness, rising elderly populations, and better healthcare facilities. Nations including China, Japan, and South Korea are expanding eye care services, promoting early treatment, and boosting investments in ophthalmic infrastructure.

India Artificial Cornea and Corneal Implant Market Overview

The rising elderly population in India is increasing demand for artificial cornea and corneal implants due to higher age-related vision problems. According to the United Nations World Population Prospects 2024, India’s population aged 60 and above is expected to reach 347 million by 2050 from 153 million. This is enlarging the patient base that requires advanced eye treatments and new corneal implants.

Key Players & Competitive Analysis

The market for artificial cornea and corneal implants is very competitive, dominated by players such as AJL Ophthalmic S.A., CorneaGen Inc., LinkoCare Life Sciences AB, and Pantheon Vision. These firms develop advanced corneal implants and vision-restoring devices for severe eye disorders. Competition is driven by partnerships and research collaborations to speed approvals and expand market presence.

Who are the major player in artificial cornea and corneal implants market?

A few major companies operating in the artificial cornea and corneal implant industry include AJL Ophthalmic S.A., CorneaGen Inc., LinkoCare Life Sciences AB, Pantheon Vision, Addition Technology Inc., CorNeat Vision, Mediphacos, Aurolab, DIOPTEX GmbH, EyeYon Medical, Presbia plc, and Massachusetts Eye and Ear.

Key Players

- Addition Technology Inc.

- AJL Ophthalmic S.A.

- Aurolab

- CorNeat Vision

- CorneaGen Inc.

- DIOPTEX GmbH

- EyeYon Medical

- LinkoCare Life Sciences AB

- Massachusetts Eye and Ear

- Mediphacos

- Pantheon Vision

- Presbia plc

Artificial Cornea and Corneal Implant Industry Developments

March 2025: Pantheon Vision partnered with Eyedeal Medical to create a bioengineered corneal implant that decreases dependence on donor tissue. The partnership plans to commercialize a single-piece polymer artificial cornea, providing corneal blindness therapy globally.

Artificial Cornea and Corneal Implant Market Segmentation

By Implant Type Outlook (Revenue, USD Million, 2020–2034)

- Synthetic

- Biosynthetic

By Transplant Type Outlook (Revenue, USD Million, 2020–2034)

- Hard Keratoprosthesis

- Soft Keratoprosthesis

By Disease Indication (Revenue, USD Million, 2020–2034)

- Fuchs’ Dystrophy

- Keratoconus

- Fungal Keratitis

- Other Diseases

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Opthalmic Centers

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Artificial Cornea and Corneal Implant Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 505.44 Million |

|

Market Size in 2025 |

USD 541.14 Million |

|

Revenue Forecast by 2034 |

USD 1,022.67 Million |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 505.44 million in 2024 and is projected to grow to USD 1,022.67 million by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America dominated the market in 2024 driven by strong healthcare spending and advanced facilities.

A few of the key players in the market are AJL Ophthalmic S.A., CorneaGen Inc., LinkoCare Life Sciences AB, Pantheon Vision, Addition Technology Inc., CorNeat Vision, Mediphacos, Aurolab, DIOPTEX GmbH, EyeYon Medical, Presbia plc, and Massachusetts Eye and Ear.

The hard keratoprosthesis segment dominated the market revenue share in 2024 due to its proven success in treating severe corneal blindness.

The ophthalmic centers segment is projected to witness the fastest growth during the forecast period due to rising surgical procedures and access to advanced implant technologies.